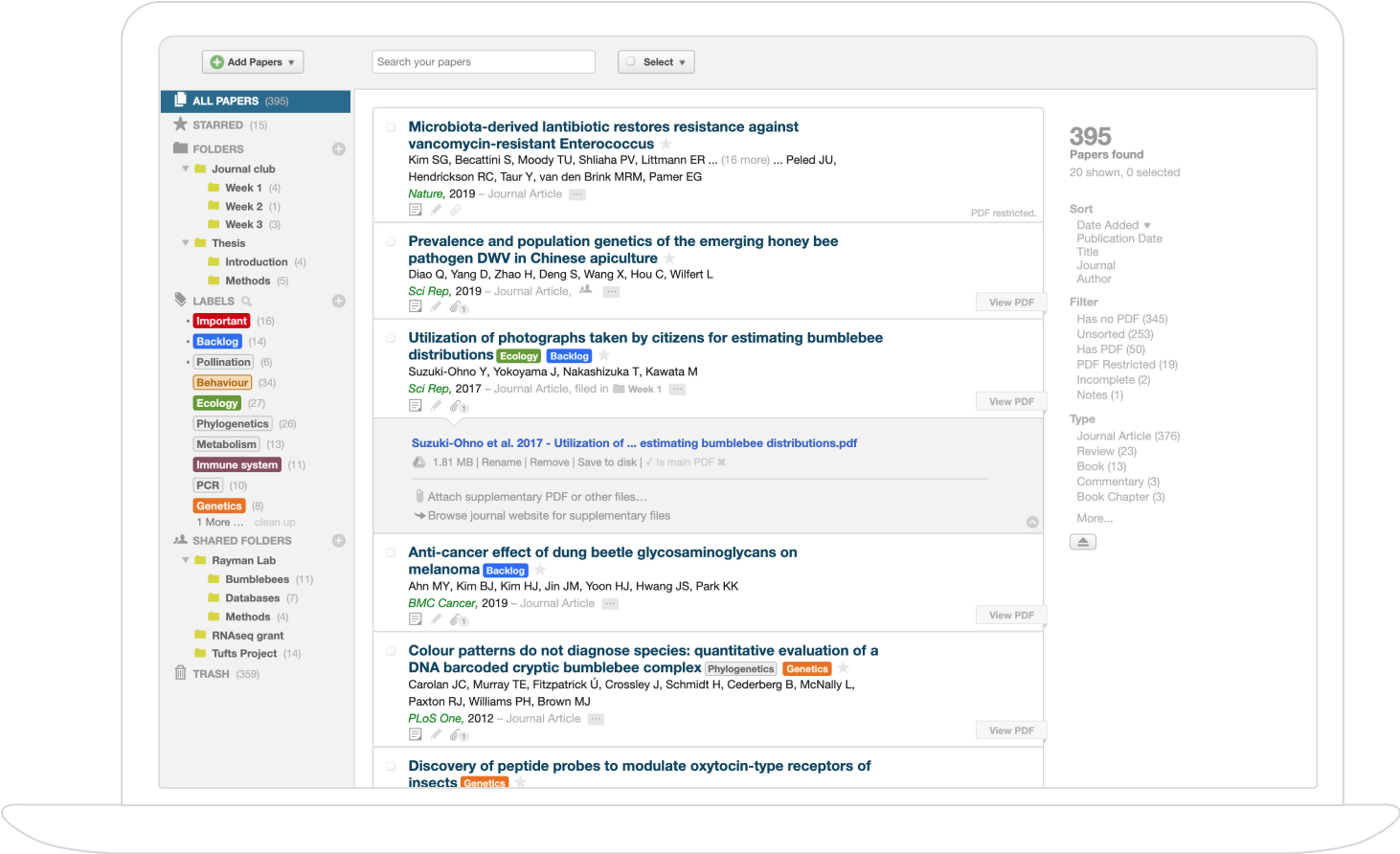

Transaction Fee Mechanisms (TFMs)

- Transaction Fee Mechanisms (TFMs) are rules for selecting and pricing blockchain transactions when demand exceeds block supply.

- Mechanisms like Ethereum’s EIP-1559 and the tipless model implement incentive properties such as MMIC and OCA-proofness to resist strategic manipulation.

- Dynamic base fee adjustments, fee burning, and variable block sizes in TFMs balance user strategies, miner revenue, and network security.

A Transaction Fee Mechanism (TFM) is an allocation and payment rule in blockchains used to select and price a subset of transactions from a public mempool for on-chain inclusion when demand exceeds block supply. The TFM must robustly incentivize both users and miners to act according to the designed protocol and be resilient to strategic manipulation and collusion—including off-chain agreements—unique to the decentralized, adversarial environment of blockchain protocols like Bitcoin and Ethereum. Recent TFM research formalizes these requirements by introducing incentive compatibility notions such as MMIC (Myopic Miner Incentive Compatibility) and OCA-proofness (Off-Chain Agreement Proofness), with immediate relevance to transaction fee designs like Ethereum’s EIP-1559 and to newly proposed alternatives such as the tipless mechanism.

1. Formal Incentive Notions in Blockchain TFMs

TFMs in the blockchain context uniquely address the dual strategic behaviors of users and miners. Two principal properties are emphasized:

- MMIC (Myopic Miner Incentive Compatibility): Ensures that a profit-maximizing miner optimally follows the protocol-specified allocation rule without manipulating the block by injecting fake transactions, reordering, or otherwise deviating. Formally, for any block history and mempool , if the payment rule is separable (fee for a transaction depends only on its own bid) and the miner’s chosen allocation maximizes revenue minus cost, the protocol is MMIC. For all protocol-recommended blocks, the myopic miner’s utility is maximized by simply implementing the prescribed rule, i.e. (no fake transactions).

- OCA-proofness (Off-Chain Agreement Proofness): Addresses the risk that miners and users may conduct off-chain (side-channel) agreements to reroute fees, threatening the integrity of the on-chain mechanism. A TFM is OCA-proof if no such off-chain deal can produce a Pareto improvement over the canonical on-chain outcome, i.e. the outcome that maximizes the joint utility of users and miner under individually rational on-chain bids. Joint utility is formalized as:

where is user 's valuation, the burned fee, the marginal miner cost, and the transaction size. The on-chain allocation must already maximize this so there is no utility gap off-chain collusion can exploit.

These notions supplement classical dominant-strategy incentive compatibility (DSIC), which in ordinary posted-price mechanisms guarantees truthful bidding as optimal for users. In TFMs, DSIC can fail under demand shocks or when base fee adaption lags behind actual congestion.

2. Mechanism Design: EIP-1559 and the Tipless Mechanism

The Ethereum EIP-1559 mechanism operationalizes these incentive properties through several structural innovations:

- Variable-Size Blocks: Rather than static capacity , EIP-1559 employs a target block size with hard maximum . The realized block size serves as a signal for supply-demand imbalance.

- History-Dependent Reserve Price (Base Fee): Each block sets a base fee adjusted solely by block filling (increased with full blocks, decreased with empty blocks), independent of miners’ choices, establishing a dynamic price floor.

- Fee Burning: The base fee revenue is burned, so miners receive only user-specified “tips” above ; this counters off-chain collusion by removing any incentive for miners to grant inclusion outside protocol rules.

Under EIP-1559, for transaction :

- User payment: ,

- Burned fee: , where is the user’s bid (fee cap plus tip).

The allocation selects the feasible transaction subset maximizing

subject to the capacity constraint, with as miner marginal cost.

The tipless mechanism is a further simplification: users specify only a fee cap, the tip is hard-coded (e.g., to or a protocol-fixed value ), and transactions are included if ; since tipping strategy is fixed, user bidding is trivially dominant.

3. Incentive Compatibility and Collusion Analysis

TFMs must balance multiple, sometimes competing, incentive properties:

| Mechanism | MMIC | DSIC | OCA-proofness | Collusion Modes Resisted |

|---|---|---|---|---|

| EIP-1559 | Yes | Usually* | Yes | Off-chain miner-user collusion |

| Tipless | Yes | Always | Not in demand spike | Simple tip manipulation, but can fail OCA under low base fee |

| First-Price | No | No | No | None |

*EIP-1559 is DSIC for users only if base fee is accurately tuned to demand; under sudden spikes, DSIC fails as the capacity is outstripped by users with .

Trade-Offs:

- EIP-1559: MMIC provides miner manipulation resistance; burning fees secures OCA-proofness; DSIC fails under lagging base fee adjustment (e.g., demand spikes).

- Tipless: Achieves DSIC unconditionally via fixed tipping; OCA-proofness may fail if the base fee is misaligned, allowing off-chain deals to Pareto dominate on-chain outcome.

No TFM with a separable, revenue-maximizing payment rule and strictly positive miner revenue can simultaneously achieve DSIC for users, MMIC, and general collusion resistance in all environments with sudden surges in demand.

4. Implications for Blockchain Protocols

The introduction of MMIC and OCA-proofness has direct effects on practical protocol behavior:

- Miner Manipulation Resistance: Protocols like EIP-1559 (that use a separable payment rule and maximize miner net revenue subject to base fee burning) remove incentives for miners to game the system via fake transactions, shill bidding, or deliberate mempool reordering.

- Off-Chain Collusion Immunity: By decoupling miner revenue from the base fee and burning this portion, EIP-1559 renders off-chain bribes or tip-steering unprofitable in equilibrium: the joint on-chain utility is already maximized.

- Dynamic Bidding and Demand Spikes: Properly calibrated, base-fee-based posted price mechanisms present clear user bidding strategies; but if fee adjustment lags, bidding departs from DSIC, and both user incentives and OCA-proofness can break down.

5. Analytical Framework and Mathematical Characterization

The formal structure of incentive compatibility under EIP-1559 and similar mechanisms is encapsulated in the following key formulas:

- Optimal user bid (in absence of overbidding incentive): .

- Incentive-compatible allocation: Maximizes over all transaction subsets s.t. total size .

- Joint utility for miner-user coalition: .

Failure points are formally characterized by the demand saturation condition:

where DSIC and/or OCA-proofness no longer hold.

6. Comparative Design Principles and Outlook

The TFM landscape is defined by trade-offs among DSIC, MMIC, and collusion resistance properties. EIP-1559 leverages variable block sizes, history-dependent price floors, and extensive fee burning to approach these desiderata, but mechanisms must navigate the inherent limitations identified by mechanism design theory: full resistance to manipulation and collusion is structurally impossible if miner revenue is to remain strictly positive and user bidding always dominant.

Designers must interleave posted price mechanisms, rigidity in allocation/payment rules, and dynamic fee adjustment with constraints on miner revenue extraction to approximate MMIC and OCA-proofness. Robustness under surges in demand remains conditional on the base fee adaptation, and overbidding incentives for users can emerge in congestion.

In conclusion, the mechanism design framework introduced for TFMs—including MMIC and OCA-proofness—shapes both theoretical understanding and empirical blockchain protocol development, highlighting that transaction fee markets must be continuously adapted to align distributed incentives and limit avenues for adversarial manipulation and collusion.