- The paper demonstrates that a multi-head CNN with self-attention effectively integrates multi-timeframe data to generate reliable trading signals.

- The methodology integrates diverse data sources including market data, on-chain metrics, and sentiment analysis to enhance prediction accuracy.

- The approach achieves a profit factor of 1.15 with a real-time inference pipeline, ensuring high-frequency execution in volatile cryptocurrency markets.

Neural Network-Based Algorithmic Trading in Cryptocurrency Markets

This paper presents an exploration of neural network-based systems for algorithmic trading, specifically within the cryptocurrency markets. Unlike traditional markets, these markets offer continuous operation and significant transparency due to blockchain technology, presenting unique challenges and opportunities for trading systems. The system devised in this paper utilizes neural networks for multi-timeframe trend analysis and high-frequency trade execution, integrating diverse data sources to produce reliable and consistent trading signals.

System Architecture and Data Integration

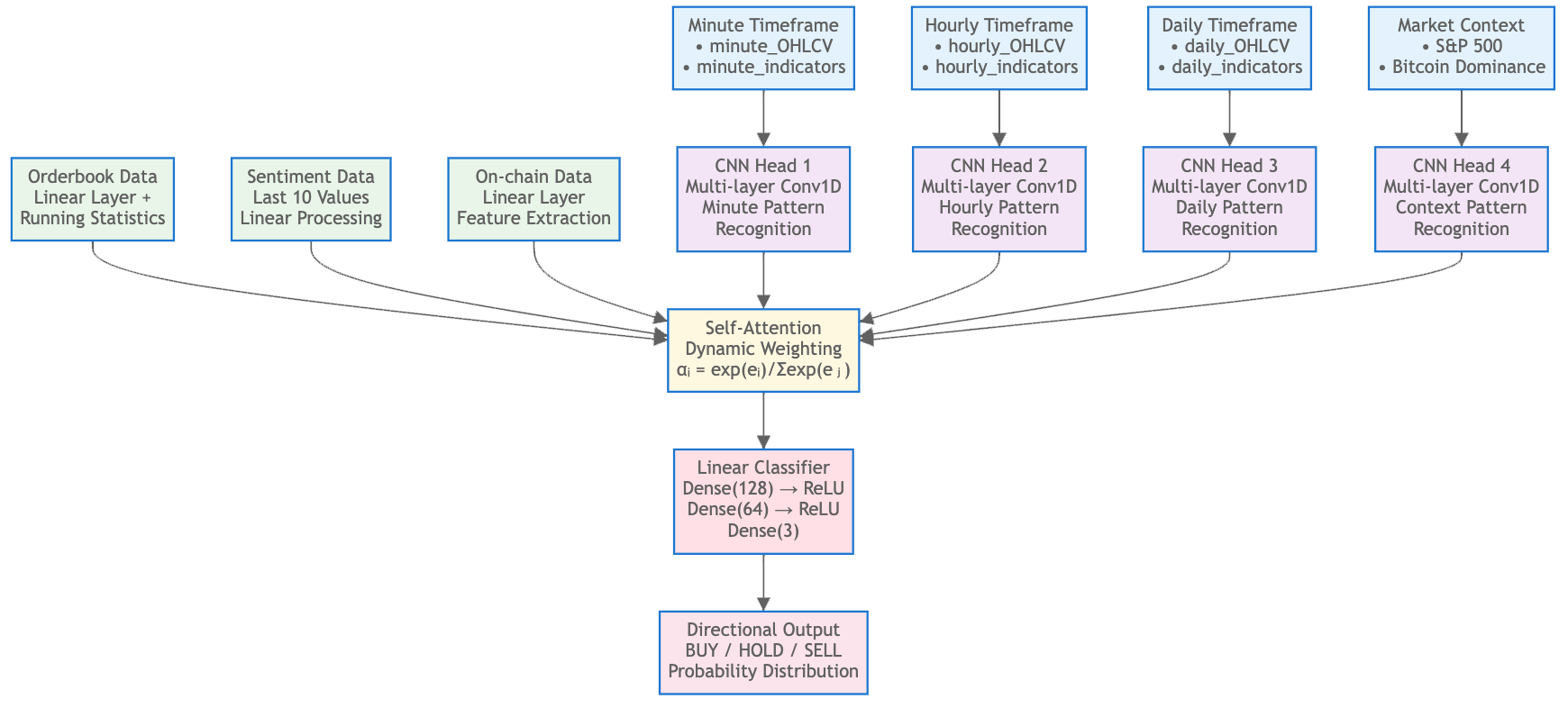

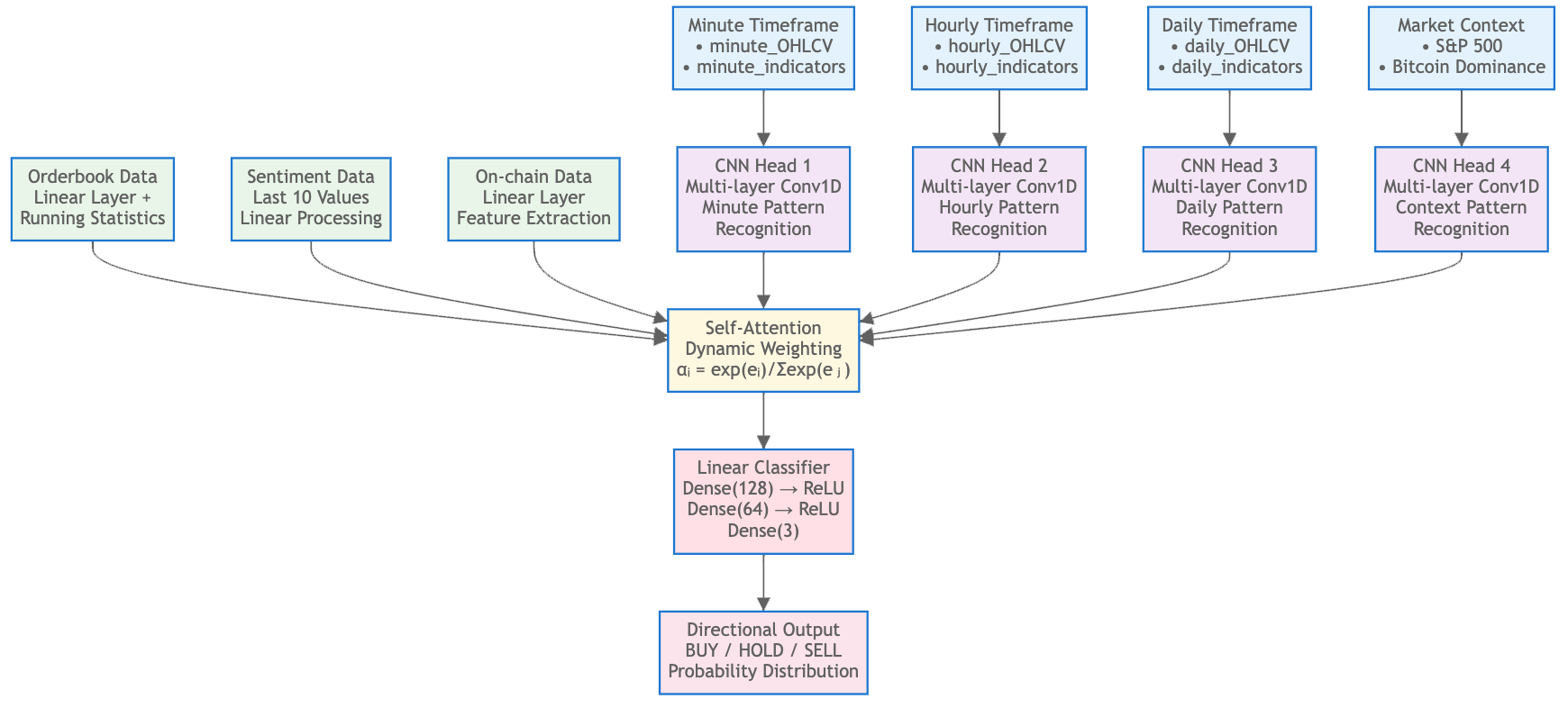

The architecture of the system consists of multimodal neural networks designed to process data from various sources, including market data, on-chain metrics, and orderbook statistics. The Direction Networks utilize a multi-head CNN architecture, with each head focusing on a specific timeframe: minute, hourly, and daily. These networks leverage technical indicators, sentiment data, and on-chain metrics, supplemented by advanced data processing techniques to continuously generate directional trading signals.

Figure 1: Direction Networks Architecture: Multi-head CNN processing of timeframe-specific market data and broader context, employing a self-attention mechanism for feature weighting before directional classification.

Data integration is a key challenge addressed by creating a unified data processing pipeline. Historical data, ranging from daily to sub-second intervals, is synchronized and normalized to ensure consistent input for the neural networks. The system processes a wide range of data types, including technical indicators from market data, transaction patterns from on-chain metrics, and sentiment data from news and social sources, enabling it to adapt to changes in market regimes and external events.

Trend and Direction Networks

The system's trend prediction model employs relatively simple neural networks for evaluating market sentiment and directional biases based on multi-timeframe averages and Bitcoin dominance metrics. Such an approach ensures that the system retains sensitivity to genuine trend changes across market cycles while maintaining computational efficiency.

The Direction Networks use a sophisticated CNN with a soft attention mechanism. This architecture dynamically weighs the outputs of its temporal processing heads, enabling it to capture and leverage data-driven insights across different timeframes efficiently. The CNN heads work in tandem, with separate processing paths for minute-scale, hourly-scale, and daily-scale data patterns. The incorporation of broader market indices like the S&P 500 and Bitcoin dominance further aids in contextualizing market regime shifts.

Empirical results attest to the efficacy of using a CNN with attention over other architectures, such as LSTMs, which were found to be slower in inference and less effective. Table 1 in the original paper indicates the superior performance of the proposed CNN with a profit factor of 1.15 compared to other models.

Inference and Execution

Real-time inference leverages the multi-network architecture, dynamically selecting which Direction Network to apply based on current trend scoring. This ensures predictions are contextually relevant, enhancing both accuracy and profitability. The ensemble method enhances transaction decision-making by aggregating predictions from multiple network heads, incorporating confidence scores for refined position sizing and execution.

The provided algorithm outlines a real-time inference pipeline, detailing how market data is processed to derive actionable trading signals. This meticulous approach ensures that execution is achieved within milliseconds, critical for high-frequency trading applications.

Production Considerations

Production deployment imposes additional constraints beyond those faced during backtesting. Operational challenges such as data reliability, network latency, and market microstructure responsiveness become as important as model accuracy. The infrastructure supporting the trading system must efficiently manage websocket connections and mitigate the risks associated with data gaps and high-volatility execution delays.

Response to these challenges requires robust engineering solutions, including resilient data pipelines, optimized server co-location, and adaptive latency management. The entire system needs to maintain risk control mechanisms that function independently of signal generation to safeguard against unexpected market shocks or model failures.

Conclusion

The system proposed in this paper provides an effective framework for utilizing neural networks in algorithmic trading within the volatile and dynamic environment of cryptocurrency markets. By integrating cross-timeframe analysis with high-frequency execution, the system generates reliable trading signals that capitalize on perceived market inefficiencies. This approach underscores the potential for neural network architectures to transform trading strategies by providing real-time, data-driven insights into complex, non-linear market behaviors. The methodologies outlined hold promise for further developments in AI-driven financial applications, potentially extending beyond the confines of cryptocurrency markets.