- The paper introduces an adaptive segmentation approach that dynamically segments time series using significant relative maxima to capture true market cycles.

- The paper presents pattern-conditioned forecasting with specialized TFT models that adapt to specific market dynamics, yielding improved accuracy.

- The paper demonstrates that the adaptive TFT approach outperforms fixed-window models in accuracy, precision, recall, and simulated trading profitability.

Introduction

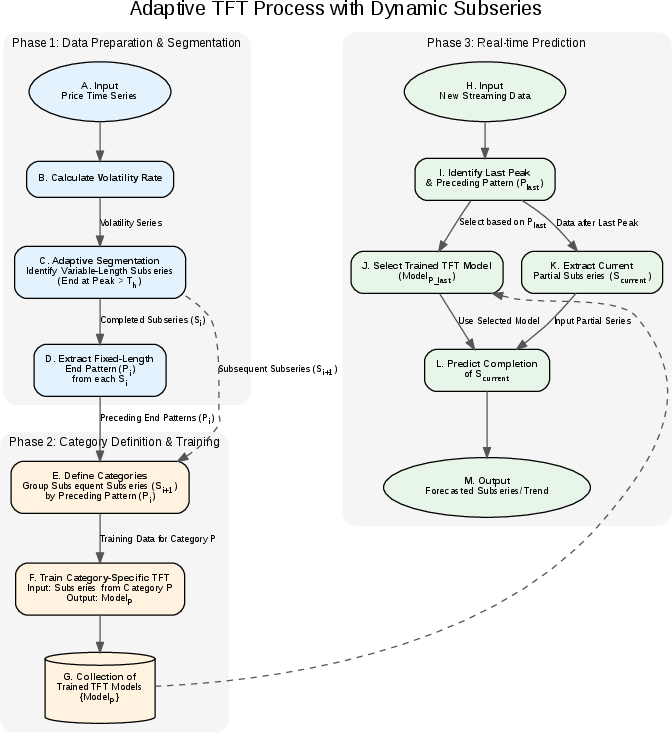

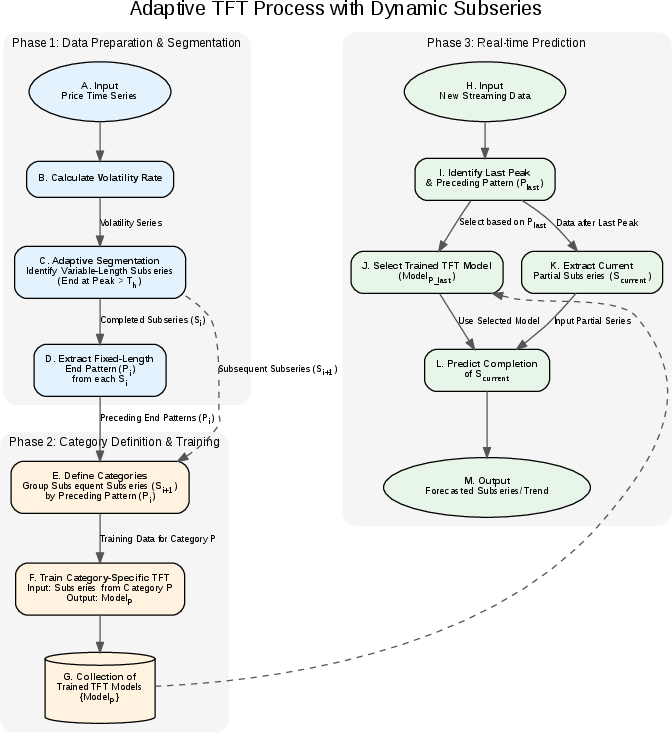

This paper introduces an innovative approach to address the challenge of predicting the volatile cryptocurrency market using Adaptive Temporal Fusion Transformers (TFTs). The methodology diverges from conventional fixed-window models by employing dynamic segmentation and pattern-based categorization to improve short-term forecasting accuracy. Two main innovations are presented: adaptive segmentation of time series into variable-length subseries based on relative maxima, and pattern-conditioned forecasting using specialized TFT models. Experimental results demonstrate that this methodology significantly enhances prediction accuracy and profitability in simulated trading over fixed-length methods.

Methodology

Adaptive Segmentation

The segmentation algorithm replaces rigid fixed-length windows with an adaptive method driven by market-induced turning points. The boundaries of each subseries are dynamically determined by significant relative maxima where the price rise surpasses a specified threshold from the previous minimum. This captures essential market cycles and effectively reduces noise interference, aligning segment boundaries with actual market phases.

Pattern-Conditioned Forecasting

For forecasting, each identified subseries is categorized based on the pattern observed at its preceding endpoint. Specifically, the end pattern of the subseries is extracted as a short binary sequence, reflecting directional volatility changes. Based on this categorization, distinct TFT models are trained, enabling the adaptation of the model to specific market conditions. Thus, a specialized model predicts future values within contextually relevant market dynamics.

Implementation Highlights

The primary model, based on the Temporal Fusion Transformer (TFT) architecture, processes three types of inputs: static covariates, time-varying known inputs, and observed inputs. Specialized techniques such as Variable Selection Networks (VSN) optimize feature relevance, while attention mechanisms offer insight into temporal dependencies. Modern practices like padding and masking accommodate variable-length data, harmonizing with the adaptive segments.

Figure 1: Overview of our proposed method.

Experimental Results

The Adaptive TFT approach was empirically validated using a dataset of ETH-USDT price movements aggregated in 10-minute intervals. Notably, the model outperformed baseline methods, including standard LSTM and TFT models, and a previously proposed fixed-length categorization approach.

- Accuracy: The adaptive method achieved an accuracy rate of 51.36%, demonstrating superior predictive power over the baselines.

- Precision and Recall: At a precision of 51.11% and a notably high recall of 92.31%, the model excels in identifying upward trends, essential for profitable trading strategies.

- Simulated Trading Profitability: The trading strategy based on the adaptive models yielded a final asset value of 117.22 USDT in simulations, surpassing fixed-length window models and passive strategies.

Discussion

The adaptive nature of the segmentation and TFT specialization ensures that the model is responsive to market conditions, enhancing the forecast precision of cryptocurrency prices. The adaptive segmentation method effectively aligns analysis windows with actual market phases, capturing intricate patterns and trends. The high recall rate aligns with profitable strategies in volatile markets, although its specificity can vary depending on overarching market trends.

Future Directions

Key areas for further exploration include optimizing segmentation thresholds, integrating external data sources such as sentiment analysis, and refining trading strategies for diverse market conditions. Addressing issues with data sparsity in rare pattern-categories presents additional opportunities for development.

Conclusion

The Adaptive TFT approach advances the state of cryptocurrency price prediction by integrating adaptive segmentation and pattern-conditioned forecasting. It presents a robust platform for capturing the dynamic nature of financial markets, marking significant progress towards improving practical forecasting accuracy and trading profitability in volatile conditions. Continued exploration in parameter optimization and model integration signifies potential for broader applications in financial analysis.