Crypto-Assets Loan Markets

- Crypto-assets loan markets are decentralized, trustless platforms enabling on-chain lending and borrowing through smart contracts.

- They employ over-collateralization, algorithmic interest rates, and liquidation mechanisms to manage risk and incentivize participants.

- These systems face challenges like oracle manipulation and flash loan exploits, prompting ongoing protocol refinements for enhanced stability.

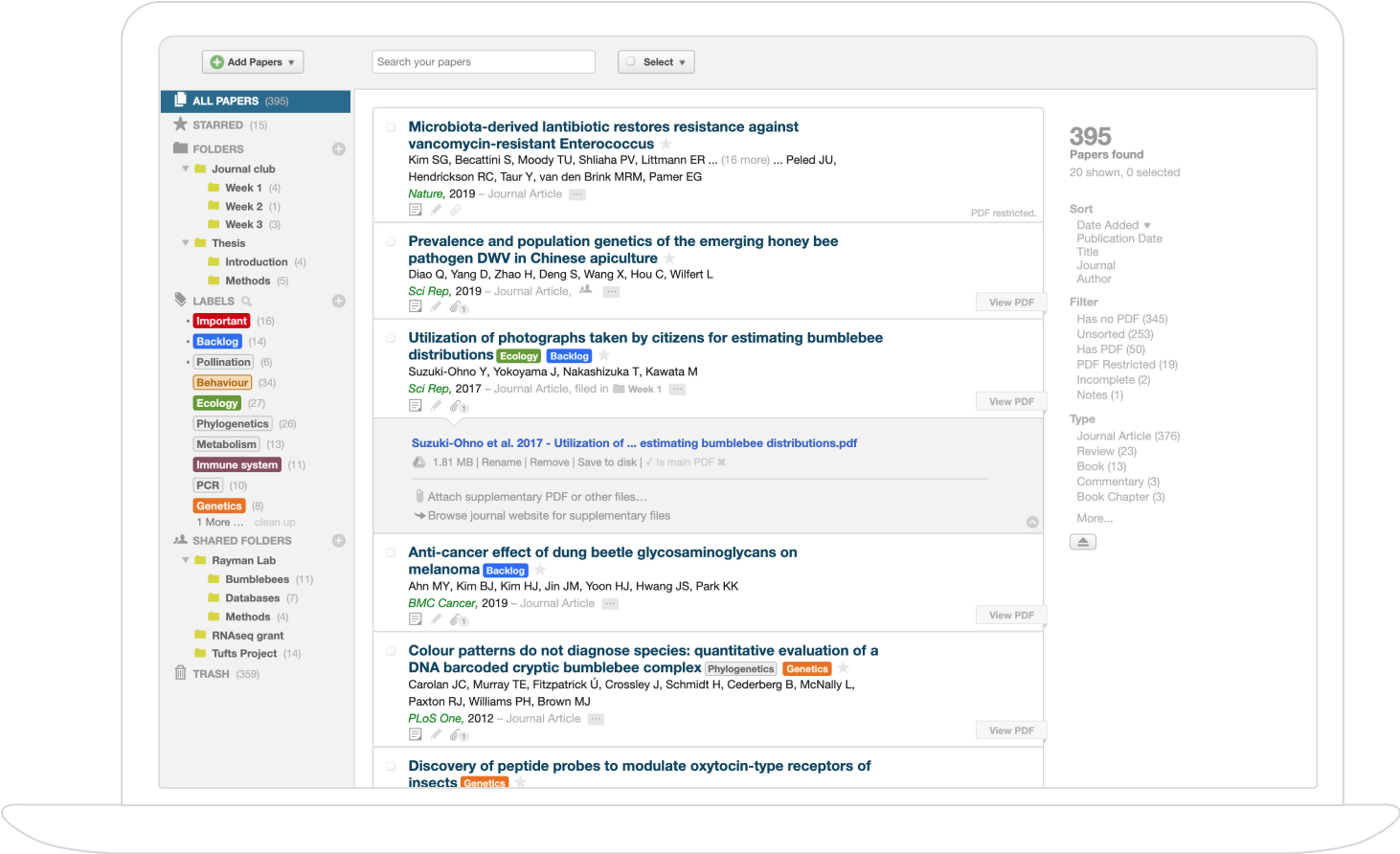

Crypto-assets loan markets are decentralized, smart contract–based systems enabling lending and borrowing of cryptocurrencies—predominantly without trusted intermediaries or off-chain enforcement. These platforms, now encompassing tens of billions of dollars in value, depend on algorithmic, on-chain incentive architectures and risk controls to achieve market stability and safety. The structural complexity of these protocols, and the interaction between user incentives, economic parameters, and potential adversarial strategies, defines both their robustness and fragility within the decentralized finance (DeFi) ecosystem.

1. Formal Structure and Core Components

The essential architecture of crypto-asset lending protocols, epitomized by Aave and Compound, integrates:

- User wallets: Each account maintains balances of various tokens.

- Lending pools: Aggregate capital and manage positions: deposits (credits), borrows (debts), and pool reserves.

- On-chain state: The global protocol state at any time is modeled as

- : Function mapping token-address pairs to balances.

- : Maps pool reserves, credit tokens, and debt tokens (per user) to quantities.

- : Token price oracle, mapping tokens to current prices.

- Interest rate setting and liquidation triggers: Algorithmic mechanisms determine the interest rate—from supply and utilization metrics—and monitor positions, triggering liquidation if collateralization falls too low.

This operational state machine model formalizes critical concepts such as credits, debts, exchange rates, and collateralization across all user and protocol actions.

2. Trustless Incentives and On-Chain Risk Controls

A. Economic Roles

- Lenders deposit assets to pools and are issued credit tokens, accruing interest over time.

- Borrowers pledge collateral to receive debt tokens, effectively borrowing assets from the pool; the position must remain over-collateralized () or else it becomes liquidatable.

- Liquidators repay the debt of under-collateralized borrowers and seize a discounted amount of the borrower's collateral. The protocol specifies a liquidation reward to incentivize this behavior.

B. Protocol Mechanisms

- Interest rates are typically linear or piecewise linear functions of pool utilization:

-

- Exchange rates for credit tokens track pool performance:

ensuring that, as loans are repaid and interest accrues, lenders benefit.

- Collateralization for each borrower :

Health factor is required to avoid liquidation.

C. Enforcement and Incentive Security

All transitions—deposits, borrows, repayments, redemptions, interest accrual, and liquidation—are governed by atomic smart contract operations. There is no concept of legal debt recovery; security is purely cryptoeconomic and built into the contract logic.

3. Economic Dynamics, Strategic Behavior, and Liquidation

A. Economic Impact of Actions

- Deposits, borrows, repayments, redemptions adjust a user’s asset positions but do not directly affect net worth.

- Interest accrual increases lenders’ credit values and borrowers’ debt obligations; explicit gains or losses are realizable only upon liquidation or price changes.

- Liquidation is the only stepwise protocol transition that directly transfers wealth:

where is the repaid debt in token .

B. Liquidation Mechanism

Liquidation is triggered when a borrower's health factor . Any actor can:

- Repay all or part of the borrower's debt.

- Seize the equivalent value of the borrower's collateral with a bonus ,

ensuring timely system resolution and decentralized enforcement.

C. Formal Properties and Structural Invariants

- Token conservation: All user actions (except price-updates or AMM swaps) preserve the total protocol balance of each token type.

- Monotonic exchange rates: The exchange rate for credit tokens can only increase during interest accruals or reset if supply is zeroed.

- Net worth preservation: Aggregate user net worth is preserved under all actions except external price updates.

4. Incentive Fragility and Attack Surfaces

A. Price Manipulation

- Oracle manipulation: Temporary distortions in the oracle price can be exploited to extract under-collateralized loans or force liquidations. Attackers can deposit when the price is high (inflating collateral), borrow excessively, drop the price (lowering debt burden), and extract value from the pool.

- Condition for under-collateralized loan attack:

Where is the required liquidation threshold.

B. Utilization and Interest Rate Manipulation

- Under-utilization attack: Adversaries can temporarily deposit tokens before interest accrual, lowering utilization and minimizing their own interest expense on debts.

- Over-utilization attack: Borrowing just before accrual can increase utilization, boosting earned interest for their own credit tokens.

C. Liquidator Monopolization

Entities controlling transaction ordering (e.g., miners or block proposers) can capture liquidation rewards at the expense of legitimate users, reflecting vulnerabilities when on-chain sequencers have outsized influence.

D. Flash Loan and Front-Running Risks

Atomic loan products (e.g., flash loans) enable attacks that combine rapid sequence actions—deposit, manipulate price, borrow, liquidate, withdraw—in a single transaction, bypassing sequential action-based defenses.

5. Implications for Protocol Design and Market Stability

- Robustness: Cryptoeconomic incentives based on over-collateralization, algorithmic interest rate adjustment, and open liquidation have enabled robust, global, and scalable loan markets without trusted parties.

- Brittleness: The very openness and mechanical incentive alignment also create surface for attacks, especially as pools grow in size and adversarial sophistication (oracle manipulation, utilization gaming, strategic sequencing).

- Disintermediation and efficiency: These systems achieve essential financial intermediation functions—aggregating and allocating capital, managing risk, incentivizing market clearing—without direct human governance, but at a cost of complex vulnerability management.

- Emergent dynamics: User strategies adapt to protocol parameters in real time, creating feedback loops and occasionally producing unexpected or adversarial equilibria.

| Mechanism/Parameter | Formula (or Description) | Significance |

|---|---|---|

| Credit exchange rate | Measures unit value of credit tokens; monotonic | |

| Health factor | Main liquidation threshold; critical for system safety | |

| Liquidator gain | Incentivizes timely liquidation | |

| Utilization ratio | Main determinant of interest rates and pool risk | |

| Interest rate | Algorithmic; target utilization and rate structure |

6. Conclusion

The theory and operational logic of crypto-asset lending protocols combine automated, trustless, over-collateralized risk management with a network of incentive-compatible user roles (lenders, borrowers, liquidators) implemented purely on-chain. The careful modeling of token flows, economic parameters, and incentive design creates efficient, disintermediated loan markets but also exposes the system to manipulation and emergent behaviors in the absence of centralized oversight. Ensuring robustness against price attacks, utilization gaming, and liquidation monopolization requires both continued formal model development and practical protocol refinements, balancing innovation in permissionless finance with resilient risk controls.