ElliottAgents: A Natural Language-Driven Multi-Agent System for Stock Market Analysis and Prediction (2507.03435v1)

Abstract: This paper presents ElliottAgents, a multi-agent system leveraging NLP and LLMs to analyze complex stock market data. The system combines AI-driven analysis with the Elliott Wave Principle to generate human-comprehensible predictions and explanations. A key feature is the natural language dialogue between agents, enabling collaborative analysis refinement. The LLM-enhanced architecture facilitates advanced language understanding, reasoning, and autonomous decision-making. Experiments demonstrate the system's effectiveness in pattern recognition and generating natural language descriptions of market trends. ElliottAgents contributes to NLP applications in specialized domains, showcasing how AI-driven dialogue systems can enhance collaborative analysis in data-intensive fields. This research bridges the gap between complex financial data and human understanding, addressing the need for interpretable and adaptive prediction systems in finance.

Summary

- The paper presents a multi-agent system that integrates natural language processing and the Elliott Wave Principle for stock market prediction.

- The system combines LLMs, deep reinforcement learning, and Fibonacci retracement techniques to enhance market trend analysis.

- Experimental results on stocks such as Amazon, Alphabet, and Nvidia demonstrate its capability to generate actionable buy/sell signals.

ElliottAgents: An NLP-Driven Multi-Agent System for Stock Market Analysis

This paper introduces ElliottAgents, a multi-agent system designed for stock market analysis and prediction. It leverages NLP and LLMs, combined with the Elliott Wave Principle (EWP), to generate human-comprehensible predictions. The system facilitates natural language dialogue between agents, enabling collaborative analysis and refinement.

Foundations of ElliottAgents

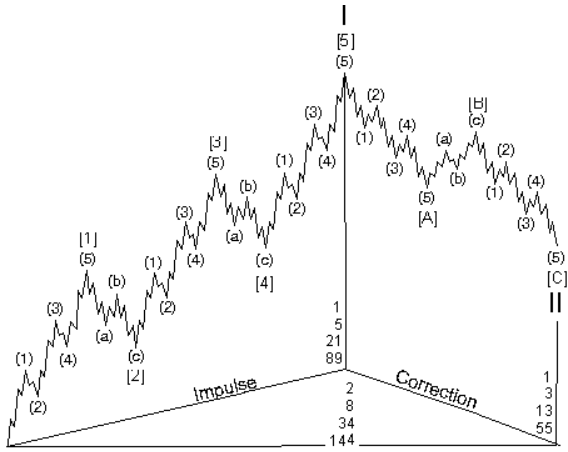

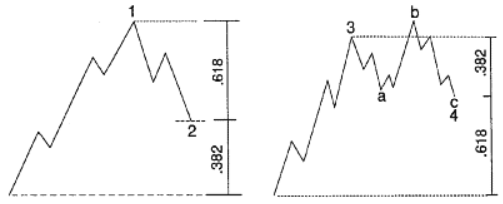

The system architecture is based on the Elliott Wave Principle (EWP), which posits that market prices move in recognizable patterns driven by investor psychology [frost_ewp_2001, murphy_technical_analysis_1999]. These patterns consist of impulsive waves, which drive market trends, and corrective waves, which counterbalance them. The system also uses Fibonacci ratios to provide a mathematical framework for wave relationships [boroden_fibo_trading_2008].

Figure 1: The fractal nature of Elliott wave patterns allows the application across various time frames, from short-term movements to long-term trends [frost_ewp_2001].

LLMs, particularly transformers, are integral to the system's ability to understand and generate human language [naveed_overview_LLMs_2024, khan_raiaan_LLMs_review_2024]. These models utilize self-attention mechanisms to weigh the importance of different words in a sentence, crucial for understanding context [amaratunga_understanding_LLMs_2023]. The paper notes that while LLMs have shown promise in NLP tasks, their application in time series prediction, particularly in finance, is an area of ongoing research [tang_time_series_forecasting_LLMs_2024, tan_are_LLM_useful_in_time_series_2024]. Techniques like positional encoding are used to address the temporal order of data points [chudziak_nn_market_predictions_2023], but further research is needed.

Figure 2: Fibonacci retracements are commonly used to identify potential support and resistance levels in corrective waves [frost_ewp_2001].

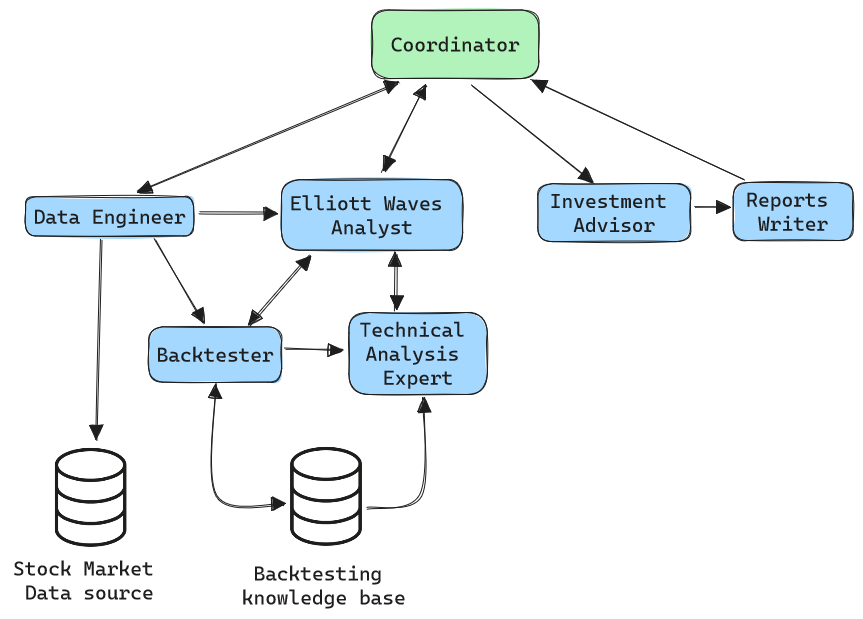

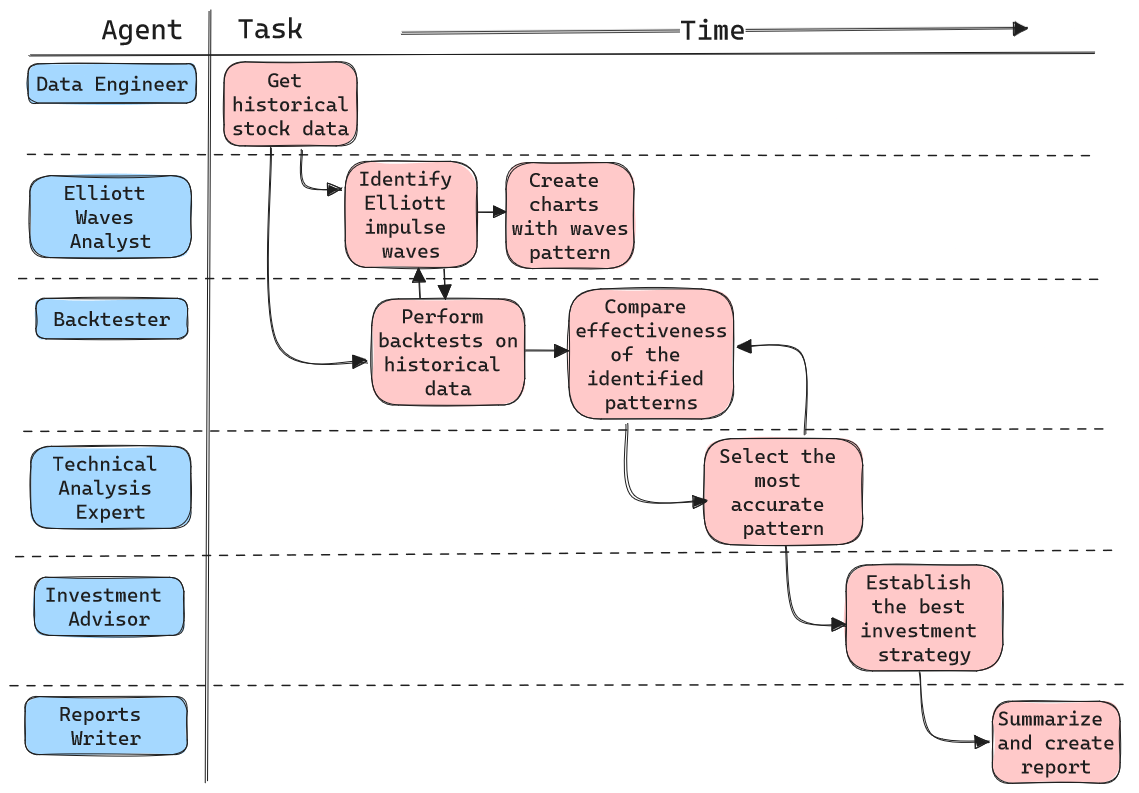

Multi-Agent System Architecture

ElliottAgents employs a multi-agent system where autonomous agents interact to achieve collective goals [guo_LLMs_mas_survey_2024]. The integration of LLMs, such as GPT-4 [open_ai_gpt4_2023], enhances the agents' natural language understanding, reasoning, and decision-making capabilities. The agents operate autonomously, adapting to new situations without explicit instructions and exhibiting goal-directed behaviors [guo_LLMs_mas_survey_2024, cinkusz_mas_project_management_2024].

Figure 3: The agents communicate and share data to collaboratively analyze market trends.

The system includes several specialized agents:

- Data Engineer: Prepares data for analysis.

- Elliott Waves Analyst: Performs detailed EWP analysis on historical stock data.

- Backtester: Uses DRL to validate predictions.

- Technical Analysis Expert: Interprets wave patterns and backtesting results.

- Investment Advisor: Synthesizes analyses into a comprehensive investment strategy.

- Reports Writer: Summarizes activities into a report for the end-user.

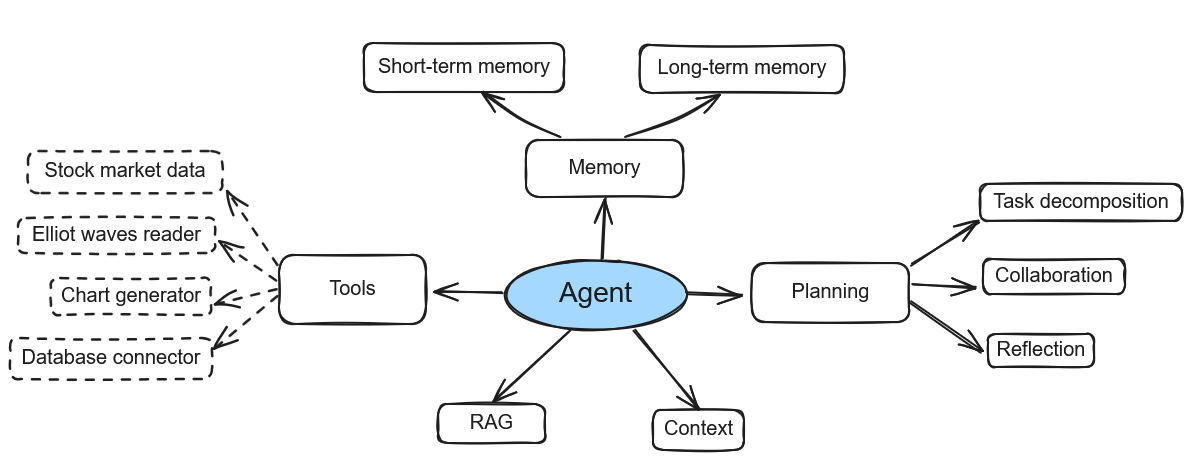

Figure 4: The autonomous agent is constructed with tools, dynamic context, planning, memory, and RAG [weng_LLM_agents_2024].

Agents Customization

The agents are customized with several key technologies:

- Retrieval-Augmented Generation (RAG): Integrates external knowledge retrieval to improve factual accuracy [lewis_rag_2021, self_rag, larson_graph_rag_2024].

- Deep Reinforcement Learning (DRL): Combines deep learning and reinforcement learning for sequential decision-making [lapam_drl_2020, kabbani_drl_stock_market_2022, szydlowski_chudziak_hidformer].

- Dynamic Context: Allows agents to adaptively adjust their contextual understanding based on real-time information [dynamic_context].

Experiments and Results

The system was tested using historical data from NYSE, with intervals ranging from hourly to daily. The system was evaluated on its ability to recognize wave patterns and identify buy or sell signals. The iterative addition of historical data allowed for evaluation under realistic market conditions.

Figure 5: The agents are assigned specific tasks in identifying Elliott impulsive waves.

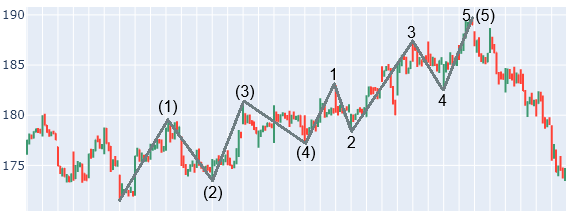

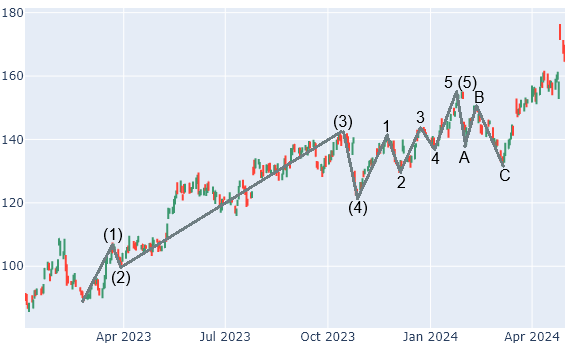

The first part of the experiment involved testing on limited historical data from major American companies. ElliottAgents successfully identified patterns such as ending diagonals and fifth wave extensions. For instance, the system identified an "ending diagonal" pattern on Amazon's stock, issuing a sell recommendation at \$185 per share with a target price of \$177 per share, resulting in a theoretical profit of 4.4\% in five days. Additionally, the system detected an impulsive wave sequence on Alphabet's stock, generating a buy recommendation at \$140 per share and a target price of \$160 per share, yielding a 13.3\% gain. A long-term analysis of Nvidia's stock also identified a complete Elliott wave cycle, leading to a buy recommendation at \$42 per share and a target price of \$50 per share, resulting in a 17.4\% gain.

Figure 6: ElliottAgents identified an "ending diagonal" pattern on Amazon's stock over a two-month period, issuing a sell recommendation at \$185 per share.

Figure 7: ElliottAgents identified an impulsive wave sequence on Alphabet's stock over a one-year period, generating a buy recommendation at \$140 per share.

The second part of the experiment focused on the correctness of detected patterns and the impact of DRL, using cross-validation on 1000 samples with daily intervals. The use of DRL improved prediction accuracy, indicating that agents can effectively use the learning process on historical data to better interpret patterns.

Figure 8: ElliottAgents detected a complete Elliott wave cycle on Nvidia's stock price on daily intervals, issuing a buy recommendation at \$42 per share.

Discussion and Future Work

The paper compares ElliottAgents with existing stock price prediction systems, noting that advancements in AI have significantly enhanced system capabilities [akintola_mas_stock_trading_2021, gamil_mas_fuzzy_logic_stock_market_2007, luo_mas_decision_support_stock_market_2002]. Unlike traditional systems relying on static rules and fuzzy logic, ElliottAgents effectively detects and interprets wave patterns with better accuracy than similar systems using EWP [tirea_mas_ewp_2012]. Future work includes expanding the analysis to include additional wave formations and incorporating other technical analysis methods, such as moving averages.

Conclusion

ElliottAgents demonstrates the potential of integrating NLP and multi-agent systems for stock market analysis [tunstall_nlp_with_transformers_2022]. By leveraging LLMs and EWP, the system transforms complex market data into comprehensible predictions. The inter-agent dialogue mimics collaborative human analysis, enhancing the accuracy of technical analysis and making financial data interpretable to users. The experimental results validate the system's effectiveness in recognizing patterns and generating natural language descriptions of trends.

Follow-up Questions

- What are the key components of the ElliottAgents system and how do they interact?

- How does the use of LLMs improve the system’s understanding of market data?

- In what ways does the Elliott Wave Principle contribute to the prediction methodology?

- How is deep reinforcement learning integrated to refine the forecasting accuracy?

- Find recent papers about multi-agent systems in stock market prediction.

Related Papers

- Temporal Data Meets LLM -- Explainable Financial Time Series Forecasting (2023)

- FinCon: A Synthesized LLM Multi-Agent System with Conceptual Verbal Reinforcement for Enhanced Financial Decision Making (2024)

- When AI Meets Finance (StockAgent): Large Language Model-based Stock Trading in Simulated Real-world Environments (2024)

- Automate Strategy Finding with LLM in Quant Investment (2024)

- TradingAgents: Multi-Agents LLM Financial Trading Framework (2024)

- LLM-Powered Multi-Agent System for Automated Crypto Portfolio Management (2025)

- Integrating Traditional Technical Analysis with AI: A Multi-Agent LLM-Based Approach to Stock Market Forecasting (2025)

- FinTeam: A Multi-Agent Collaborative Intelligence System for Comprehensive Financial Scenarios (2025)

- MountainLion: A Multi-Modal LLM-Based Agent System for Interpretable and Adaptive Financial Trading (2025)

- Language Model Guided Reinforcement Learning in Quantitative Trading (2025)