- The paper presents the Multi-period Learning Framework (MLF) that integrates IRF, LWI, and MAP to improve TSF accuracy and efficiency.

- It employs a transformer-based architecture with a patch squeeze module to reduce memory usage and computational complexity.

- Deployment in Alipay’s fund management system demonstrates notable improvements in forecasting accuracy and GMV.

Multi-period Learning for Financial Time Series Forecasting

This paper presents the Multi-period Learning Framework (MLF) designed to enhance the performance of financial time series forecasting (TSF). MLF addresses the complexities involved in processing multi-period inputs, considering both the accuracy and efficiency requirements crucial for real-world applications, such as fund sales forecasting.

Background and Objectives

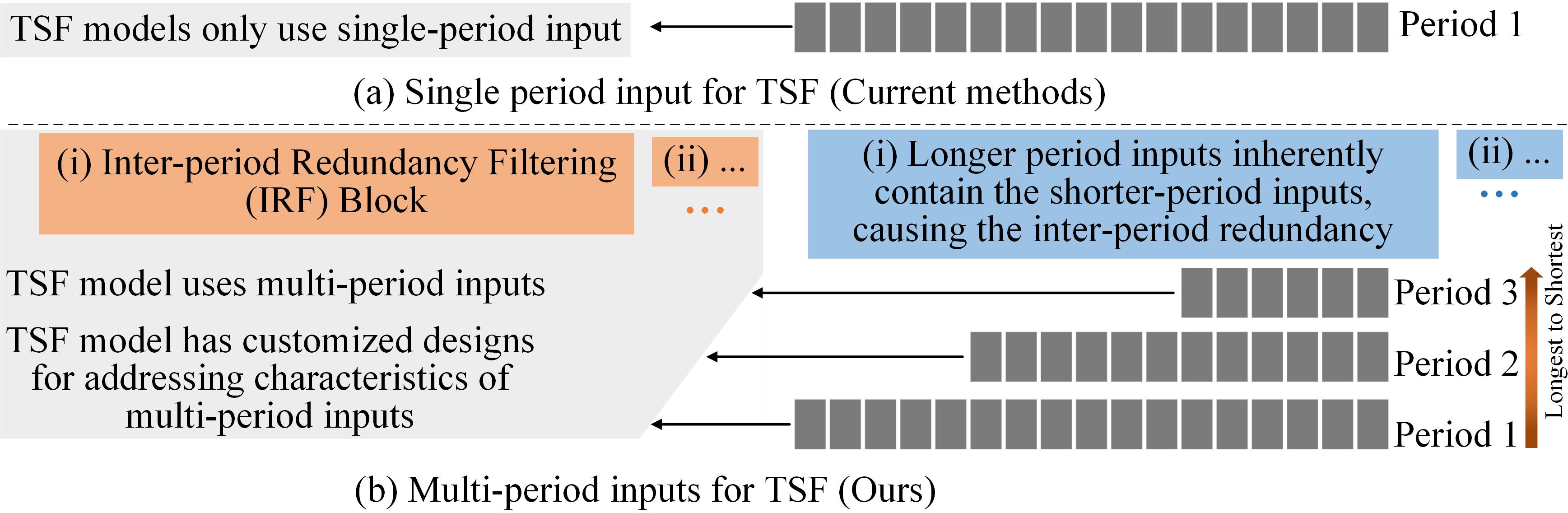

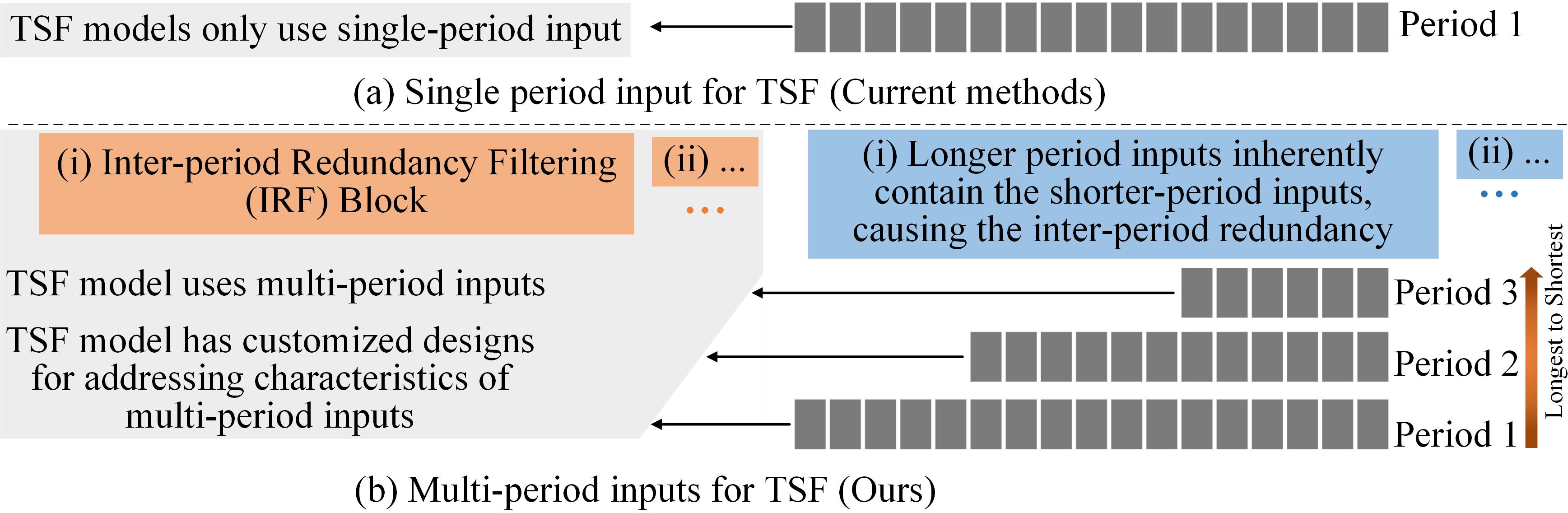

Time series forecasting, especially in the financial domain, is influenced by short-term public opinions and medium/long-term market trends. Traditional TSF models typically utilize single-period inputs or lack dedicated mechanisms to effectively process multi-period characteristics. MLF is proposed to overcome these limitations by simultaneously leveraging multiple inputs with varying lengths to improve forecasting accuracy and efficiency.

Proposed Methodology

Multi-period Learning Framework Components

The MLF architecture integrates several novel modules to adeptly handle multi-period inputs:

- Inter-period Redundancy Filtering (IRF): This module removes redundant information across periods to facilitate more accurate self-attention modeling in the transformer architecture.

- Learnable Weighted-average Integration (LWI): LWI adaptively integrates forecasts from multiple periods by assigning weights based on prediction accuracy, thereby enhancing the final integration of multi-period forecasts.

- Multi-period self-Adaptive Patching (MAP): MAP ensures equal numbers of patches across periods by adjusting patch lengths self-adaptively. This design prevents bias towards certain periods with varying patch numbers.

- Patch Squeeze Module: This module reduces intra-period redundancy and lowers computational overhead by efficiently condensing the number of patches used in self-attention modeling.

Figure 1: Current TSF scheme (a) and ours (b). The blue rectangle highlights the characteristics of the multi-period inputs.

Practical Implementation

The implementation utilizes a transformer-based architecture with enhancements to effectively manage information across multiple periods. The patch squeeze module is vital for lowering computational requirements without compromising forecasting quality. The IRF block progressively filters inter-period redundancy, improving prediction accuracy iteratively.

For deployment, MLF has been integrated into Alipay's fund management system, demonstrating substantial improvements in forecasting performance and efficiency compared to previously deployed models.

Experimental Analysis

MLF outperforms existing TSF models on both proprietary fund datasets and various public datasets, showing superiority in MSE and accuracy across short-term and long-term predictions.

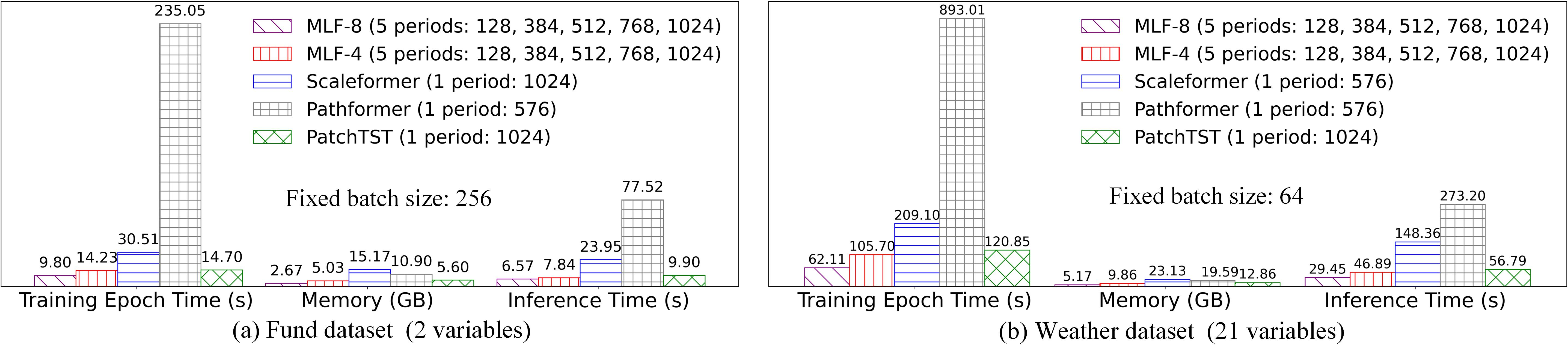

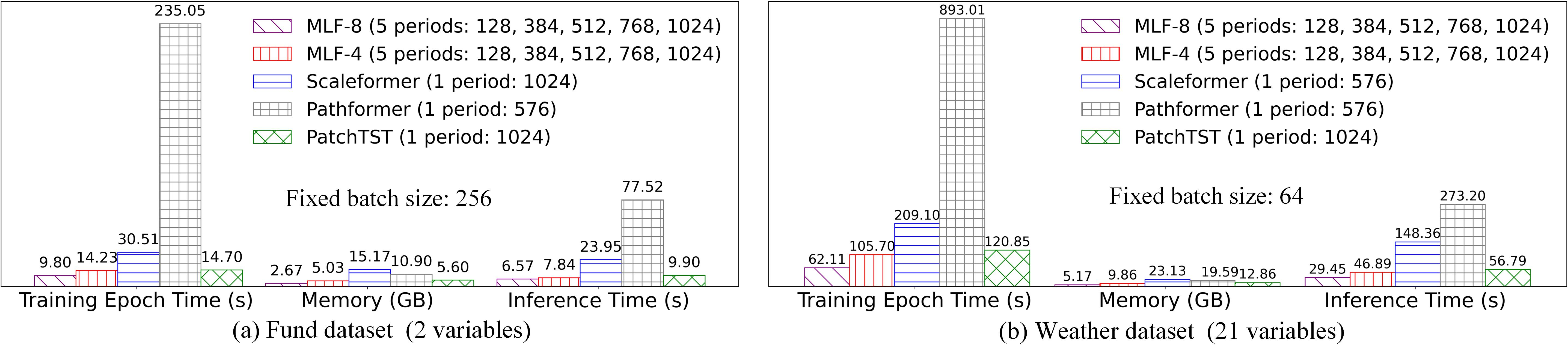

Efficiency Analysis

The patch squeeze module significantly reduces memory and time complexity, confirming MLF's scalability for large datasets and compatibility with production systems such as Alipay's financial services.

Figure 2: Efficiency analysis for best-performing TSF models was conducted on Ettm1, Weather, and Fund datasets.

Deployment and Real-world Impact

Deployment results indicate a notable improvement in forecasting accuracy and gross merchandise volume (GMV) over consecutive weeks at Alipay, showcasing MLF's effective application in real-world financial forecasting scenarios.

Conclusion

The MLF framework represents an advanced approach to financial TSF by leveraging multi-period inputs with unique architectural designs tailored for accurate and efficient forecasting. Future research can further explore specialized architectures addressing multi-period characteristics to continue improving forecasting potential.

By offering significant enhancements in both theoretical concepts and practical implementations, MLF sets a precedent for evolving TSF methodologies to accommodate and maximize the benefits of multi-period analysis.