- The paper introduces GoldMine OS, an AI-driven multi-agent system that integrates compliance auditing, token issuance, market making, and risk control for decentralized trading.

- It employs a layered architecture with blockchain integration and on-chain safeguards, such as reserve ceiling checks and circuit-breakers, to ensure secure tokenization and liquidity.

- Experimental evaluations in simulation and pilot tests demonstrate low-latency performance, tight spreads in market making, and scalability up to thousands of transactions per second.

AI Agent Architecture for Decentralized Trading

This paper introduces GoldMine OS, a novel AI-driven multi-agent architecture designed for the decentralized trading of real-world assets (RWAs), specifically gold-backed tokens. The architecture aims to bridge the gap between traditional regulated exchanges and decentralized finance (DeFi) by integrating compliance, liquidity provision, and risk management through a system of specialized AI agents. The system's performance is evaluated through simulation and a controlled pilot deployment, demonstrating its potential to enhance the efficiency and security of asset tokenization.

System Architecture and Components

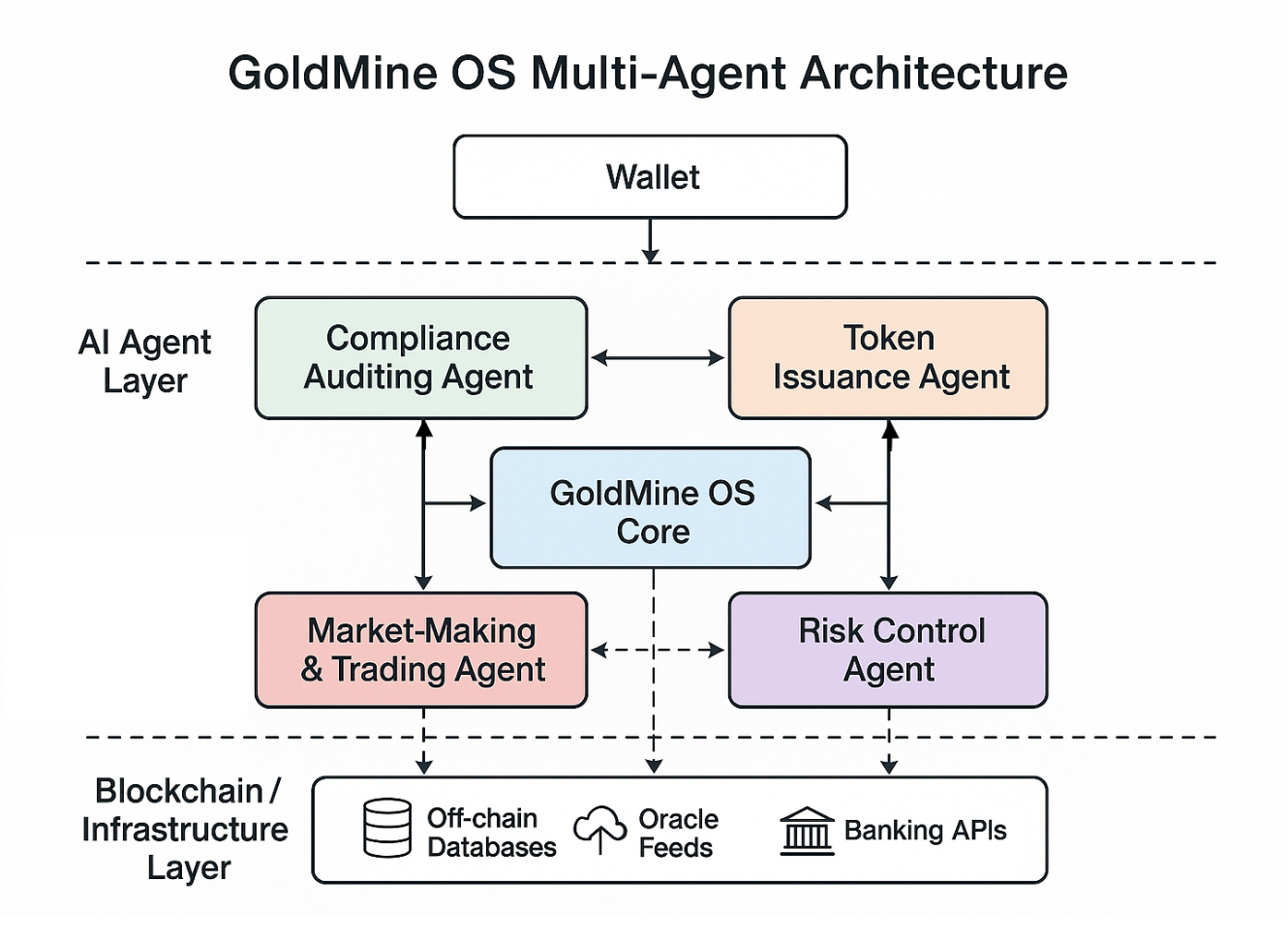

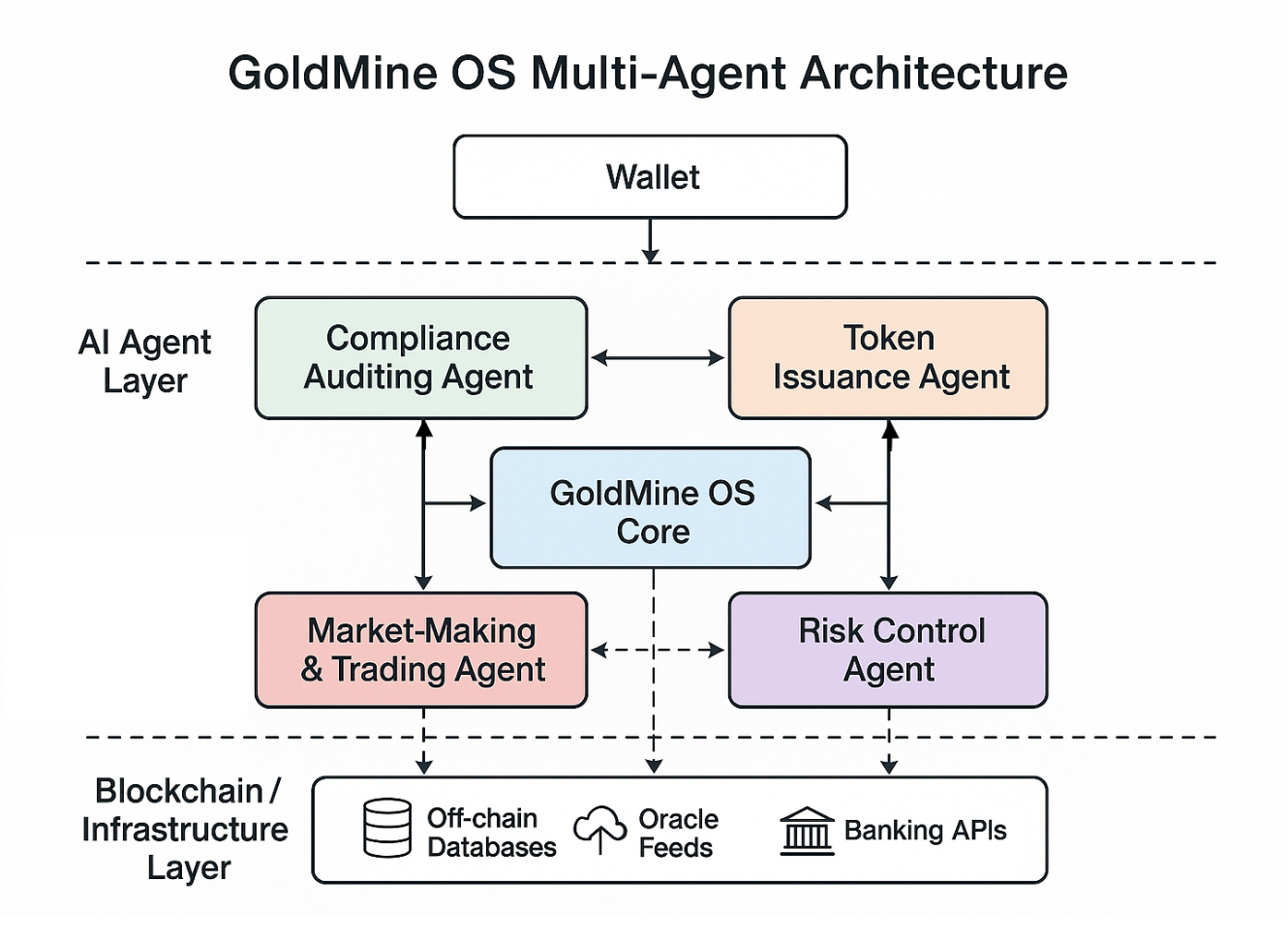

GoldMine OS employs a layered architecture comprising a user interface, an AI agent layer, and a blockchain infrastructure layer. The AI agent layer is the core of the system, featuring four specialized agents: Compliance Auditing Agent, Token Issuance Agent, Market-Making Agent, and Risk Control Agent. These agents operate under a central orchestrator, the GoldMine OS core, which coordinates their interactions and interfaces with the blockchain ledger.

Figure 1: GoldMine OS multi-agent architecture. The GoldMine OS core orchestrates four AI agents (Compliance, Issuance, Market-Making, Risk) and coordinates their interaction with user wallets and the blockchain ledger. Solid arrows indicate primary workflows (e.g., user requests flowing into the agent layer and transactions flowing to the blockchain), while dashed arrows indicate monitoring and control signals (e.g., risk alerts that can pause token issuance).

The Compliance Auditing Agent manages KYC/AML procedures, integrating with external identity verification APIs and internal policy databases (2507.11117). The Token Issuance Agent handles the minting and burning of OZ stablecoins, ensuring that each token is fully backed by physical gold, referencing vault records and audit data (2507.11117). The Market-Making Agent provides liquidity by algorithmically quoting buy/sell prices, adjusting prices based on real-time gold price feeds and inventory (2507.11117). The Risk Control Agent monitors system health, enforcing safety constraints and intervening if abnormal conditions are detected (2507.11117).

Risk Management and On-Chain Safeguards

The system incorporates on-chain risk safeguards implemented directly in the blockchain smart contracts, including a reserve ceiling check and a circuit-breaker mechanism (2507.11117). The reserve ceiling check ensures that the total token supply does not exceed the documented physical gold reserves (2507.11117). The circuit-breaker mechanism halts token transfers or new issuances in response to abnormal market conditions, such as extreme price volatility or oracle failures (2507.11117). These on-chain safeguards are designed to provide a tamper-proof enforcement of key invariants, even if off-chain components malfunction (2507.11117).

Governance and Model Updates

Updates to the AI agent algorithms are managed via a multi-signature scheme, requiring a quorum of authorized stakeholders to sign off on any code or model update before deployment (2507.11117). On-chain parameters that affect risk and monetary policy are managed through on-chain voting by token holders or delegates (2507.11117). This governance model combines off-chain oversight with on-chain decision-making, ensuring that the platform can evolve in a controlled, decentralized manner (2507.11117).

Experimental Evaluation

The GoldMine OS prototype was evaluated in a controlled laboratory testnet environment and a small-scale pilot deployment with real users (2507.11117). The experiments included functional tests, integration tests, stress tests, and fault-injection tests to verify the performance, scalability, and robustness of the system (2507.11117). The Compliance Auditing Agent significantly accelerated user onboarding, while the Token Issuance Agent demonstrated low-latency tokenization (2507.11117). The Market-Making Agent ensured liquidity for OZ tokens, maintaining tight spreads even during volatility spikes (2507.11117). The Risk Control Agent effectively detected and mitigated faults, such as oracle price feed failures and vault reserve misreports (2507.11117). Scalability tests showed that the system could achieve throughput up to thousands of transactions per second with manageable load on the agents (2507.11117).

Implications and Future Directions

The paper's findings indicate that an AI-agent-based approach to decentralized asset exchange offers advantages in speed, automation, and risk management (2507.11117). The integration of compliance, trading, and risk functions through AI agents improves efficiency and safety compared to traditional siloed approaches (2507.11117). Future work includes enhancing the AI sophistication of the agents, expanding to multi-asset tokenization, progressive decentralization of agent deployment, and improving governance assurance through formal verification (2507.11117).

Conclusion

The GoldMine OS architecture demonstrates a tangible step toward democratizing access to alternative assets by leveraging intelligent automation (2507.11117). The system's design, implementation, and evaluation provide a blueprint for similar efforts in tokenizing real assets, envisioning a future where commodities, real estate, and other traditionally illiquid assets can be traded with the same ease and security as cryptocurrencies (2507.11117). The use of AI agents in conjunction with blockchain protocols offers a promising path towards more efficient, transparent, and secure decentralized financial systems (2507.11117).