- The paper introduces a game-theoretic model to analyze the order flow auction and its role in redistributing MEV.

- It finds that while PBS democratizes rewards for proposers, the OFA mechanism may increase centralization among builders.

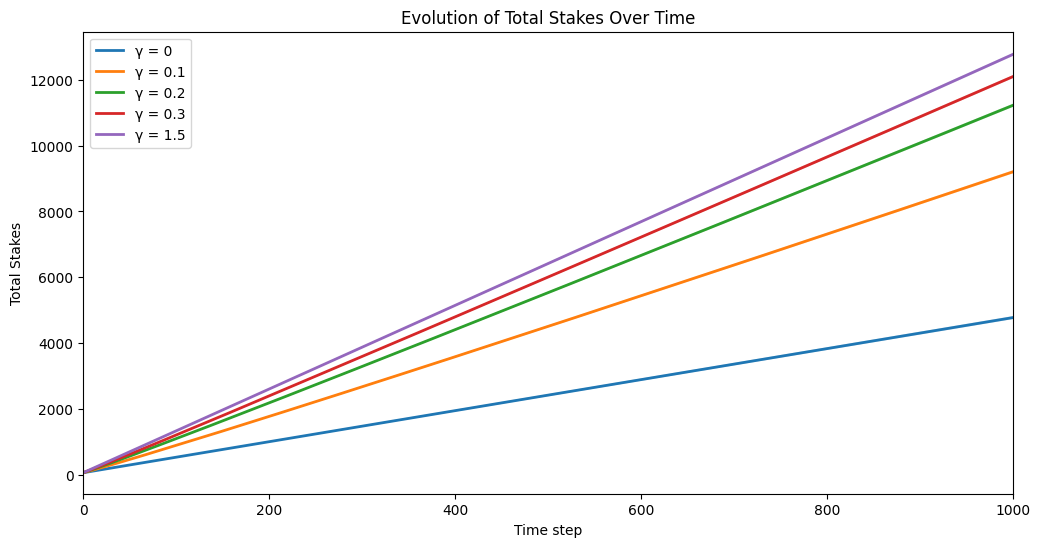

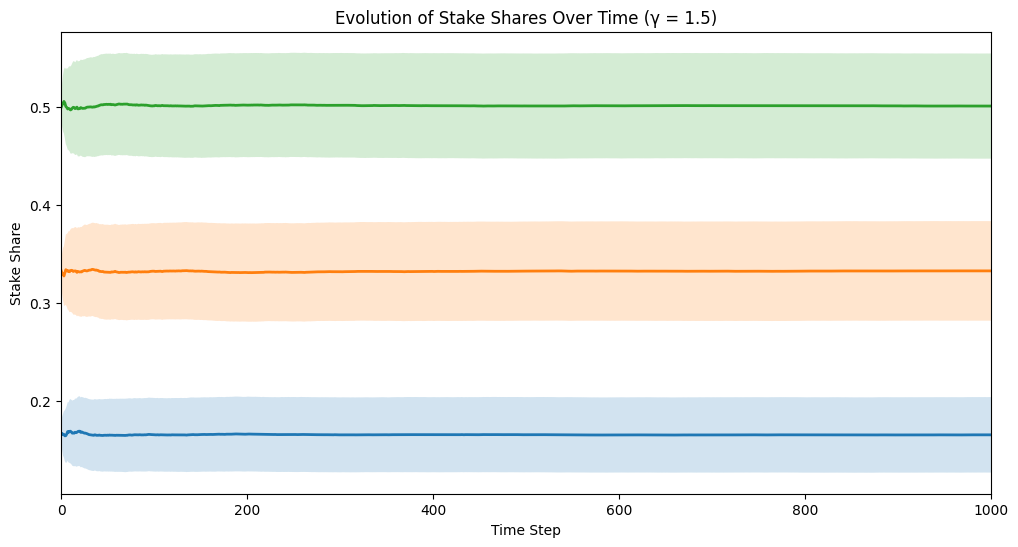

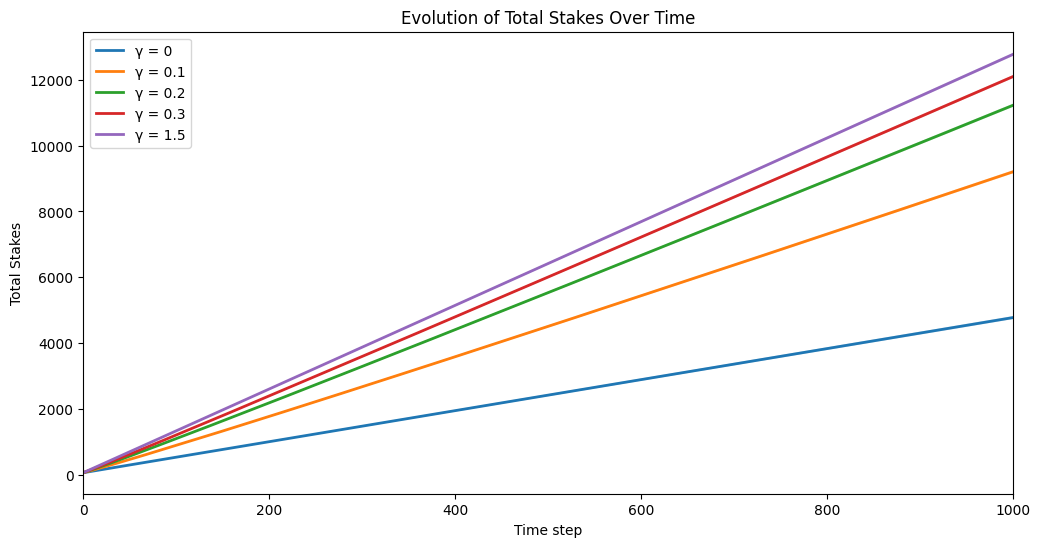

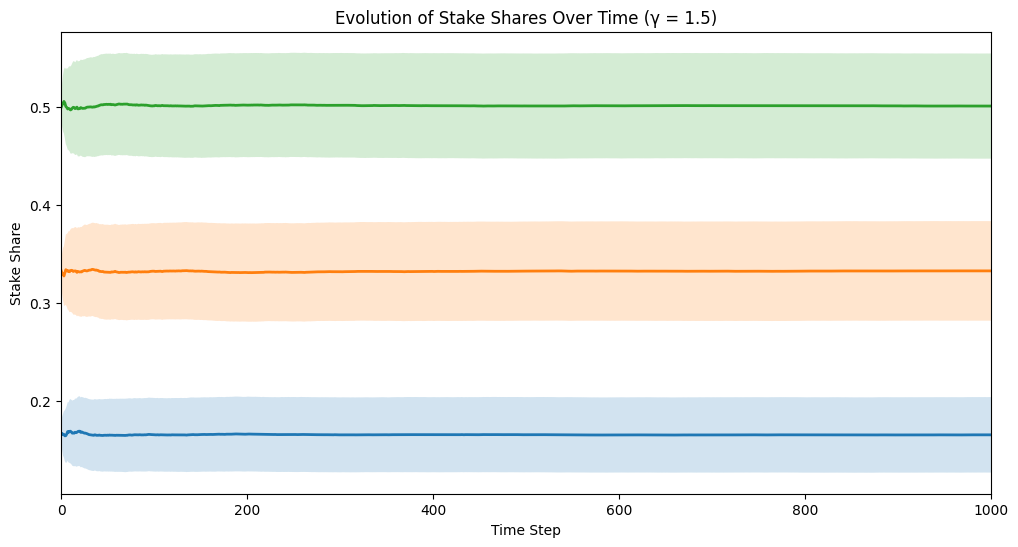

- Simulations reveal non-linear scaling of builder payments and a martingale process ensuring stable validators' stake evolution.

Analysis of the Order Flow Auction under Proposer-Builder Separation

The paper "Analysis of the Order Flow Auction under Proposer-Builder Separation" (2502.12026) investigates the dynamics and effects of the order flow auction (OFA) in the context of blockchain systems employing the proposer-builder separation (PBS) mechanism. This research is grounded in a game-theoretic framework, which explores the interaction between various players—particularly builders and validators—within the blockchain ecosystem.

Proposer-Builder Separation Mechanism

Blockchain platforms require a mechanism to securely validate transactions without centralized oversight. The PBS mechanism is proposed to distribute Maximal Extractable Value (MEV), which can otherwise lead to a centralization of power among larger validators. PBS segregates roles within the blockchain ecosystem by splitting proposers (validators) from builders, who compete to construct blocks from transactions.

In this model, proposers submit blocks for validation while builders assemble blocks for auction. This auction format allows proposers to earn revenue from builders, who bid for the right to have their block included on-chain. Thus, PBS aims to democratize MEV distribution, reducing centralization tendencies among validators [ethereum_pbs].

Order Flow Auction Model

The OFA presents a second auction layer by redistributing some MEV back to users. Users' transaction orders are auctioned to builders who bid for the privilege to execute strategies on these orders. Unlike PBS, which involves only validators and builders, the OFA incorporates user interactions, targeting a more equitable distribution of MEV. This approach is particularly analogous to Payment For Order Flow (PFOF) in traditional finance, a concept explored by Gosselin and Chiplunkar [gosselin2023].

Key components include:

- Order Flow Originators (OFO): Interfaces (wallets, dApps) that relay user orders to the auction.

- Auctioneer: Conducts the auction, revealing order information to potential bidders.

- Bidders (Builders/Searchers): Submit bids for transaction rights.

- Winning Bid: Determines block inclusion based on highest bid submitted.

Figure 1: Depicts the flow of transactions from users to validators, mediated by OFA interactions and builder bidding dynamics.

Game-Theoretic Analysis

The paper models OFA as a multiplayer game where builders bid for MEV extraction opportunities. Several critical results are derived:

- Nash Equilibrium: The game exhibits a unique Nash equilibrium among builders. This equilibrium, characterized mathematically via a quartic equation solution, shows that builders with greater extraction abilities pay less, promoting centralization within the builder community.

- Martingale Process: Validators’ stakes evolve as a martingale, indicating stability in proposers' shares and reduced centralization risk.

- Simulation Studies: Simulations underscore the non-linear scaling of builder payments with MEV extraction capabilities, highlighting competitive dynamics.

The strategic advantage held by more capable builders potentially exacerbates builder community centralization, contrasting the decentralizing effects of PBS on proposers [bahrani2024].

Validator Stake Analysis

The paper further explores validator dynamics under PBS:

- Validators’ stake shares evolve predictably, adhering to a martingale process, ensuring consistency over time.

- The research identifies no centralization tendencies among validators despite differentiated rewards in MEV distribution and auction structures.

- Consumption costs are considered, adding realism regarding staking expenses, opportunity costs, etc.

The convergence results indicate that validators' stake distribution remains stable, aligned with initial shares, when consumption costs are minor.

Conclusion

The findings present insightful implications for blockchain system design and operation. While PBS can mitigate validator centralization by democratizing access to auction revenues, the OFA potentially amplifies builder centralization, requiring further refinement in auction protocols. Future advancements in auction design can leverage these insights for maintaining system integrity and fairness in blockchain transactions.

Overall, the paper contributes critical understanding to blockchain consensus dynamics and provides a mathematical foundation to address centralization and fairness within blockchain ecosystems. Future work should explore more complex OFA models, potentially integrating dynamic and adaptive auction systems to enhance decentralization across all participants.