AlphaAgents: Large Language Model based Multi-Agents for Equity Portfolio Constructions (2508.11152v1)

Abstract: The field of AI agents is evolving rapidly, driven by the capabilities of LLMs to autonomously perform and refine tasks with human-like efficiency and adaptability. In this context, multi-agent collaboration has emerged as a promising approach, enabling multiple AI agents to work together to solve complex challenges. This study investigates the application of role-based multi-agent systems to support stock selection in equity research and portfolio management. We present a comprehensive analysis performed by a team of specialized agents and evaluate their stock-picking performance against established benchmarks under varying levels of risk tolerance. Furthermore, we examine the advantages and limitations of employing multi-agent frameworks in equity analysis, offering critical insights into their practical efficacy and implementation challenges.

Collections

Sign up for free to add this paper to one or more collections.

Summary

- The paper introduces a modular, role-based multi-agent LLM framework that integrates fundamental, sentiment, and valuation analyses for systematic equity portfolio construction.

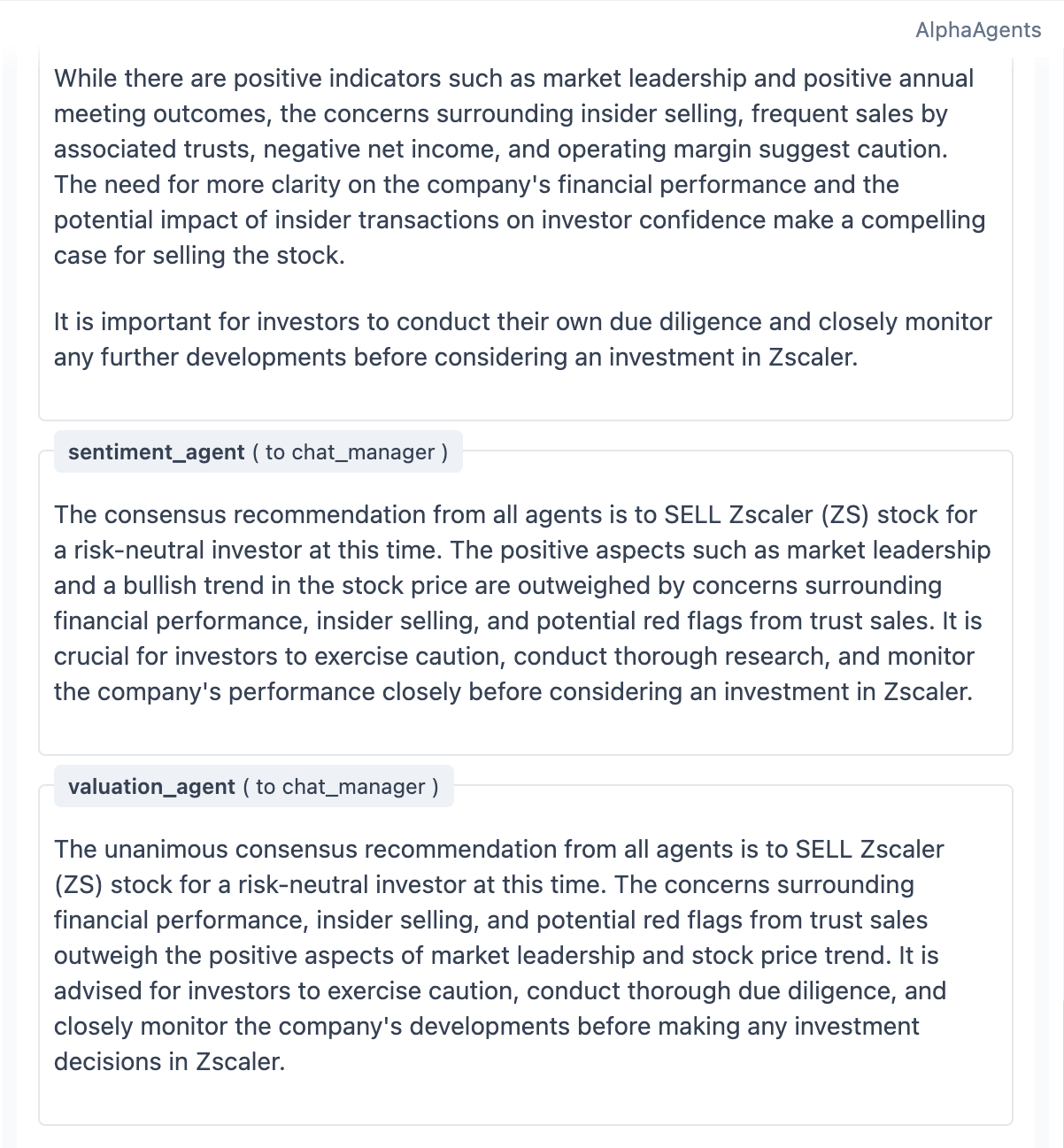

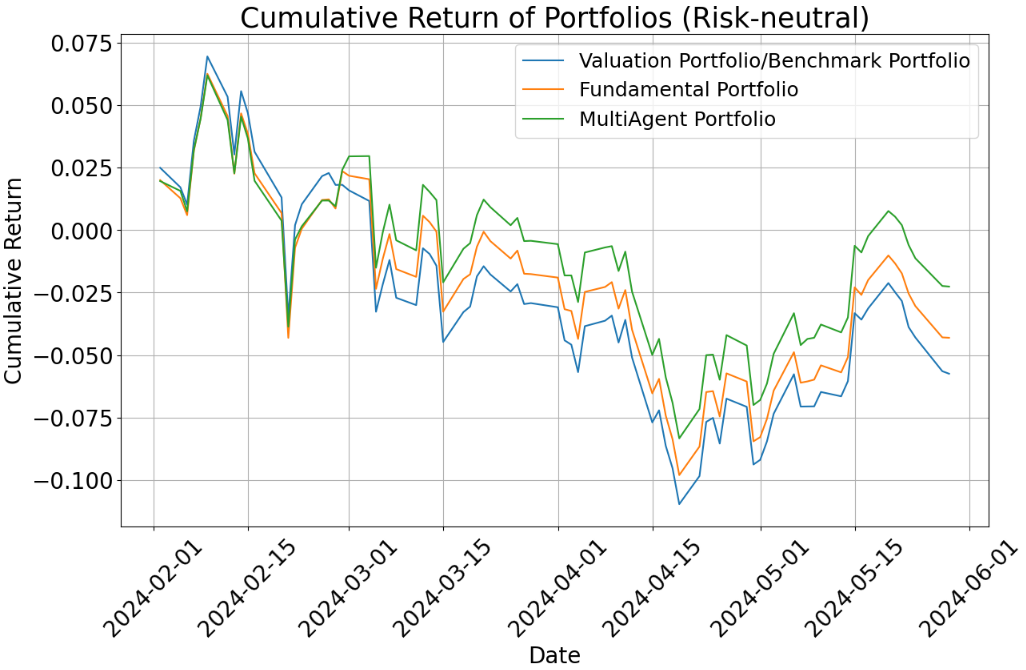

- The paper demonstrates superior performance in risk-neutral settings, with improved cumulative returns and rolling Sharpe ratios validated through backtesting.

- The paper incorporates explicit risk tolerance modeling and a structured debate protocol, enhancing transparency and reducing LLM hallucination.

AlphaAgents: A Multi-Agent LLM Framework for Equity Portfolio Construction

Introduction and Motivation

AlphaAgents introduces a modular, role-based multi-agent system leveraging LLMs for systematic equity research and portfolio construction. The framework is motivated by the need to process heterogeneous, high-volume financial data and to mitigate both human cognitive biases and LLM-specific issues such as hallucination. The system is designed to emulate the collaborative and adversarial reasoning processes of human investment teams, with explicit modeling of risk tolerance and agent specialization.

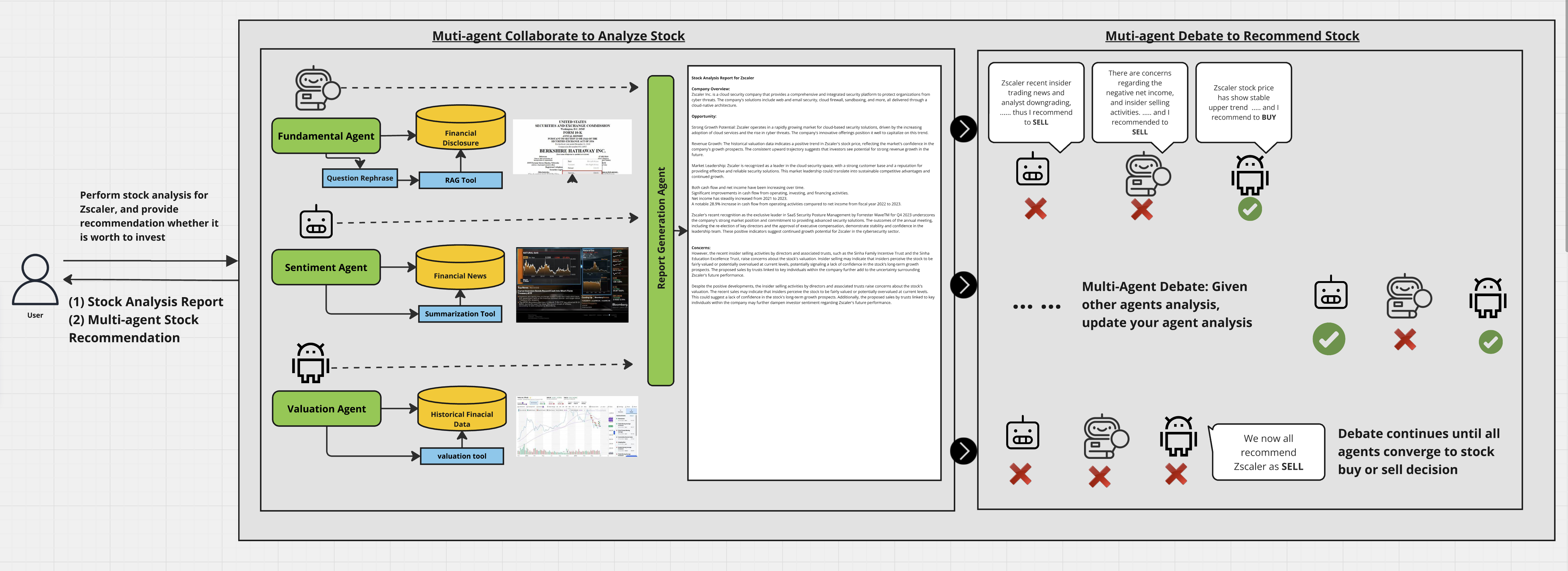

Figure 1: System diagram of multi-agent collaboration and debate for stock analysis.

System Architecture and Agent Design

The AlphaAgents framework comprises three specialized micro-agents: Fundamental, Sentiment, and Valuation. Each agent is assigned a distinct role, data access, and toolset, reflecting the division of labor in human portfolio management teams. The agents operate on disjoint data modalities—10-K/10-Q filings, financial news, and historical price/volume data, respectively—enabling both specialization and reduction of information leakage across tasks.

Role prompting is employed to enforce agent specialization, with prompts engineered to embed both task objectives and risk tolerance profiles. The agents are further augmented with domain-specific tools: the Valuation Agent receives computational modules for volatility and return estimation; the Sentiment Agent is equipped with a reflection-enhanced summarization tool; and the Fundamental Agent utilizes a RAG pipeline with section-aware context tracking and iterative API validation.

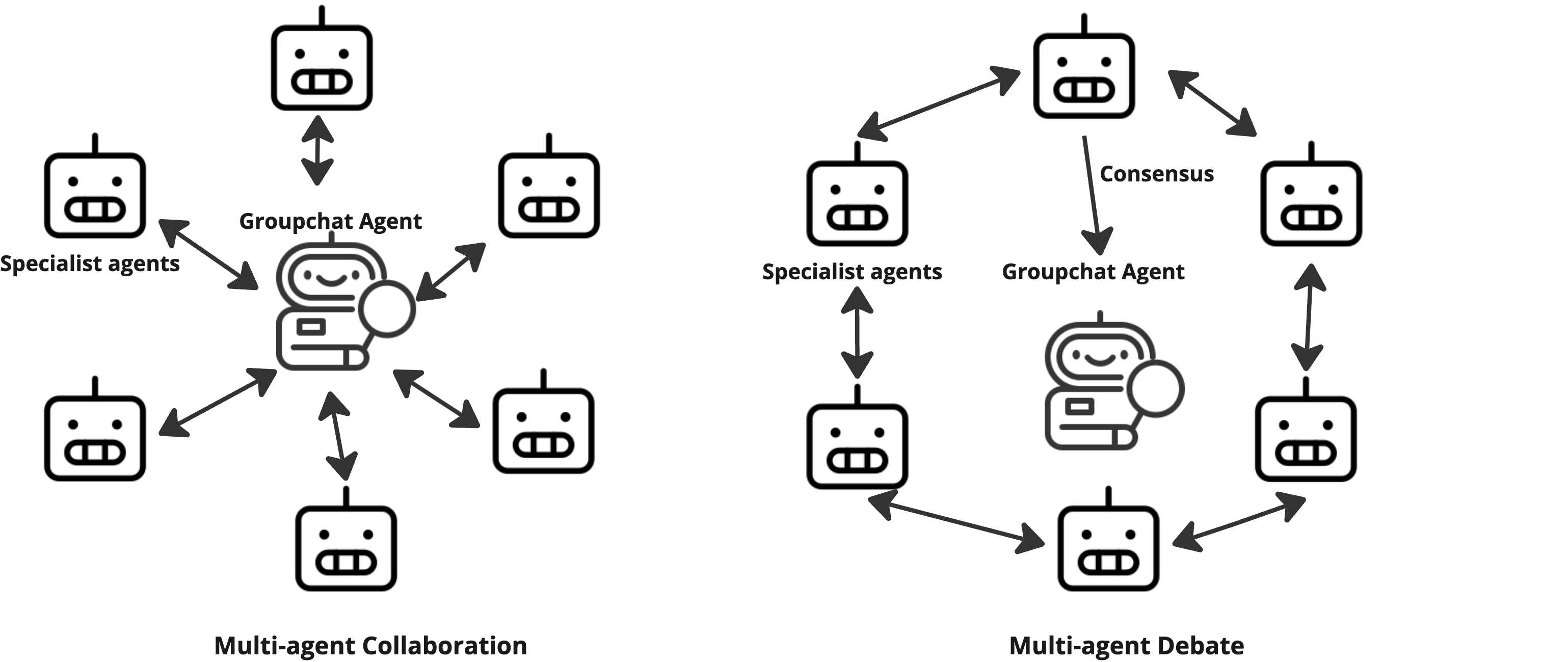

Figure 2: The AlphaAgents agentic communication workflow diagram.

The system is implemented atop the Microsoft AutoGen framework, which orchestrates agent communication via group chat and round-robin debate protocols. The debate mechanism is invoked when agent recommendations diverge, with consensus required for final portfolio inclusion. This process is designed to both improve reasoning soundness and reduce hallucination, as supported by recent literature.

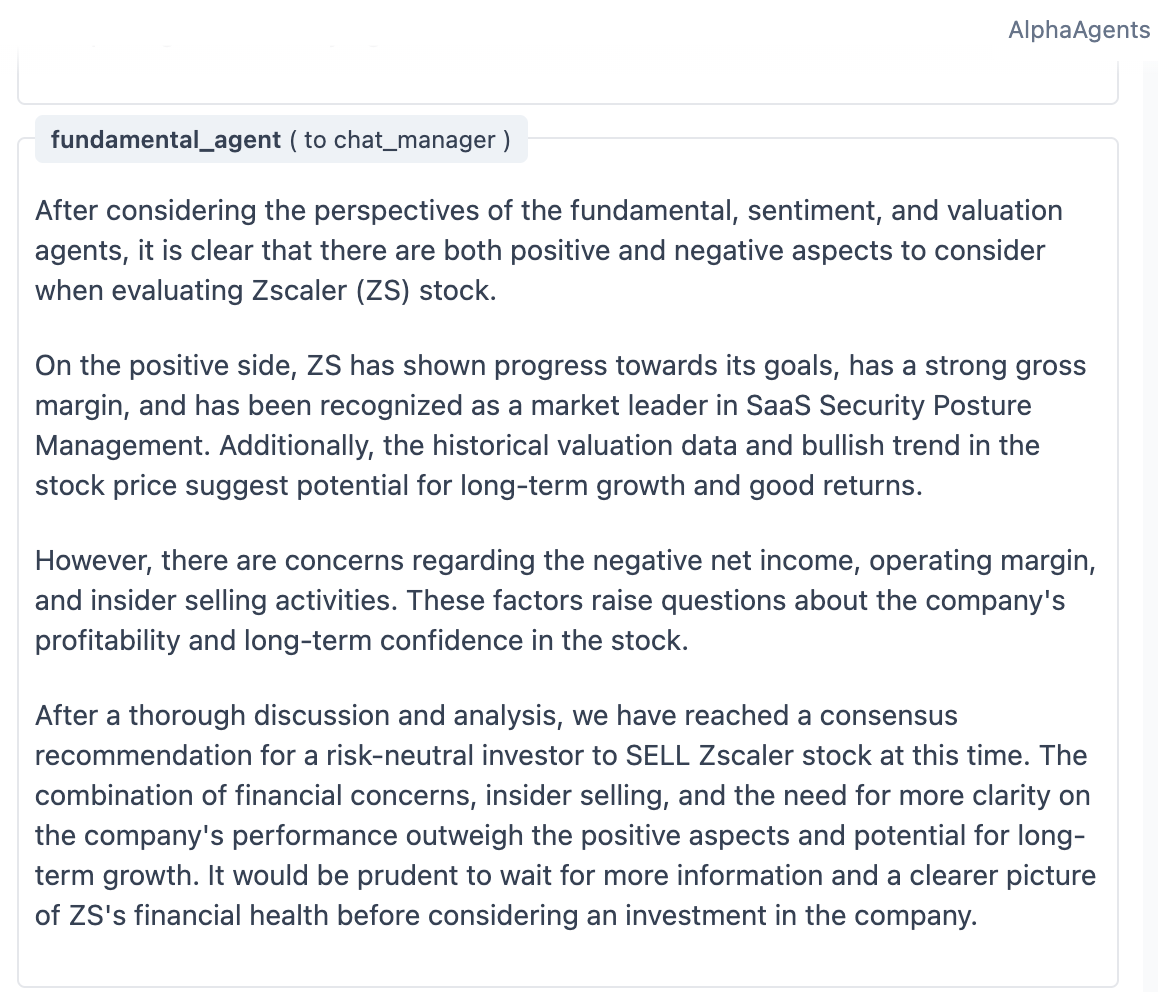

Multi-Agent Collaboration and Debate

The collaborative workflow is structured such that each agent contributes at least two rounds of analysis, with a group chat assistant consolidating their inputs into a unified stock analysis report. When agent outputs conflict, a structured debate is initiated, with agents iteratively critiquing and refining their positions until consensus is achieved.

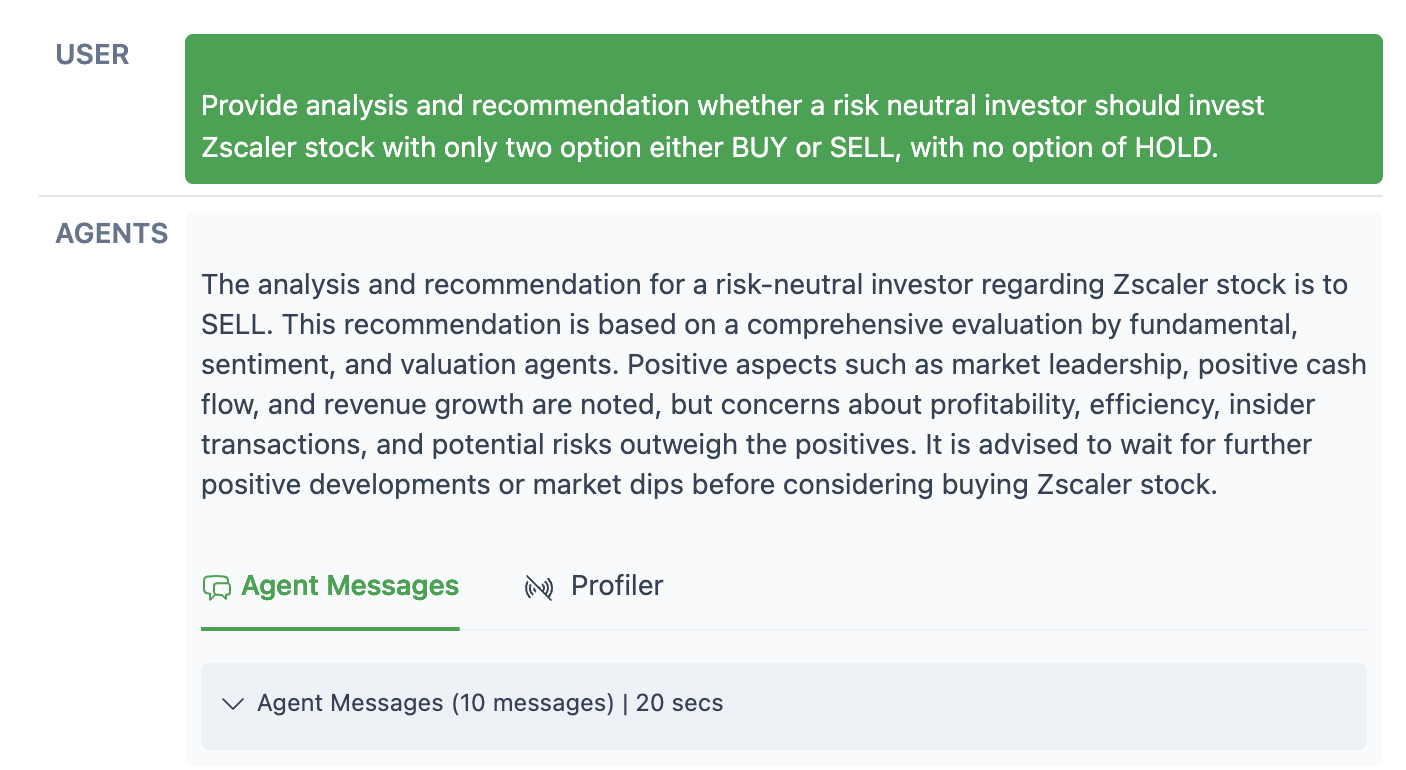

Figure 3: Multi-agent Debate Example on Zscaler.

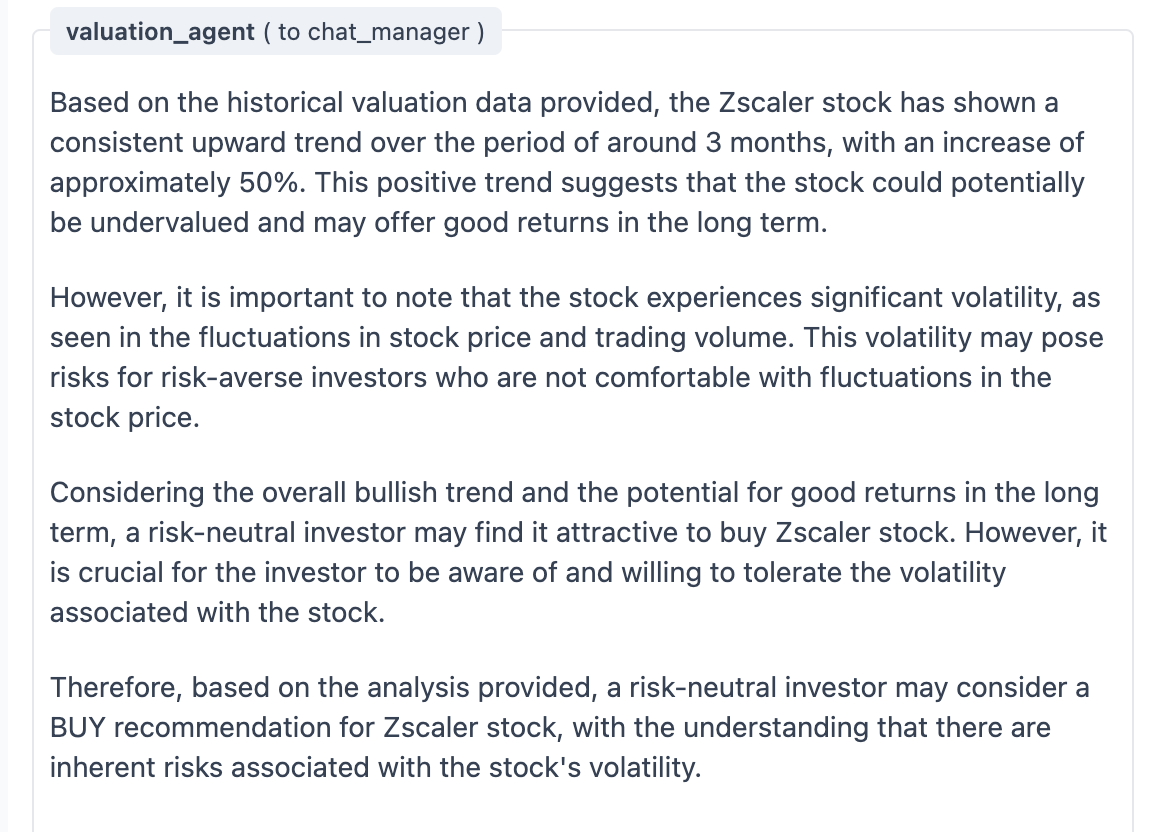

Figure 4: Multi-agent Debate Process Illustration.

Figure 5: Multi-agent Debate Consensus Illustration.

This debate protocol is critical for surfacing and reconciling divergent perspectives, particularly in the presence of incomplete or noisy data. The process is fully auditable, with all discussion logs retained for downstream review and override, addressing a key challenge in the evaluation and governance of agentic AI systems.

Risk Tolerance Modeling

A notable contribution of AlphaAgents is the explicit modeling of agent risk tolerance via prompt engineering. Agents are conditioned to adopt risk-neutral or risk-averse stances, with their recommendations and portfolio construction logic adapting accordingly. Empirically, risk-averse agents exhibit more conservative selection, favoring lower-volatility equities and reducing exposure to high-growth, high-risk sectors. The system demonstrates that prompt-based risk conditioning can meaningfully influence agent behavior, though differentiation between adjacent profiles (e.g., risk-neutral vs. risk-seeking) remains limited.

Evaluation Methodology

Evaluation is conducted on two axes: (1) retrieval and relevance metrics for RAG-based agents using Arize Phoenix, and (2) downstream portfolio performance via backtesting. The latter is the primary metric of interest, with portfolios constructed from agent consensus recommendations and benchmarked against single-agent and market portfolios. All portfolios are equal-weighted, with future work proposed to incorporate confidence-weighted allocations.

Performance is assessed over a four-month out-of-sample window, with rolling Sharpe ratios and cumulative returns as the principal metrics. The risk-free rate is proxied by the one-month Treasury rate.

Empirical Results

Stock Analysis and Selection

The multi-agent system produces comprehensive, explainable stock analysis reports, synthesizing fundamental, sentiment, and valuation perspectives. In the stock selection task, the multi-agent portfolio consistently outperforms both single-agent portfolios and the benchmark in risk-neutral settings, as measured by cumulative return and rolling Sharpe ratio.

Figure 6: Risk Neutral Portfolio Performance: the multi-agent portfolio outperforms both single-agent portfolios in terms of cumulative return and rolling Sharpe ratio.

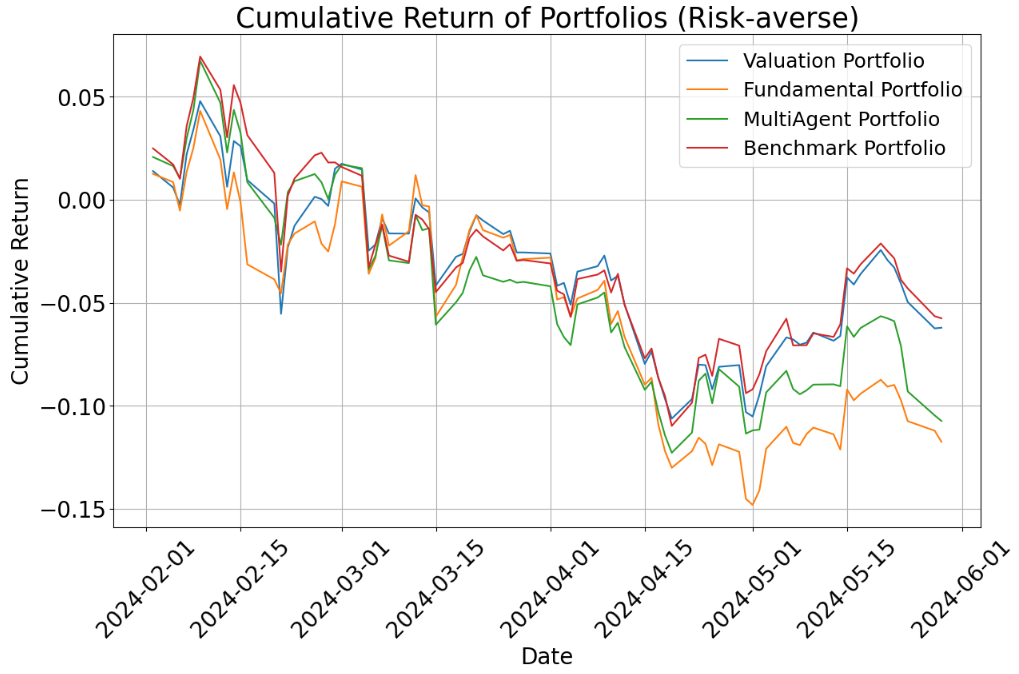

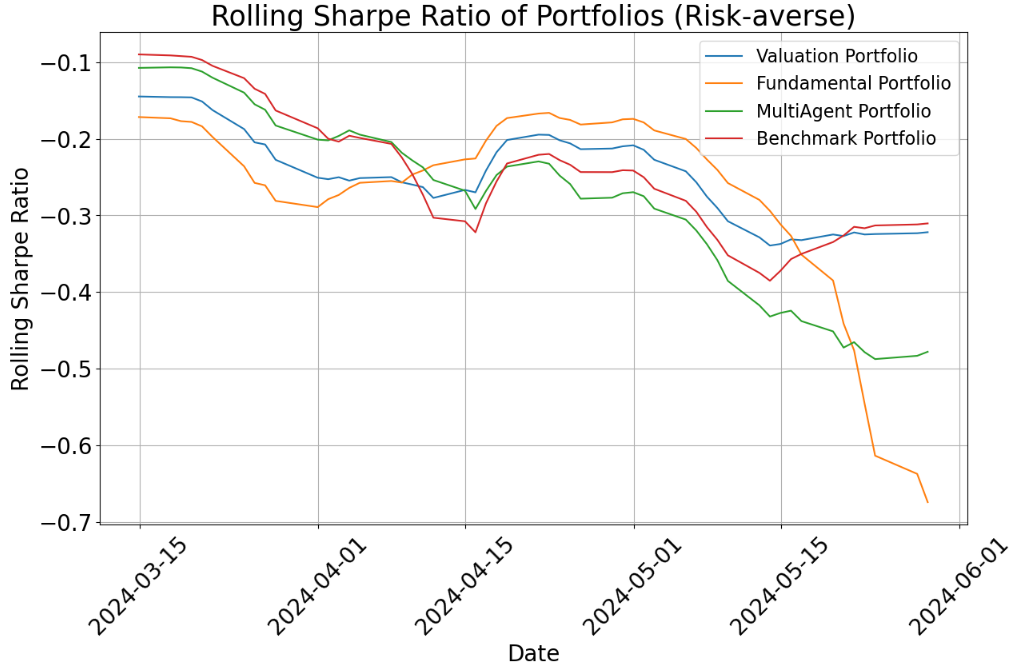

In risk-averse scenarios, all agent portfolios experience larger drawdowns and underperform the benchmark, primarily due to reduced exposure to high-volatility technology stocks during a bullish period. However, the multi-agent portfolio demonstrates lower volatility and smaller drawdowns relative to single-agent portfolios, indicating improved downside risk management.

Figure 7: Risk Averse Portfolio Performance: all portfolios experience larger drawdowns.

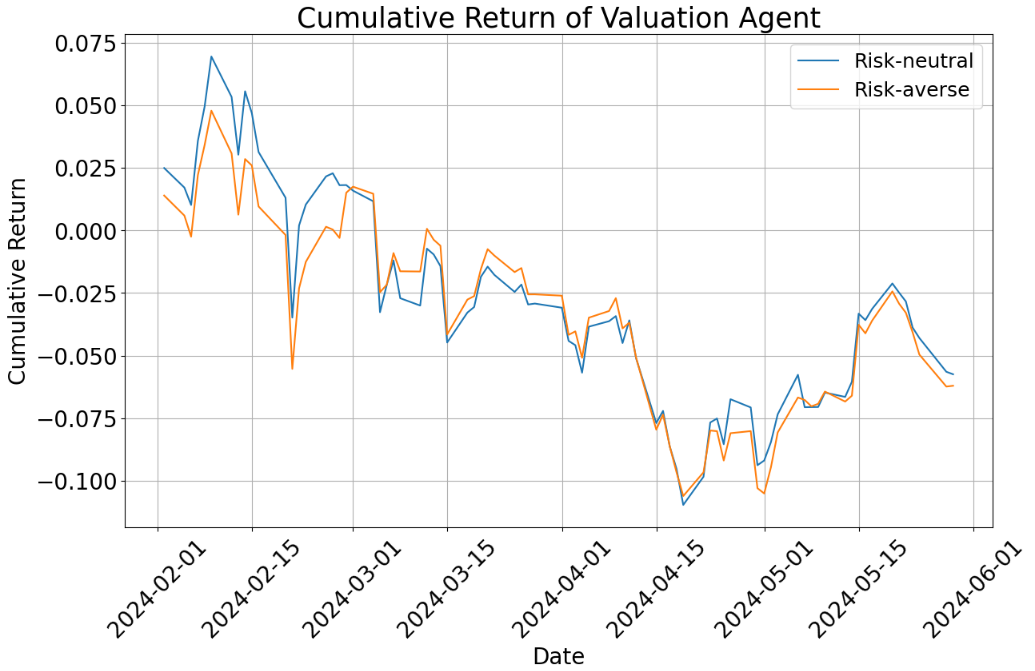

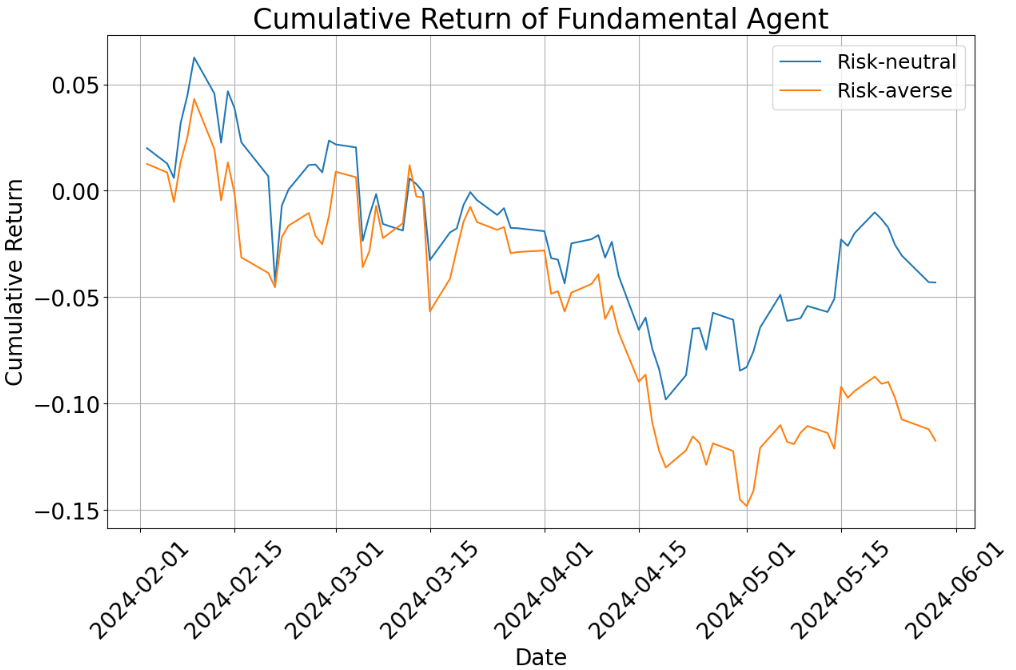

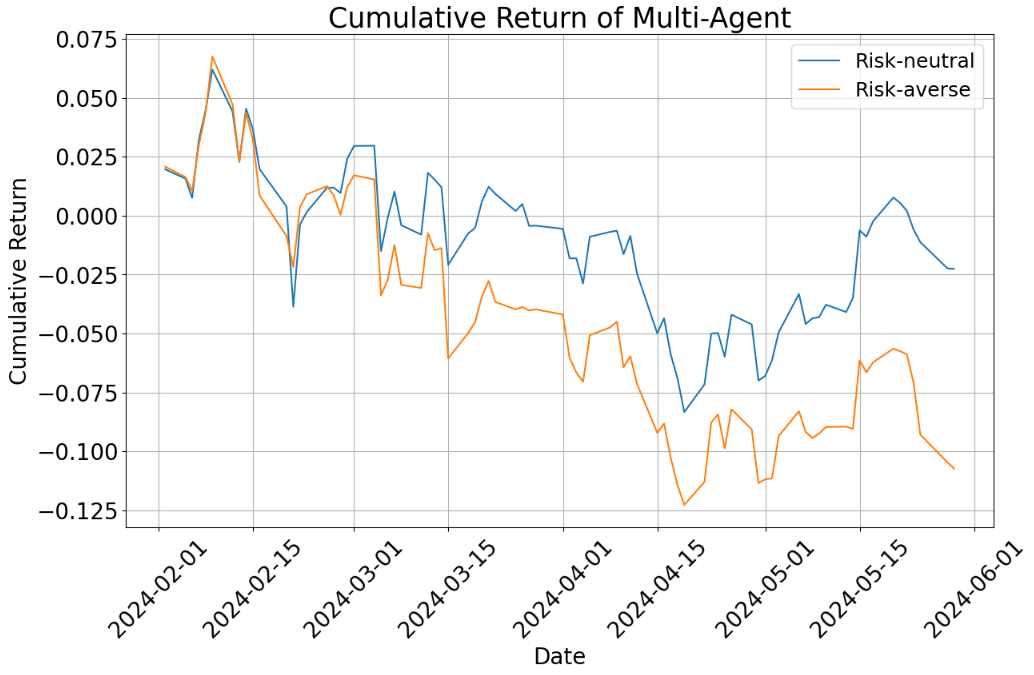

A direct comparison of risk-neutral and risk-averse strategies across agent types reveals that risk-neutral portfolios consistently achieve higher returns, while risk-averse portfolios provide greater capital preservation at the expense of upside capture.

Figure 8: Risk neutral vs Risk averse: Comparing risk-neutral and risk-averse strategies, risk-neutral portfolios consistently achieve higher cumulative returns across all agent types.

Analytical Observations

- Multi-agent debate improves analytical rigor and reduces hallucination, particularly in cases of conflicting or partial agent reliability.

- The integration of short-term (sentiment, valuation) and long-term (fundamental) signals enables the multi-agent system to balance momentum and value considerations, yielding superior performance in risk-neutral settings.

- The debate mechanism provides transparent, auditable reasoning trails, facilitating human-in-the-loop oversight and post-hoc analysis.

Practical and Theoretical Implications

AlphaAgents demonstrates the feasibility and efficacy of modular, role-based multi-agent LLM systems for systematic equity research and portfolio construction. The architecture is extensible, with the potential to incorporate additional agent specializations (e.g., macroeconomic, technical analysis) and to serve as an input layer for downstream portfolio optimization engines (e.g., Mean-Variance, Black-Litterman).

The explicit modeling of risk tolerance and the structured debate protocol align the system with established discretionary investment workflows, making it suitable for both augmentation and partial automation of institutional decision processes. The framework also provides a template for mitigating both human and AI-specific biases through agent diversity and adversarial reasoning.

Future Directions

Key avenues for future research include:

- Scaling the agent pool to encompass a broader range of financial modalities and investment styles.

- Incorporating confidence-weighted portfolio allocations based on agent consensus strength.

- Extending the debate protocol to handle more complex, multi-stage investment decisions.

- Integrating real-time data streams and external tool APIs for dynamic portfolio rebalancing.

- Developing formal evaluation benchmarks for multi-agent LLM systems in financial domains.

Conclusion

AlphaAgents establishes a robust foundation for agentic, explainable, and modular AI-driven equity research and portfolio construction. The empirical results support the claim that multi-agent debate and specialization can enhance decision quality, risk management, and transparency relative to single-agent or monolithic LLM approaches. The framework is well-positioned for integration into institutional investment workflows and for further extension toward fully autonomous portfolio management systems.

Follow-up Questions

- How does the multi-agent framework help mitigate LLM hallucination in equity research?

- What are the benefits of role-specific agents in the AlphaAgents system?

- How does prompt engineering influence agent risk tolerance and portfolio recommendations?

- What impacts do the debate mechanisms have on analytical rigor and decision transparency?

- Find recent papers about multi-agent LLM systems in finance.

Related Papers

- FinCon: A Synthesized LLM Multi-Agent System with Conceptual Verbal Reinforcement for Enhanced Financial Decision Making (2024)

- TradingAgents: Multi-Agents LLM Financial Trading Framework (2024)

- LLM-Powered Multi-Agent System for Automated Crypto Portfolio Management (2025)

- Agentic AI Systems Applied to tasks in Financial Services: Modeling and model risk management crews (2025)

- MASS: Multi-Agent Simulation Scaling for Portfolio Construction (2025)

- Integrating Traditional Technical Analysis with AI: A Multi-Agent LLM-Based Approach to Stock Market Forecasting (2025)

- Building crypto portfolios with agentic AI (2025)

- MountainLion: A Multi-Modal LLM-Based Agent System for Interpretable and Adaptive Financial Trading (2025)

- ContestTrade: A Multi-Agent Trading System Based on Internal Contest Mechanism (2025)

- Language Model Guided Reinforcement Learning in Quantitative Trading (2025)

Tweets

alphaXiv

- AlphaAgents: Large Language Model based Multi-Agents for Equity Portfolio Constructions (26 likes, 0 questions)