- The paper demonstrates that TimeBoost auctions reveal significant challenges in accurately predicting immediate arbitrage profits despite identifying longer-term trends.

- It employs a heuristic analysis linking transaction markouts with ETH bids, showing weak short-term correlations due to high price return variance.

- The findings question the efficiency of AOT auction models in blockchain ordering, suggesting the need for alternative auction designs to mitigate volatility impacts.

TimeBoost: Do Ahead-of-Time Auctions Work?

Introduction

The paper "TimeBoost: Do Ahead-of-Time Auctions Work?" (2511.18328) presents an empirical analysis of the TimeBoost auction mechanism implemented on the Arbitrum rollup platform. The authors address the distinction between Just-in-Time (JIT) and Ahead-of-Time (AOT) auctions in the context of blockchain transaction ordering, specifically examining the efficiency and predictive accuracy of AOT auctions. TimeBoost aims to leverage transaction timing advantages, assessing how effectively bids correlate with the value extracted from such advantages.

Many blockchains employ auctions for transaction ordering. While Ethereum employs Proposer Builder Separation (PBS) with block builders bidding for block content ordering rights, Arbitrum uses TimeBoost as a transaction ordering policy. TimeBoost introduces an AOT element, where bidders compete for future execution advantages in high-frequency trading settings.

TimeBoost Auction Mechanism

TimeBoost is characterized by selling a time advantage in a First-Come-First-Serve (FCFS) policy to one party via a second-price auction. Bidders compete for low-latency transaction execution, allowing them to capitalize on CEX-DEX arbitrage opportunities. Bids are denominated in ETH, with a reserve price of 0.001 ETH. The mechanism involves a 200ms advantage lasting for one minute, executed by the designated sequencer merging TimeBoosted transactions with regular FCFS transactions.

Empirical data reveals that most fast lane activity corresponds to CEX-DEX arbitrage, with entities like Wintermute and Selini capitalizing significantly on this advantage.

Empirical Approach and Findings

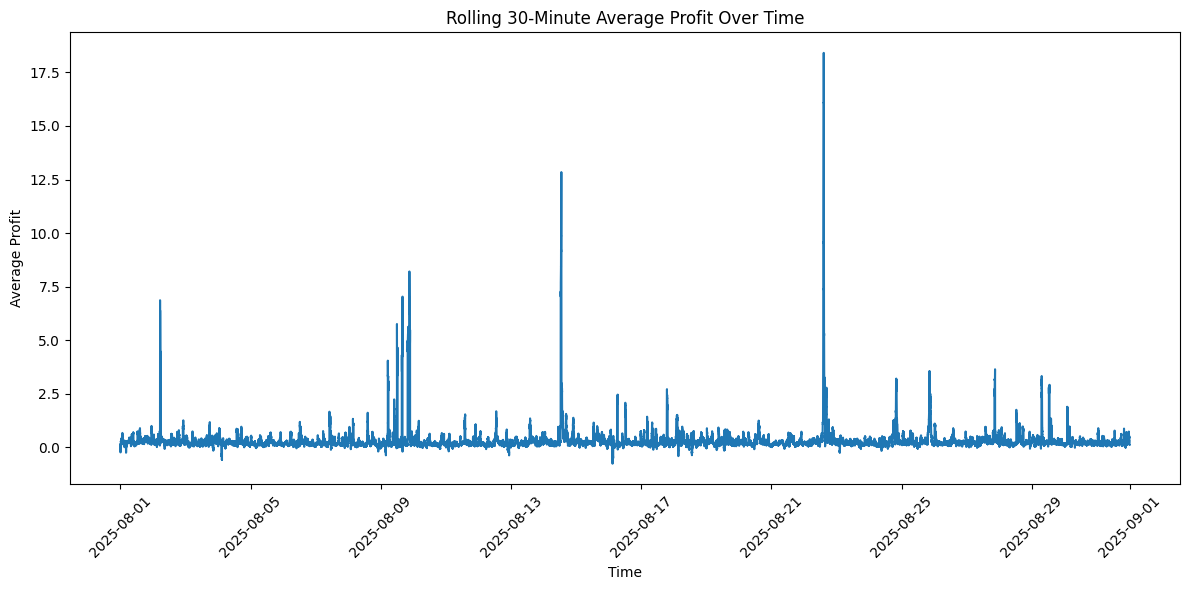

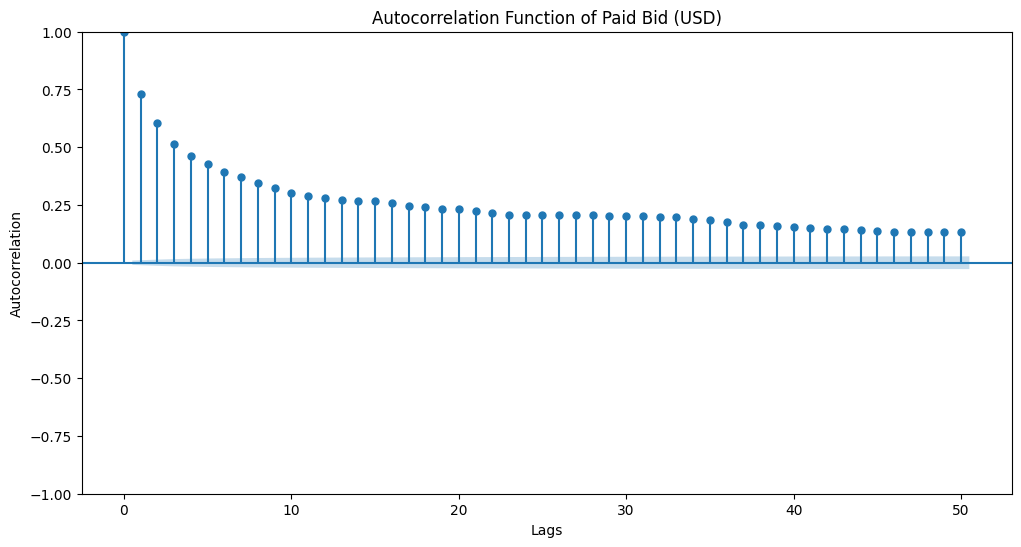

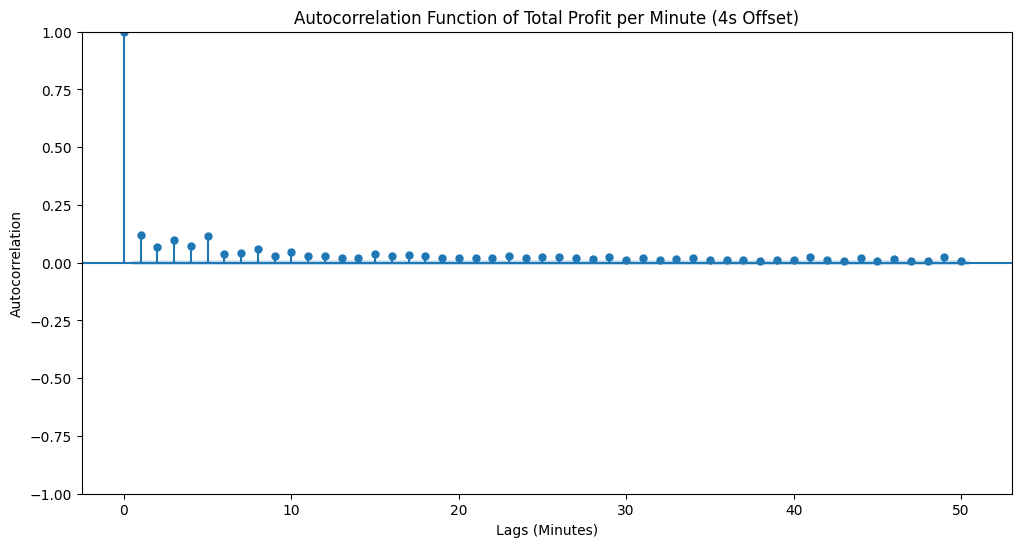

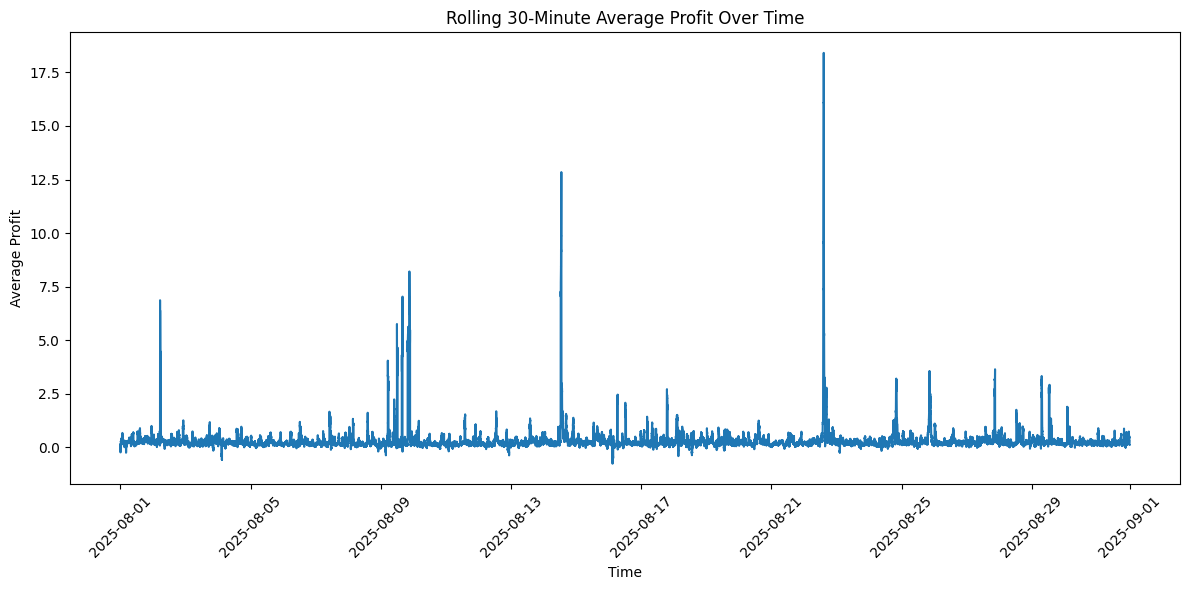

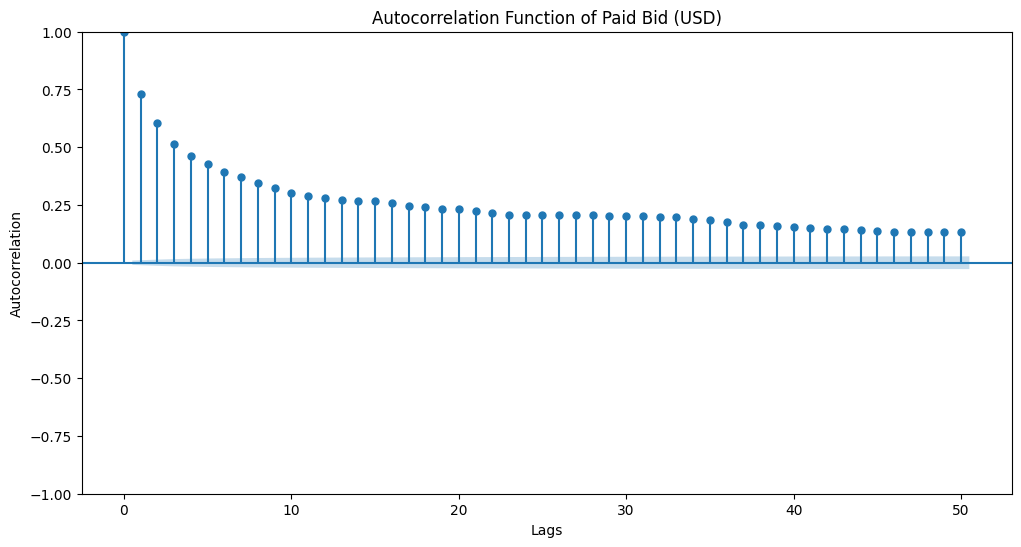

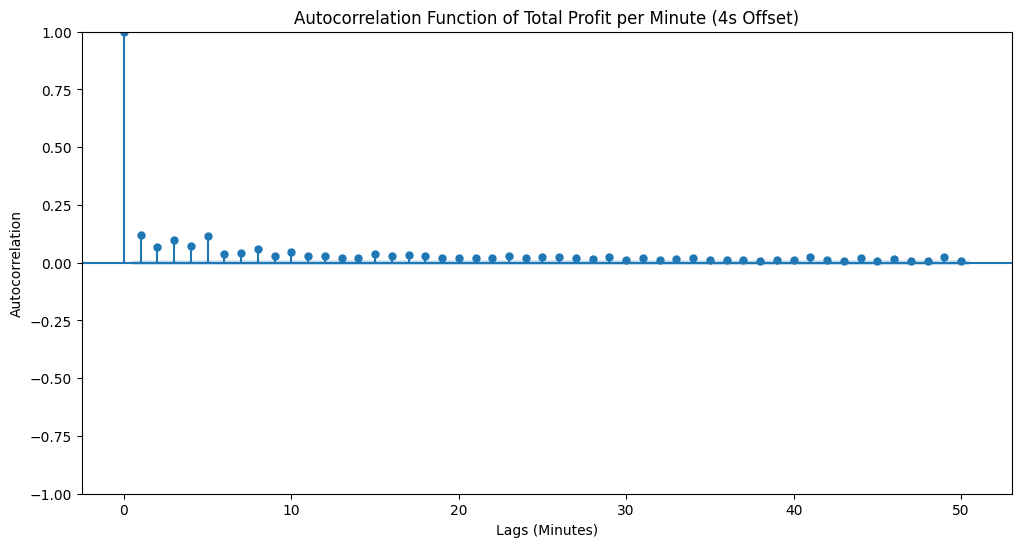

The research employs a heuristic approach to estimate arbitrage value by tracking markouts, representing hypothetical profits from fast lane trades. Correlations between winning bids and markouts are weak, suggesting challenges in predicting future extracted value from time advantages.

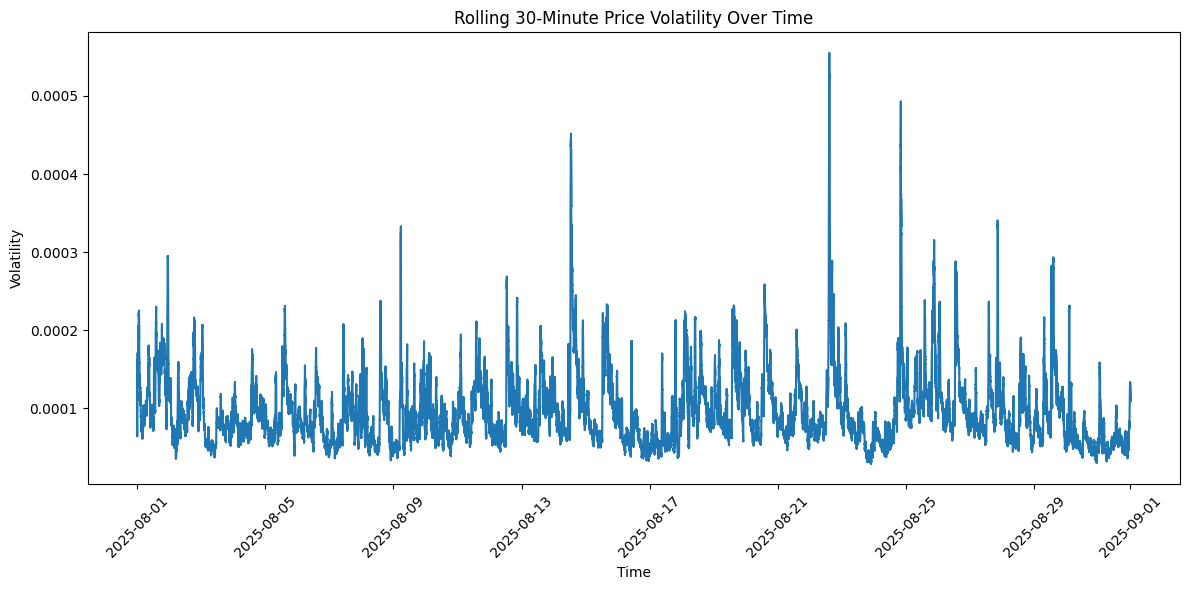

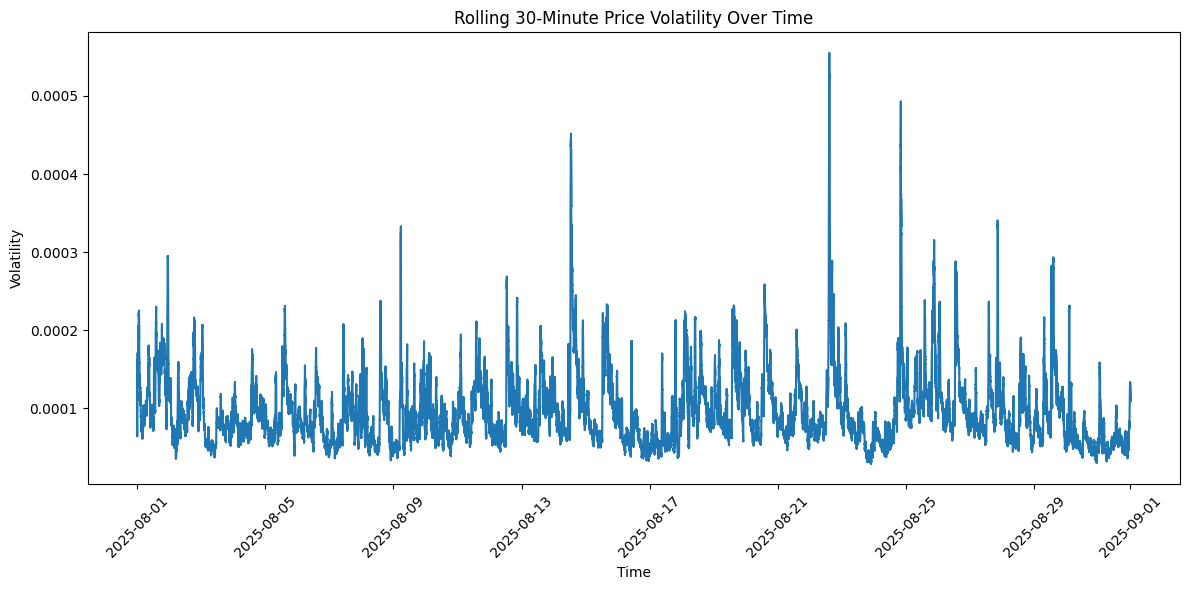

Figure 1: Price Volatility.

Bids correlate better with longer time interval profits, indicating bidders can detect broader trends but struggle to pinpoint precise arbitrage opportunities. The Pearson correlation between aggregated markouts and bids improves significantly over extended intervals, highlighting challenges in short-term prediction due to high price return variance.

Figure 2: Arbitrage Profits.

Theoretical Predictions

The theoretical underpinnings of TimeBoost auctions draw from auction theory, particularly common value auctions where values are driven by both common and private components. The authors model bidder behavior under common-value influences, highlighting the predictive limitations of private value components in a common-value dominated setting.

Analysis also suggests that arbitrage profits are proportional to price volatility. High variance periods yield higher arbitrage potential, but predicting such volatility is infeasible over short horizons, reinforcing the observed empirical patterns.

Methodological Insights

The paper utilizes TimeBoost transaction data matched with Binance price data to estimate arbitrage profits. A key finding is the significantly variable nature of arbitrage profits, with high volatility contributing disproportionately to overall gains.

Figure 3: Autocorrelation of paid bid and of markouts per minute.

Overall, bids are confirmed to be noisy predictors for immediate future profits but effective for longer-term averages. High return variance complicates short-term forecasting, consistent with literature on market microstructural noise impacting predictive accuracy.

Implications and Future Directions

The insights gained from TimeBoost suggest skepticism regarding AOT auctions' efficiency in blockchain transaction ordering contexts. The predictive challenges observed call into question broader proposals, such as AOT slot auctions in Ethereum's PBS architecture. Given the difficulty in forecasting arbitrage profits over short intervals, the TimeBoost findings may not support the adoption of such market structures.

Further research could explore TimeBoost's impacts on liquidity providers and broader market effects beyond direct participants in the auction. Additional inquiries into alternative auction designs, particularly in mitigating prediction inaccuracies and enhancing competitive structures, may provide deeper insights into optimizing blockchain transaction ordering.

Conclusion

Empirical analysis of the TimeBoost auction mechanism indicates significant challenges in accurately predicting immediate arbitrage value, although trends can be effectively identified over longer periods. These findings inform the exploration of efficient auction designs in blockchain networks, highlighting the delicate balance between time advantage exploitation and predictive limitations. The conclusions drawn offer valuable insights into the efficacy and future prospects of AOT auction paradigms in decentralized finance systems.