- The paper examines the emergence of a distinct blob fee market, identifying a 15-order fee variance during peak network demand events.

- It highlights that over 80% of blob transactions are driven by leading L2s and reveals substantial losses, such as 70% fee inefficiencies due to suboptimal blob packing.

- It suggests targeted improvements like multidimensional priority fees and revised transaction formats to enhance blob efficiency and support Ethereum's scaling roadmap.

The Early Days of the Ethereum Blob Fee Market and Lessons Learnt

Introduction

Ethereum's scalability roadmap has prioritized layer-2 (L2) solutions to manage increasing network demands while maintaining decentralization and security. The Ethereum Improvement Proposal (EIP) 4844 introduced blob transactions, a pivotal step in supporting L2 protocols by allowing the use of blobs—temporary, large data objects crucial for L2 solutions. This mechanism significantly reduces the cost associated with storing L2 data on-chain and establishes a separate blob fee market. Analyzing this new market offers insights into operational efficiencies and market participant behaviors.

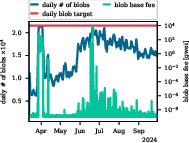

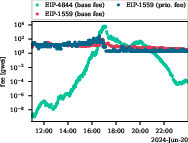

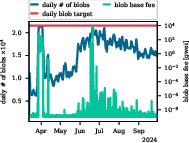

Figure 1: Daily number of blobs (green line) and daily blob target (red line) on the left y-axis. We further plot the blob base fee (blue line) on the right y-axis.

Blob Fee Market Analysis

Initial Findings

The paper highlights a substantial variance in the blob base fee, increasing by 15 orders during peak demands, such as the LayerZero airdrop. Blob adoption, although impactful in isolated events, remains below the daily target, reflecting an unsustained demand (Figure 1). Despite this, the blob mechanism reduces costs for L2s using blobs instead of Ethereum calldata.

Participant Behavior

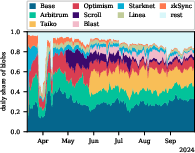

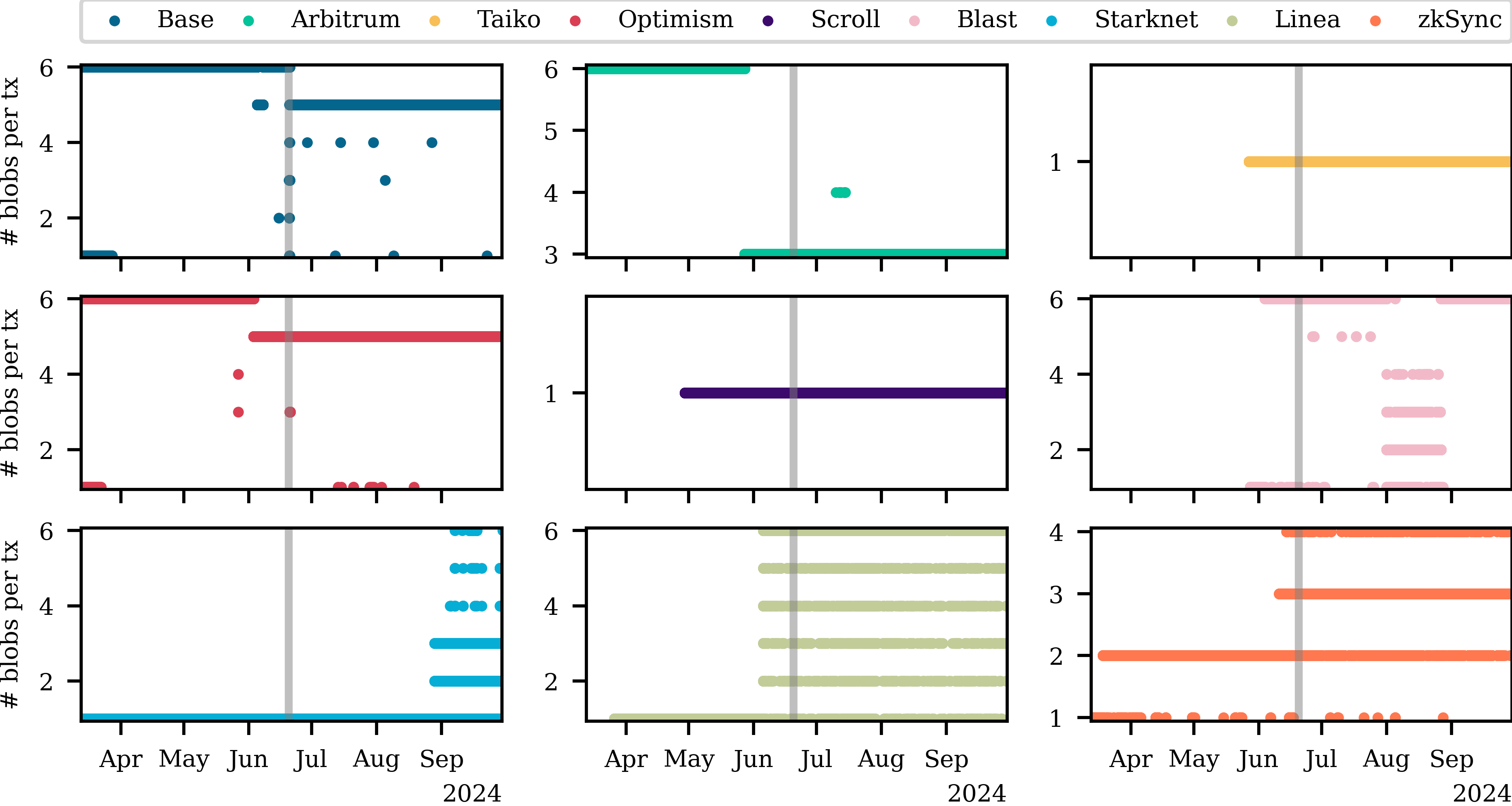

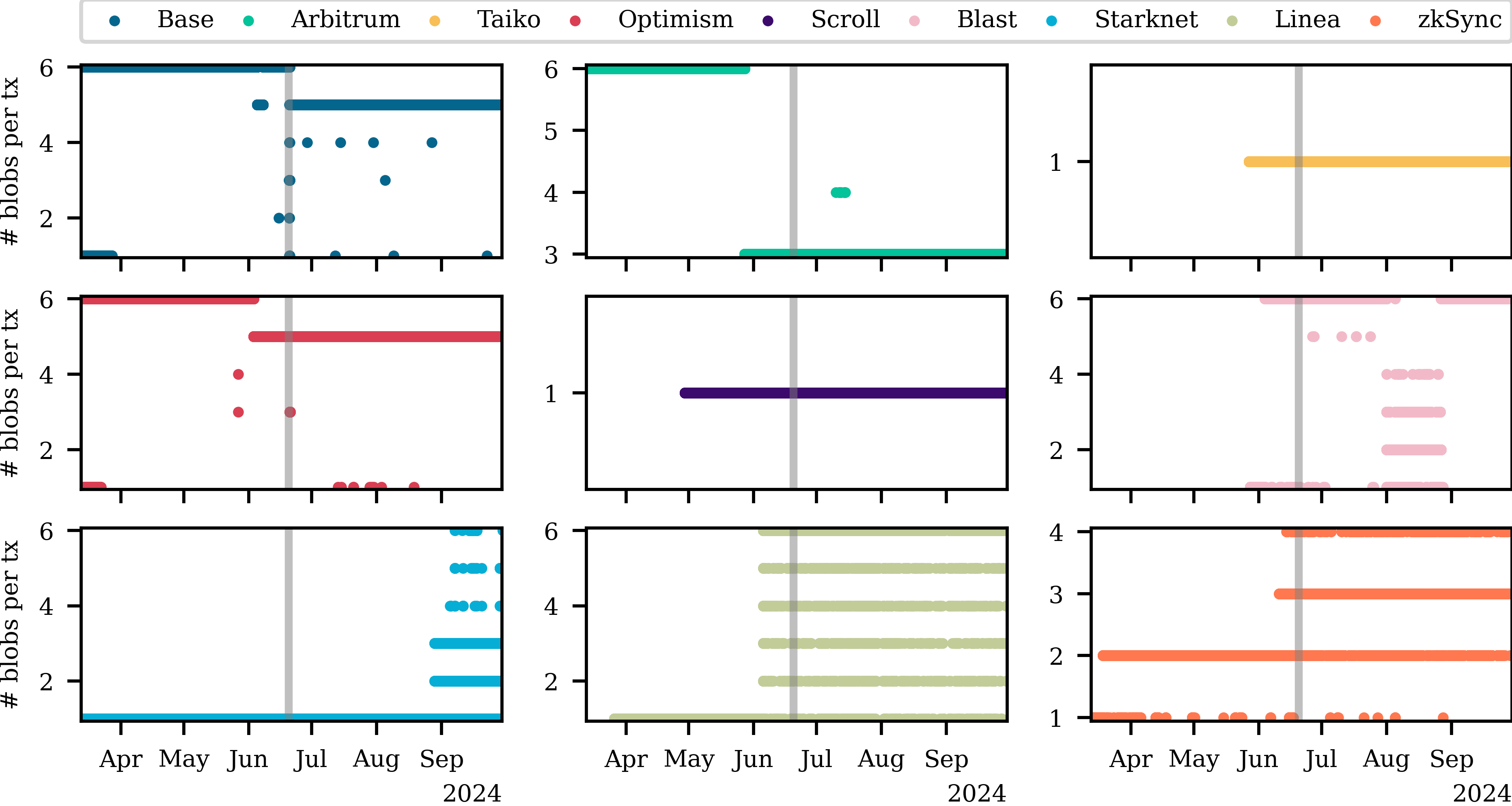

The behavior of L2s, responsible for over 80% of blob usage, reveals varying strategies in transaction structuring and blob usage (Figure 2). Large L2s like Base consistently use blobs effectively, while others adapt blob counts potentially in response to varying demand or internal network conditions.

Figure 2: Number of blobs submitted by the biggest nine L2s per type-3 transaction over time, each dot represents one type-3 transaction submitted by the respective L2.

Blob Fee Dynamics

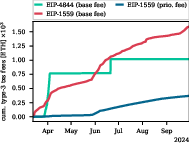

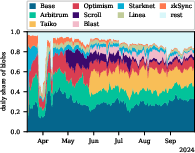

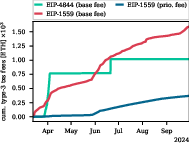

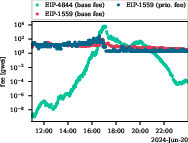

The distinct blob fee market within the Ethereum ecosystem interacts minimally with the core EIP-1559 gas market (Figure 3), comprising only 1% of total fees during the analysis period. Despite facilitating lower-cost data settlement for L2s, the blob fee market presents inefficiencies and minimal financial incentives for validators and builders.

Figure 3: Cumulative fees paid by blob transactions over time. We separate the EIP-4844 fee market (base fee) from the EIP-1559 fee market (base and priority fee).

Inefficiencies and Design Flaws

Blob Packing

Analysis reveals substantial inefficiencies in blob packing, where suboptimal block packing often led to 70% fee losses for builders. The immature market shows a slow evolution towards better efficiency, still highlighting an investment deficiency in required infrastructure due to low economic incentives for builders.

Subset Bidding

A key market design flaw involves subset bidding, where transactions must include all requested blobs or none, leading to potential inefficiencies. This rigidity suggests that adjustment in transaction formats could enhance flexibility and optimal blob usage without undermining economic incentives.

Suggested Improvements

Fee Market Adjustments

Addressing pricing inefficiencies involves introducing multidimensional priority fees and speeding up price discovery through measures such as increasing the minimum blob fee per gas. A gradual increase in blob targets could stabilize supply-demand dynamics, balancing network and participant incentives.

Market Structure Evolution

Enhancing blob packing methodologies could benefit specialized builders by increasing block packing efficiency. Introducing subset bidding within the transaction standard could resolve the design flaw, allowing optimal and flexible blob inclusion, encouraging further scalability and efficiency in Ethereum's network.

Conclusion

The integration of blob transactions marks significant progress in Ethereum's scaling efforts. However, inefficiencies such as suboptimal packing and design limitations pose challenges that hinder full potential realization. Addressing these through strategic fee market adjustments and revised market structures could enhance network capabilities and provide valuable insights into future decentralized systems.

Improving infrastructure for blobs and aligning economic incentives will be crucial as Ethereum continues to evolve and embraces broader scalability solutions.