- The paper provides an empirical evaluation of four major private RPC providers by comparing metrics like inclusion rate, timing, swap price improvement, and rebate outcomes.

- It employs systematic transaction submissions to assess performance, focusing on efficiency in mitigating MEV exploits in DeFi ecosystems.

- Findings reveal MEV Blocker's superior inclusion and rebate performance, while Flashbots, Blink, and Merkle exhibit distinct trade-offs under varying conditions.

Private MEV Protection RPCs: Benchmark Study

Decentralized finance (DeFi) ecosystems on Ethereum have evolved significantly, particularly with the advent of Proof of Stake (PoS) and Proposer-Builder Separation (PBS). The transaction landscape now increasingly relies on private Remote Procedure Calls (RPCs) rather than public mempools, a shift that demands closer examination of their efficacy in mitigating Maximal Extractable Value (MEV) exploits. This paper provides an empirical evaluation comparing four major private RPC services—MEV Blocker, Flashbots Protect, Blink, and Merkle—through simultaneous transaction submissions.

Background and Context

MEV Threats and Protection Mechanisms

The Ethereum public mempool enables widespread transaction visibility, which exposes it to MEV threats—where sophisticated actors exploit this visibility to extract value unfavorably. As DeFi matures, the reliance on private RPCs bypassing public mempools offers an alternative submission mechanism purported to shield transactions from MEV exploits. MEV Protection RPCs implement Order Flow Auctions (OFAs) that redistribute MEV profits more equitably to users through rebates and gas optimizations.

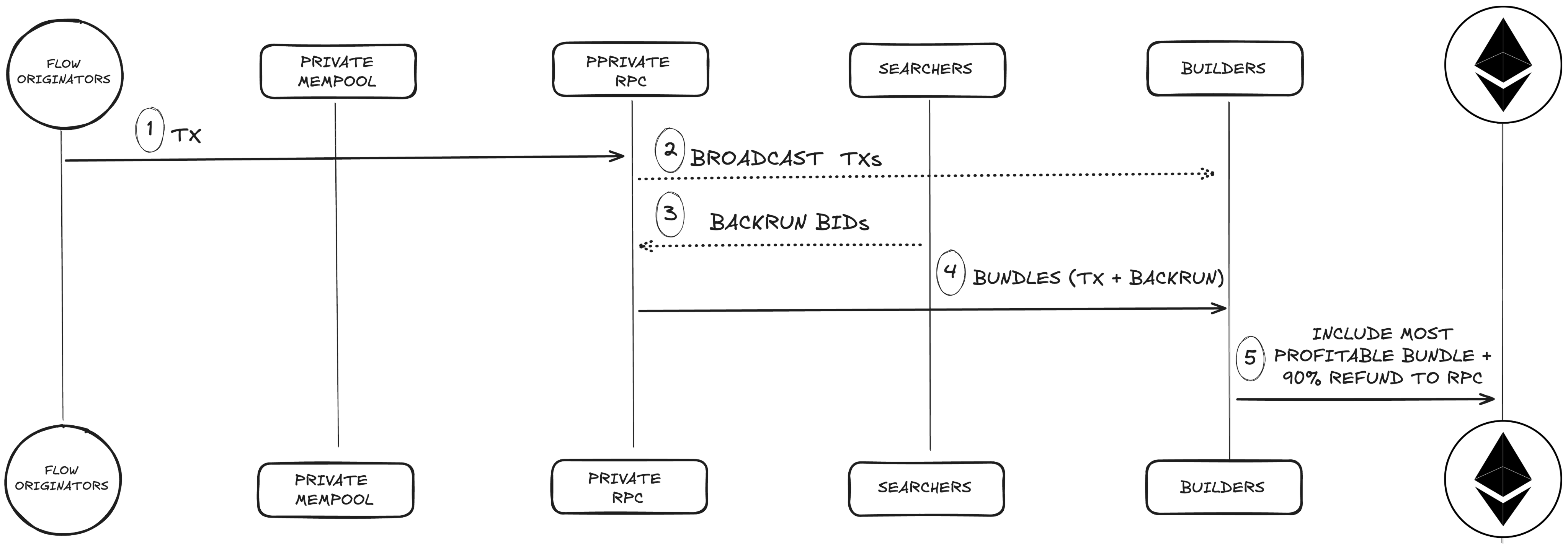

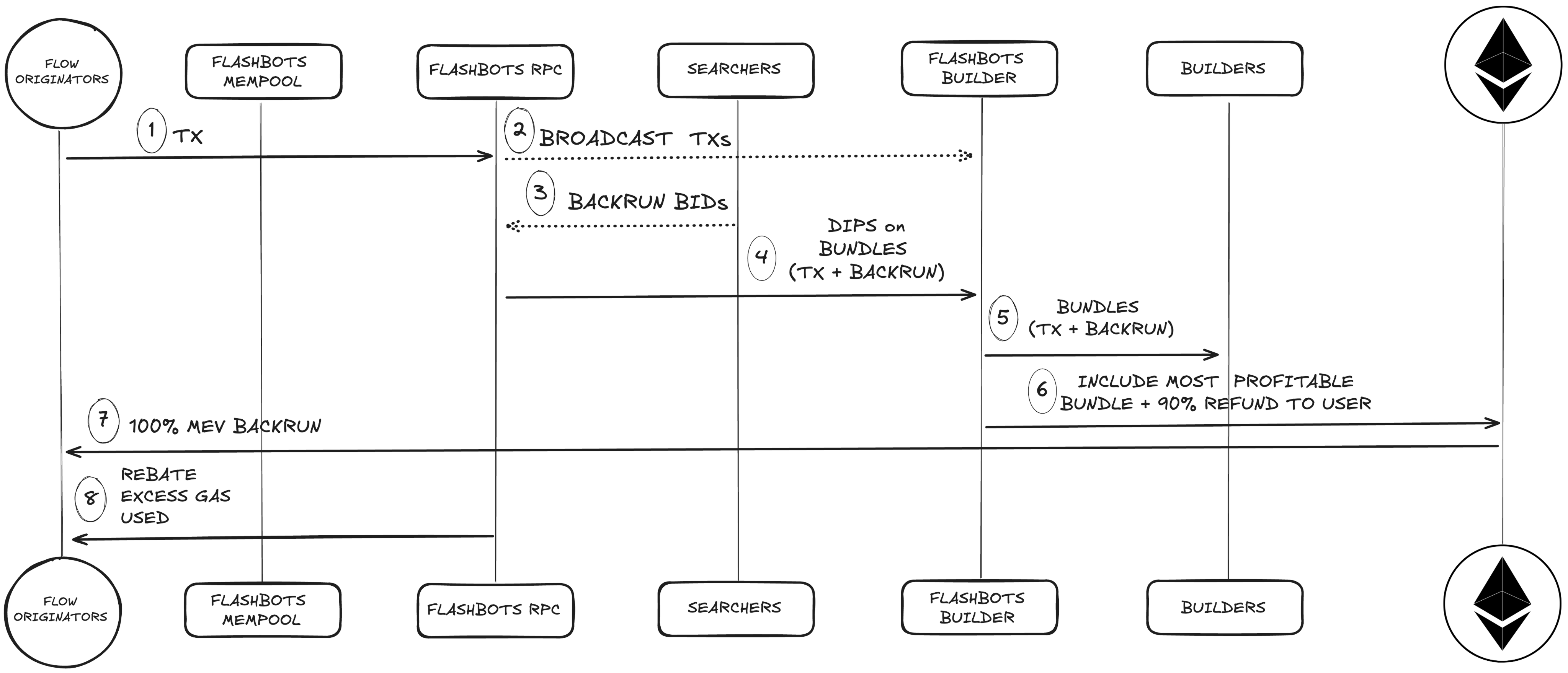

Figure 1: Transaction flow in MEV protection RPCs.

Role of Private RPCs

Private RPCs facilitate MEV protection by orienting searcher incentives towards executing beneficial trades that include user rebates from MEV grosses rather than predatory front-running strategies. Various OFAs exhibit differences in execution strategies, economic incentives, and transaction handling efficiencies.

Evaluation of Major RPC Providers

The methodology involved empirical analysis of transaction outcomes across four significant private RPC providers to assess their respective efficiencies. Metrics such as inclusion success rate, time to inclusion, swap price improvement, and backrun quality were the focal point of analysis.

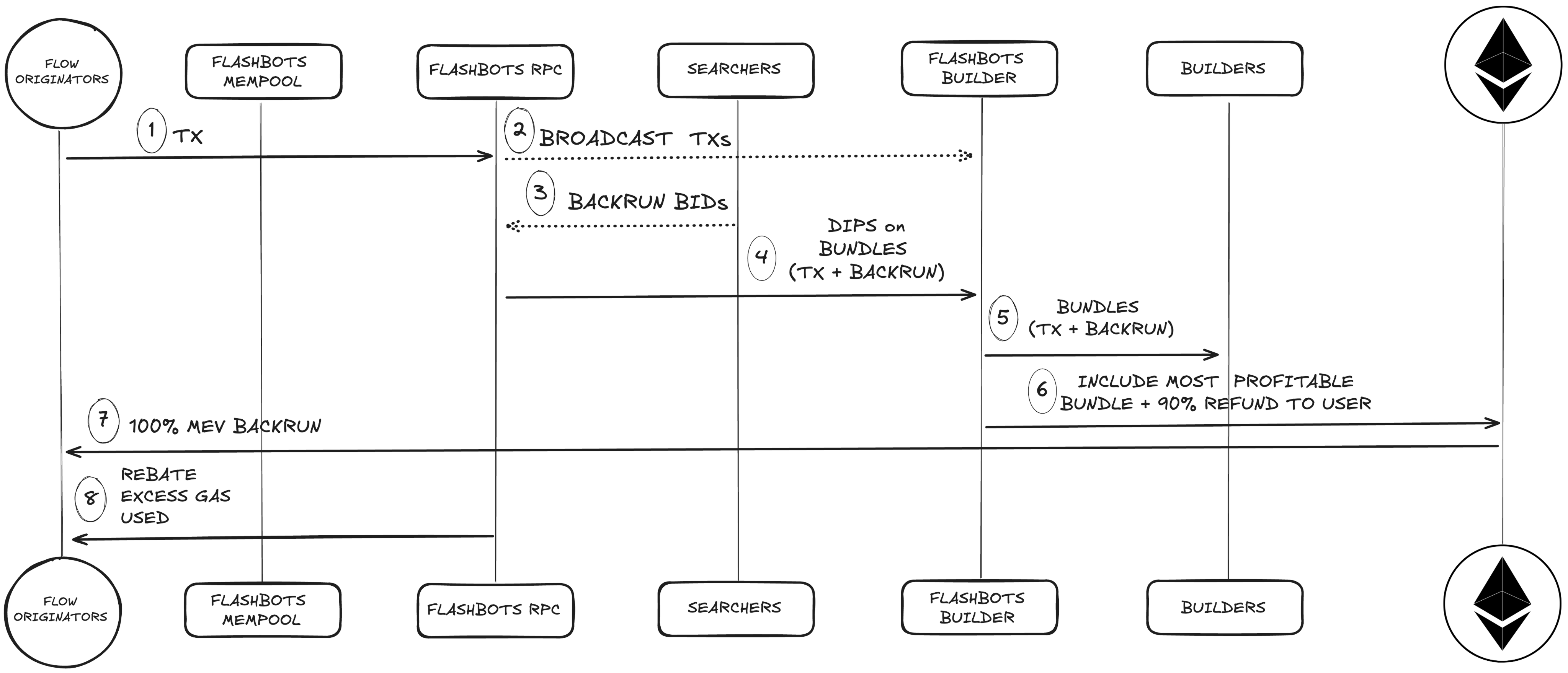

Flashbots Protect RPC

Flashbots Protect offers a permissionless and selective transaction sharing model, allowing transactions to be shared initially with Flashbots builders before disseminating to other builders. This approach, while offering flexibility in builder selection by the user, potentially delays transactions shared with external builders.

Merkle and Blink RPCs

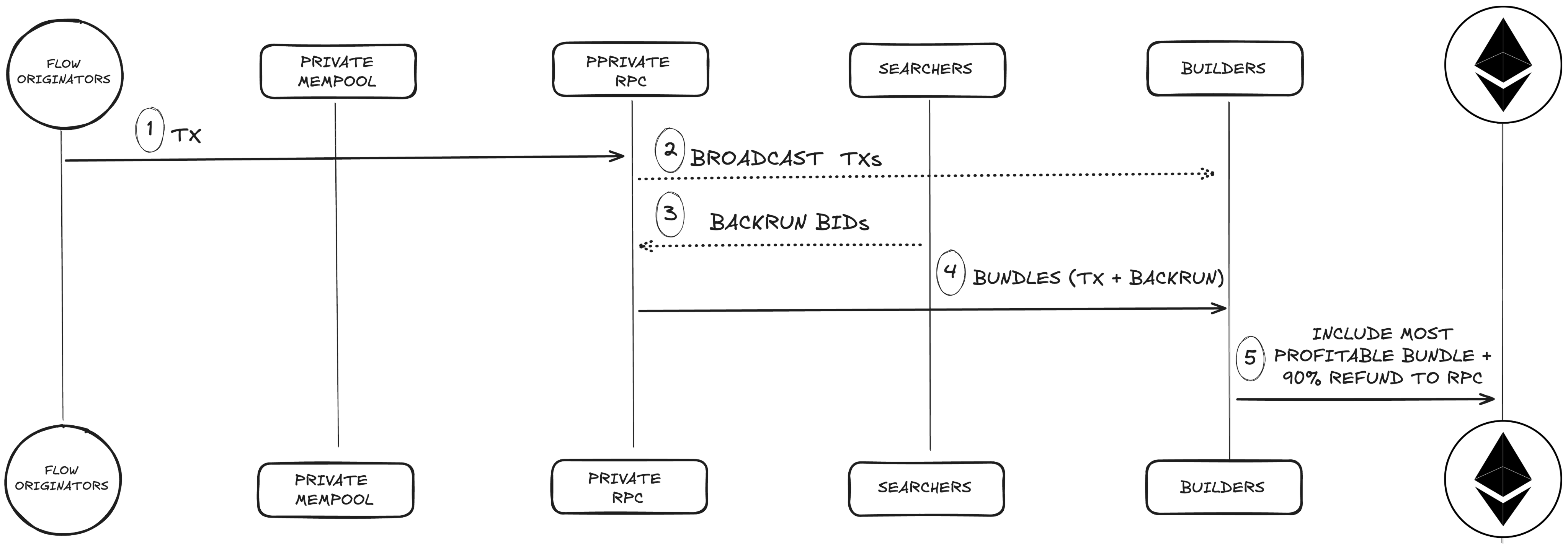

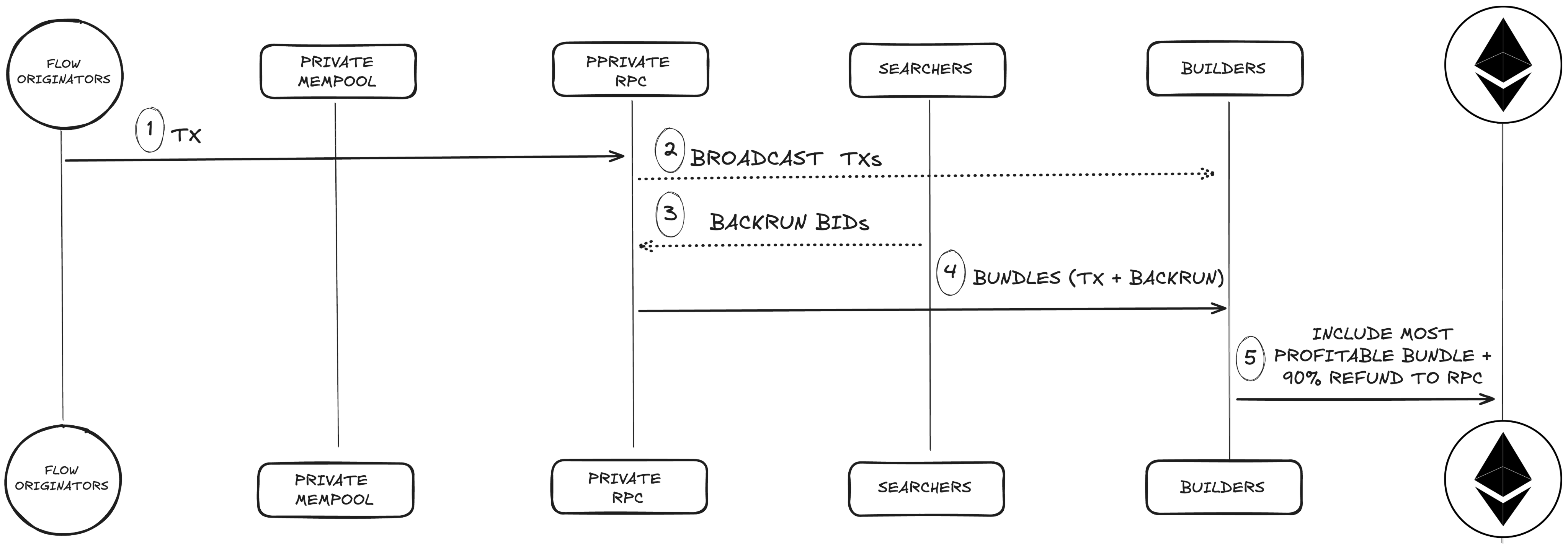

Merkle and Blink services employ a gated and pre-approved searcher network, allowing complete transaction data sharing but introducing opacity due to controlled access. Both employ a per-transaction fee model which, while ensuring transactions stay private, disincentivizes fast inclusion due to the additional cost burden on builders.

Experimental Analysis

Methodology

Transactions were systematically submitted across the RPC providers over a defined period and analyzed using two primary components: "Inclusion Quality" which covers success rate and time to inclusion, and "Execution Quality" covering swap price improvement and backrun generation.

Figure 2: Transaction flow illustrating the varying success rates across RPC providers.

Results

Success Rate

MEV Blocker, Blink, and Flashbots achieved high success rates, while Merkle lagged significantly behind, indicating variability in the efficiency of transaction handling.

Time to Inclusion

Time to inclusion analysis revealed MEV Blocker led slightly over Flashbots, with Blink and Merkle in trailing positions. The prioritization policy inherent to each RPC's auction design impacts such timing significantly.

Swap Price Improvement and Backrun Quality

MEV Blocker facilitated better swap price improvements and consistently higher backrun values. Flashbots showed statistically significant weaker performance compared to MEV Blocker, while Merkle and Blink exhibited particularly low rebate capabilities.

Figure 3: Comparative analysis of swap price improvement across RPCs showing MEV Blocker's superior performance.

Conclusion

The paper identified distinctive advantages of MEV Blocker's model, notably its superior transaction inclusion quality and rebate benefits compared to other RPC providers. Flashbots, while competitive in terms of inclusion timing, showed less favorable price execution outcomes. Both Merkle and Blink faced challenges with lower success rates and weaker rebate provisions, yet they manage to add value by preventing MEV attacks. These analyses provide crucial insights for DeFi order flow originators on the strategic selection of RPC services based on transaction efficiency and economic implications.

Implications and Future Developments

The implications of this benchmark paper suggest further exploration into decentralized mechanisms to improve transparency, efficiency, and user trust in MEV protection systems, as the adoption of PoS and private RPCs could reshape the transaction execution landscape. Future research could optimize OFA configurations for enhanced economic fairness and integration across emerging blockchain ecosystems.