- The paper introduces a novel multi-agent trading system that uses an internal contest mechanism to evaluate agent performance in real time.

- It details a dual-stage pipeline where the Data Team refines raw market data into textual factors and the Research Team generates precise trading signals.

- Experimental results demonstrate significant improvements with a CR of 52.80%, SR of 3.12, and strong predictive metrics such as Rank IC and ICIR.

ContestTrade: A Multi-Agent Trading System Based on Internal Contest Mechanism

The paper "ContestTrade: A Multi-Agent Trading System Based on Internal Contest Mechanism" (2508.00554) introduces a novel multi-agent system designed to enhance trading performance in noisy market environments. The system, named ContestTrade, uses an internal competitive mechanism inspired by modern corporate management structures. The framework integrates real-time competitive evaluation with a deep research methodology, empowering agents with comprehensive financial tools to improve trading signal quality.

System Architecture

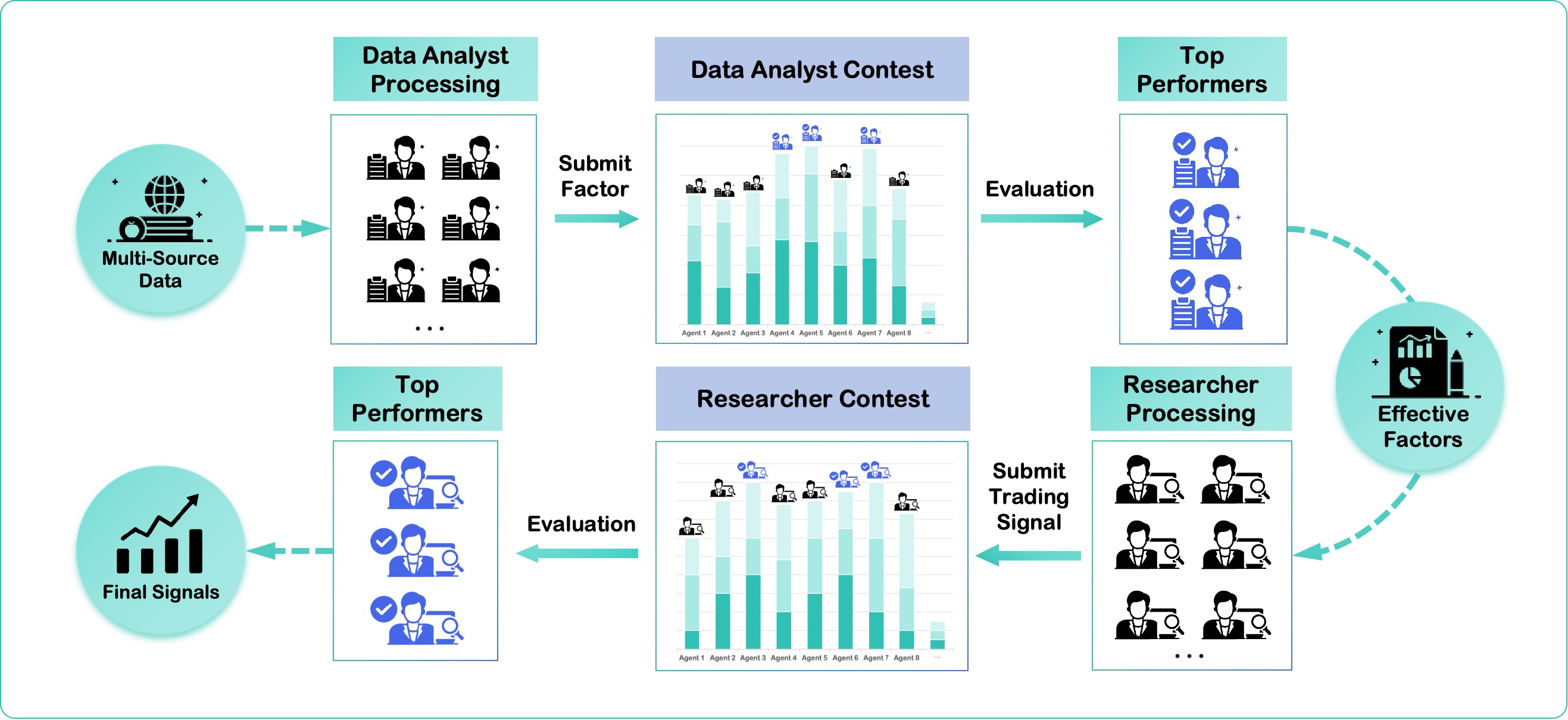

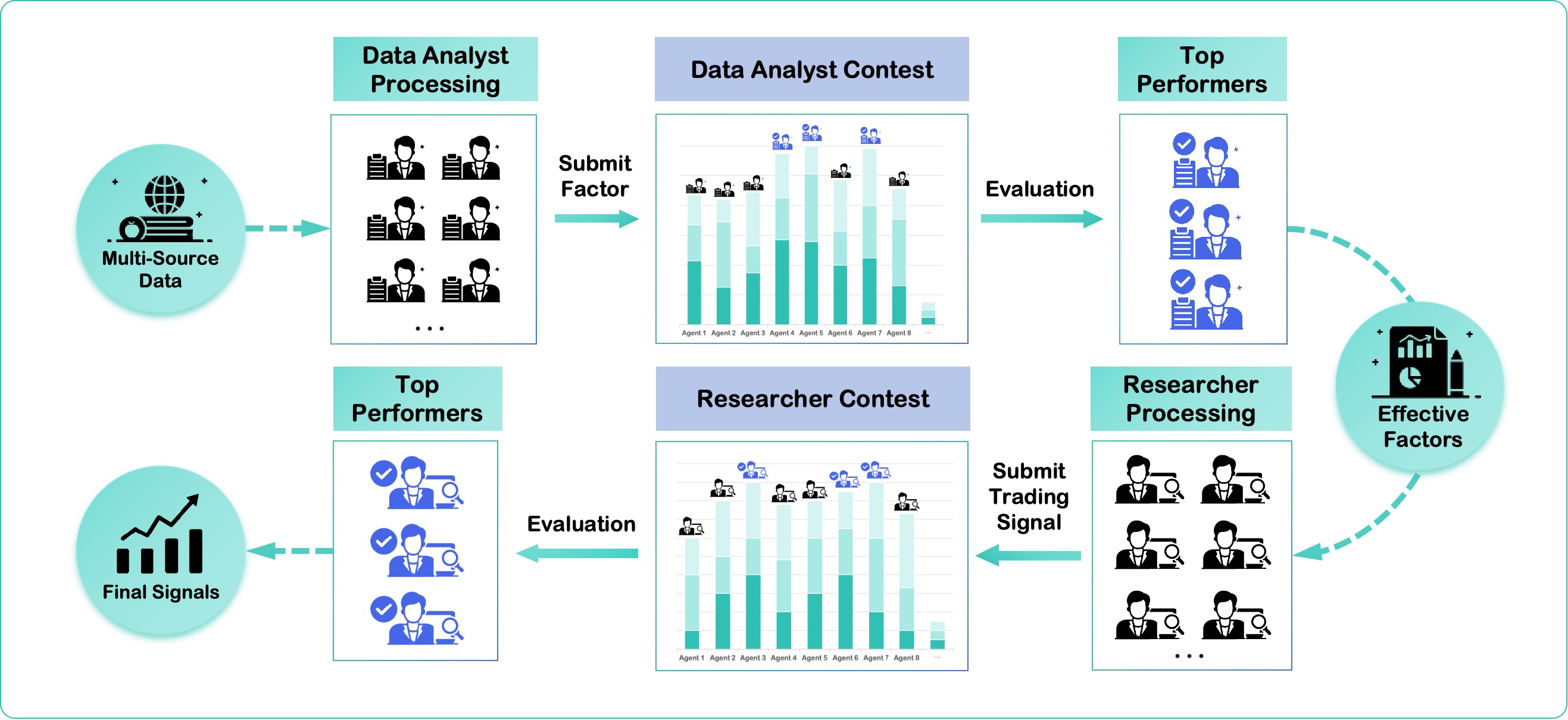

ContestTrade emulates investment firm dynamics through a dual-stage pipeline comprising the Data Team and the Research Team (Figure 1).

Figure 1: The ContestTrade Framework Architecture, showing the complete pipeline from multi-source data input to final signals.

The Data Team processes raw market data into textual factors, while the Research Team makes parallelized trading decisions based on deep research methods. A key component is the internal contest mechanism, which continuously evaluates agent performance using authentic market feedback.

Data Team Design

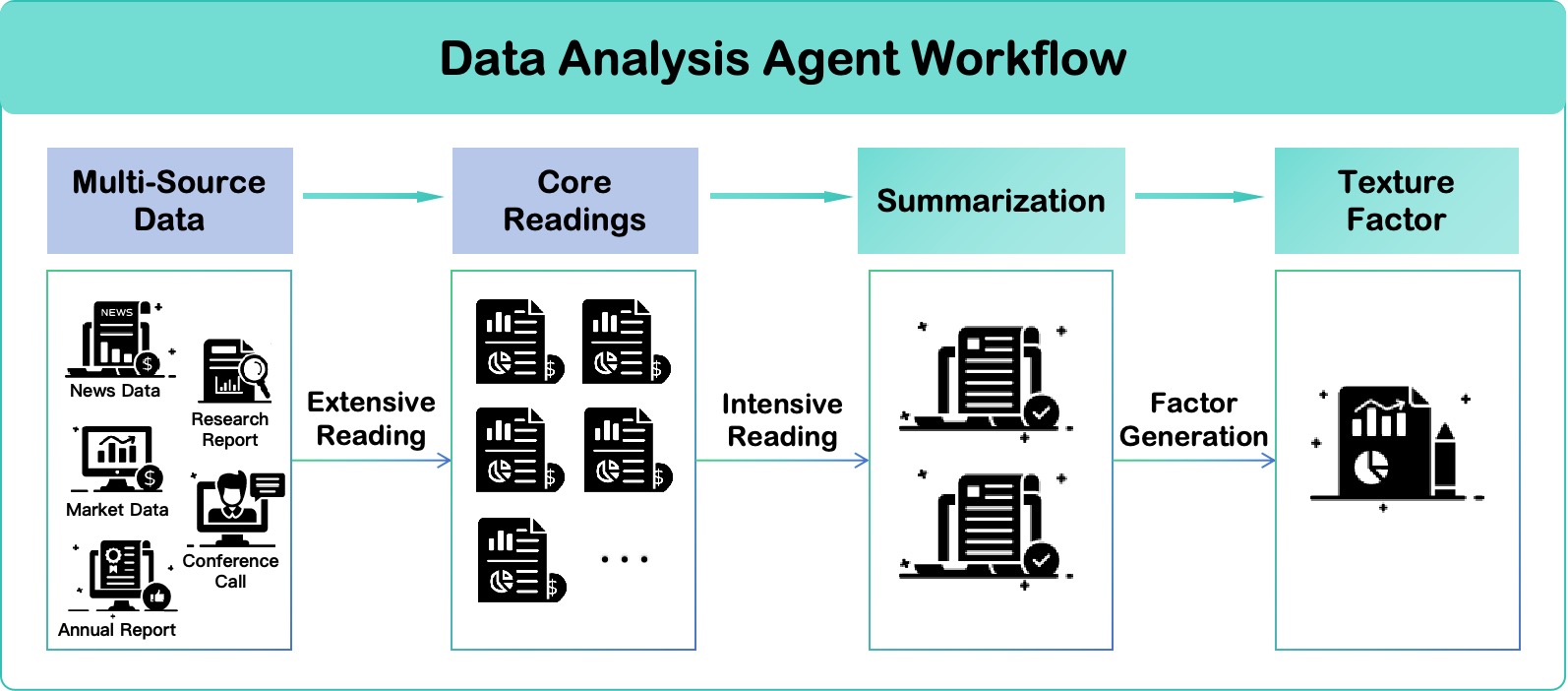

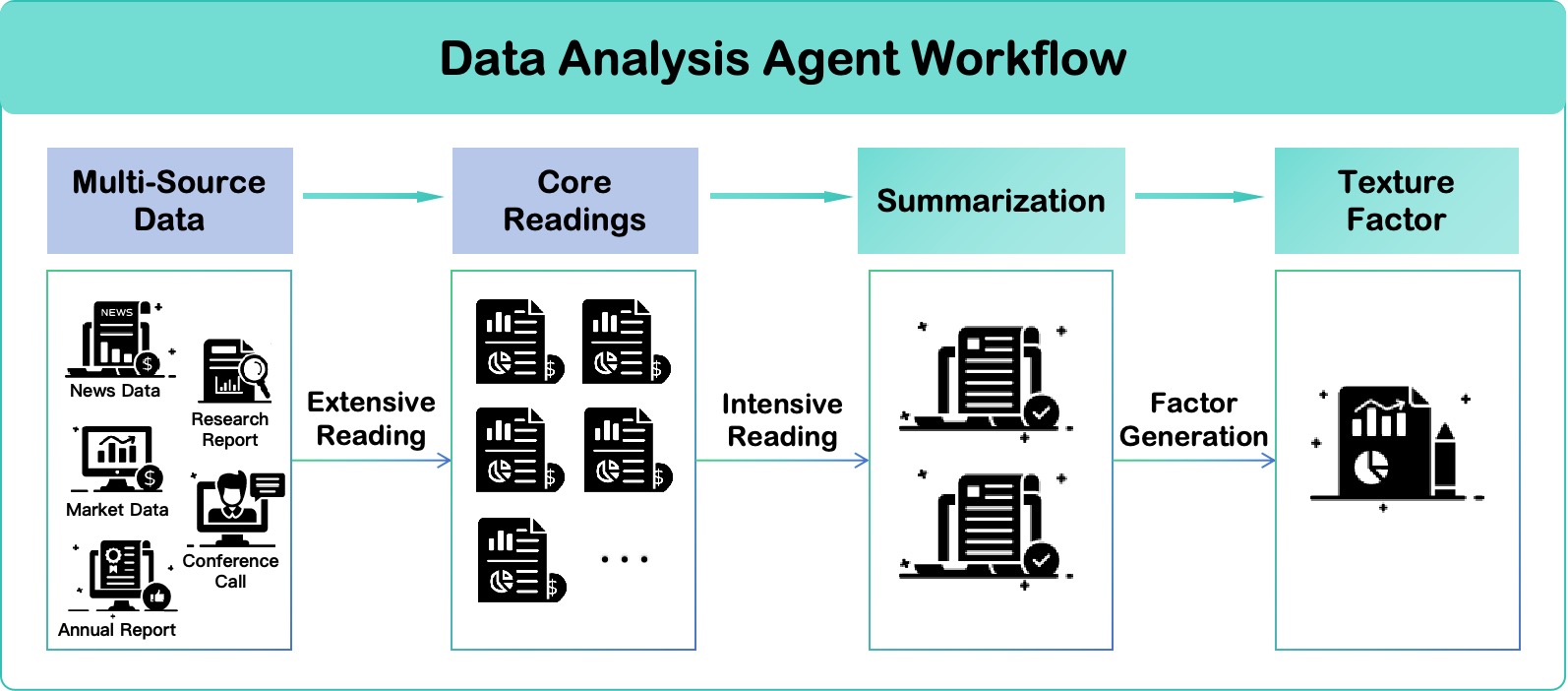

The Data Team's primary role is to distill vast amounts of raw market data into high-quality, context-friendly textual factors suitable for LLMs. The team comprises multiple Data Analysis Agents operating in parallel (Figure 2).

Figure 2: The Data Team Architecture, showing the workflow of market data analysis.

Each agent dynamically generates a specific focus aligned with the short-term trading strategy, filters market information, and engages in intensive reading and summarization. The culmination is the creation of a textual factor, an unstructured natural language summary capped at 4k tokens to ensure compatibility with downstream models.

Research Team Design

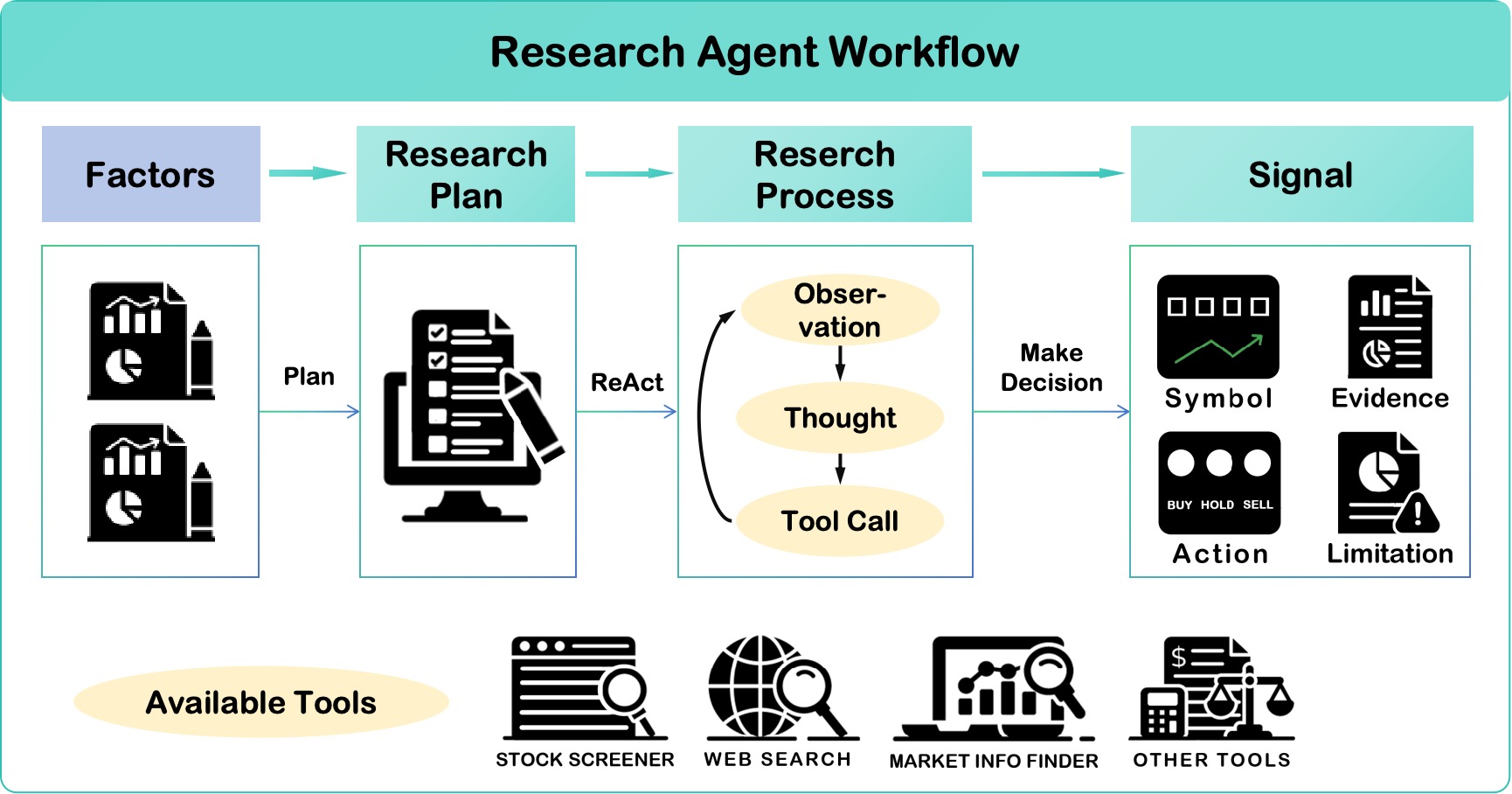

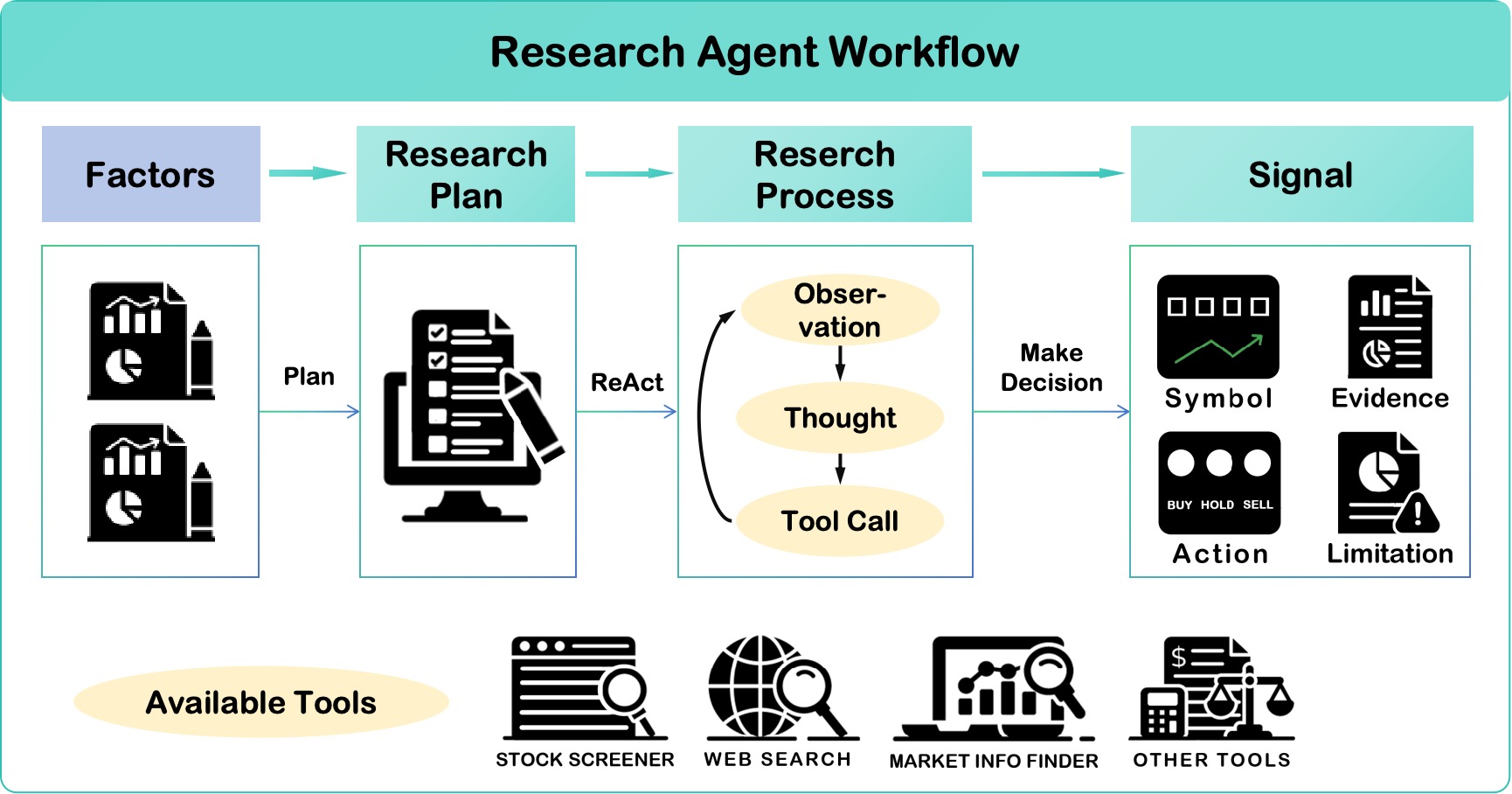

The Research Team serves as a bridge between distilled market insights and actionable trading signals. The team consists of autonomous Research Agents, each initialized with distinct "trading beliefs" generated by LLMs. Each Research Agent follows a Plan + ReAct framework to formulate informed trading decisions (Figure 3).

Figure 3: The Trading Strategy Architecture, showing the workflow of trading signal making.

Agents receive aggregated textual factors from the Data Team and leverage a suite of specialized financial tools to gather additional information. The final deliverable is a structured trading signal comprising a trading symbol, action, evidence list, and limitation claim.

Contest Mechanism

The core of ContestTrade is an internal contest mechanism designed to enhance system adaptivity in dynamic markets. The mechanism is formalized as a three-phase "Quantify-Predict-Allocate" model. The entire process transforms a set of competing agents (A) into a final allocation decision, represented by a weight vector (Wt):

$\mathcal{A} \xrightarrow{f_{\text{quant} \{ q_{i,t} \} \xrightarrow{f_{\text{predict} \{ \hat{u}_{i,t+n} \} \xrightarrow{\pi_{\text{allocate} \mathcal{W}_t$

The Data Analyst Contest constructs an optimal factor portfolio to maximize the Research Agent's final Decision Value (DV), modeled as a product of Information Value (V) and Decision Capability (DC):

DV(Ft)=V(Ft)⋅DCwhereV(Ft)=i∈Ft∑vi

DC(L)=1+ek(L−L0)1

To quantify a factor's latent value (vi), the framework simulates a Zero-Intelligence (ZI) Trader. The score is formally defined as:

$q_{i,t} = \sum_{\text{obs} \in F_{i,t} \text{ZI}(\text{obs})$

The allocation policy $\pi_{\text{allocate}$ determines the final weight vector $\mathbf{\mathcal{W}_t$ for the Data Analyst Contest. This selection is formulated as a 0/1 Knapsack problem:

$\mathbf{\mathcal{W}_t = \underset{\mathbf{\mathcal{W}_t \in \{0,1\}^N}{\text{argmax} \sum_{i=1}^{N} \hat{u}_{i,t+n} \cdot w_{i,t} \quad \text{s.t.} \quad \sum_{i=1}^{N} l_i \cdot w_{i,t} \le L^*$

The Researcher Contest dynamically allocates capital among research agents to maximize the portfolio's future risk-adjusted return, using a practical heuristic policy based on predicted utilities. The weight wi,t for agent i is calculated as:

wi,t=∑j=1Nmax(0,u^j,t+n)max(0,u^i,t+n)

Experimental Results

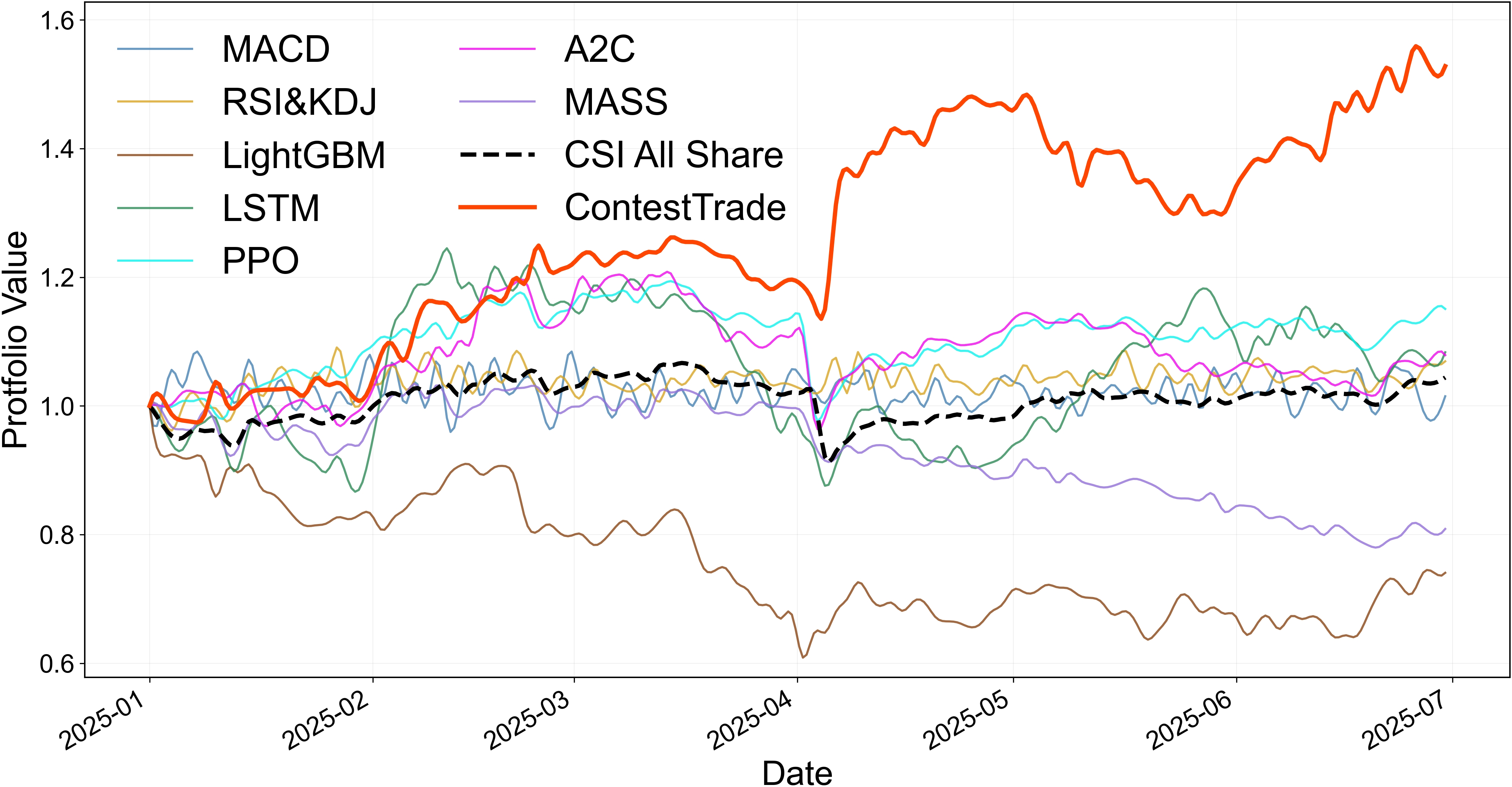

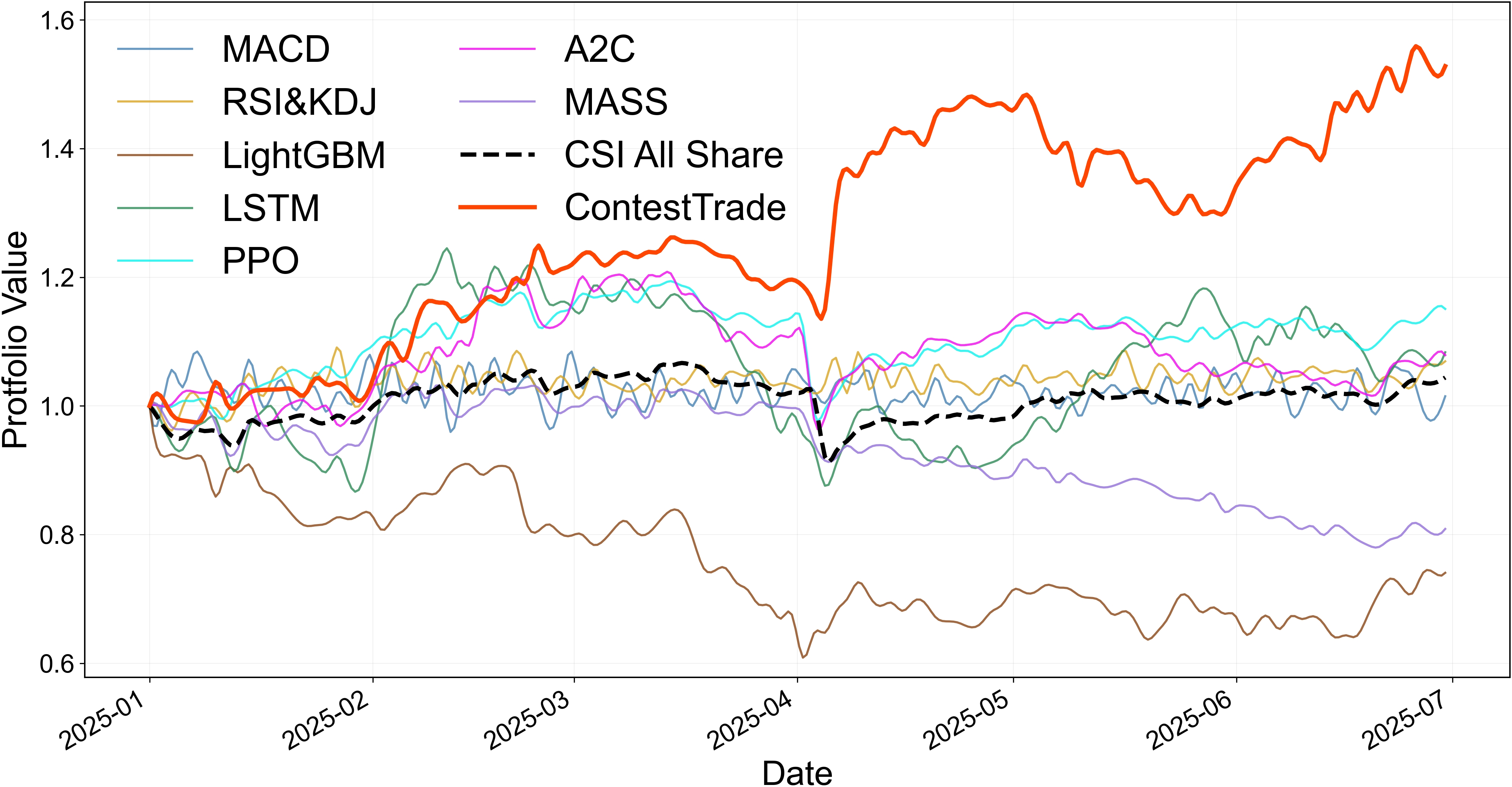

Experiments were conducted using real-world financial datasets, benchmarking ContestTrade against diverse strategies, including the Broad Market Index, rule-based methods, machine learning, deep learning, and multi-agent systems. The framework primarily uses DeepSeek-V3 as the backbone LLM, switching to DeepSeek-R1 for critical signal generation. Strategy performance metrics included Cumulative Return (CR), Sharpe Ratio (SR), and Maximum Drawdown (MDD). Contest effectiveness was evaluated using Rank Information Coefficient (Rank IC) and Information Coefficient Information Ratio (ICIR). ContestTrade significantly outperformed all baseline models across all strategy performance metrics (Figure 4).

Figure 4: Portfolio value over time. This figure compares the net value of the ContestTrade portfolio against various baseline strategies, demonstrating its performance over the experimental period.

The system achieved a CR of 52.80%, an SR of 3.12, and an MDD of 12.41%. The factor ranks predicted by the Data Analyst Contest achieved a strong mean Rank IC of 0.054 and an ICIR of 0.13. The signal ranks predicted by the Research Agent performed strongly with a Rank IC of 0.079 and ICIR of 0.18.

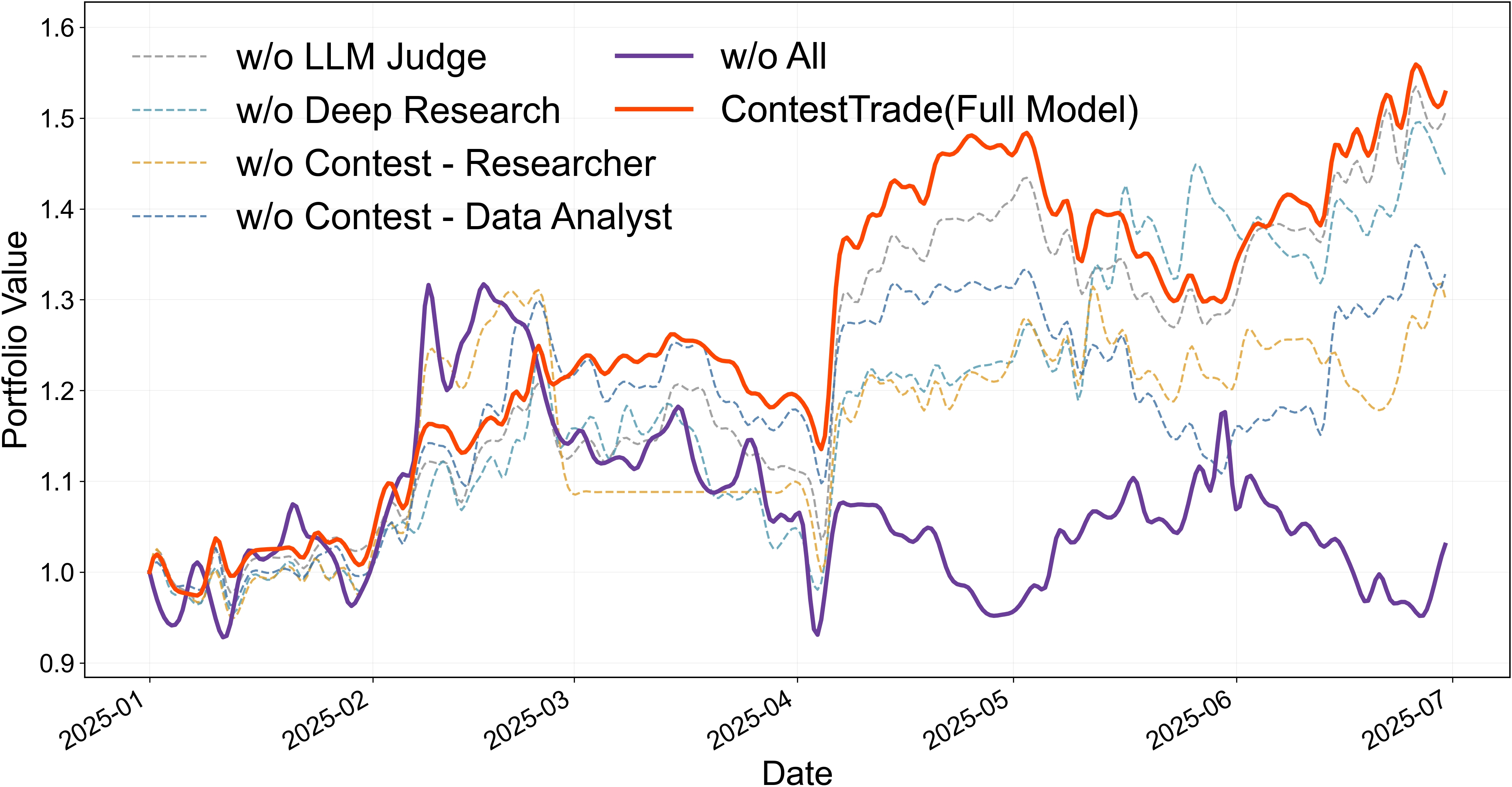

Ablation Studies

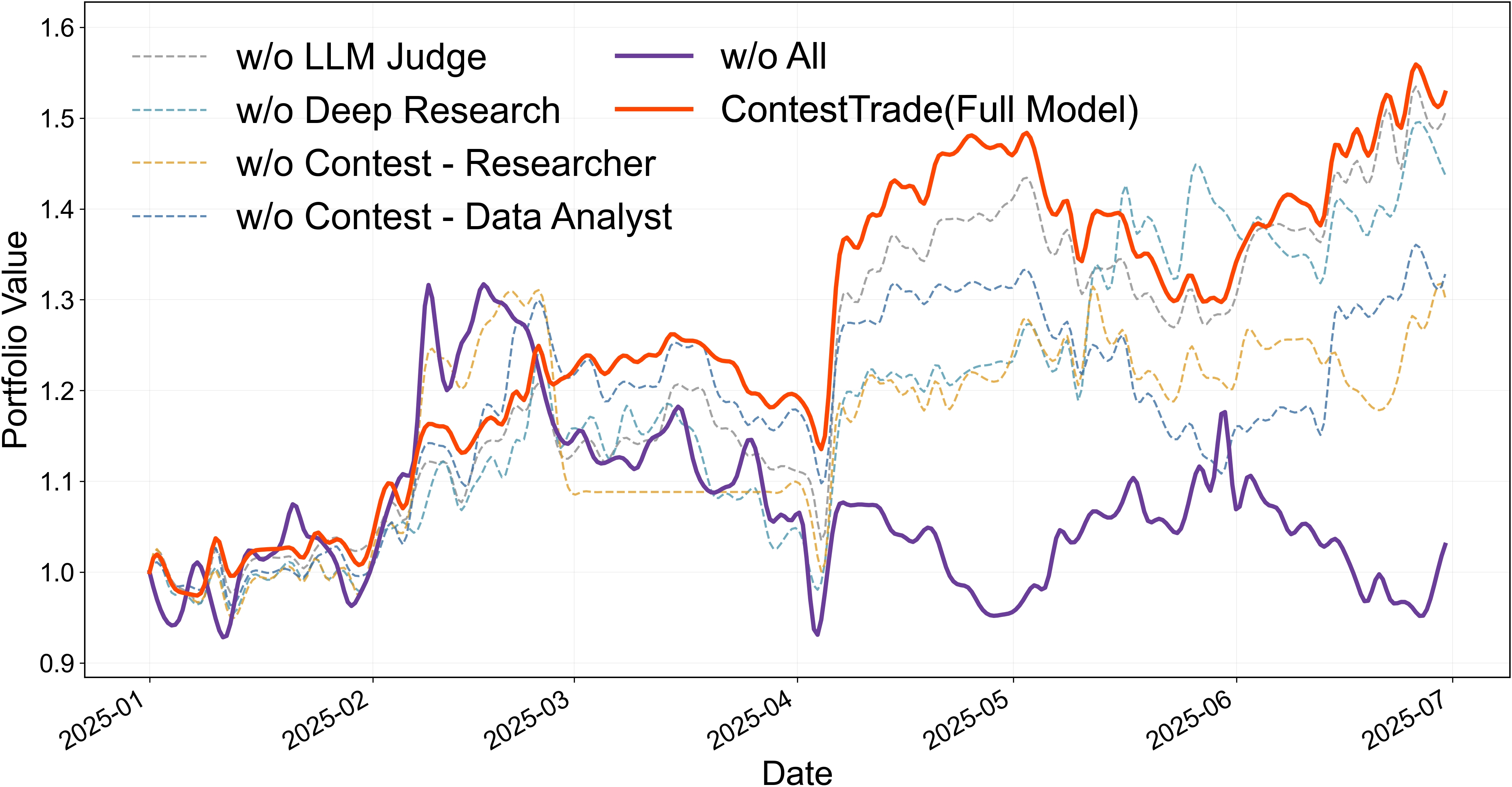

Ablation studies validated the effectiveness of key components within ContestTrade (Figure 5).

Figure 5: Portfolio value over time. This figure compares the portfolio value of the full ContestTrade model against various ablated configurations over time.

Removing components such as the LLM Judge, Researcher Contest, Data Analyst Contest, or Deep Research significantly degraded performance.

Conclusion

The paper presents ContestTrade, a multi-agent framework addressing the challenges of market noise in LLM-based trading systems. The system features a Data team, Research team, and internal contest mechanisms that continuously evaluate agents and select high-quality outputs. Future work will involve larger-scale simulations, stronger reasoning frameworks, broader market applications, and diverse data integration.