- The paper introduces a multi-agent trading system that employs LLMs to execute strategic hedging and improve robustness in volatile markets.

- The methodology relies on coordinated agent meetings (BAC, ESC, EMC) to optimize asset allocation and balance risk and return across various financial instruments.

- The system achieved superior performance on nine financial metrics, including Sharpe Ratio and Maximum Drawdown, outperforming state-of-the-art baselines.

HedgeAgents: A Balanced-aware Multi-agent Financial Trading System

Introduction

The paper "HedgeAgents: A Balanced-aware Multi-agent Financial Trading System" proposes a novel multi-agent system designed to enhance the robustness of financial trading strategies through effective hedging. The system employs LLMs and comprises various hedging agents, including a central fund manager, to execute and manage trading actions across multiple asset classes like stocks, forex, and cryptocurrencies. Despite the promising capabilities of LLMs and agent-based models in dynamic trading scenarios, existing systems often struggle with robustness in volatile markets, resulting in significant losses. This research addresses these limitations by employing strategic hedging within a multi-agent framework.

Methodology

Multi-agent Framework and Hedging Strategies

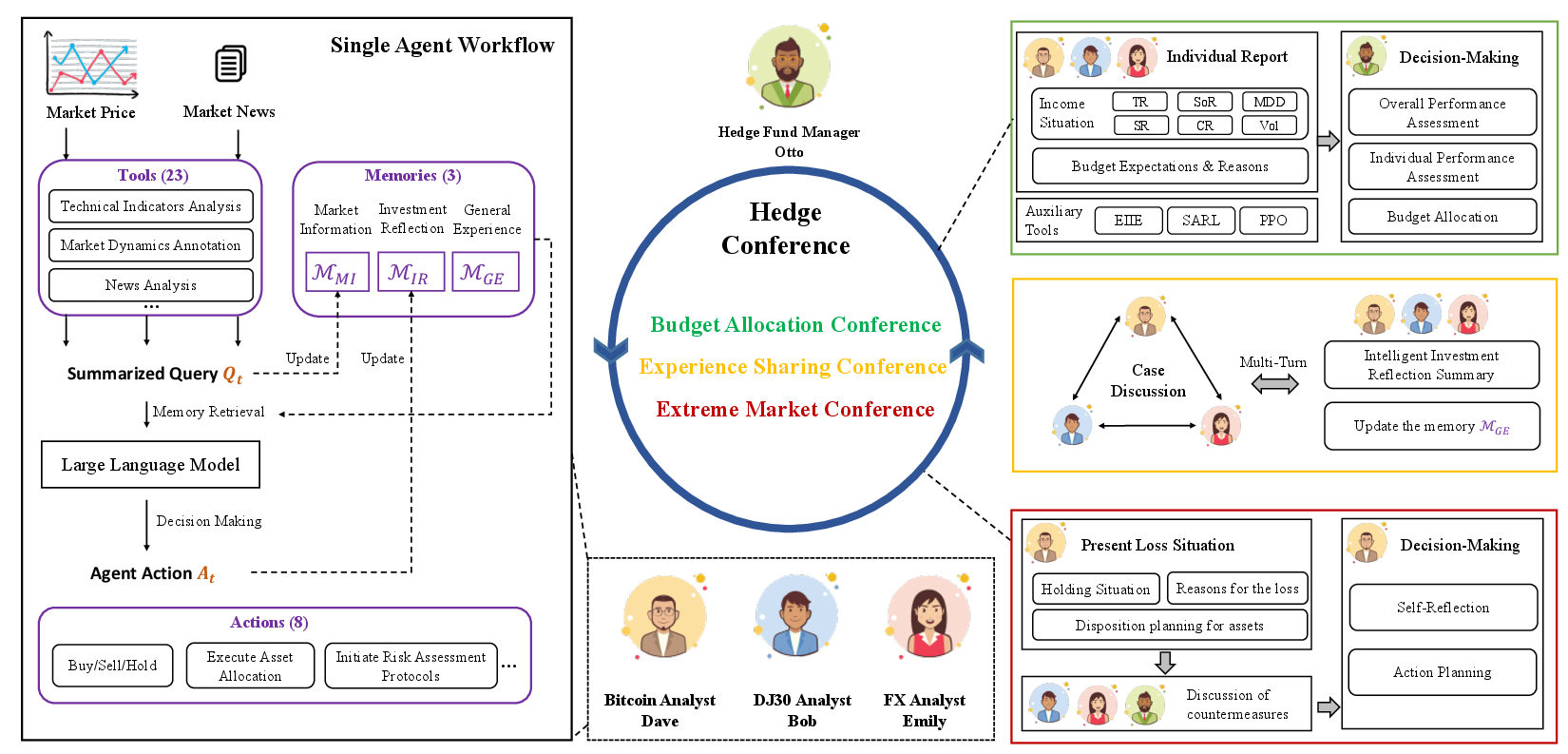

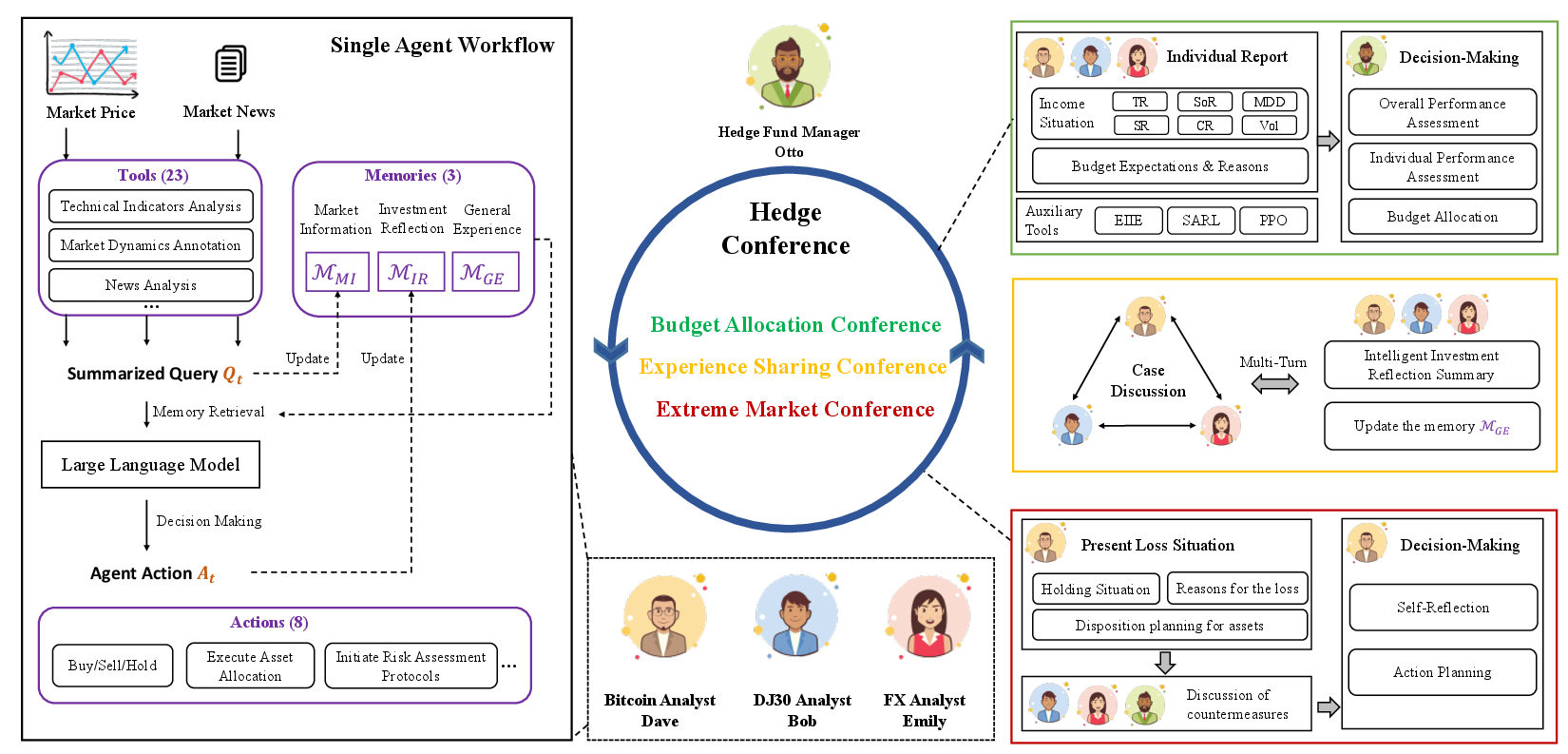

The HedgeAgents system consists of specialized agents, each dedicated to a particular asset class and a central fund manager who facilitates overall portfolio management. The agents are equipped with LLMs to process information and make informed trading decisions. The framework simulates a hedge fund's structure, with agents coordinating through various conference types, including Budget Allocation Conference (BAC), Experience Sharing Conference (ESC), and Extreme Market Conference (EMC). These conferences enable effective resource allocation, knowledge sharing, and tactical response to market fluctuations.

Figure 1: Our HedgeAgents comprise 3 hedging agents and 1 manager. Each agent is equipped with 23 tools and possesses 3 types of memory to execute 8 actions.

Single Agent Workflow

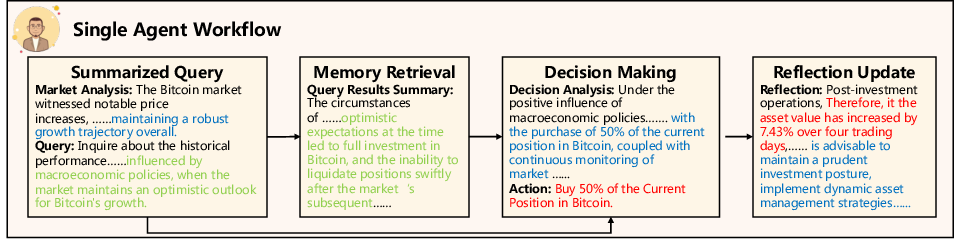

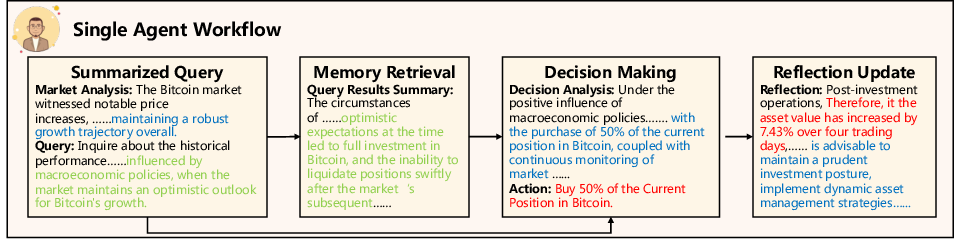

In the HedgeAgents system, each agent operates through a cycle of memory retrieval, decision-making, and reflection. Utilizing a reinforcement learning framework, agents perform actions based on historical data, simulated scenarios, and their cognitive interpretations facilitated by LLMs. This design ensures decisions are well-grounded in empirical evidence, enhancing adaptability and reactivity to market changes.

Figure 2: Workflow of a single agent, taking Bitcoin Analyst Dave as an example. Blue represents the analysis content, green indicates the query process, and red shows the specific decisions and outcomes.

Coordination Mechanisms

- Budget Allocation Conference (BAC): This periodic meeting optimizes asset distributions by assessing expected returns and risk factors.

- Experience Sharing Conference (ESC): Facilitates the consolidation of experiences and strategies, stored in shared memories.

- Extreme Market Conference (EMC): Provides a structured approach for addressing market volatility, emphasizing risk control and strategy adaptation.

Evaluation and Results

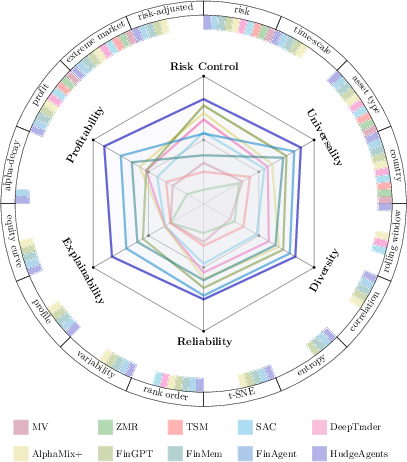

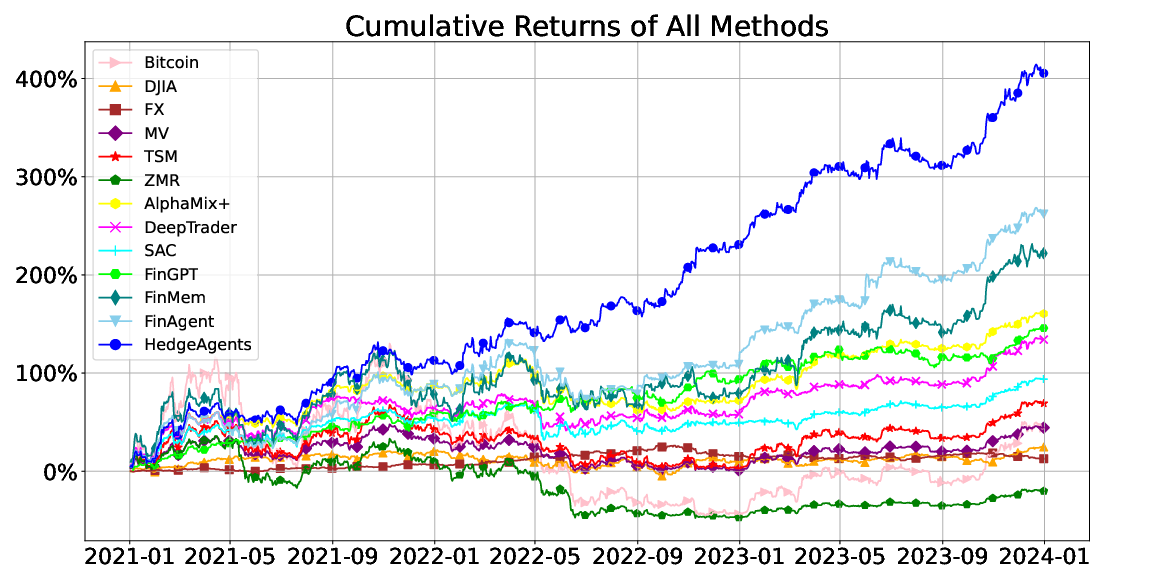

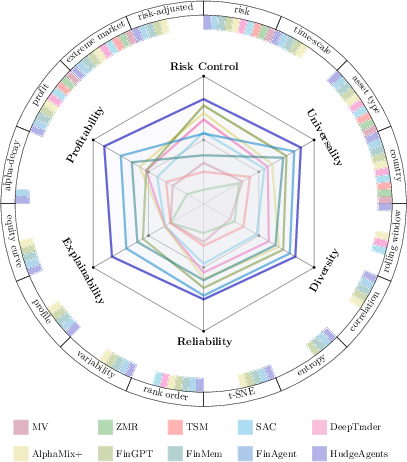

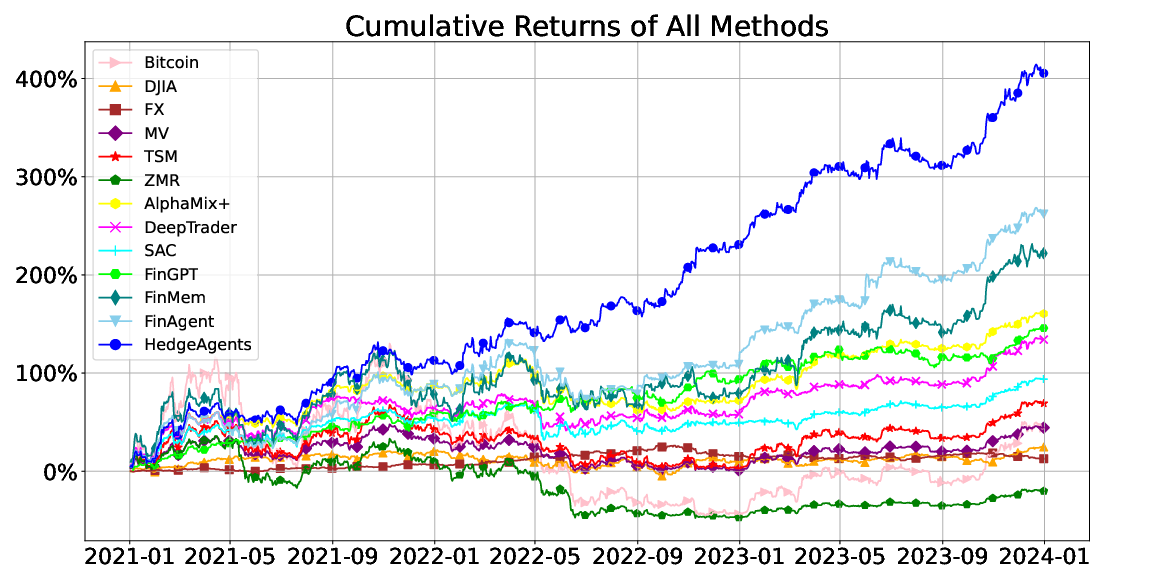

The HedgeAgents framework was evaluated against various state-of-the-art baselines using nine financial metrics, including Total Return (TR), Sharpe Ratio (SR), and Maximum Drawdown (MDD). The system significantly outperformed all baselines, achieving optimal performance across these metrics.

Figure 3: Our method outperformed all baselines on the PRUDEX benchmark across six dimensions.

Figure 4: Cumulative Returns Comparison of all baselines and our HedgeAgents.

In ablation studies examining the impact of key components like ESC, BAC, and EMC, the findings revealed each module's importance in maintaining a balanced risk and return profile. The integration of LLMs as the cognitive hub was shown to enhance decision-making accuracy and robustness across all market scenarios.

Discussion and Future Work

The results demonstrate the efficacy of HedgeAgents in achieving consistent returns and resilience in volatile markets. The strategic incorporation of hedging within a multi-agent system contributes significantly to mitigating risks and optimizing returns. Moving forward, potential research avenues include refining the coordination mechanisms among agents and exploring the scalability of the approach to other financial instruments and markets. The framework's adaptability suggests broader applicability across sectors requiring sophisticated multi-agent coordination and decision-making under uncertainty.

Conclusion

"HedgeAgents: A Balanced-aware Multi-agent Financial Trading System" presents a comprehensive approach to enhancing resilience in trading systems through multi-agent collaboration and strategic hedging. The framework's robust performance across various metrics underscores its potential for real-world application in financial markets, offering a promising direction for future advancements in automated trading and LLM-based decision support systems. The paper establishes a solid foundation for ongoing exploration of AI-driven trading strategies that balance return optimization and risk management effectively.