- The paper demonstrates that an Informer architecture using GMADL loss can effectively capture market inefficiencies in high-frequency Bitcoin trading.

- The paper employs innovative methodologies with multiple loss functions (RMSE, Quantile, GMADL) to optimize algorithmic trading strategies.

- The paper shows that the GMADL Informer strategy outperforms traditional benchmarks like Buy and Hold, MACD, and RSI by achieving higher returns and lower drawdowns.

Introduction

The paper addresses the development of automated trading strategies using the Informer architecture and evaluates their application specifically for high-frequency Bitcoin data. Three unique models leveraging different loss functions—Root Mean Squared Error (RMSE), Generalized Mean Absolute Directional Loss (GMADL), and Quantile loss—are proposed and compared against traditional benchmarks like Buy and Hold, MACD, and RSI strategies. The paper focuses on the integration and effectiveness of machine learning models in algorithmic trading, aiming to provide superior trading outcomes.

Data Description and Preparation

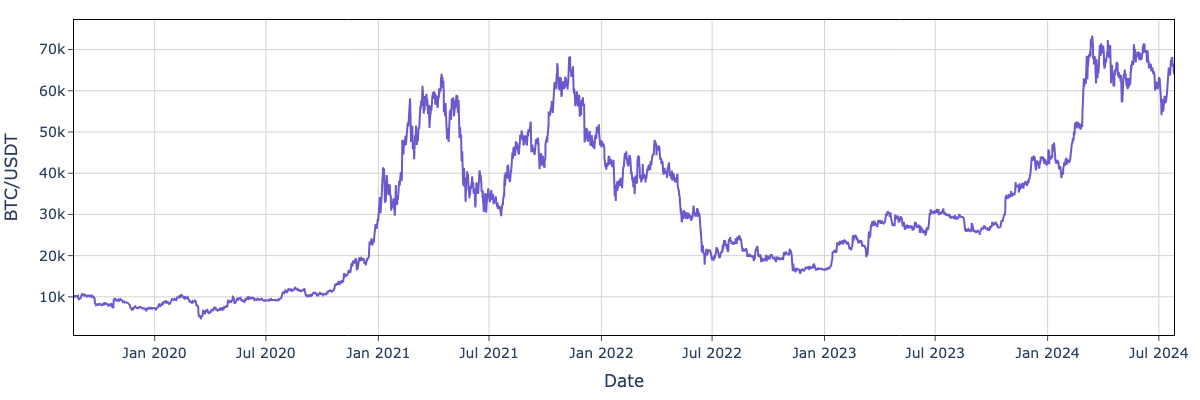

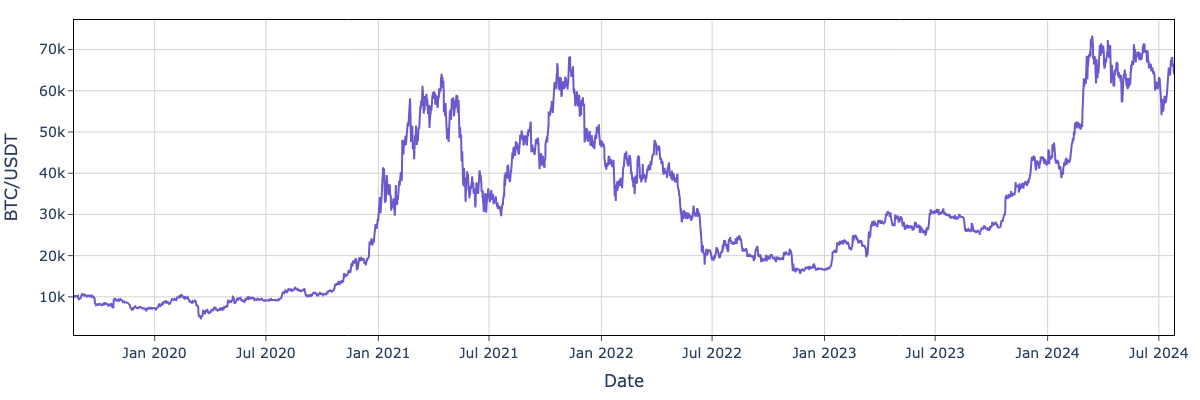

The dataset consists of BTC/USDT price data across various intervals: 5-minute, 15-minute, and 30-minute windows spanning a period from August 21, 2019, to July 24, 2024. BTC/USDT was chosen due to the availability of high-frequency data, continuous market operation without overnight fluctuations, and the asset's significant trading volume and liquidity.

Figure 1: Price of the BTC/USDT.

Additional datasets incorporated include the Cboe Volatility Index (VIX), Federal Funds effective rates, and the Crypto Fear/Greed Index to account for market conditions and sentiment variability that may impact Bitcoin trading behavior.

Methodology

The paper formally defines a trading strategy as a function mapping a lookback window of market indicators to a position recommendation—either long, short, or no position. Evaluation metrics employed include Annualized Return Compounded (ARC), Information Ratio (IR*), and Maximum Drawdown (MD), among others. These metrics allow for a comprehensive analysis of both return and risk.

Informer Architecture

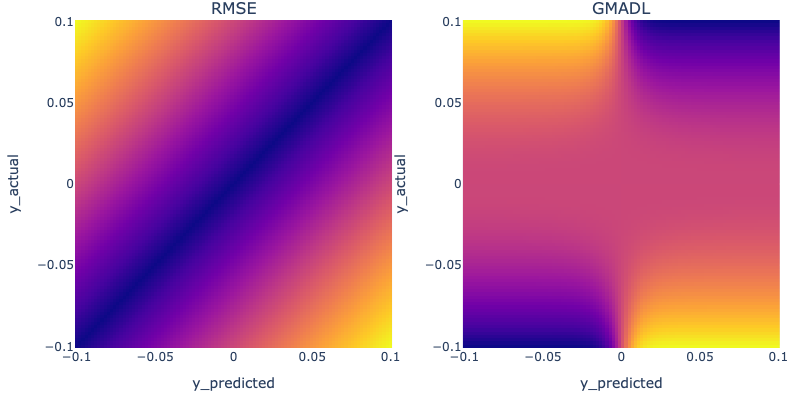

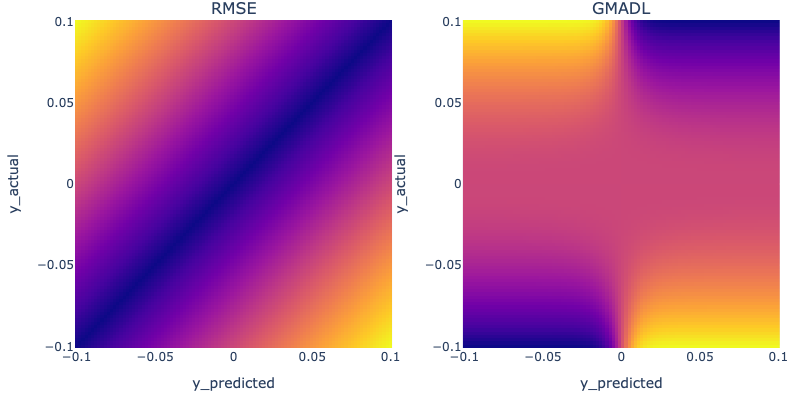

The Informer model adopts an encoder-decoder structure focusing on processing long time series effectively. It utilizes multi-head self-attention equipped with a sparse mechanism, enhancing the computational efficiency. The loss functions RMSE, Quantile, and GMADL play critical roles in training the model, impacting its predictive capabilities and subsequent strategy effectiveness.

Figure 2: RMSE vs GMADL loss functions.

Experimental Results

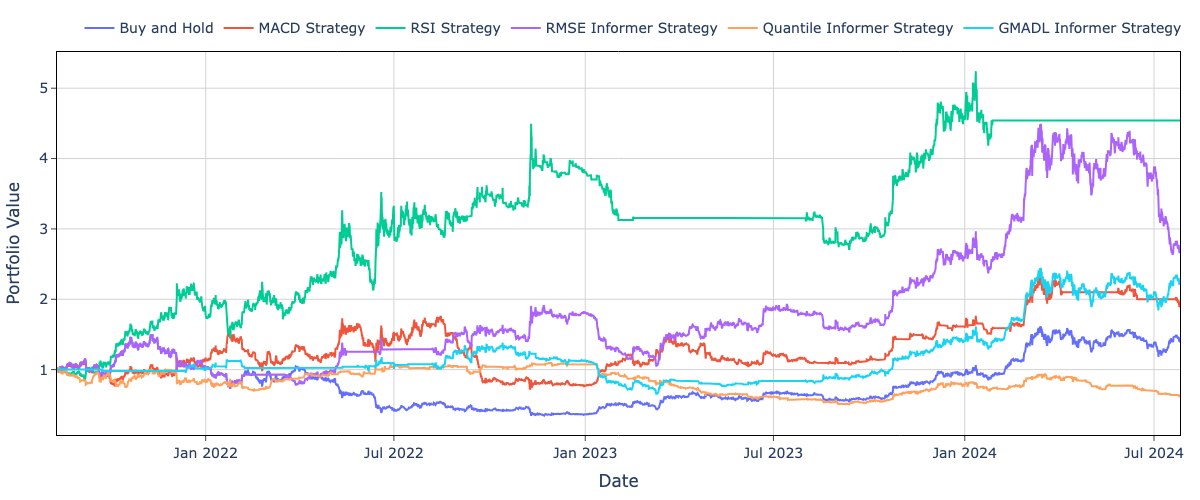

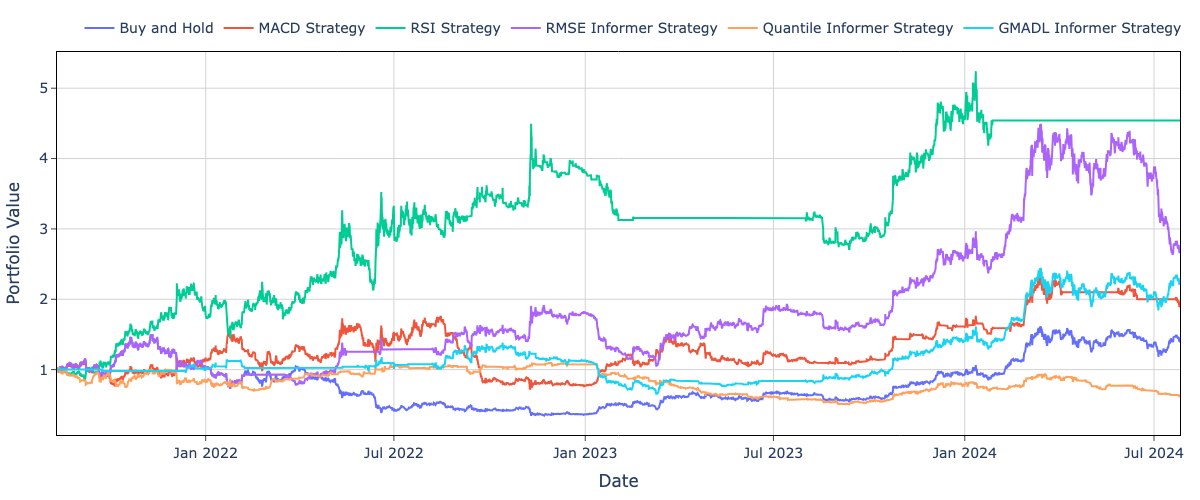

Each strategy was evaluated across distinct data frequencies. The GMADL Informer strategy particularly stood out, exhibiting superior performance on high-frequency 5-minute data, highlighting its capacity to handle intricate data structures and provide enhanced predictive accuracy for sudden market movements.

Figure 3: Evaluation results on 30 min data.

The comparison demonstrated that machine learning-based strategies, particularly using GMADL, can outperform traditional technical indicators under certain conditions. Quantile-based models, while theoretically robust, underperformed relative to the benchmark due to potentially over-aggressive filtering of trading signals.

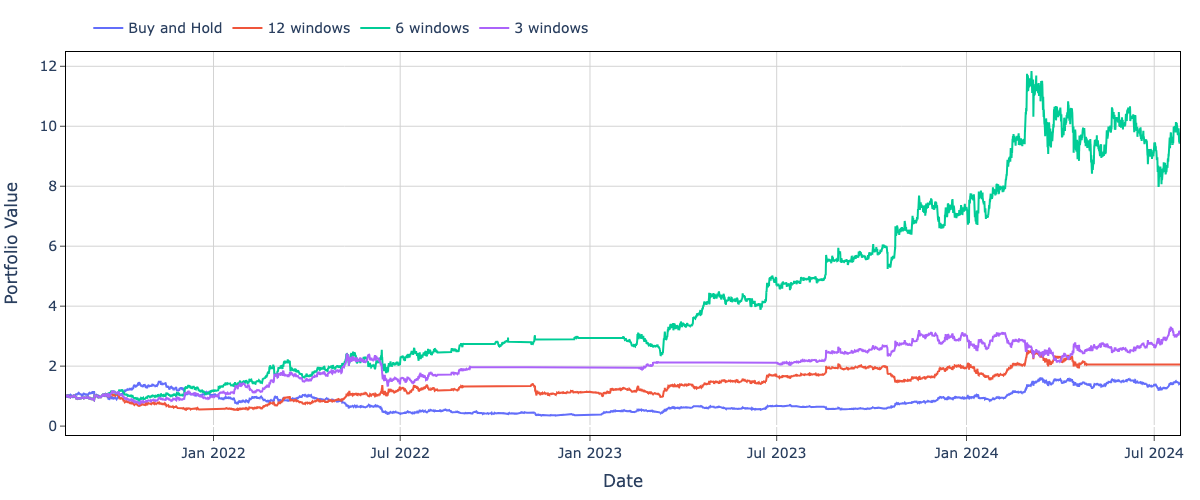

Sensitivity Analysis

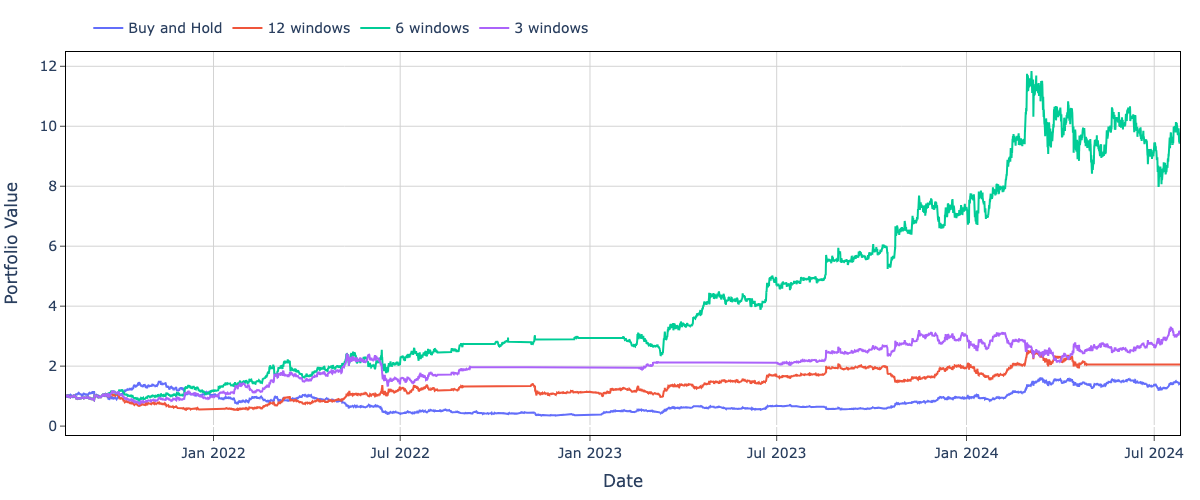

Sensitivity tests indicate the selection of validation window size impacts hyperparameter optimization, influencing overall strategy performance. Additionally, testing different numbers of evaluation windows revealed that the GMADL Informer strategy remained resilient, consistently beating the buy-and-hold benchmark.

Figure 4: GMADL Informer strategies evaluated on different number of windows.

Conclusion

The paper successfully demonstrates that employing sophisticated neural architectures like Informer, especially when trained with GMADL loss, can lead to effective trading strategies capable of outperforming traditional methods. The analysis affirms the potential of machine learning models in capturing market inefficiencies and driving algorithmic trading to new heights. Future research could explore broader market applications and further refine loss function integration to maximize strategy outcomes.

The implementation of this research provides a solid framework for AI-driven trading systems, highlighting Informer's adaptability and effectiveness in real-world financial markets. It opens avenues for more intensive exploration into high-frequency trading with AI models and the continual evolution of automated market strategies.