- The paper demonstrates that transaction reordering due to MEV practices significantly affects decentralized exchange costs and validator revenues.

- It employs an ordered probit model to quantify the impact of fees and DEX transactions on block positioning and MEV revenue.

- The findings suggest protocol reforms such as time priority systems to mitigate sandwich attacks and reduce network centralization.

The Marginal Effects of Ethereum Network MEV Transaction Re-Ordering

Introduction

The paper investigates the impact of transaction reordering due to Maximum Extractable Value (MEV) tactics on the Ethereum network, specifically focusing on sandwich attacks and block validation strategies. MEV builders play a crucial role in the Ethereum proof-of-stake framework, prioritizing transactions to maximize revenue, with transaction reordering leading to significant economic consequences for participants involved, particularly in decentralized exchanges (DEXs).

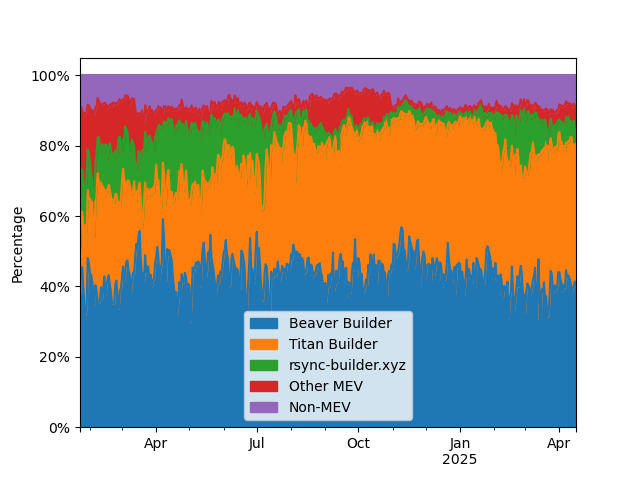

Network Concentration and MEV Revenue

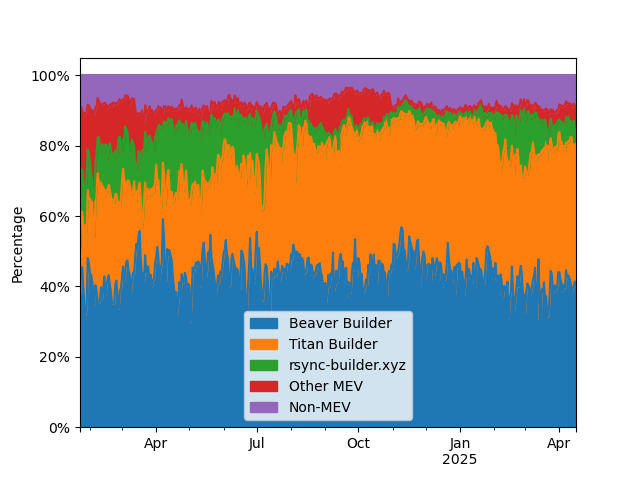

The centralization of the Ethereum block-building process has increased substantially post the Beacon merge, with two MEV builders dominating the landscape. This concentration has implications for competition and fairness in the blockchain ecosystem.

Figure 1: The dominance of two primary MEV builders in block formation since January 2024 shows a trend toward increased centralization.

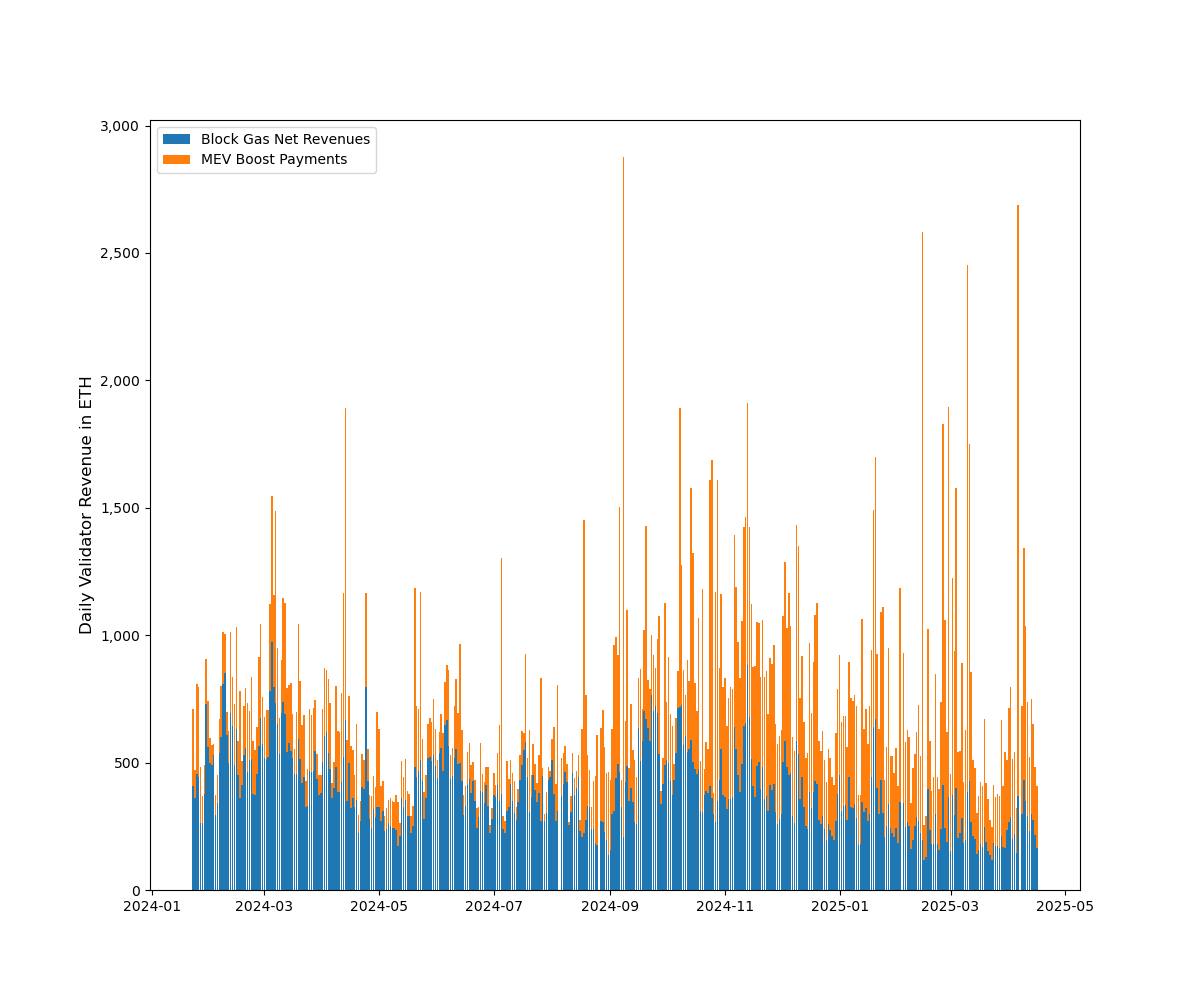

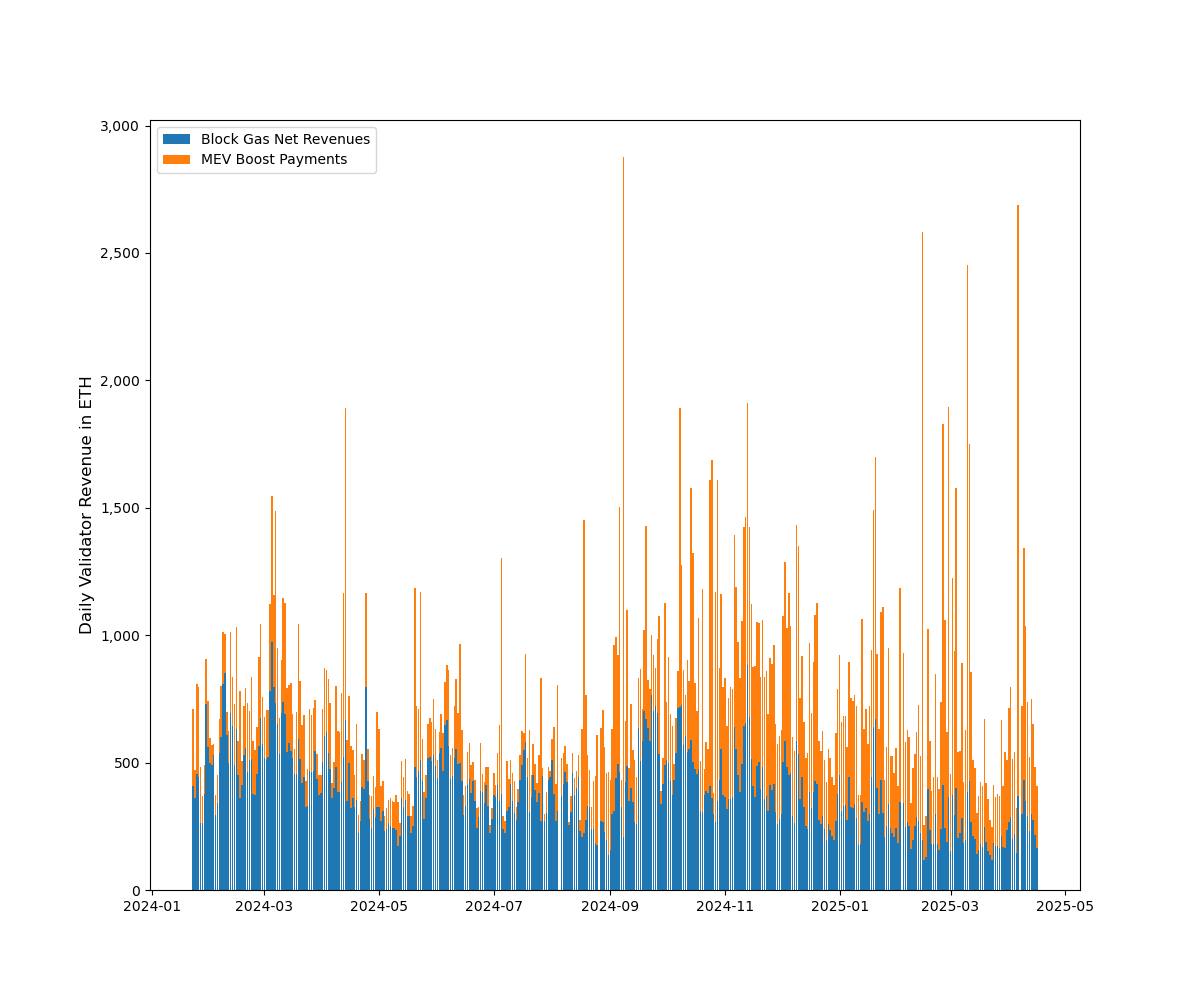

Validator revenues from MEV payments contribute significantly to their overall income, driven by transaction reordering practices and high gas fees.

Figure 2: Validator revenue analysis indicates substantial income from MEV payments during January 2024 to April 2025.

Implementation of Time Priority

The absence of strict time priority rules in transaction ordering contrasts sharply with equity markets, where regulations enforce price-time priority to protect participants from unjust practices. In blockchain networks, without centralized control or regulatory mandates, transaction ordering remains subject entirely to the choices of MEV builders and validators.

Baseline Model for Transaction Re-Ordering

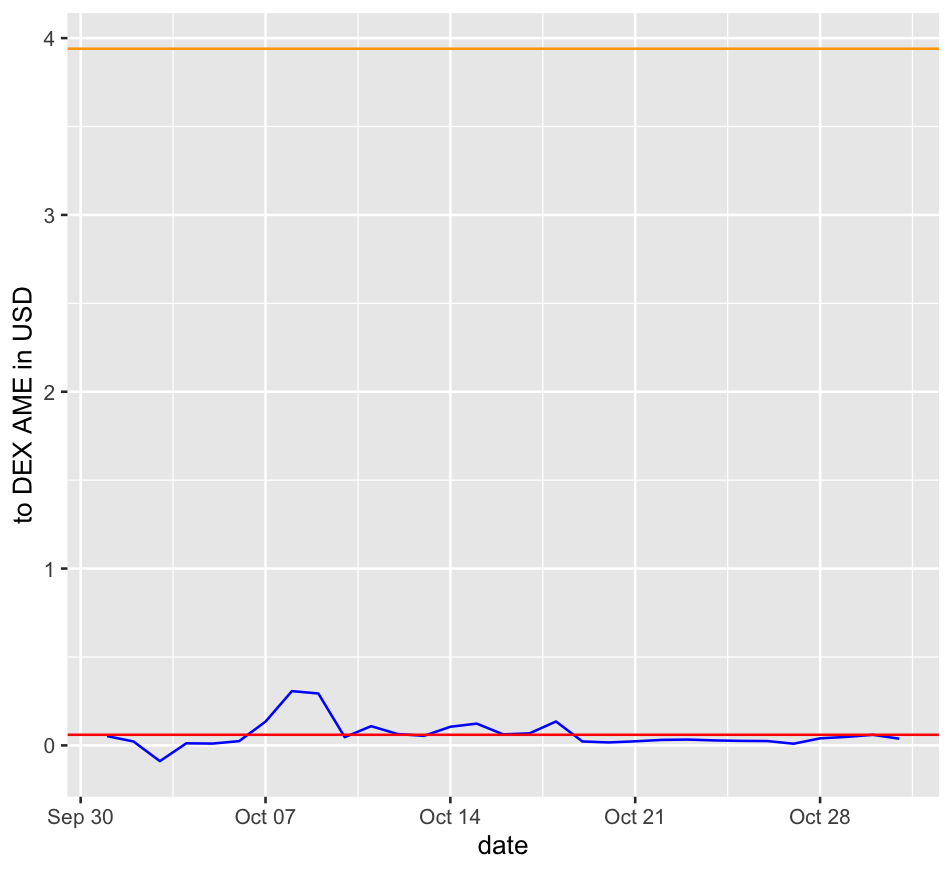

The paper employs an ordered probit model to assess the probability of a transaction being placed early in the block. The analysis reveals that mempool positioning only weakly predicts block position, while transaction fees to MEV agents and DEX transactions have greater impacts.

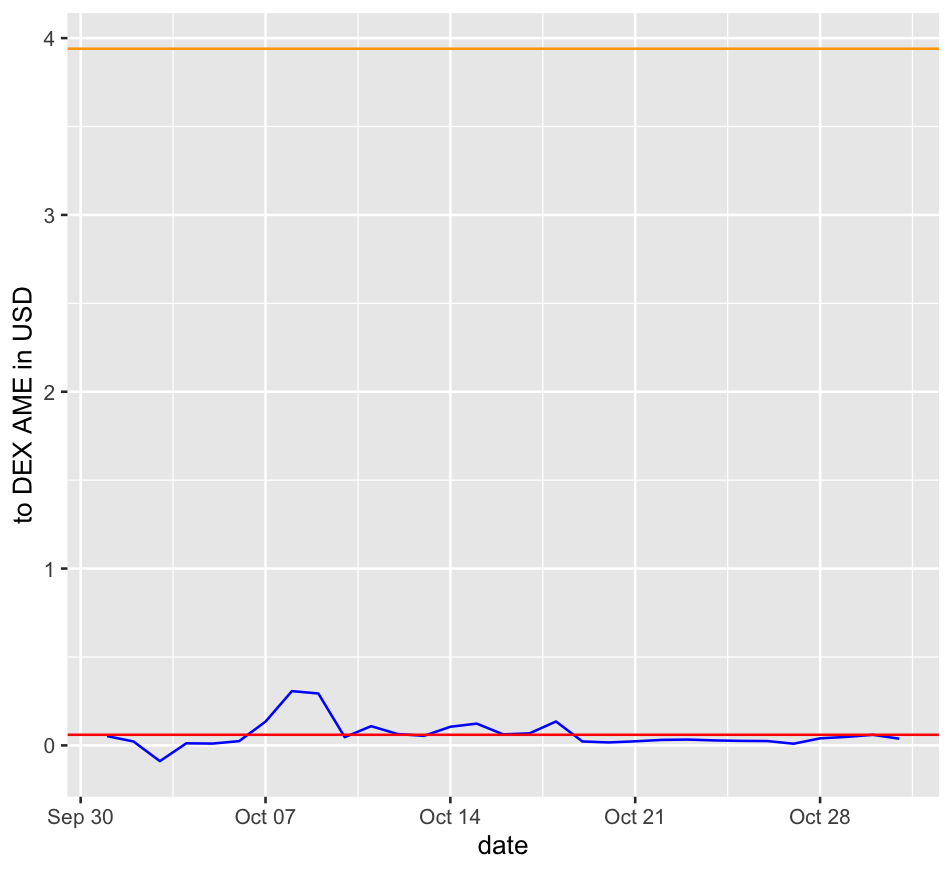

Figure 3: The marginal effects of sending transactions to DEXs, highlighting the heightened probability of inclusion in the first block quartile.

Sandwich Attacks

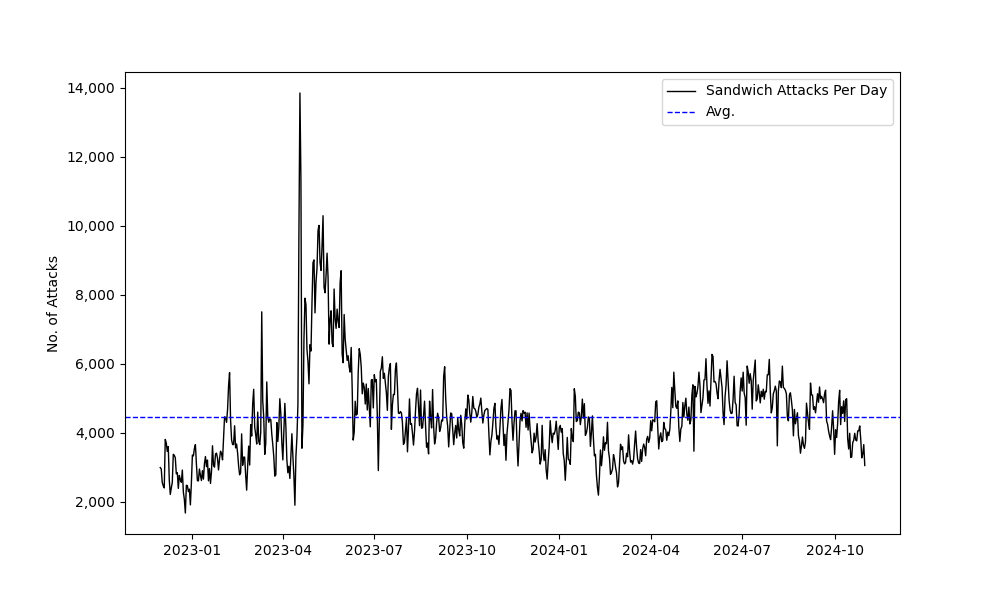

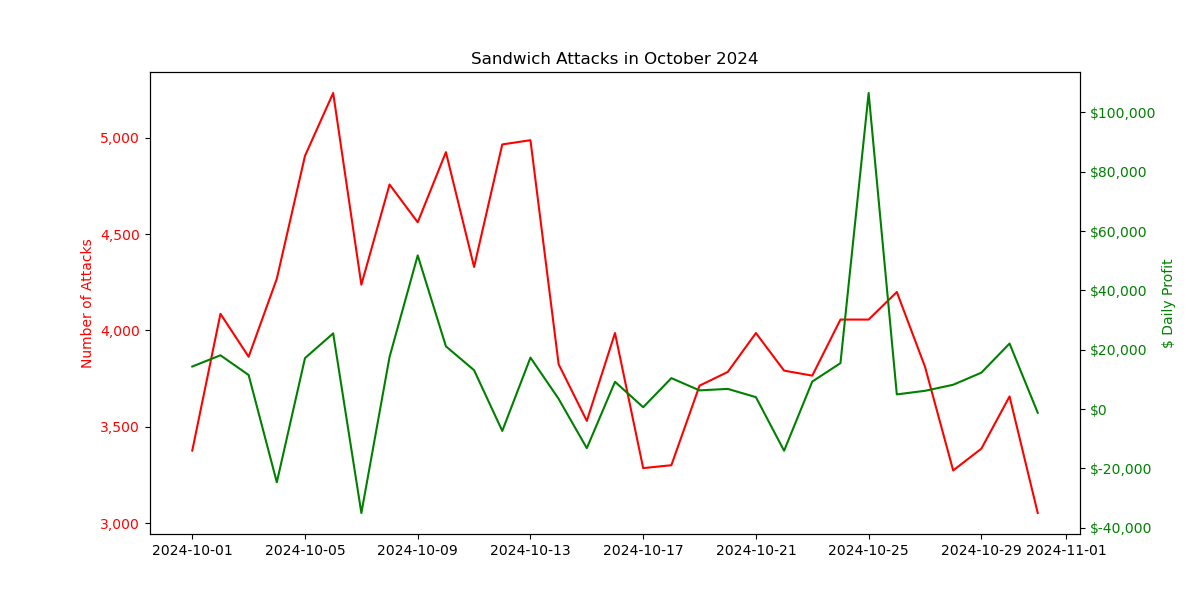

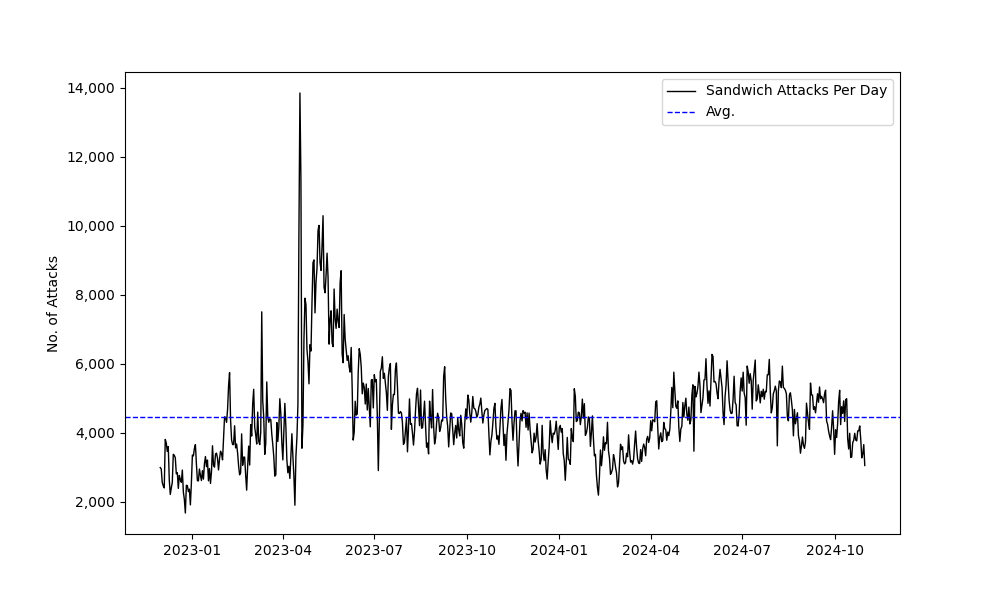

Sandwich attacks are prevalent, averaging more than 4,400 daily. These attacks exploit transaction placement for profit, impacting the natural ordering in the block and increasing participants' costs significantly.

Figure 4: Sandwich attacks trend, highlighting their frequency and impact on block transactions between 2023 and 2024.

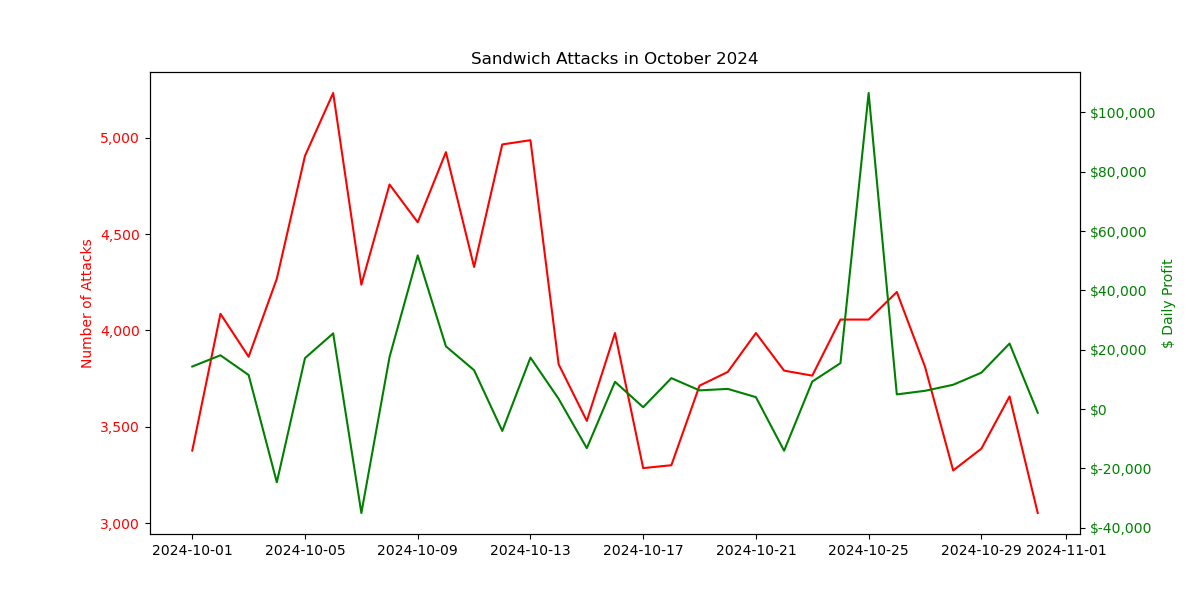

In October 2024, transactions involved in sandwich attacks demonstrate disproportionately large marginal effects, although a significant portion of these effects can be attributed to front-running and back-running practices.

Figure 5: Daily sandwich attack outcomes in October 2024, showing prominently altered transaction priorities.

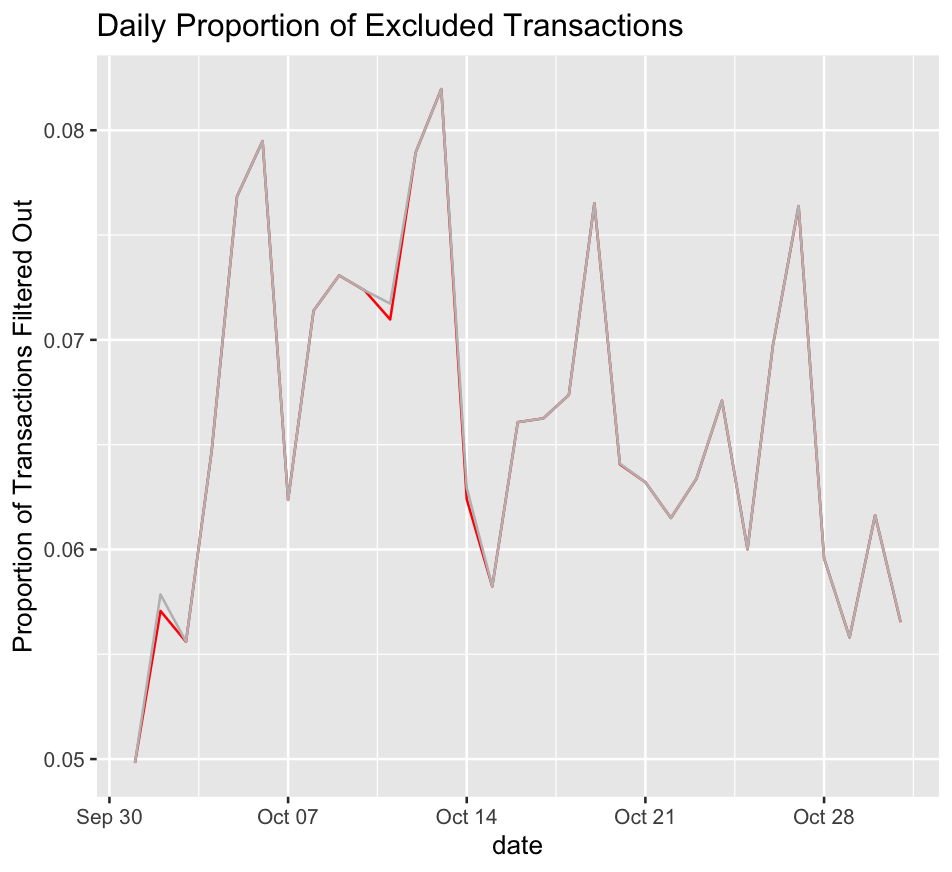

Mitigating Skewness and Marginal Effects

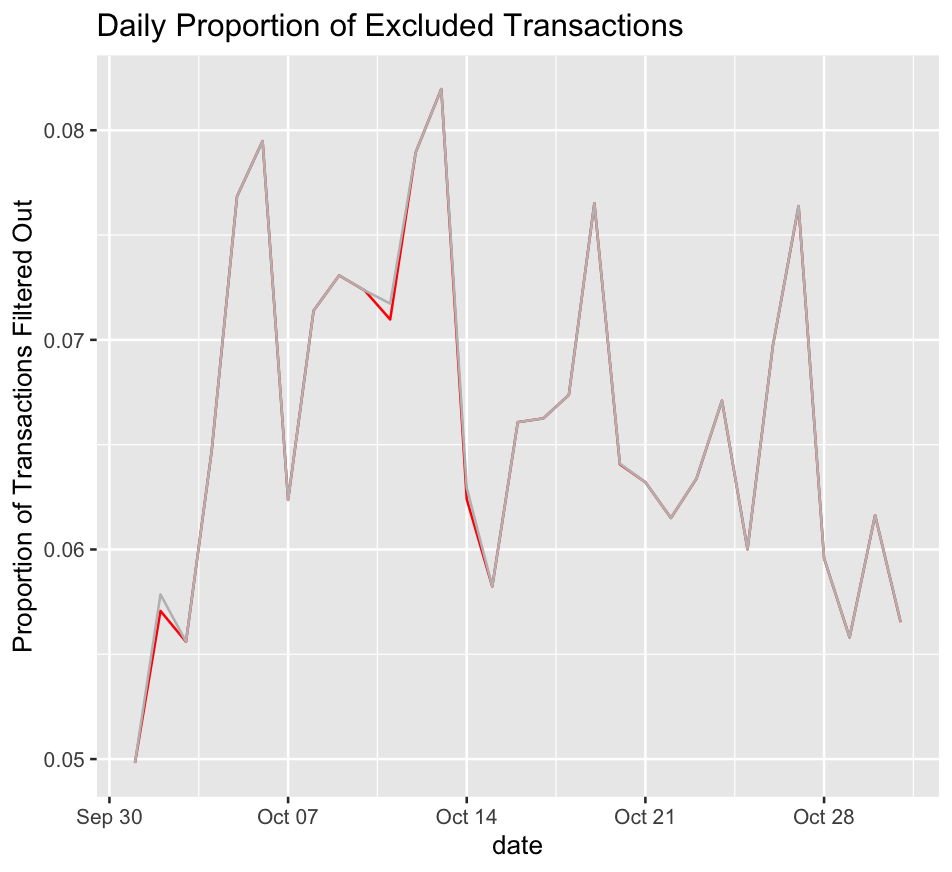

The skewness in transaction marginal effects results mainly from sandwich attacks. Analysis shows that controlling for sandwich transaction costs and numbers significantly reduces this skewness.

Figure 6: Analysis of excluded transactions in October 2024 highlights high marginal effects distribution skewness due to sandwich attacks.

Conclusion

The systemic concentration of MEV builders and the economic implications of transaction reordering underscore the need for reconsidering blockchain transaction ordering protocols. Current MEV practices lead to substantial financial impacts on transactions in DEXs, prompting considerations for protocol reforms to mitigate these effects, such as prioritizing time and fee systems similar to traditional equity markets.

Efforts to implement time priority and alternative transaction ordering mechanisms on Layer 2 platforms illustrate potential paths forward. These changes could alleviate the adverse consequences of MEV extraction and enhance fairness and efficiency in blockchain networks.