- The paper introduces a multi-scale MCP framework to assess systemic risk via transfer entropy and wavelet analysis.

- It integrates agent-based models simulating roles of HFTs, market makers, institutional investors, and regulators.

- The study constructs a systemic risk index combining volatility, liquidity, and contagion to guide macroprudential policies.

Multi-Scale Network Dynamics and Systemic Risk: A Model Context Protocol Approach to Financial Markets

Introduction to Framework

The paper "Multi-Scale Network Dynamics and Systemic Risk: A Model Context Protocol Approach to Financial Markets" introduces a framework innovatively designed to analyze systemic risk in financial markets using multi-scale network dynamics. The methodology combines transfer entropy networks, agent-based modeling, and wavelet decomposition integrated into the MCPFM (Model Context Protocol Financial Markets) R package.

Model Context Protocol Integration

Central to the framework is the Model Context Protocol (MCP), which facilitates communication among heterogeneous agents, including high-frequency traders (HFTs), market makers (MMs), institutional investors (IIs), and regulators (REGs). The MCP constructs a dynamic communication network that adapts to market conditions, thus enabling efficient propagation of information tailored to agent-based interactions.

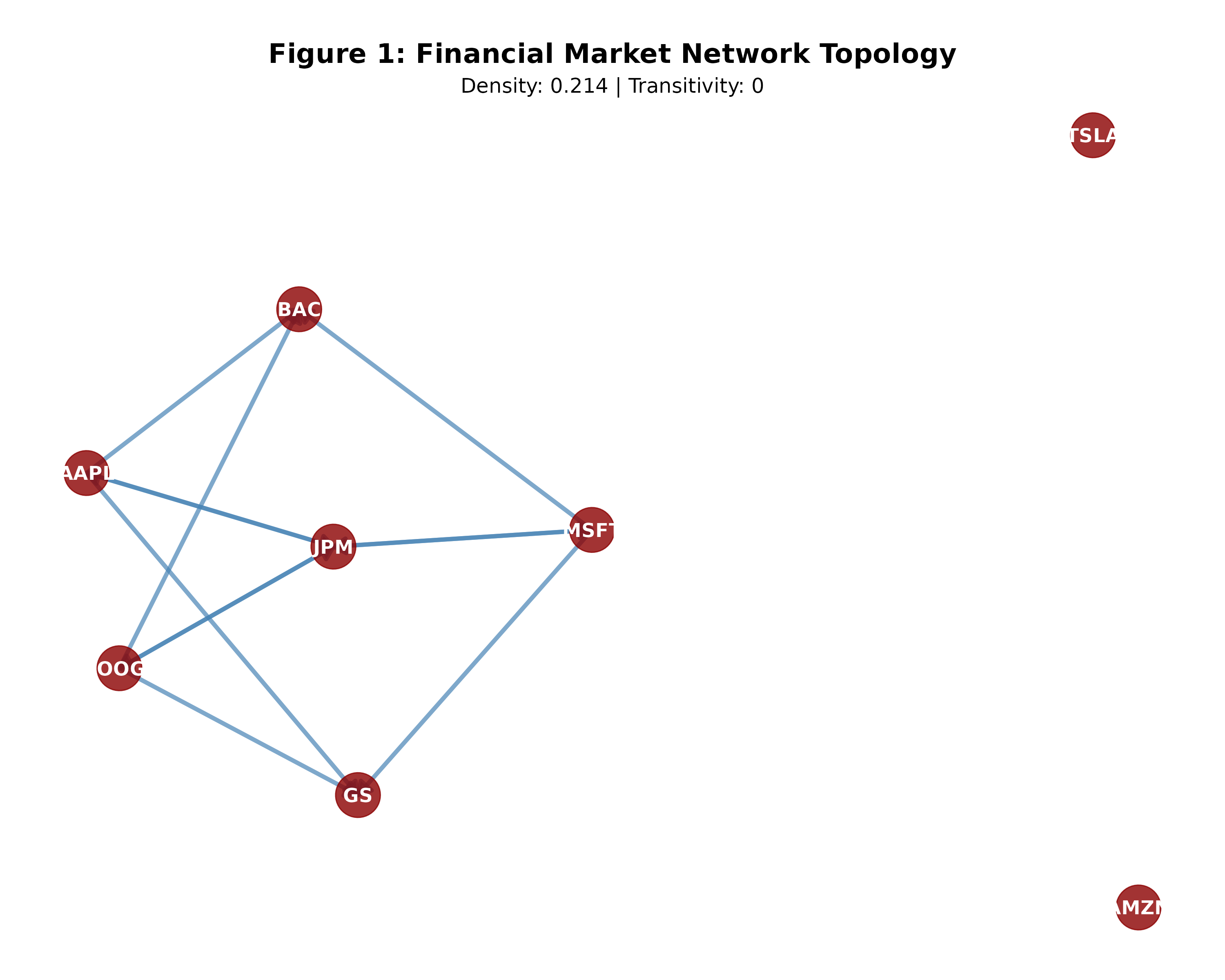

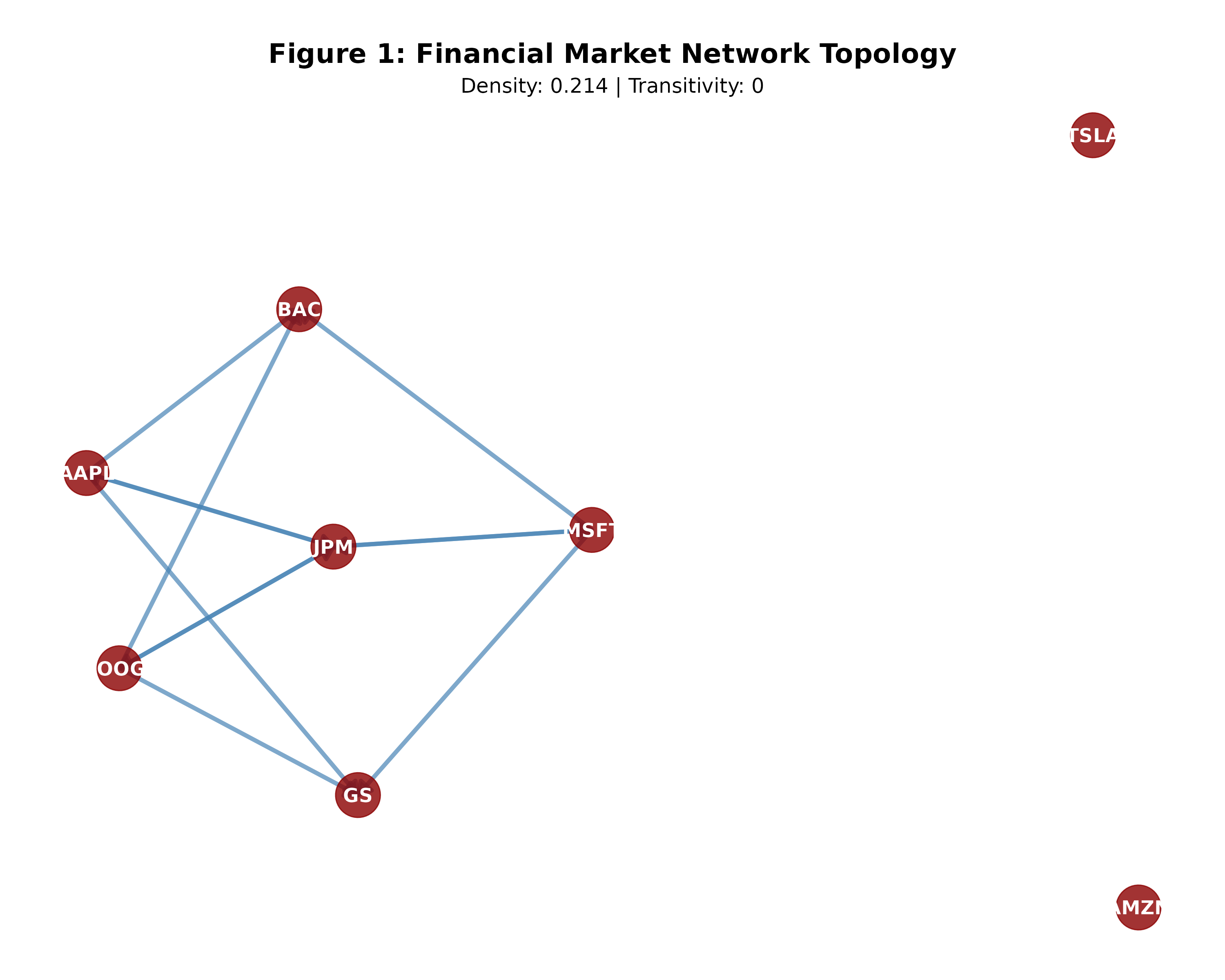

Figure 1: Financial Market Network Topology. The directed network shows information flow patterns derived from transfer entropy analysis. Node size reflects asset importance, while edge thickness indicates information flow strength.

Multi-Scale Network Dynamics

The paper's approach utilizes continuous wavelet transformation to decompose financial data into various temporal scales, capturing information flows across high-frequency trading, market-making, institutional, and regulatory decision horizons. Each scale-specific network allows detailed examination of information propagation through transfer entropy, a measure of directed information flow between assets.

Agent-Based Market Simulation

The model encompasses an agent-based simulation, wherein each agent type optimizes decision criteria specific to its role in financial markets. High-frequency traders focus on speed and profit, market makers ensure liquidity while managing risks, institutional investors optimize portfolios, and regulators target systemic stability.

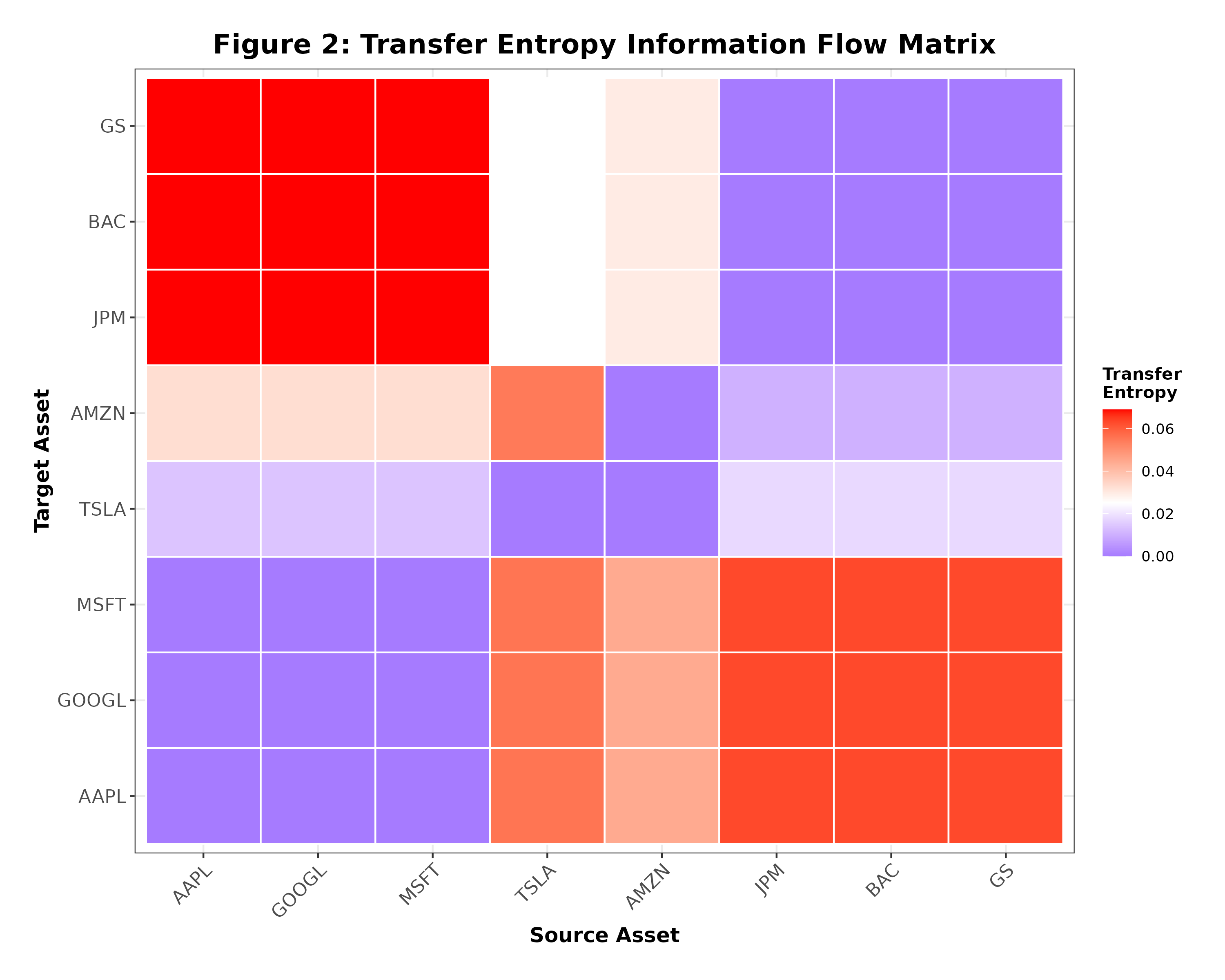

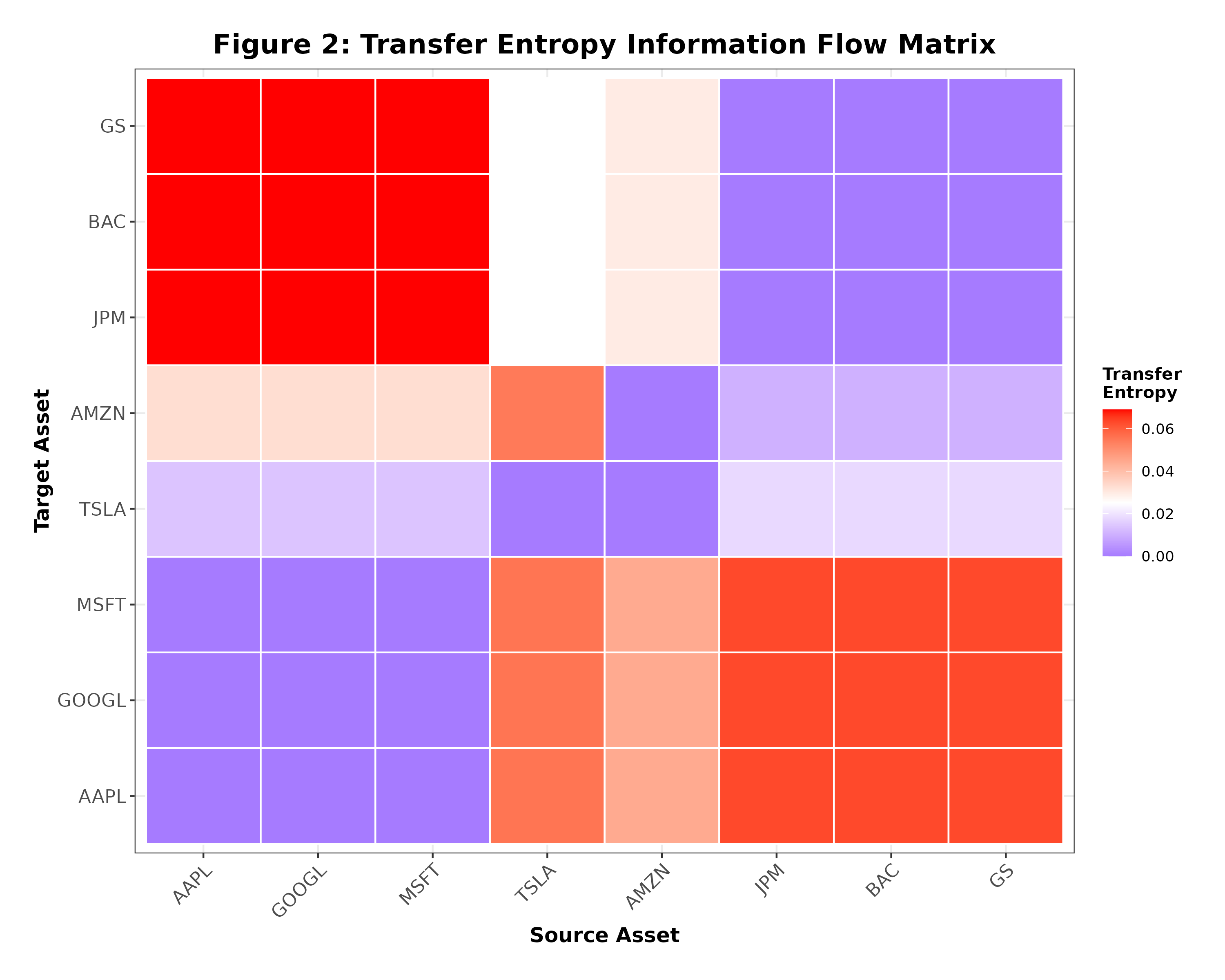

Figure 2: Transfer Entropy Information Flow Matrix. The heatmap displays directional information flows between asset pairs, with red indicating strong information transfer and blue indicating weak transfer.

Systemic Risk Index Construction

A systemic risk index (SRI) is formulated, integrating network topology, concentration, volatility, liquidity, and contagion effects into a unified risk measurement. The index provides superior early-warning capabilities compared to traditional methods through multi-component risk analysis and scale-specific network insights.

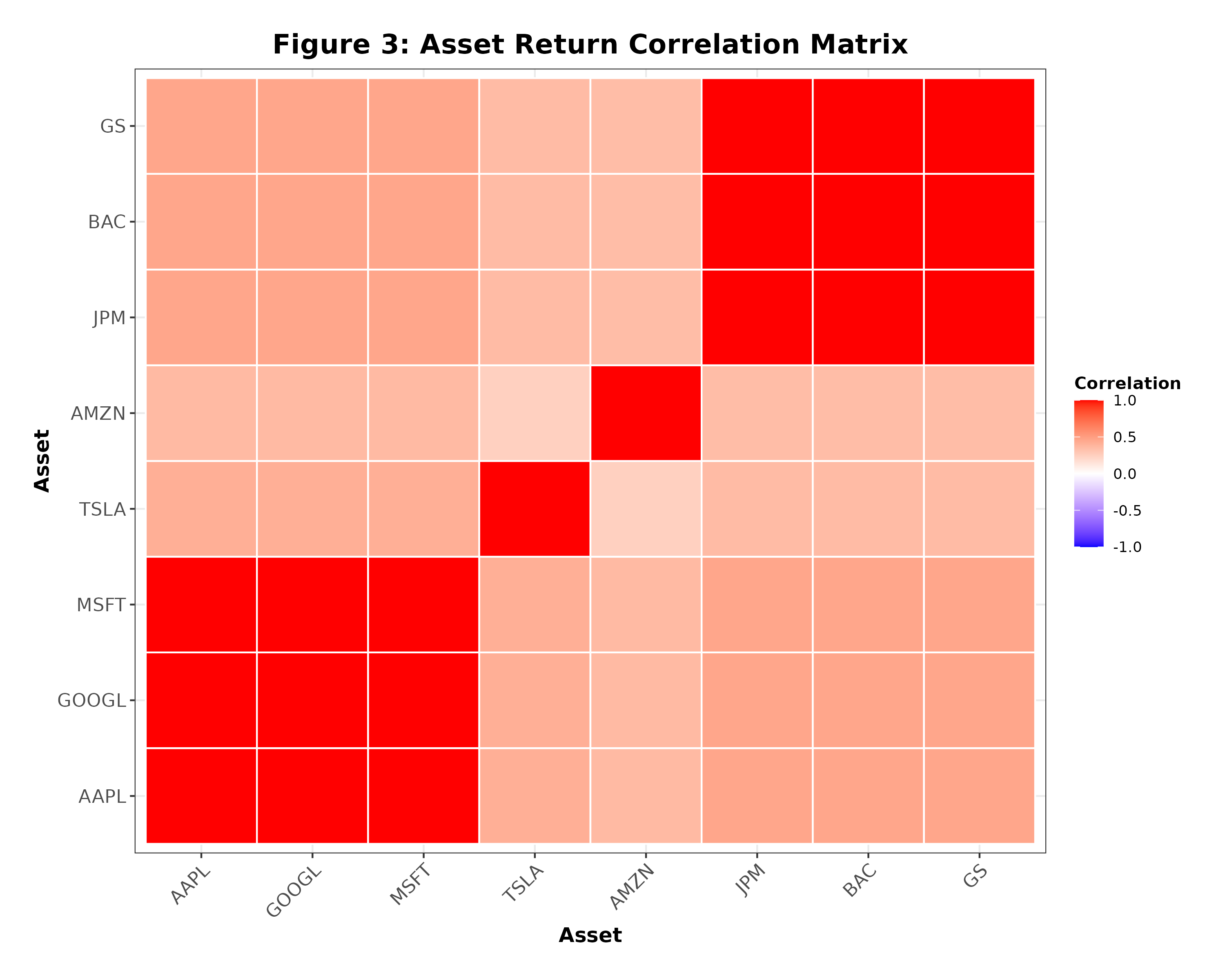

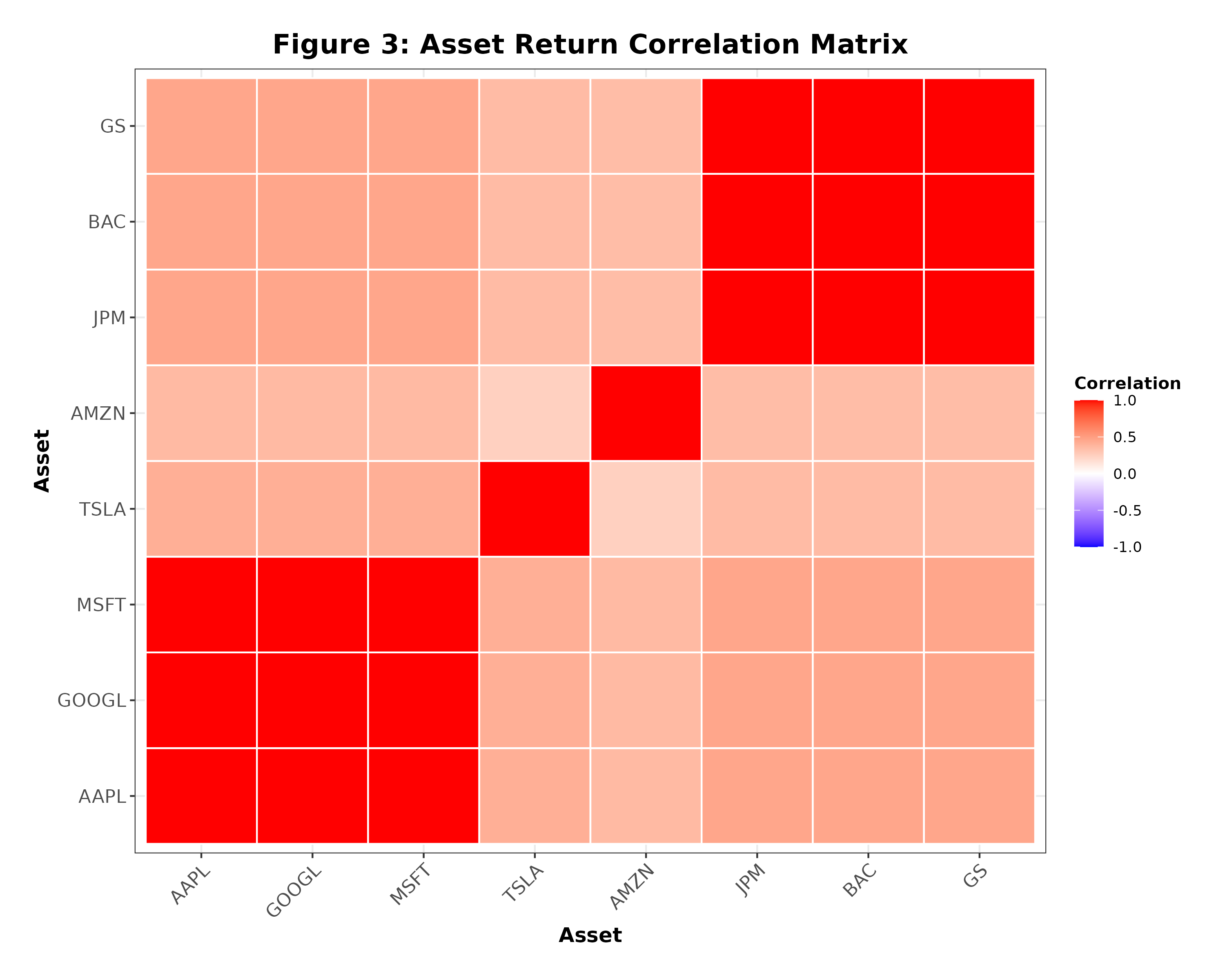

Figure 3: Asset Return Correlation Matrix. The correlation heatmap reveals sector-specific clustering with technology stocks showing higher intra-sector correlations and financial stocks exhibiting strong co-movement.

Empirical Analysis Results

Empirical validation demonstrates that the multi-scale network dynamics reveal systemic risk patterns not observable in single-scale assessments. By employing a realistic market dataset spanning major technology and financial stocks, the analysis highlights significant information flows and network structures that underpin systemic risk.

Policy Implications

The research offers critical implications for macroprudential policy, advocating targeted interventions based on risk component insights. By focusing on correlation risk and market structure concentration, regulatory strategies could be more effectively calibrated to enhance financial stability.

Conclusion

This framework marks a significant advancement in systemic risk analysis by accommodating the complexity of financial markets through multi-scale dynamics and structured agent communication. The theoretical and practical insights derived from this study offer a promising path for further exploration into adaptive market models, potentially influencing policy and risk management strategies across emerging financial sectors.

The MCPFM R package provides a robust platform for reproducible research, allowing extension of the methodology to diverse applications. Future research could explore machine learning integration, real-time surveillance implementations, and adaptions for decentralized finance domains, leveraging the modular architecture for innovative pursuits in financial market analysis.