- The paper introduces a multi-agent framework using LLMs to integrate multi-modal financial data for accurate stock market prediction.

- It employs specialized agents—Summarize, Technical Analyst, and Reflection modules—to refine trading strategies with explainable decision-making.

- Evaluation metrics such as ARR, Sharpe Ratio, and MDD demonstrate its improved performance over rule-based and RL models, emphasizing risk management and adaptability.

FinVision: A Multi-Agent Framework for Stock Market Prediction

The "FinVision" paper presents a novel multi-agent framework designed to enhance stock market prediction by leveraging the capabilities of LLMs to process and interpret multi-modal financial data. This framework is composed of specialized agents within a multi-agent system, each proficient in handling different aspects of financial data, providing a comprehensive decision-making process for financial trading tasks.

Framework Overview

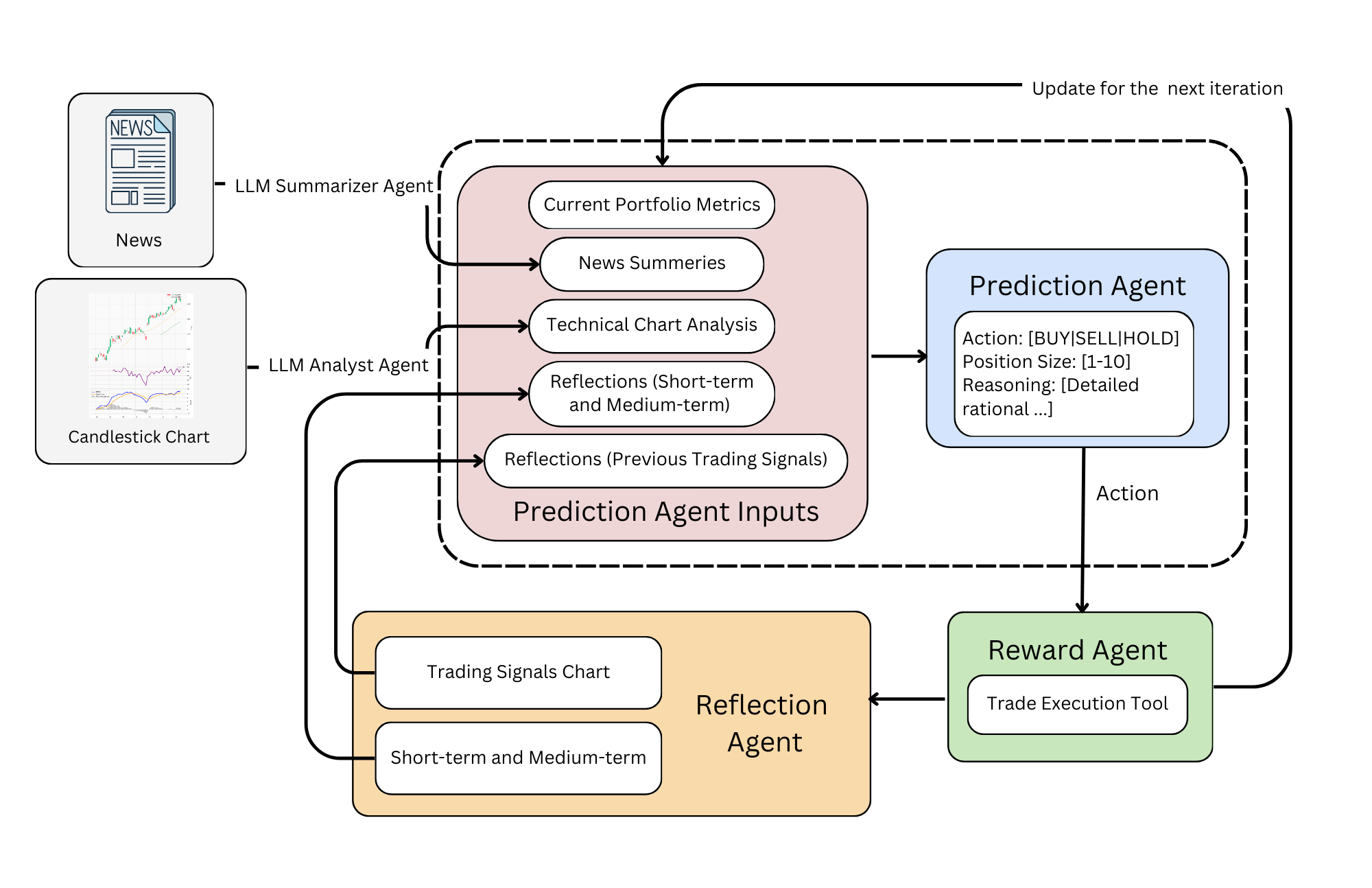

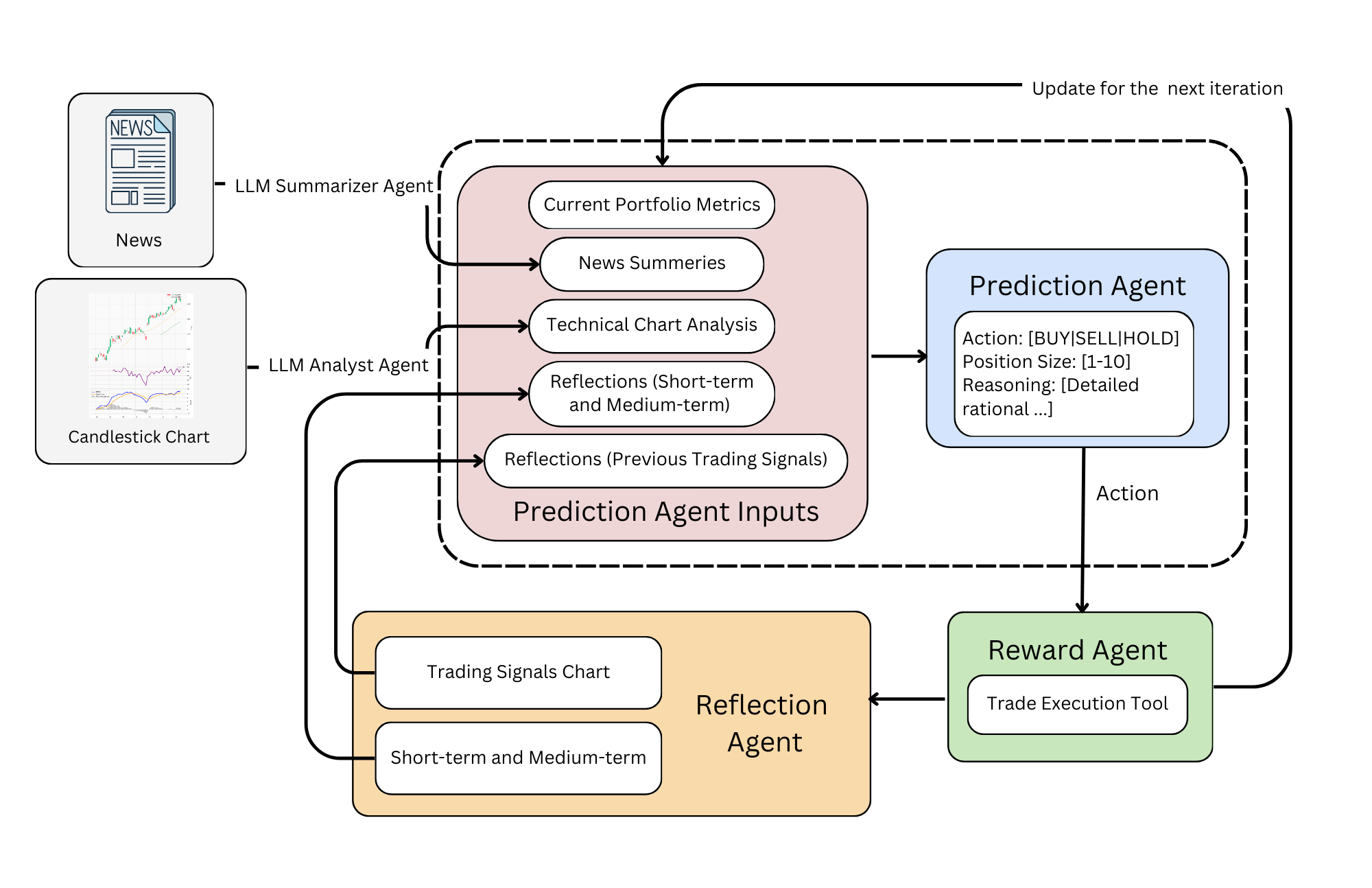

The framework introduced in "FinVision" incorporates multiple LLM-based agents, each tasked with processing specific forms of financial data, such as textual news, candlestick charts, and trading signal charts. The key innovation is the integration of a reflection module that analyzes past trading signals and outcomes to refine future decision-making. This module enhances the system's ability to adapt and improve over time, providing more accurate and explainable trading decisions.

Figure 1: The Multi-modal Multi-Agent Prediction Framework

System Components

- Summarize Module:

- Converts extensive textual news into concise summaries, highlighting key factors influencing stock decisions. It ensures that agents make informed decisions by focusing only on impactful news elements.

- Technical Analyst Module:

- Utilizes LLMs for visual reasoning to interpret and analyze technical indicators from candlestick charts. This agent provides insights into potential trading strategies.

- Reflection Module:

- Composed of two parts: one evaluates past trades for short- and medium-term outcomes, while the other compiles trading signal analyses. This retrospective analysis is crucial for ongoing improvement of trading strategies.

- Prediction Module:

- Integrates data from all previous modules to generate comprehensive trading actions. It recommends specific transaction types and proportions of the portfolio to trade, offering a detailed explanation for each decision.

Methodological Strengths

The paper highlights the system's low demand on training time, significantly reducing computational overhead and API costs. By extending decision-making to include position sizing—allocating trades as a percentage of the portfolio—the framework addresses risk management more granularly, a crucial element often overlooked in similar systems.

Evaluation

The system's performance was evaluated using data from three major technology companies—Apple, Amazon, and Microsoft—over a period of seven months. The results indicate that FinVision outperformed traditional rule-based and RL-model systems, although it fell short of the benchmark set by similar multi-agent systems like FinAgent.

- Annual Rate of Return (ARR) and Sharpe Ratio (SR) were used to measure portfolio growth and risk-adjusted returns, respectively.

- Maximum Drawdown (MDD) offered insight into the model's capability to manage significant portfolio declines.

The reflection module's role was pivotal, as demonstrated by ablation studies that pointed out considerable performance enhancement due to its inclusion. The results show that by integrating multi-modal and multi-agent techniques, "FinVision" can handle a complex and volatile market environment effectively.

Discussion

Implications of Results

The use of LLMs for financial analysis introduces improvements in transparency and explainability, crucial for practical deployment in real trading scenarios. The reflection module ensures continuous learning and adaptation based on historical performance, a feature that enhances the framework's robustness and effectiveness.

Future Directions

Future work could focus on integrating more advanced reinforcement learning strategies and expanding the system to handle a wider array of financial instruments and market conditions. Enhancements in the agents' cognitive capabilities through advancements in multi-modal data processing and real-time analysis will also be crucial, particularly with evolving market dynamics.

Conclusion

"FinVision" successfully demonstrates the potential of a multi-agent framework using LLMs for stock market prediction. By effectively integrating and analyzing diverse datasets, the framework offers a promising approach to improving accuracy and interpretability in financial trading systems. While it achieves competitive results, opportunities exist for further development in enhancing adaptive trading strategies and reducing computational limitations.