- The paper introduces a multi-agent evolutionary framework for automating quantitative trading strategy discovery, emphasizing diversity preservation and investor-specific customization.

- It employs a hypothesis-driven process combined with feature mapping and island migration to iteratively refine and enhance strategy performance.

- Empirical results demonstrate improved Sharpe ratios and cumulative returns in both equity and futures markets compared to standard baselines.

QuantEvolve: Multi-Agent Evolutionary Framework for Automated Quantitative Strategy Discovery

Introduction

QuantEvolve introduces a multi-agent evolutionary framework for the automated discovery of quantitative trading strategies, addressing the limitations of both human-driven research and current LLM-based agentic systems in navigating the vast, high-dimensional strategy space of modern financial markets. The framework is designed to maintain population diversity aligned with investor preferences and to systematically explore and refine trading strategies through a hypothesis-driven, multi-agent evolutionary process. This approach is motivated by the need for robust, adaptive, and personalized investment solutions that can respond to regime shifts and heterogeneous investor requirements.

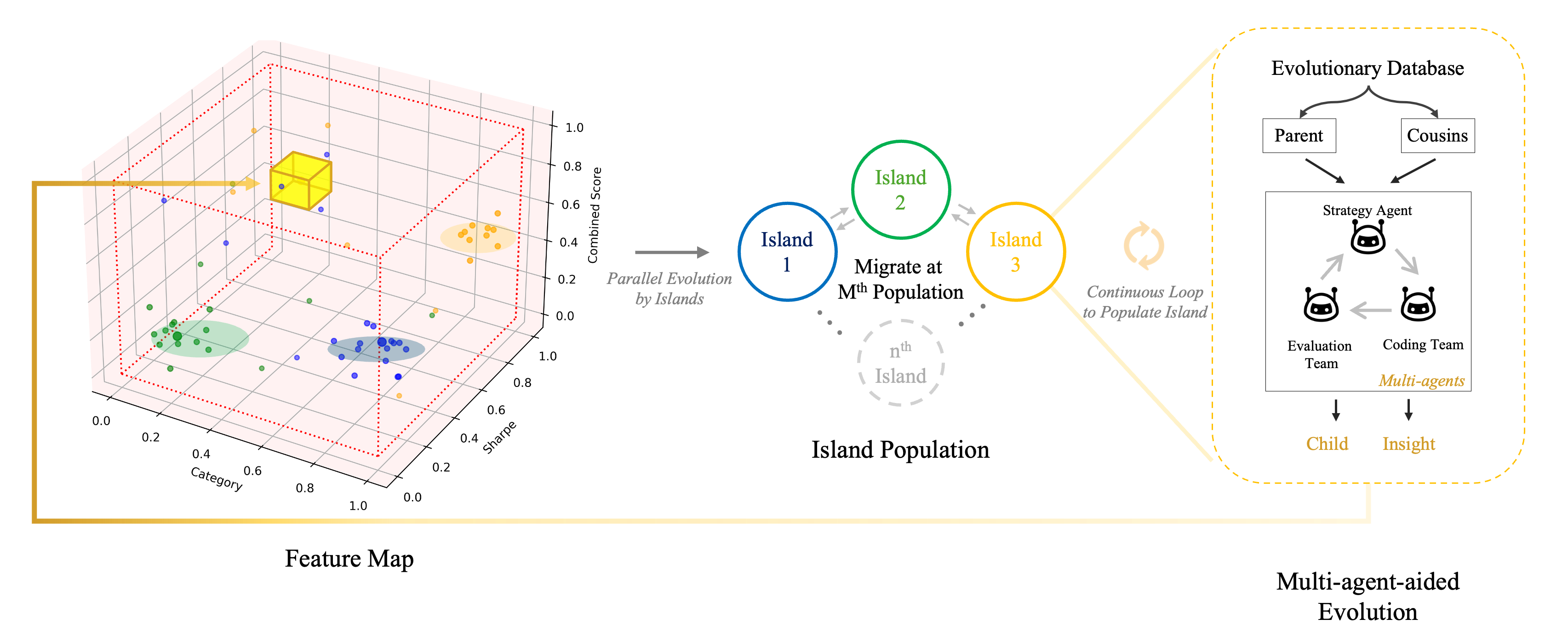

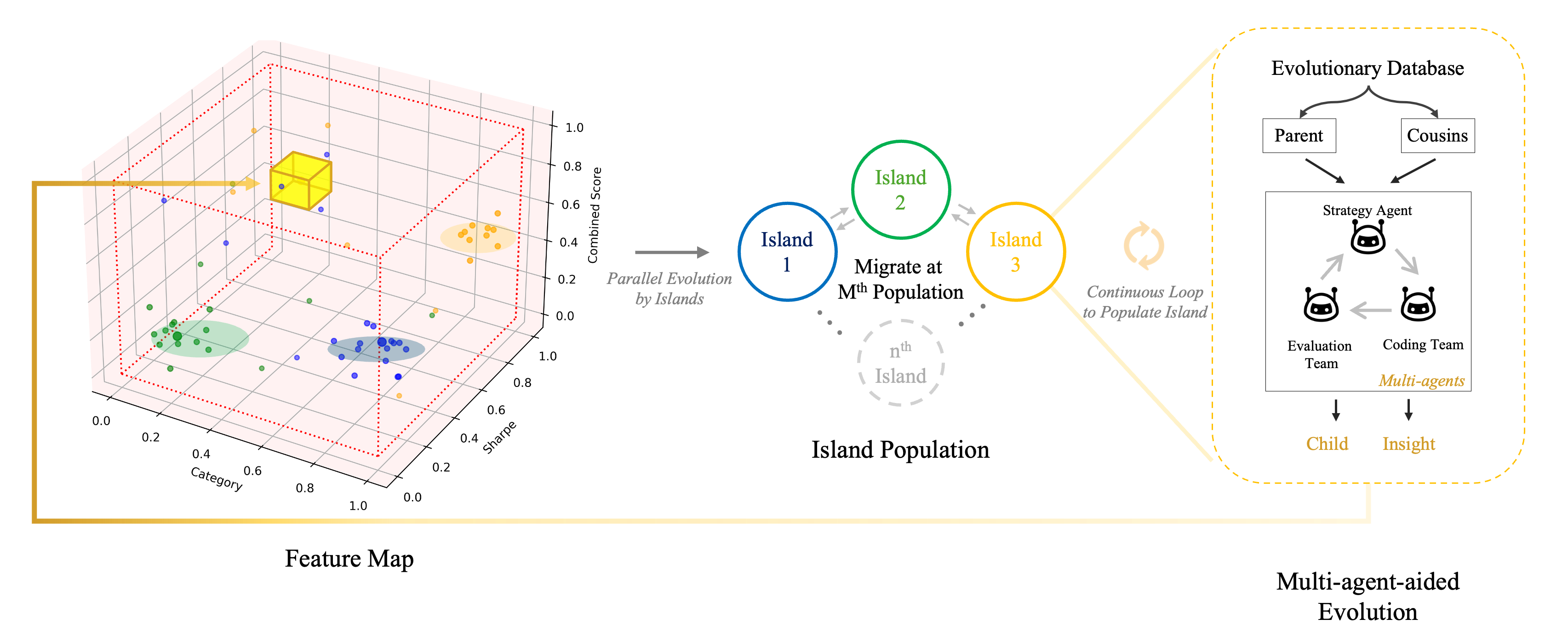

Figure 1: Architecture of the proposed QuantEvolve framework.

Methodological Framework

Feature Map and Diversity Preservation

QuantEvolve employs a multi-dimensional feature map to organize the strategy population. Each dimension corresponds to a salient strategy attribute (e.g., Sharpe ratio, trading frequency, strategy category, maximum drawdown), discretized into bins to form a grid of behavioral niches. Each cell in this grid retains only the best-performing strategy for its feature vector, ensuring that diverse behavioral profiles are preserved and that the evolutionary process does not collapse into a narrow region of the search space.

This design enables targeted matching of strategies to investor profiles and enhances robustness by maintaining solutions optimized for different market regimes. The feature map is extensible to asset-specific requirements, supporting adaptation to various asset classes and market structures.

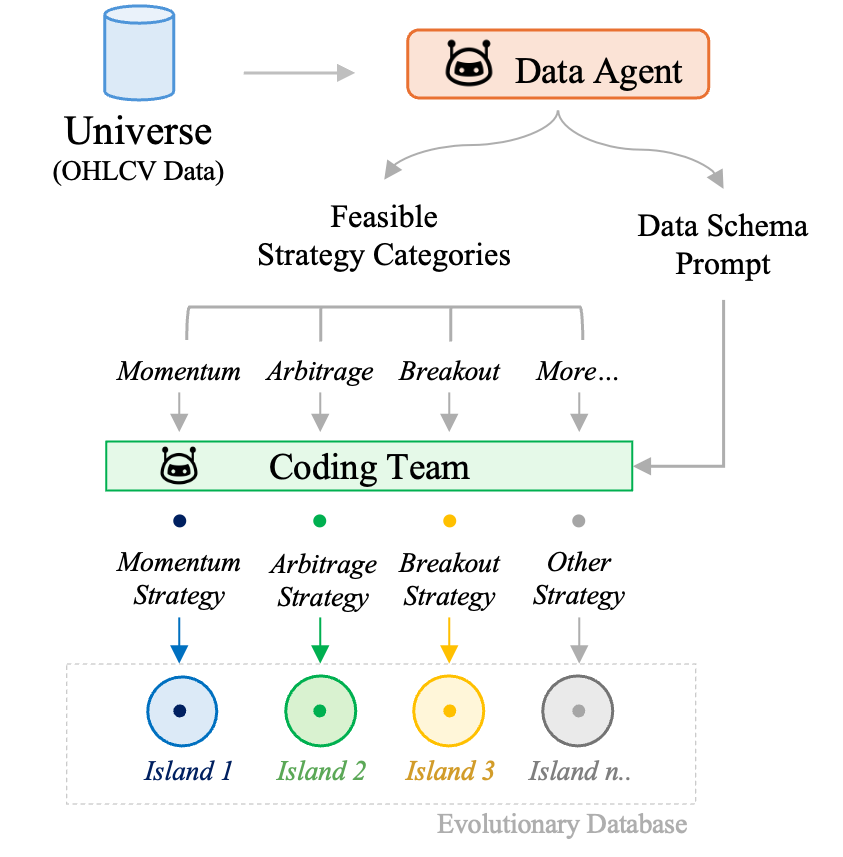

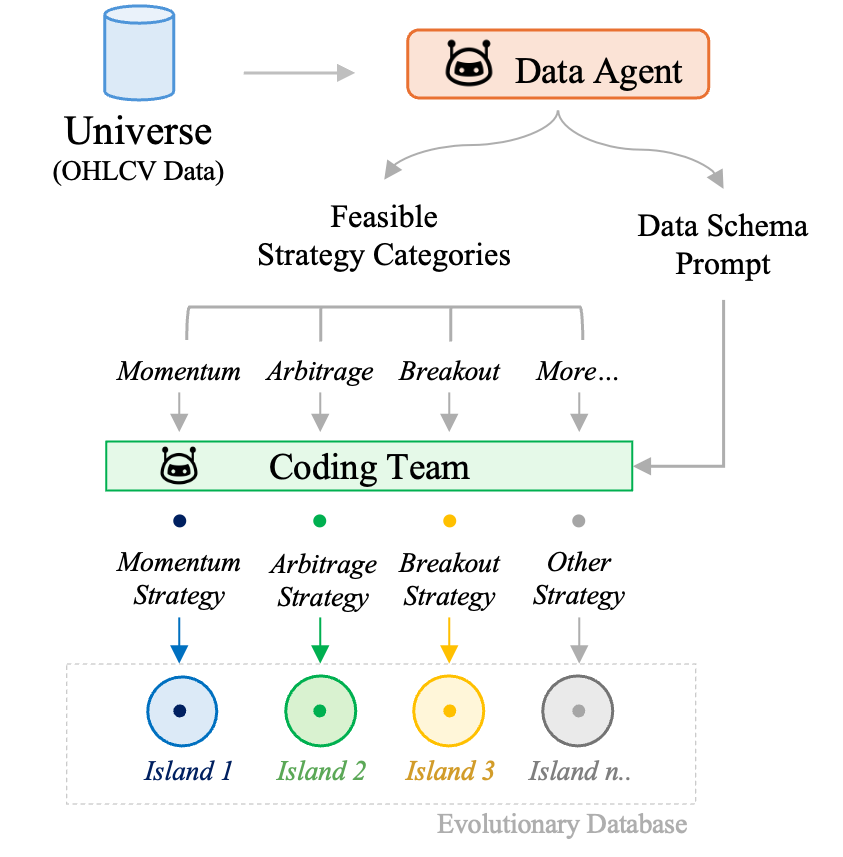

Island Model and Migration

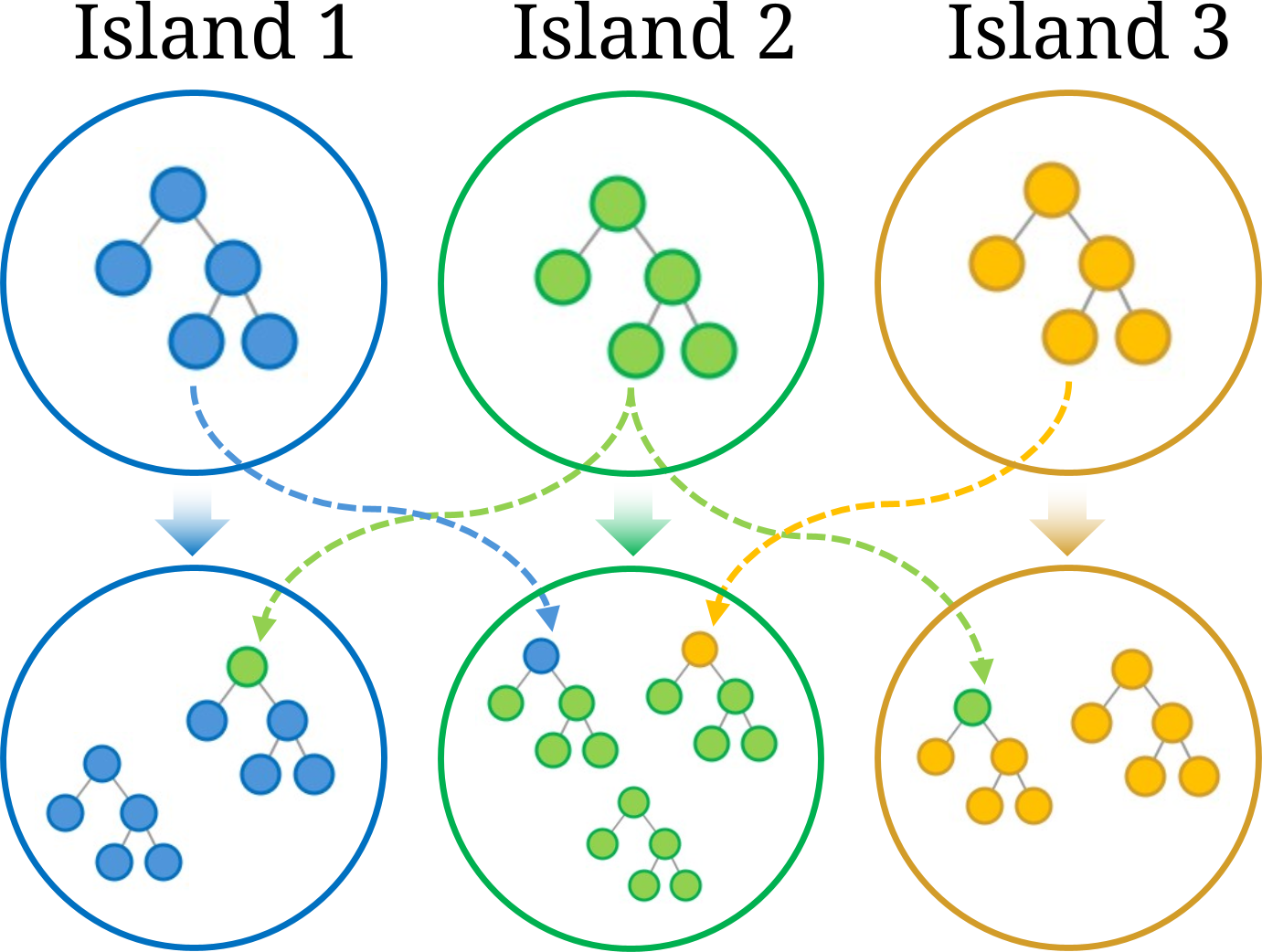

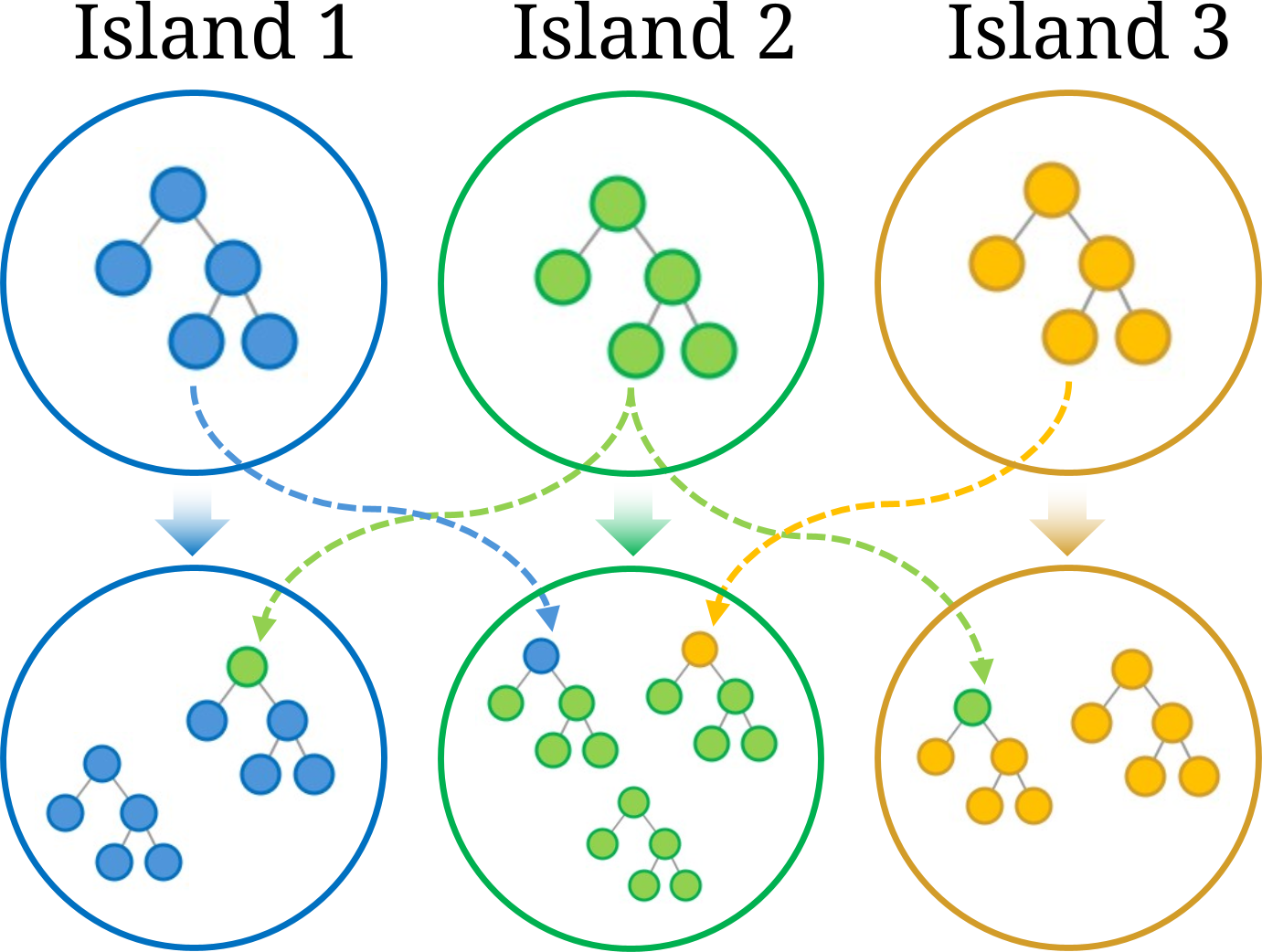

QuantEvolve utilizes an island model, initializing multiple populations (islands) with seed strategies from distinct categories. Each island evolves in isolation during early generations, developing specialized expertise. Periodic migration exchanges top-performing strategies across islands, facilitating the recombination of diverse trading concepts and promoting the emergence of hybrid strategies.

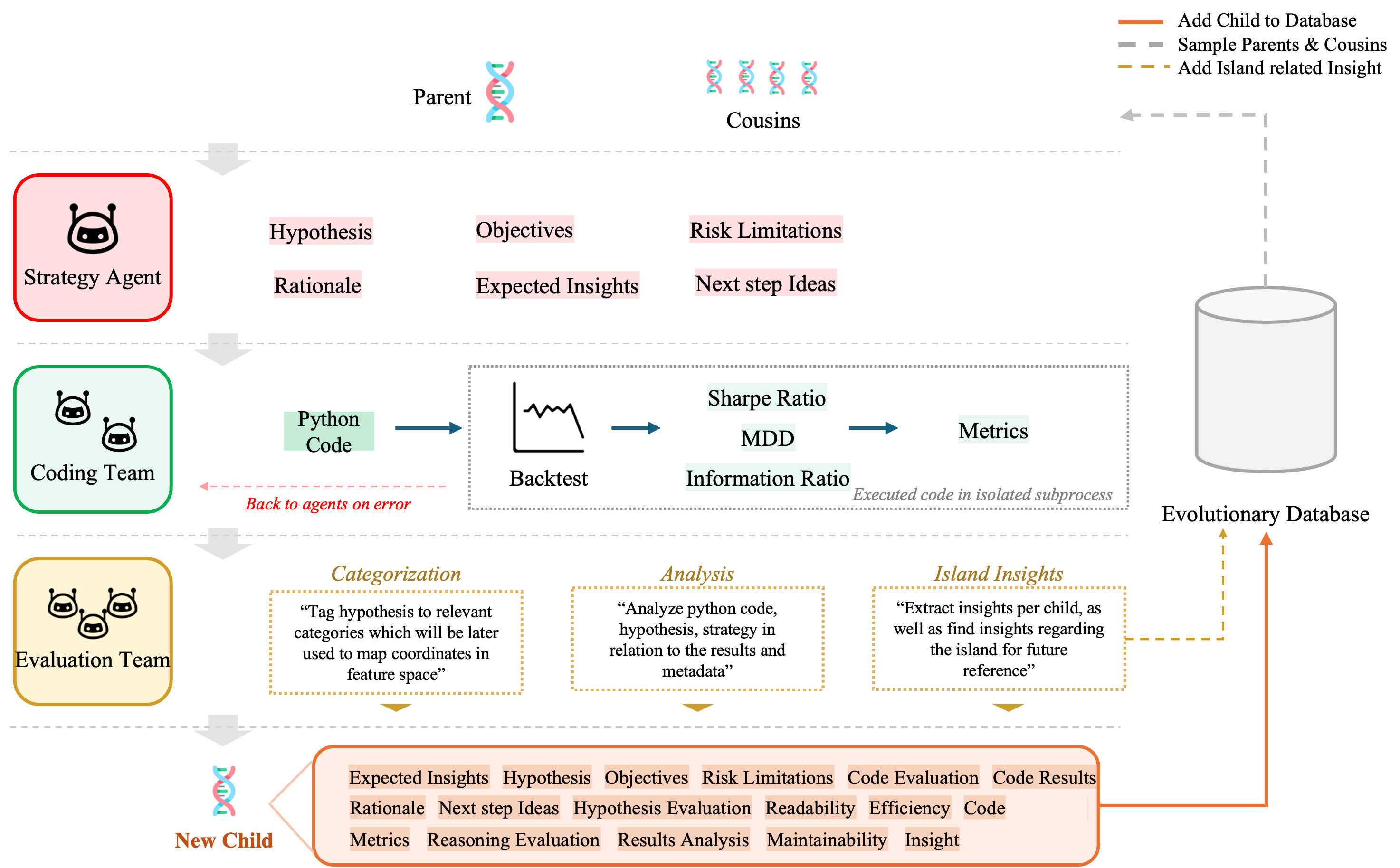

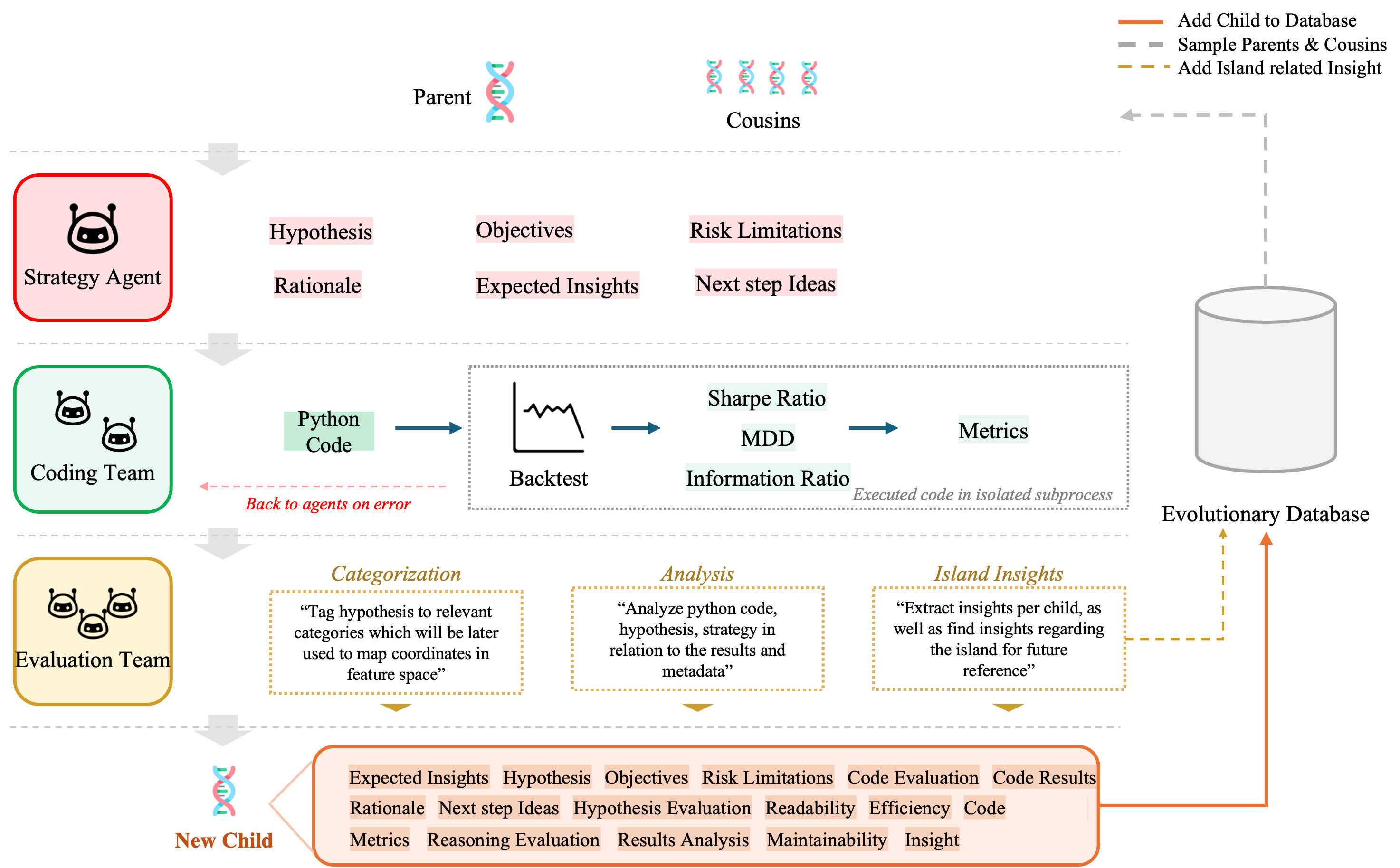

Figure 2: Multi-agent evolution architecture.

Figure 3: Exchange of superior strategies across islands.

Multi-Agent Hypothesis-Driven Evolution

The core evolutionary cycle is orchestrated by a multi-agent system comprising research, coding, and evaluation teams. The process is as follows:

- Parent and Cousin Sampling: A parent strategy is sampled from the feature map, and cousin strategies with similar characteristics are selected to provide context and promote diversity.

- Hypothesis Generation: The research agent formulates a new hypothesis for a trading strategy, grounded in financial theory and informed by the parent/cousin strategies and accumulated insights.

- Strategy Implementation: The coding team translates the hypothesis into executable code, performs backtesting, and iteratively refines the implementation.

- Evaluation and Analysis: The evaluation team assesses the hypothesis, code, and results, extracting actionable insights and updating the evolutionary database.

This hypothesis-driven approach provides directional guidance in the high-dimensional search space, enabling systematic improvement while preserving diversity.

Figure 4: Initialization of QuantEvolve.

Empirical Results

Evolution in Equity Markets

The evolutionary process in equity markets demonstrates the framework's capacity to populate the feature map with increasingly diverse and high-performing strategies. Early generations are dominated by simple, category-specific strategies, while later generations exhibit both improved performance and greater diversity across risk-return dimensions.

Figure 5: Evolution of the feature map across max drawdown and category dimensions, measured by Sharpe ratio.

Figure 6: Feature map visualizations across different dimension pairs, including the number of transactions and cumulative return, evaluated using the information ratio.

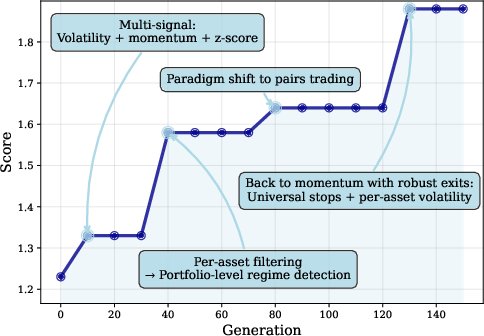

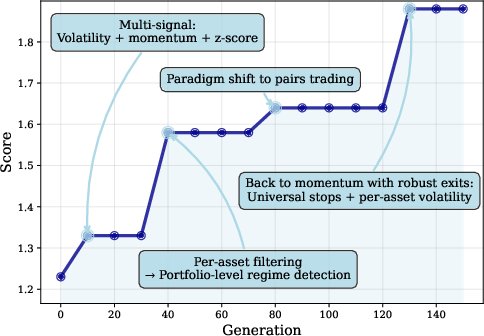

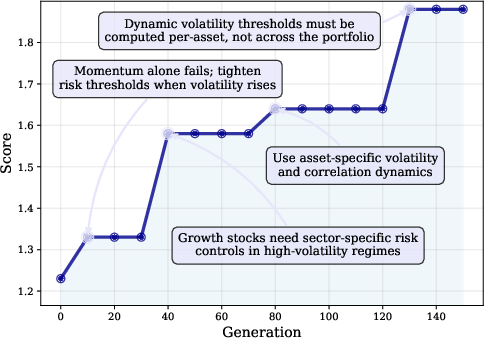

The evolutionary trajectory of individual strategies reveals a process of iterative hypothesis testing, selective retention of effective components, and avoidance of unnecessary complexity. For example, the optimal strategy in later generations integrates volume-momentum signals, volatility-scaled position sizing, and trailing stop-loss rules, reflecting a balance between sophistication and parsimony.

Figure 7: The evolutionary process leading to the optimal strategy in equity markets.

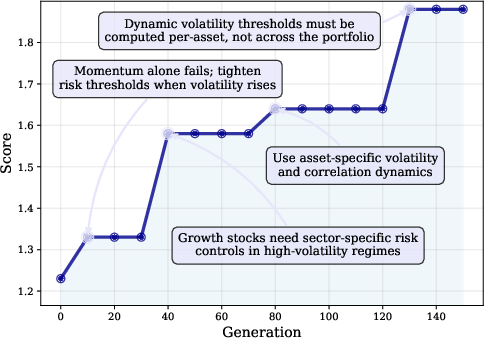

The accumulation and refinement of insights across generations is a critical aspect of the framework. Insights evolve from high-level observations (e.g., the failure of simple volatility indicators during crises) to detailed implementation specifications (e.g., dynamic, per-asset volatility thresholds), with failed approaches systematically documented to prevent repeated errors.

Figure 8: The evolutionary process of the insights in equity markets.

QuantEvolve outperforms standard baselines (market-cap, equal-weight, MACD, RSI, risk parity) in out-of-sample tests, achieving a Sharpe ratio of 1.52 and cumulative return of 256% by generation 150, compared to 1.22 and 130% for the best baseline.

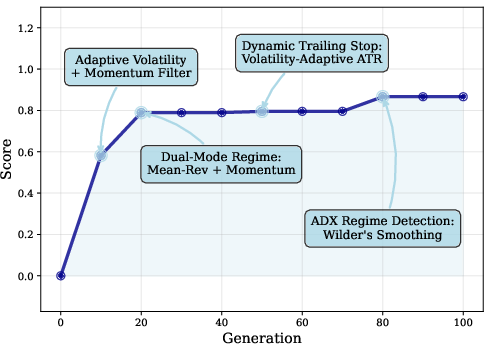

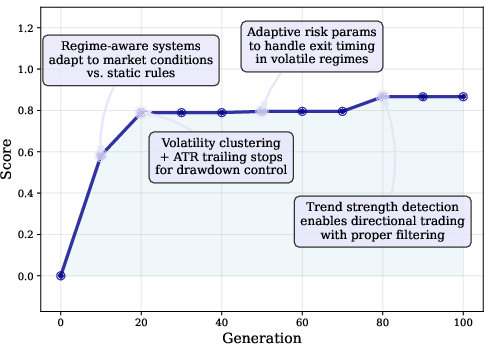

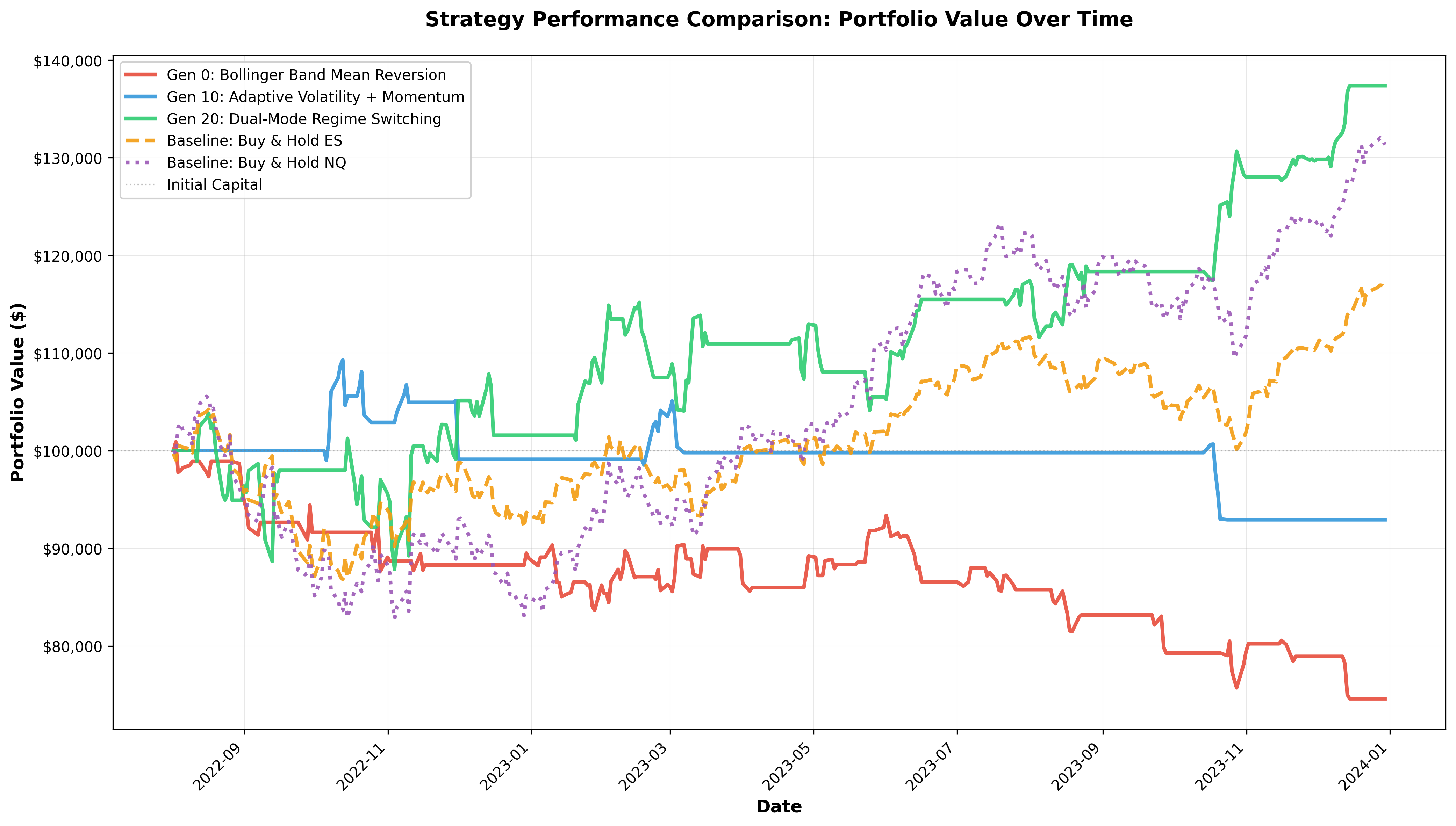

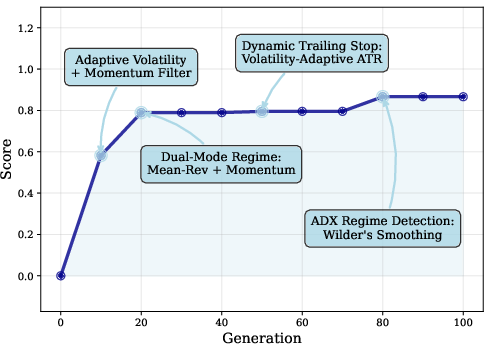

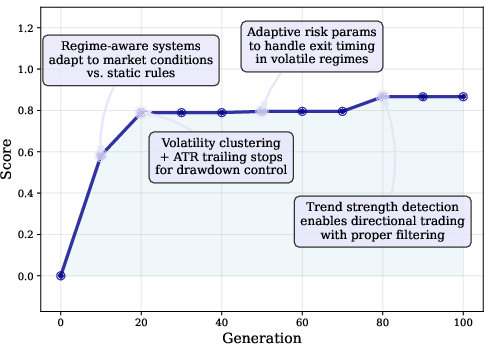

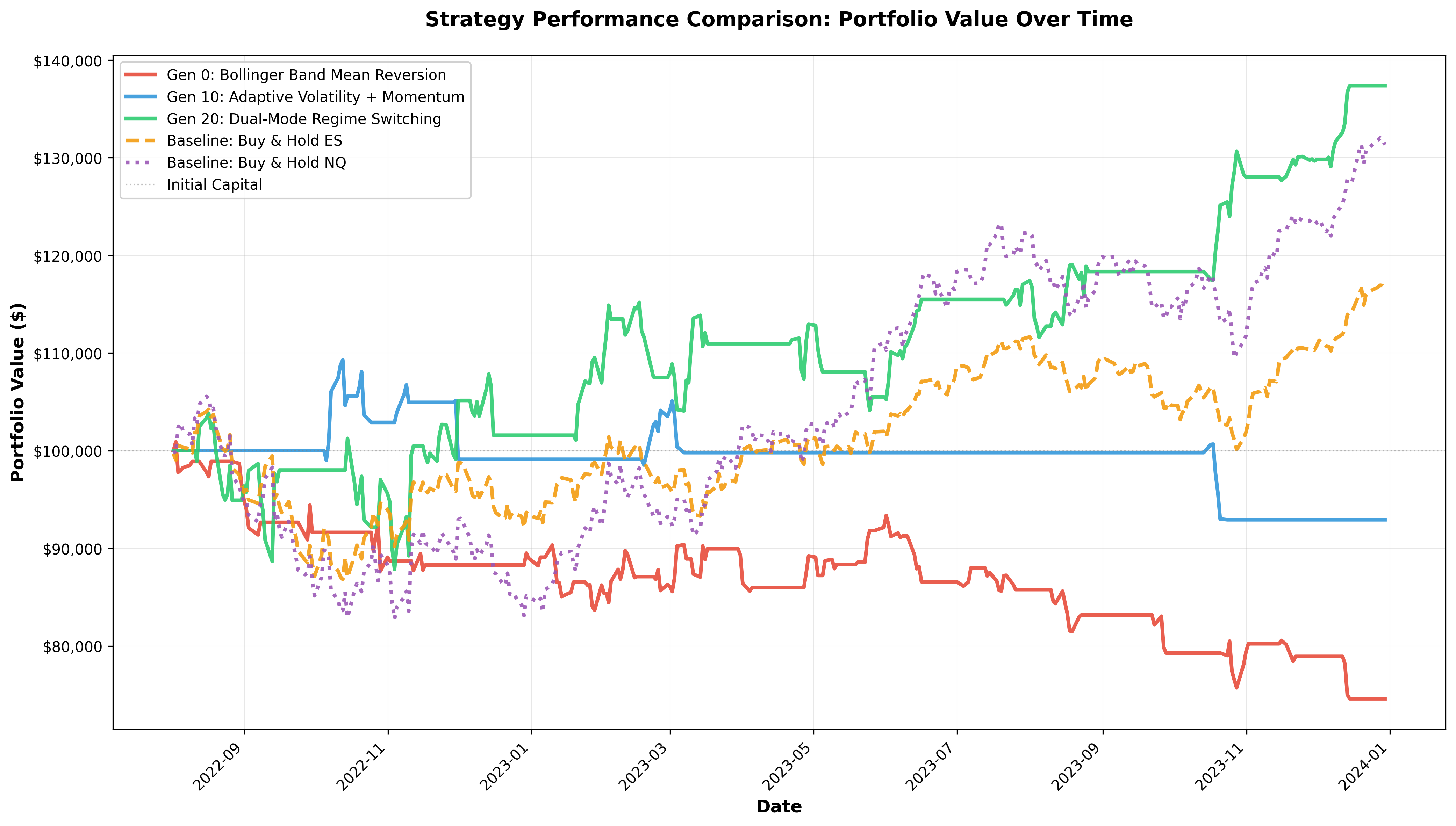

Evolution in Futures Markets

The framework generalizes effectively to futures markets, rapidly adapting from poor initial performance (SR = -1.21) to outperforming buy-and-hold baselines (SR = 1.03, CR = 37.4%) by generation 20. The evolved strategies employ regime-aware mechanisms, such as adaptive volatility scaling and dual-mode systems, and demonstrate robust generalization without manual recalibration.

Figure 9: Strategy evolution in futures markets from generation 0 to 100.

Figure 10: Insight evolution in futures markets.

Figure 11: Portfolio value evolution for futures strategies and baselines over the test period.

Ablation Studies

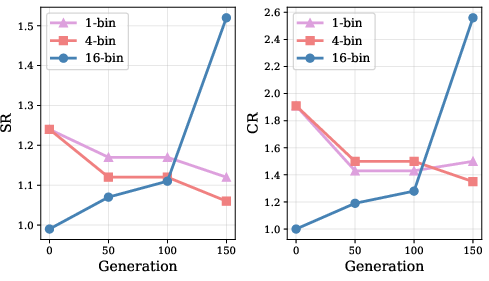

Feature Bin Resolution

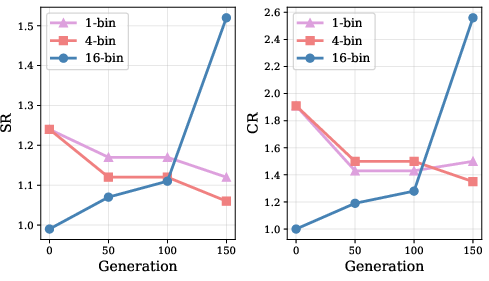

Ablation on feature bin size reveals that higher bin resolution (16-bin) enables sustained improvement and prevents premature convergence, while lower resolutions (1-bin, 4-bin) lead to early stagnation and reduced diversity. This underscores the importance of maintaining a sufficiently granular feature map to support exploration.

Figure 12: Impact of bin size on evolutionary performance. Higher bin resolution (16-bin) enables sustained improvement across generations, while lower resolutions (1-bin, 4-bin) lead to premature convergence.

Feature Dimensions

Including the strategy category as a feature dimension significantly enhances population diversity, reducing the dominance of any single category and promoting exploration of a broader range of strategic paradigms.

Figure 13: Distribution of strategy categories across strategies in the evolutionary database. Each pie slice represents the proportion of strategies in a given category, with the top 9 most frequent categories displayed individually and remaining categories aggregated. Percentages are shown for the top 3 categories only.

Implementation Considerations

- LLM Inference Cost: Each evolutionary cycle requires 5-10 LLM inferences, which may limit scalability in resource-constrained environments.

- Backtesting and Evaluation: The framework leverages Zipline for backtesting and QuantStats for risk/return analytics, ensuring realistic simulation of market mechanics.

- Robustness and Overfitting: While the evolutionary process maintains diversity and documents failed approaches, comprehensive robustness testing and external validation of hypotheses remain open challenges.

- Personalization and Extensibility: The feature map design supports extensibility to new asset classes and investor-specific requirements, enabling personalized strategy recommendation.

Theoretical and Practical Implications

QuantEvolve demonstrates that combining evolutionary computation with hypothesis-driven, multi-agent reasoning enables systematic exploration and refinement of trading strategies in high-dimensional, non-stationary environments. The preservation of diversity across multiple behavioral dimensions is critical for robustness and adaptability, particularly in the context of regime shifts and heterogeneous investor needs.

The framework's modular architecture and extensible feature map facilitate adaptation to new asset classes, market structures, and investor profiles. The systematic documentation and accumulation of insights across generations provide a foundation for continual improvement and knowledge transfer.

Future Directions

- Robustness and Validation: Integration of more rigorous validation methodologies, including cross-validation, walk-forward analysis, and external expert review of hypotheses.

- Scalability: Optimization of LLM inference and distributed computation to support larger asset universes and longer time horizons.

- Integration with Real-Time Systems: Bridging the research-to-deployment gap by incorporating execution constraints, transaction cost modeling, and real-time data feeds.

- Automated Causal Inference: Enhancing hypothesis generation with causal inference frameworks to distinguish spurious correlations from genuine market structure.

Conclusion

QuantEvolve presents a principled, extensible framework for automated quantitative strategy discovery, leveraging multi-agent evolutionary computation and hypothesis-driven reasoning to generate diverse, high-performing strategies. Empirical results across equities and futures demonstrate the framework's capacity for robust, adaptive, and personalized strategy generation. The approach provides a foundation for further research into fully automated, scalable, and theoretically-grounded quantitative research systems.