FinTeam: A Multi-Agent Collaborative Intelligence System for Comprehensive Financial Scenarios (2507.10448v1)

Abstract: Financial report generation tasks range from macro- to micro-economics analysis, also requiring extensive data analysis. Existing LLM models are usually fine-tuned on simple QA tasks and cannot comprehensively analyze real financial scenarios. Given the complexity, financial companies often distribute tasks among departments. Inspired by this, we propose FinTeam, a financial multi-agent collaborative system, with a workflow with four LLM agents: document analyzer, analyst, accountant, and consultant. We train these agents with specific financial expertise using constructed datasets. We evaluate FinTeam on comprehensive financial tasks constructed from real online investment forums, including macroeconomic, industry, and company analysis. The human evaluation shows that by combining agents, the financial reports generate from FinTeam achieved a 62.00% acceptance rate, outperforming baseline models like GPT-4o and Xuanyuan. Additionally, FinTeam's agents demonstrate a 7.43% average improvement on FinCUGE and a 2.06% accuracy boost on FinEval. Project is available at https://github.com/FudanDISC/DISC-FinLLM/.

Summary

- The paper introduces FinTeam as a multi-agent system that distributes financial analysis tasks among specialized LLM agents.

- The system is evaluated on macroeconomic, industry, and company analysis tasks, outperforming baselines with notable improvements on benchmarks like FinCUGE.

- The modular design and LoRA-based training enable precise financial computations and real-time analysis, evidenced by a 62.00% human evaluation acceptance rate.

FinTeam: A Multi-Agent System for Financial Analysis

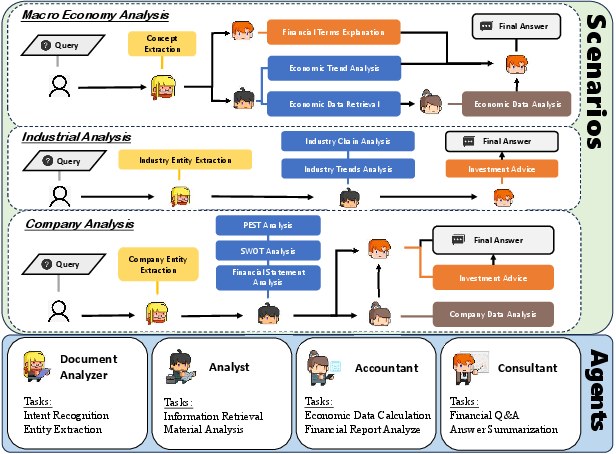

This paper introduces FinTeam, a multi-agent collaborative intelligence system designed for comprehensive financial analysis. FinTeam addresses the limitations of existing LLMs in handling complex, multifaceted financial problems by distributing tasks among specialized agents, mimicking the organizational structure of financial companies (Figure 1). The system comprises four LLM agents: a document analyzer, an analyst, an accountant, and a consultant, each trained with specific financial expertise. FinTeam is evaluated on macroeconomic, industry, and company analysis tasks, demonstrating superior performance compared to baseline models like GPT-4o and Xuanyuan.

Figure 1: Inspired by the financial companies that assign tasks to specialized teams, FinTeam distributes financial tasks among the document analyzer, analyst, accountant, and consultant agents, enabling a more efficient and sophisticated process.

Architecture of FinTeam

FinTeam is structured around a collaborative workflow involving four distinct LLM agents, each responsible for a specific aspect of financial analysis. The system processes financial texts, performs real-time analysis using knowledge bases, utilizes computational tools for financial calculations, and provides expert financial insights. This multi-agent approach aims to provide comprehensive solutions to complex financial challenges. (Figure 2)

Figure 2: Overview of FinTeam Multi-Agent Collaborative Intelligence System.

Agent Roles

Each agent within FinTeam is designed to perform specific functions:

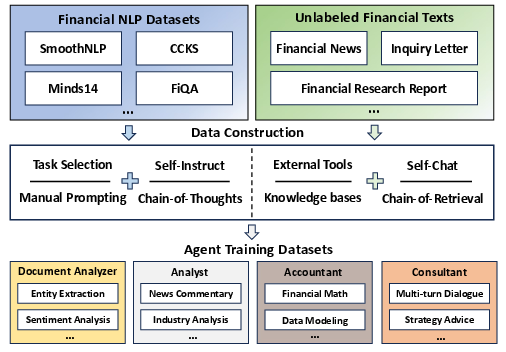

- Document Analyzer: This agent processes unstructured text data, such as news and market commentaries, performing NLP tasks like intent recognition, financial entity extraction, and sentiment analysis. The agent is trained using domain-specific NLP datasets, including labeled open-source datasets and unlabeled texts automatically annotated by ChatGPT.

- Analyst: The analyst leverages Retrieval-Augmented Generation (RAG) to analyze real-time financial materials from multiple knowledge bases. A Chain-of-Retrieval (CoR) prompting methodology is used to create a financial analysis instruction dataset, ensuring the agent can effectively retrieve and synthesize relevant information.

- Accountant: This agent utilizes computational tools to perform numerical calculations, addressing the limitations of LLMs in accurate computations. Equipped with tools like expression calculators, equation solvers, and probability tables, the accountant can perform various computing tasks.

- Consultant: The consultant interprets and answers finance-related queries, drawing upon extensive background knowledge. The agent is trained using a Chinese-language dataset, including translations of the FiQA dataset and QA pairs generated from finance-specific terms.

Training and Evaluation

The agents are trained using the LoRA mechanism on the Qwen2.5-7B-Chat model. The agent training dataset construction is shown in Figure 3. The effectiveness of FinTeam is evaluated on three financial scenarios: macroeconomic analysis, industry analysis, and company analysis. The evaluation involves comparing FinTeam's performance against baseline models using a dataset of 150 real investor queries. GPT-4o is used to score the outputs based on accuracy, thoroughness, clarity, and professionalism. Human preference evaluations are also conducted to validate FinTeam's real-world relevance.

Figure 3: Construction of agent training dataset.

Key Results

The results show that FinTeam achieves an overall score of 4.86 (out of 5), outperforming baseline models such as Qwen2.5-7B-Chat, GPT-4o, ChatGLM3-6B, and Xuanyuan-13B. Human evaluations confirm FinTeam's superiority, with an acceptance rate of 62.00%. Individual agent performance is also significantly better than other models in each evaluation. Specifically, the document analyzer achieves an average score of 47.20 on the FinCUGE benchmark, a 7.43-point improvement over Qwen2.5-7B-Instruct. The consultant outperforms the base model by 2.06 points on the FinEval benchmark. The accountant also demonstrates a notable performance boost with the addition of computational plugins.

Implications and Future Directions

The development of FinTeam demonstrates the potential of multi-agent systems in addressing complex financial tasks. By distributing tasks among specialized agents, FinTeam achieves superior performance compared to single LLM approaches. The modular design of FinTeam allows for flexible and tailored responses to user needs, making it a valuable tool for financial professionals. Future research could focus on expanding the scope of scenarios, incorporating additional financial tasks, and testing the system's effectiveness in global markets. The limitations of the current system, such as its focus on Chinese financial contexts and the lack of guaranteed financial outcomes, highlight areas for further development.

Conclusion

FinTeam represents a significant advancement in the application of multi-agent systems to financial analysis. The system's collaborative workflow, specialized agent roles, and comprehensive training methodology result in robust performance across various financial scenarios. The evaluation results demonstrate FinTeam's effectiveness in providing accurate, thorough, and professional financial insights, paving the way for future developments in financial intelligence systems.

Follow-up Questions

- How does FinTeam's multi-agent approach improve the handling of complex financial tasks compared to traditional LLM models?

- What specific roles do the document analyzer and analyst agents play in processing and synthesizing financial data?

- How does the integration of computational tools in the accountant agent enhance the accuracy of numerical computations?

- What are the challenges and future directions highlighted for scaling FinTeam to global financial markets?

- Find recent papers about multi-agent systems in financial analysis.

Related Papers

- Are ChatGPT and GPT-4 General-Purpose Solvers for Financial Text Analytics? A Study on Several Typical Tasks (2023)

- DISC-FinLLM: A Chinese Financial Large Language Model based on Multiple Experts Fine-tuning (2023)

- Revolutionizing Finance with LLMs: An Overview of Applications and Insights (2024)

- FinEval: A Chinese Financial Domain Knowledge Evaluation Benchmark for Large Language Models (2023)

- FinBen: A Holistic Financial Benchmark for Large Language Models (2024)

- FinCon: A Synthesized LLM Multi-Agent System with Conceptual Verbal Reinforcement for Enhanced Financial Decision Making (2024)

- FinRobot: AI Agent for Equity Research and Valuation with Large Language Models (2024)

- Enhancing Financial Question Answering with a Multi-Agent Reflection Framework (2024)

- TradingAgents: Multi-Agents LLM Financial Trading Framework (2024)

- LLM-Powered Multi-Agent System for Automated Crypto Portfolio Management (2025)

GitHub

- GitHub - FudanDISC/DISC-FinLLM: DISC-FinLLM,中文金融大语言模型(LLM),旨在为用户提供金融场景下专业、智能、全面的金融咨询服务。DISC-FinLLM, a Chinese financial large language model (LLM) designed to provide users with professional, intelligent, and comprehensive financial consulting services in financial scenarios. (744 stars)

- GitHub - FudanDISC/DISC-FinLLM: DISC-FinLLM,中文金融大语言模型(LLM),旨在为用户提供金融场景下专业、智能、全面的金融咨询服务。DISC-FinLLM, a Chinese financial large language model (LLM) designed to provide users with professional, intelligent, and comprehensive financial consulting services in financial scenarios. (744 stars)