- The paper presents a novel multi-agent system that integrates LLM capabilities with specialized modules for data and literature integration, enhancing crypto investment decisions.

- The methodology employs expert training and collaborative decision-making, using token log probabilities and inter-agent insights to boost prediction accuracy.

- Empirical results demonstrate superior classification and portfolio returns compared to traditional strategies, underscoring the system’s robust explainability and performance.

LLM-Powered Multi-Agent System for Automated Crypto Portfolio Management

The paper "LLM-Powered Multi-Agent System for Automated Crypto Portfolio Management" presents a sophisticated framework aimed at addressing the complex requirements of cryptocurrency investment, by leveraging the capabilities of LLMs in a multi-agent system. The proposed system integrates multi-modal data and expert methodologies to enhance decision-making and explainability in crypto market investments.

Introduction to the Problem

Cryptocurrency markets are characterized by their volatile nature, integration of vast data modalities, and intricate reasoning needed for sound investment decisions. This complexity poses significant challenges for both traditional deep learning models and human investors. Traditional models often lack transparency, leading to distrust among investors. LLMs offer a promising solution due to their ability to comprehend and synthesize multi-modal data, yet single LLMs lack the domain specificity needed for comprehensive asset investment.

Proposed Framework

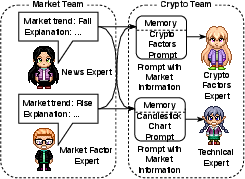

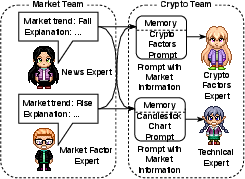

The authors propose a multi-agent framework consisting of specialized agents that perform a variety of tasks, including data analysis and literature integration, in a collaborative structure. This framework targets the top 30 cryptocurrencies, based on market capitalization, to optimize decision-making and prediction accuracy.

- Expert Training Module: This module utilizes historical data and academic literature to fine-tune agents within specialized teams. The data team processes raw market inputs, while the literature team gathers relevant academic insights to enhance model explainability.

- Multi-Agent Investment Module: In this module, agents apply their training to real-time data to make informed investment decisions. The collaboration mechanisms include intrateam collaboration, which aggregates confidence scores to adjust predictions, and interteam sharing of insights to enrich decision-making processes.

Figure 1: Agent training process demonstrating the multi-layered collaboration within the investment framework.

Multi-Agent Model Design

The framework applies distinct roles to specialized agents within two main collaborative modules:

- Data and Literature Integration: Agents in the data team gather comprehensive market data such as candlestick patterns and economic indicators, while literature agents provide academic context (e.g., risk factors models [Liu et al., 2022]).

- Decision-Making and Collaboration: Intrateam collaboration consolidates predictions using token log probabilities to create final investment advisories, while interteam approaches allow task-specific agents to refine decisions with supplementary market insights.

Figure 2: Intrateam collaboration showing integration of predictions from specialized agents to form cohesive investment strategies.

Empirical Evaluation

The empirical evaluation demonstrates the framework's superiority over both non-fine-tuned LLMs and single-agent systems. The multi-agent approach outperforms benchmarks in classification and asset pricing tasks, achieving stronger portfolio returns.

Figure 3: The cumulative return denominated in USD showing superior performance of the multi-agent model.

- Classification and Pricing Performance: The model shows improved accuracy and Matthews correlation coefficient in predicting cryptocurrency price trends, suggesting its efficacy in complex market conditions.

- Portfolio Performance: The system's portfolio management consistently surpasses traditional models and Bitcoin buy-and-hold strategies across various market scenarios.

Explainability and Insights

A significant advantage of the proposed framework is its enhanced explainability. By integrating literature-derived knowledge, the system can articulate investment reasoning, transforming the black-box nature of traditional models into an interpretable format.

Figure 4: Example outputs highlighting the asset pricing terminologies learned from the expert model.

Conclusions

The proposed multi-agent system for crypto portfolio management effectively combines domain-specific knowledge with LLM capabilities, offering a robust solution for managing cryptocurrency investments. Through empirical testing, the framework not only achieves superior prediction accuracy and financial returns but also addresses the need for explainability in investment strategies. The collaborative agent-based design holds promise for future applications in other financial domains.