Direct analytic solution of the Lindquist–Rachev PDE for European call options

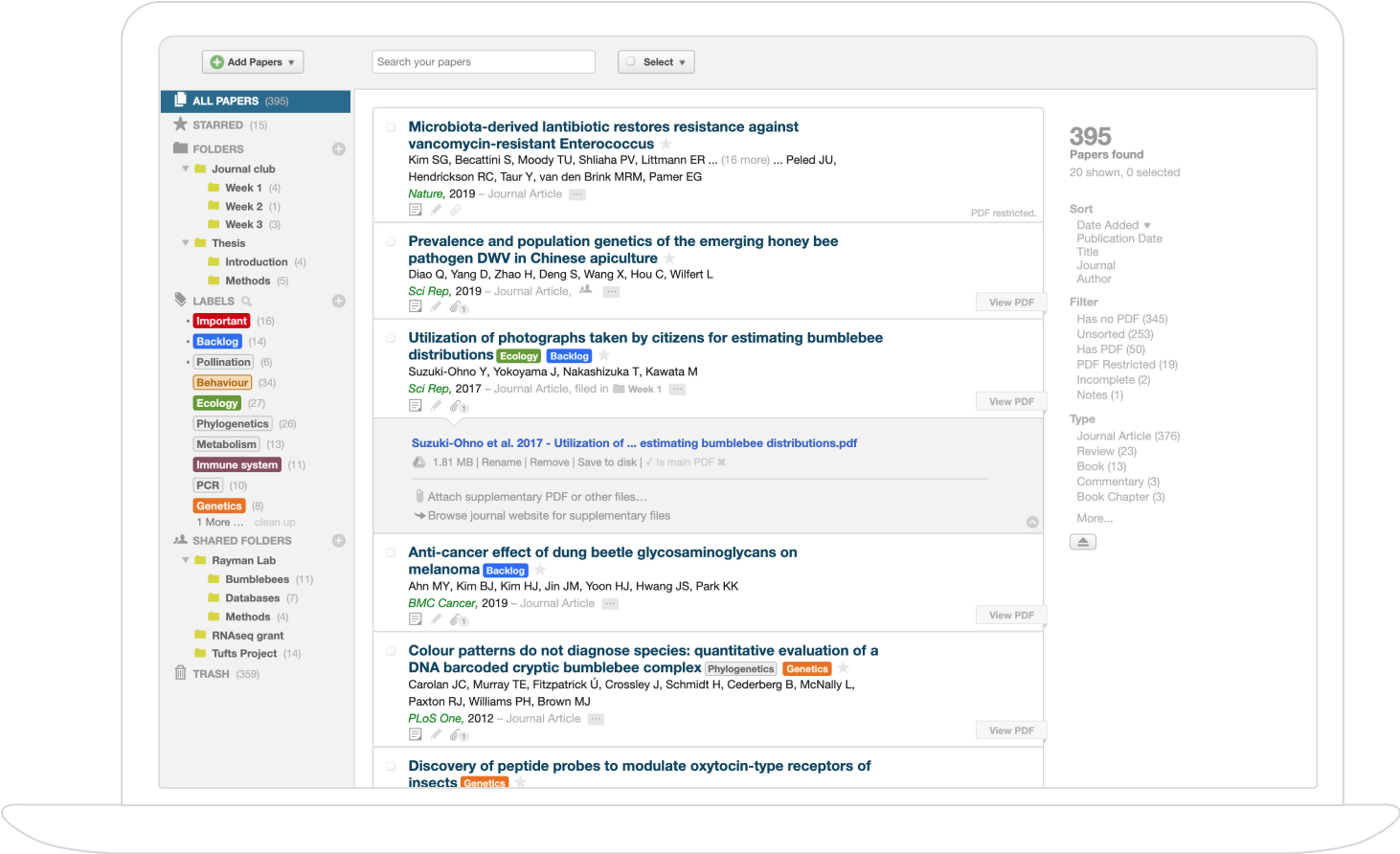

Develop a direct analytic solution method for the Lindquist–Rachev partial differential equation governing the price C(t,S,Z) of a European call option in a market with two risky assets S and Z driven by the same Brownian motion and no riskless asset. In this setting, the stock prices follow dS(t)=S(t)(μ(t)dt+σ(t)dW(t)) and dZ(t)=Z(t)(μ̃(t)dt+σ̃(t)dW(t)), the numéraire is S, and the resulting option-pricing PDE features the shadow riskless rate r(t)=(μ(t)σ̃(t)−μ̃(t)σ(t))/(σ̃(t)−σ(t)). The goal is to obtain a closed-form or otherwise explicit analytic solution for C(t,S,Z) without resorting to numerical methods or implicit auxiliary parameters.

Sponsor

References

We have found no direct method of solving (4) analytically for a European call option.

— Alternatives to classical option pricing

(2403.17187 - Lindquist et al., 2024) in Section 2A (A. Derivation and Solution of the Stochastic PDE for the Option)