- The paper presents a rationality-driven agentic trading system (TiMi) that decouples strategy development from minute-level deployment.

- It employs specialized agents for macro analysis, strategy adaptation, bot evolution, and feedback reflection to optimize trading performance.

- Experimental results demonstrate competitive returns, improved Sharpe ratios, and robust risk management across various financial markets.

Trade in Minutes! Rationality-Driven Agentic System for Quantitative Financial Trading

Introduction

The paper introduces TiMi, a novel rationality-driven multi-agent system for quantitative financial trading. TiMi differentiates itself from existing financial agents by decoupling strategy development from minute-level deployment, leveraging specialized LLM capabilities in semantic analysis, code programming, and mathematical reasoning. The system aims to integrate mechanical rationality with strategic depth, facilitating profitable and efficient trading without the reliance on anthropomorphic roles that might introduce biases.

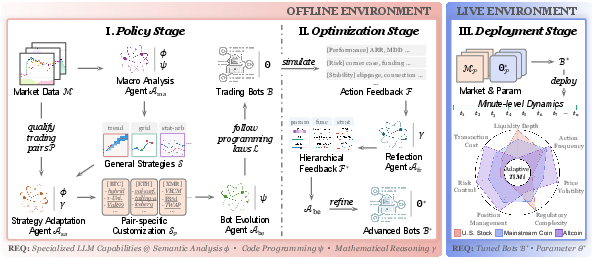

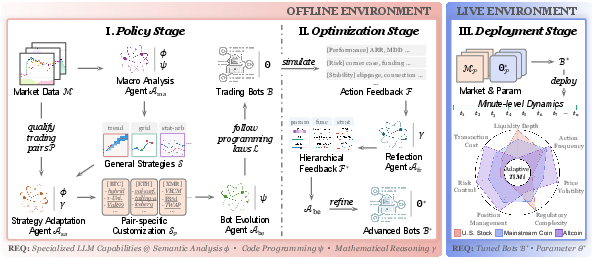

Figure 1: Architecture of the proposed TiMi system comprising three stages: policy, optimization, and deployment.

System Architecture

Decoupled Multi-Agent Design

TiMi's architecture consists of three primary stages: policy formulation, strategy optimization, and live deployment. The policy stage deals with offline simulations, where trading strategies are developed and fine-tuned using macro and micro analysis paradigms. This is followed by an optimization stage that simulates historical data to refine strategies. The deployment stage involves executing optimized strategies in live trading environments.

Specialized Agents

- Macro Analysis Agent: Utilizes technical indicators to derive general market strategies.

- Strategy Adaptation Agent: Customizes strategies for specific trading pairs, ensuring adaptability to individual pair characteristics.

- Bot Evolution Agent: Transforms strategies into executable trading bots using a layered programming design.

- Feedback Reflection Agent: Employs mathematical reasoning to optimize and refine these strategies.

Implementation

TiMi's approach to implementation is highly structured, focusing on decoupling complex reasoning from deployment. This separation facilitates low latency and efficient trading operations. The agents collectively leverage the capabilities of LLMs to ensure precise and adaptable trading decisions.

Layered Programming Design

TiMi constructs trading bots in three hierarchical layers: strategy, function, and parameter layers. This modular design allows for systematic refinement and efficient implementation adjustments based on market conditions and feedback iterations.

Optimization and Deployment

The optimization stage uses simulation data to gather transaction feedback, which is analyzed to refine strategies. This refinement is a closed-loop process, driven by parameter tuning and function-level adjustments, enhancing trading efficacy.

Experimental Results

TiMi was evaluated across 200+ trading pairs in stock and cryptocurrency markets, displaying competitive performance in profitability, risk management, and action efficiency. It achieved remarkable results in terms of annualized returns, Sharpe ratios, and maximum drawdowns.

Figure 2: Comparison of action latency (left) and capital utilization (right) for representative methods.

Discussion

The introduction of TiMi marks a significant step towards integrating rationality-driven methodologies into financial trading. By leveraging the specific capabilities of LLMs in semantic analysis and code programming, TiMi provides a robust framework for dynamic trading environments.

The system's ability to maintain low latency and execute complex strategies in real-time markets underscores its practical utility. Its modular design and decoupled architecture offer notable advantages in terms of system stability, adaptability, and scalability.

Figure 3: Detailed transactions of TiMi on four representative cryptocurrency trading pairs.

Conclusion

TiMi represents an evolution in trading systems, effectively harmonizing strategic depth with mechanical rationality. Through its agentic system, it advances the efficacy of algorithmic trading, presenting a customizable framework capable of robust performance across varying market dynamics. TiMi's contribution lies in its ability to offer a structured, efficient, and rational approach to financial trading that leverages the complementary skills of modern LLMs. Future explorations may focus on extending these principles to broader financial domains and incorporating further adaptive learning techniques.