- The paper presents ElliottAgents, a novel system that integrates the Elliott Wave Principle with LLMs and DRL for improved stock trend forecasting.

- It employs multi-agent collaboration and advanced pattern recognition to analyze historical market data and identify impulsive and corrective waves.

- Experimental results on Apple stock demonstrate enhanced prediction accuracy and effective backtesting compared to traditional methods.

ElliottAgents: A Multi-Agent LLM-Based System for Stock Market Forecasting

This paper introduces ElliottAgents, a multi-agent system leveraging LLMs to forecast stock market trends by integrating the Elliott Wave Principle (EWP) with modern AI techniques. The system addresses the limitations of traditional technical analysis methods in today's complex financial markets by using Retrieval-Augmented Generation (RAG) and Deep Reinforcement Learning (DRL) within a multi-agent framework for continuous market data analysis. The paper validates the system's effectiveness in recognizing wave patterns and forecasting trends through experiments on historical data from major U.S. companies.

Background and Motivation

Traditional AI methods for stock price prediction have often been limited by their ability to process vast amounts of data and adapt to rapidly changing market conditions [multiagent_stock_market_4, multiagent_stock_market_5]. The paper highlights the potential of multi-agent systems enhanced by LLMs to improve the interpretability and efficiency of financial market trend analyses using the EWP. ElliottAgents uses a framework for orchestrating AI agents, combined with technologies like RAG [rag_2], DRL, and dynamic context management [dynamic_context], to analyze the stock market.

Theoretical Underpinnings

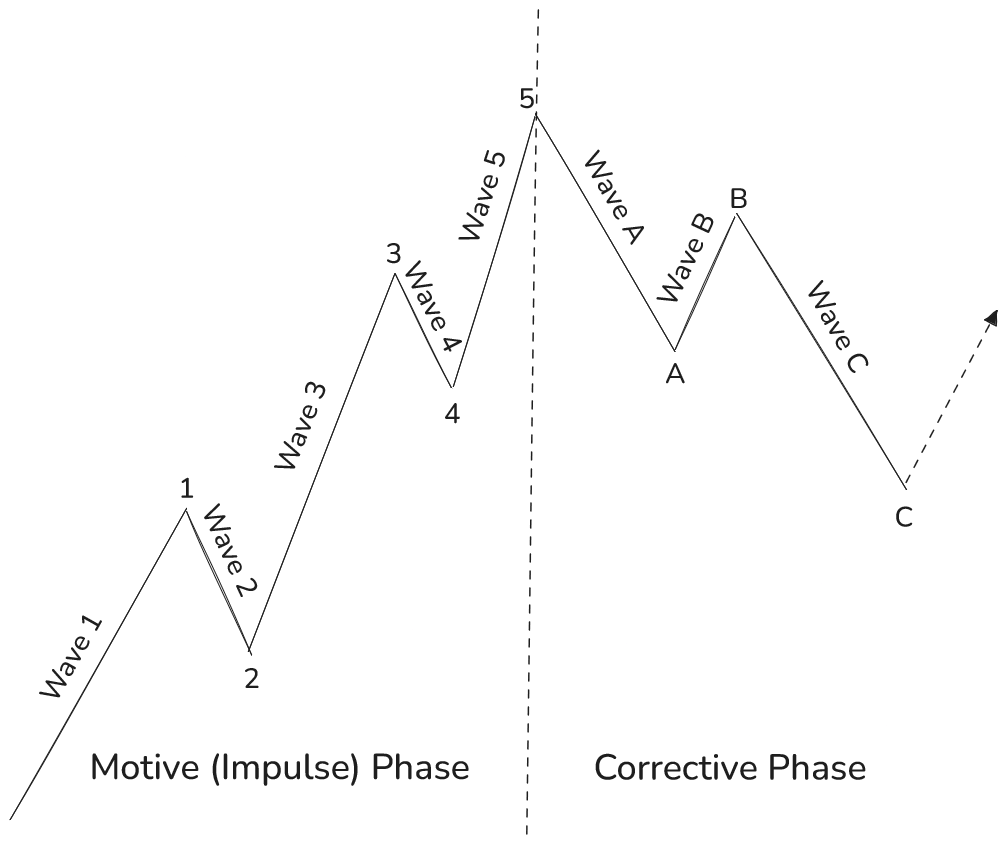

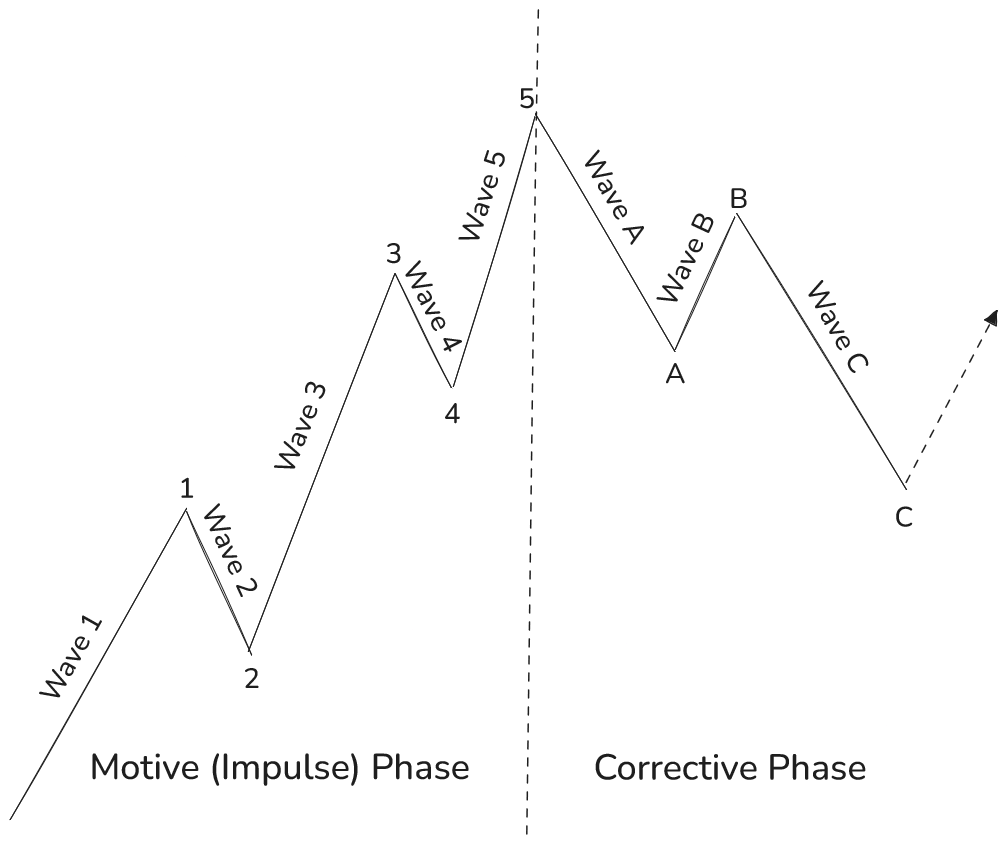

The EWP, introduced by Ralph Nelson Elliott, posits that market prices follow identifiable patterns influenced by investor behavior [elliott_theory_1, elliott_theory_2]. These patterns consist of impulsive waves, which drive the trend, and corrective waves, which move against it (Figure 1). The Fibonacci sequence is integral to the EWP, quantifying the relationships between different waves, where the length of one wave might be 1.618 times the length of another [fibonacci_theory_1].

Figure 1: Impulse and corrective waves patterns, adapted from Prechter and Frost, 1978 [elliott_theory_1].

LLMs are used for time series prediction, leveraging their capability to understand and generate sequential data [time_series_LLM_2]. DRL is employed to analyze historical market data, enabling an agent to learn effective patterns and understand their impact on future price movements [drl_3]. A multi-agent architecture, enhanced by LLMs, facilitates collaboration and advanced NLP capabilities [agents_8]. The ReAct paradigm combines chain-of-thought reasoning with the ability to interact with external environments for robust problem-solving [react_agent].

System Architecture

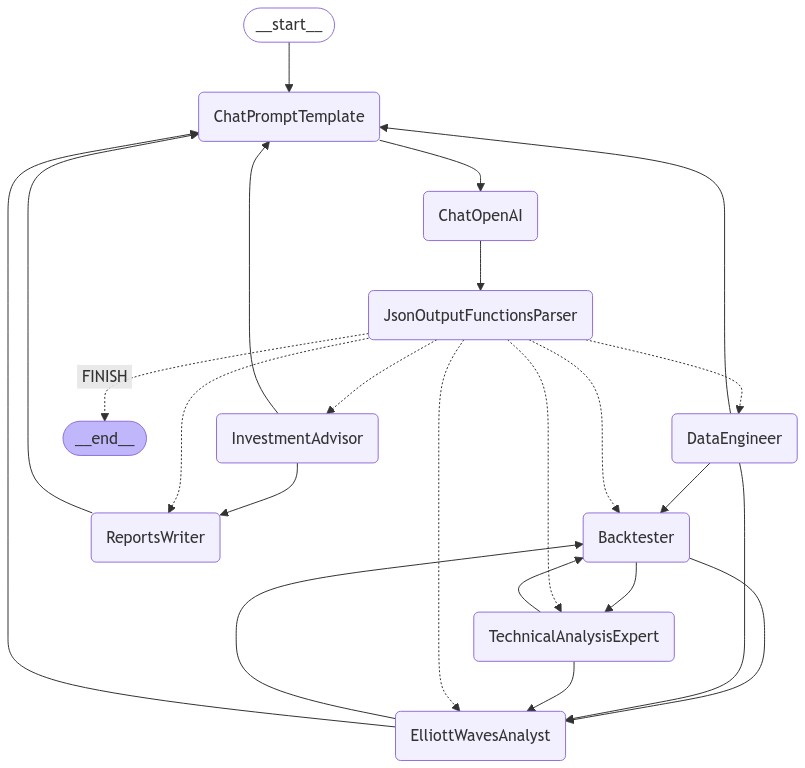

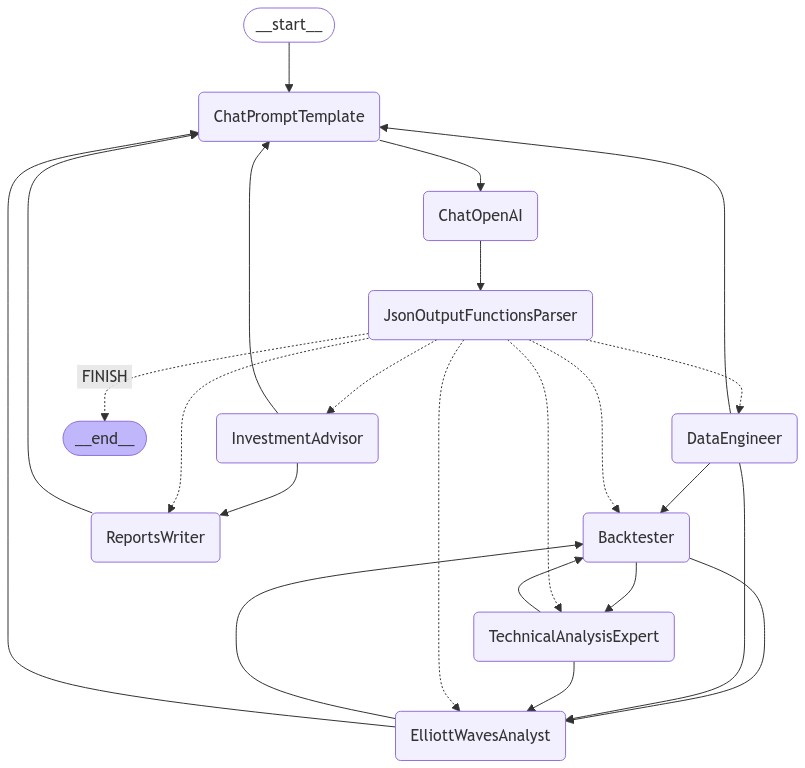

ElliottAgents is designed with configurable analysis parameters, dynamic data integration via the yfinance API, pattern recognition algorithms, and multi-agent collaboration. The architecture comprises seven specialized agents that communicate in a structured manner (Figure 2).

Figure 2: Graph presenting data flow between agents, generated in LangGraph framework.

The Coordinator agent orchestrates the process, while other agents such as the Data Engineer, Elliott Waves Analyst, Backtester, Technical Analysis Expert, Investment Advisor, and Reports Writer perform specific tasks. Each agent is provided with a specific context through natural language prompts to perform its designated role effectively. Agents are built using components like memory, planning capabilities, dynamic context awareness, RAG, and specialized tools. The system implements a continuous learning process, enabling agents to adapt and refine their knowledge over time [continous_learning].

Experimental Evaluation

The experiments were designed to test the system's use in the real market, the effectiveness of pattern recognition, and the impact of the backtesting process. The first phase focused on a case paper using Apple (AAPL) price data from September 2023 to September 2024. The second phase assessed pattern recognition capabilities and prediction accuracy using a cross-validation method on historical market price movements. The tests focused on incomplete impulsive waves (1-2-3-4) and complete impulsive waves (1-2-3-4-5). The effect of DRL was evaluated by conducting parallel tests with and without the DRL backtesting process.

Key Findings

In a detailed analysis of Apple stock (Figure 3), ElliottAgents identified an impulsive wave sequence and a subsequent corrective wave pattern, issuing a buy recommendation at \$232 per share with a target price of \$250 per share.

Figure 3: Impulsive and corrective waves found on Apple stock on 1d interval.

The cross-validation experiments revealed that the identification of a complete impulsive wave pattern contributes to better predictions of subsequent price movements than an incomplete impulse wave pattern. The use of DRL resulted in improved prediction accuracy, demonstrating the agents' ability to use the learning process on historical data for better interpretation of patterns. Table 1 presents a comparison of pattern recognition with and without backtesting.

Discussion and Implications

The paper claims that the ElliottAgents system effectively detects and interprets wave patterns with greater accuracy than comparable systems utilizing EWP. The experiments demonstrate high accuracy in identifying wave patterns across various time frames, and the implementation of DRL for backtesting significantly enhances the system's predictive accuracy.

Future Directions and Conclusion

Future work includes expanding the platform to include additional wave formations and incorporating other technical analysis methods. Integrating Large Action Models (LAMs) into the system could automate the trading process. ElliottAgents represents a significant advancement in financial technology, bridging the gap between traditional technical analysis and AI methodologies.