- The paper introduces MountainLion, a multi-agent LLM-based system that integrates heterogeneous data sources to boost transparency and adaptability in cryptocurrency trading.

- The methodology fuses real-time technical analysis, sentiment-aware news integration, and dual-path price forecasting to generate actionable, coherent reports.

- Experimental results demonstrate that MountainLion outperforms baseline strategies by leveraging dynamic market signals and adaptive weighting of predictive models.

MountainLion: A Multi-Modal LLM-Based Agent System for Interpretable and Adaptive Financial Trading

This paper introduces MountainLion, a multi-agent system leveraging LLMs for cryptocurrency trading, designed to enhance interpretability and adaptability in financial decision-making. The system addresses the challenges of integrating heterogeneous data and the limitations of traditional DL and RL methods in providing transparent and responsive investment strategies.

System Architecture and Modularity

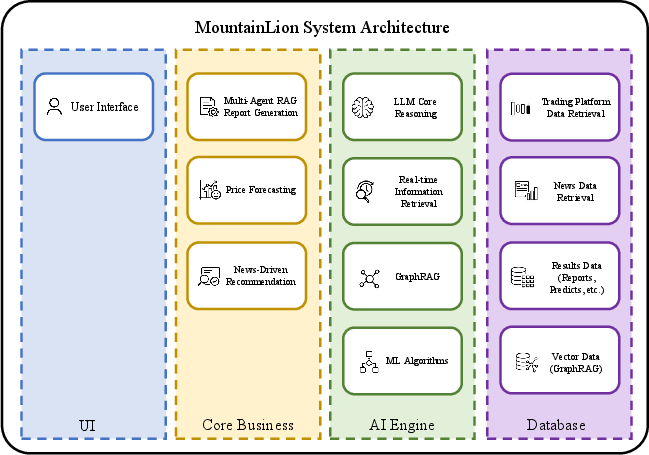

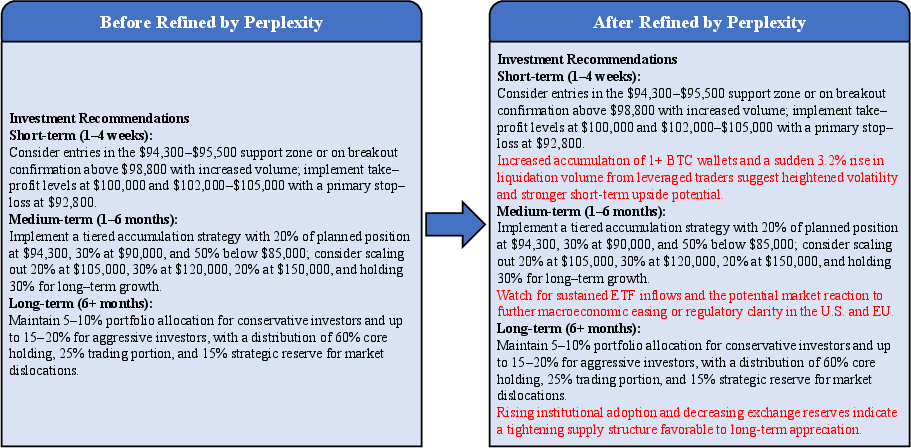

MountainLion adopts a modular architecture comprising four layers: the User Interface, Core Business Logic, AI Engine, and Database Layer (Figure 1).

Figure 1: MountainLion's layered system architecture, showcasing modularity across the UI, Core Business, AI Engine, and Database layers.

The UI offers an interactive dashboard for alerts and preference customization. The Core Business Logic coordinates multi-agent report generation, price forecasting, and news-driven recommendations. The AI Engine incorporates LLM-based reasoning agents, real-time retrieval modules, and GraphRAG components. The Database Layer integrates data from exchanges, news aggregators, and on-chain metrics.

Report Generation Pipeline

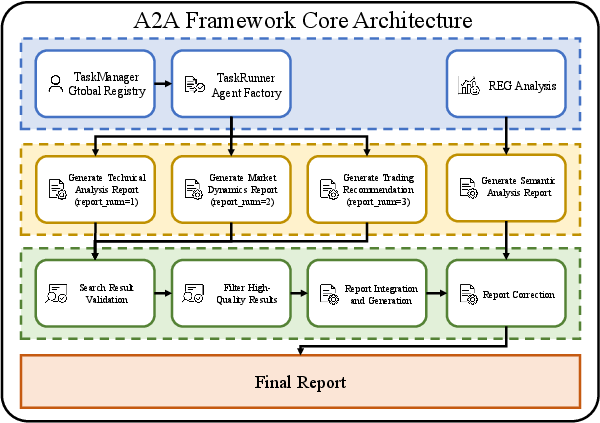

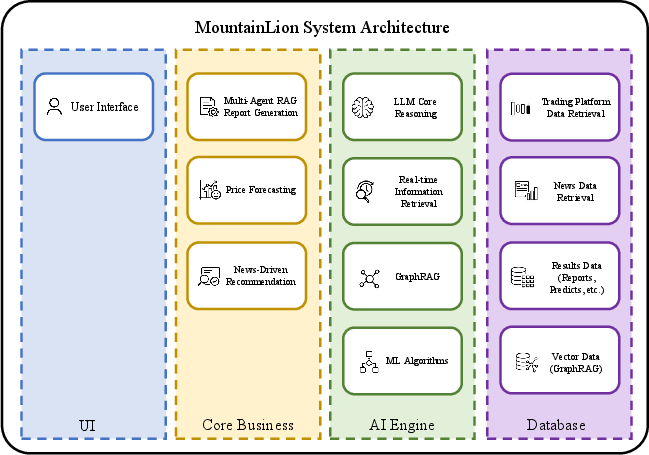

The system generates context-aware digital asset reports through a structured pipeline that orchestrates agent collaboration, signal validation, and semantic refinement (Figure 2).

Figure 2: An overview of the report generation pipeline employed by MountainLion.

The pipeline involves task decomposition and specialization, parallel analysis, and report synthesis and enhancement. Specialized agents, such as the Technical Analysis Agent, Market Dynamics Agent, Trading Recommendation Agent, and Semantic Agent, are coordinated to generate comprehensive reports. The Technical Analysis Agent processes historical price and volume data to compute technical indicators. The Market Dynamics Agent synthesizes external signals such as real-time news and sentiment indexes. The Trading Recommendation Agent integrates outputs from the other agents to generate multi-horizon trading strategies. The Semantic Agent refines the combined outputs through LLM-based analysis, enhancing coherence and logical consistency. The system refines these reports through a Perplexity-based retriever, ensuring alignment with prevailing market conditions.

Price Forecasting Framework

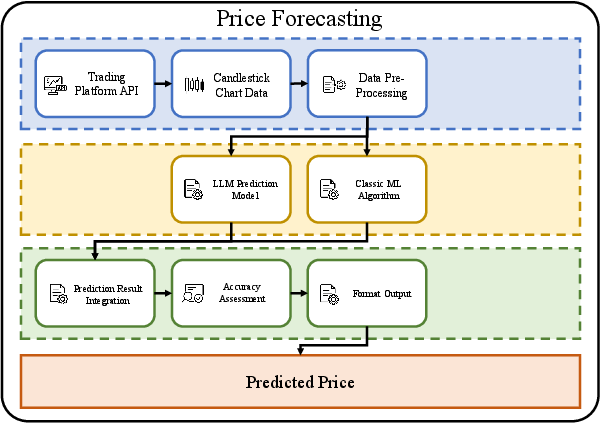

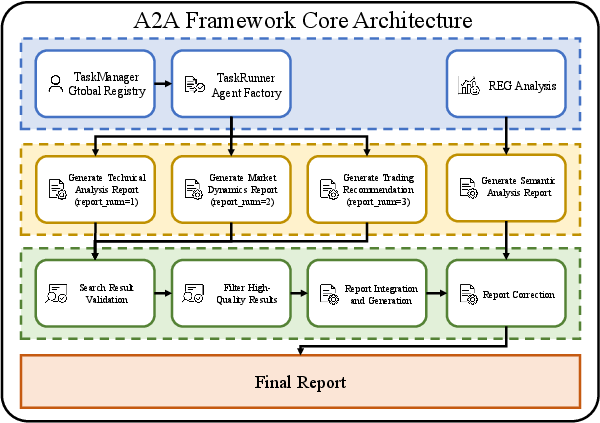

To provide timely investment decisions, MountainLion uses a dual-path price forecasting framework that combines statistical learning with LLM-based reasoning (Figure 3).

Figure 3: The architecture of MountainLion's price forecasting system.

The LLM-Based Forecasting path processes OHLCV data alongside sentiment embeddings from financial news to generate multi-step forecasts. The ML-Based Forecasting path applies classical ML models to engineered technical features. The outputs from these two paths are then fused using a weighted function, with weights adaptively updated based on the historical accuracy of each predictor. The system converts numerical forecasts into natural language summaries to enhance interpretability for end users.

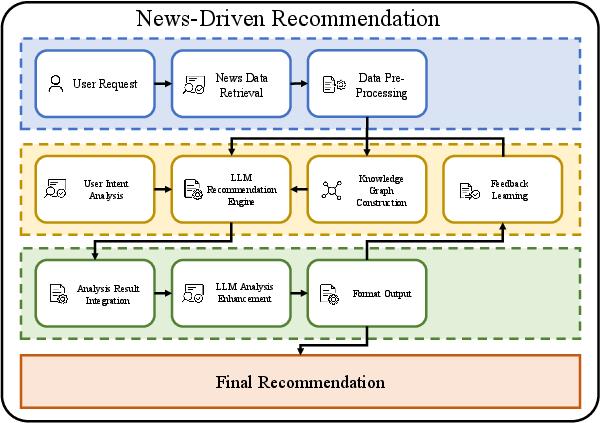

News-Driven Recommendation Engine

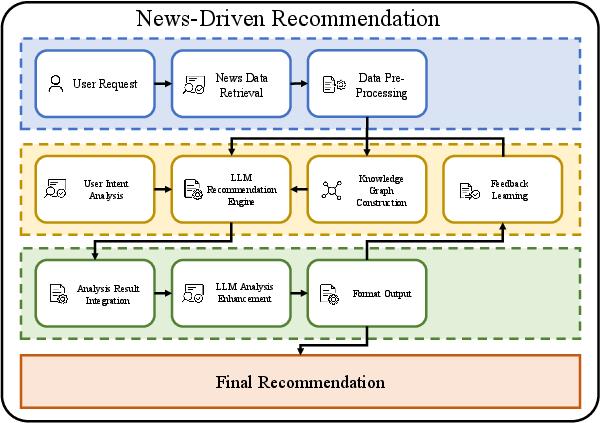

MountainLion incorporates a news-driven recommendation engine that integrates user intent, news semantics, and graph-based reasoning to support sentiment-aware investment decisions (Figure 4).

Figure 4: The architecture of MountainLion's news-driven recommendation system.

The system integrates multi-source information retrieval, contextual entity analysis, and LLM-based summarization to produce interpretable trading insights. It continuously ingests financial news, classifies articles according to sentiment polarity, and extracts salient entities via NER techniques. A dynamic knowledge graph encodes semantic relationships among news items and extracted entities to support multi-hop reasoning. The system infers implicit user preferences, generates investment recommendations by integrating evidence from retrieved news documents and the graph context, and logs user engagement signals to refine retrieval and summarization strategies over time.

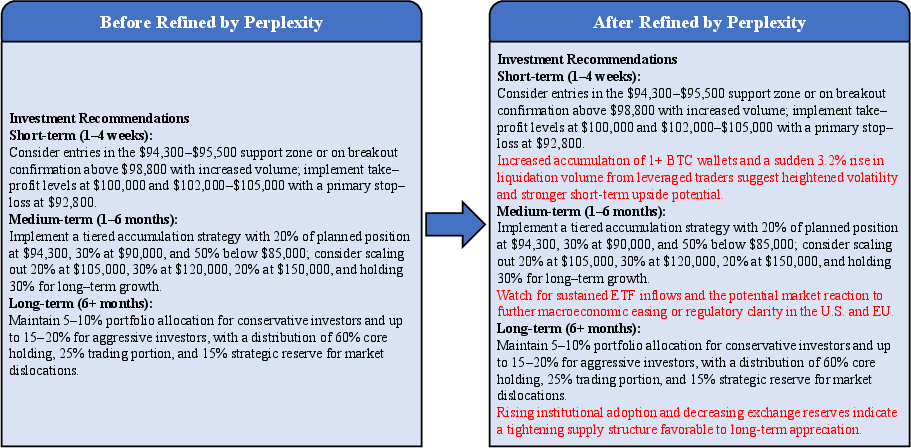

Experimental Results and Case Study

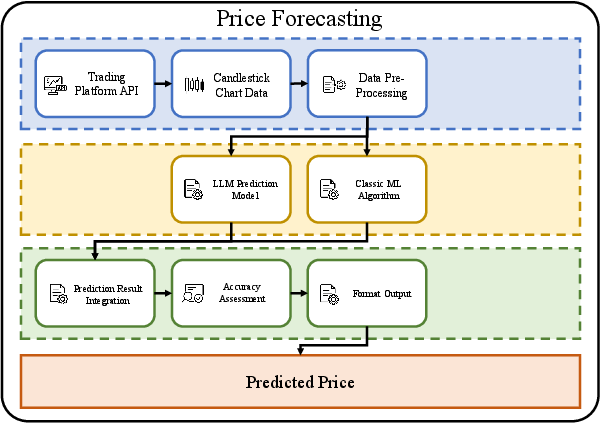

The system's refined investment recommendations integrate dynamic market signals and macroeconomic context to improve upon original baselines (Figure 5).

Figure 5: A comparison of the input report versus the output report after refinement by the MountainLion system, demonstrating the integration of contextual signals.

Experiments compared MountainLion's performance against a baseline strategy relying exclusively on technical indicators. Results indicated that LLM-driven analysis enhances medium-term cryptocurrency investment strategies with improved adaptability and interpretability. The paper showed how ChatGPT-4o leveraged whale accumulation metrics, ETF net inflow triggers, and dynamic volatility thresholds. It also described how DeepSeek~V3 emphasized policy overlays, on-chain flows, and adaptive cash buffers, while Grok-3 prioritized on-chain whale transfers, IMF-based classification signals, and dynamic redeployment based on ETF momentum.

Conclusion

MountainLion demonstrates the potential of multi-agent, RAG-enabled frameworks for financial analysis in cryptocurrency trading. By integrating specialized LLM agents, graph-based retrieval reasoning, and a reflective decision module, the system enables interpretable, real-time, and adaptive responses across diverse financial modalities. The empirical results suggest that the system enhances transparency and adaptability, providing a foundation for robust cryptocurrency trading intelligence.