Riding Wavelets: A Method to Discover New Classes of Price Jumps (2404.16467v1)

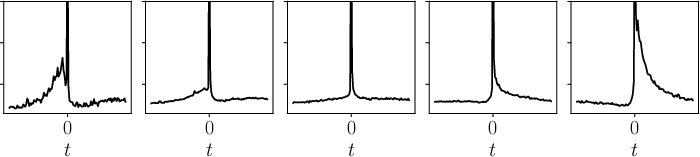

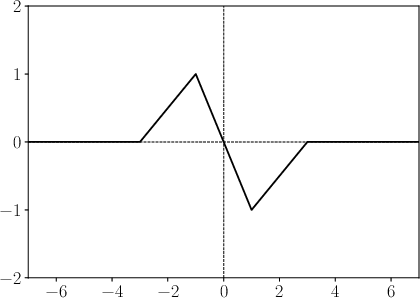

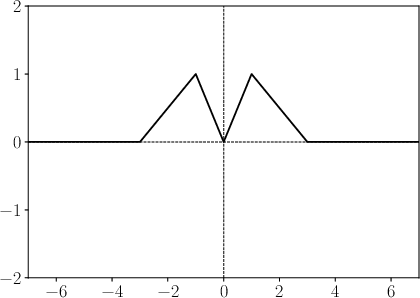

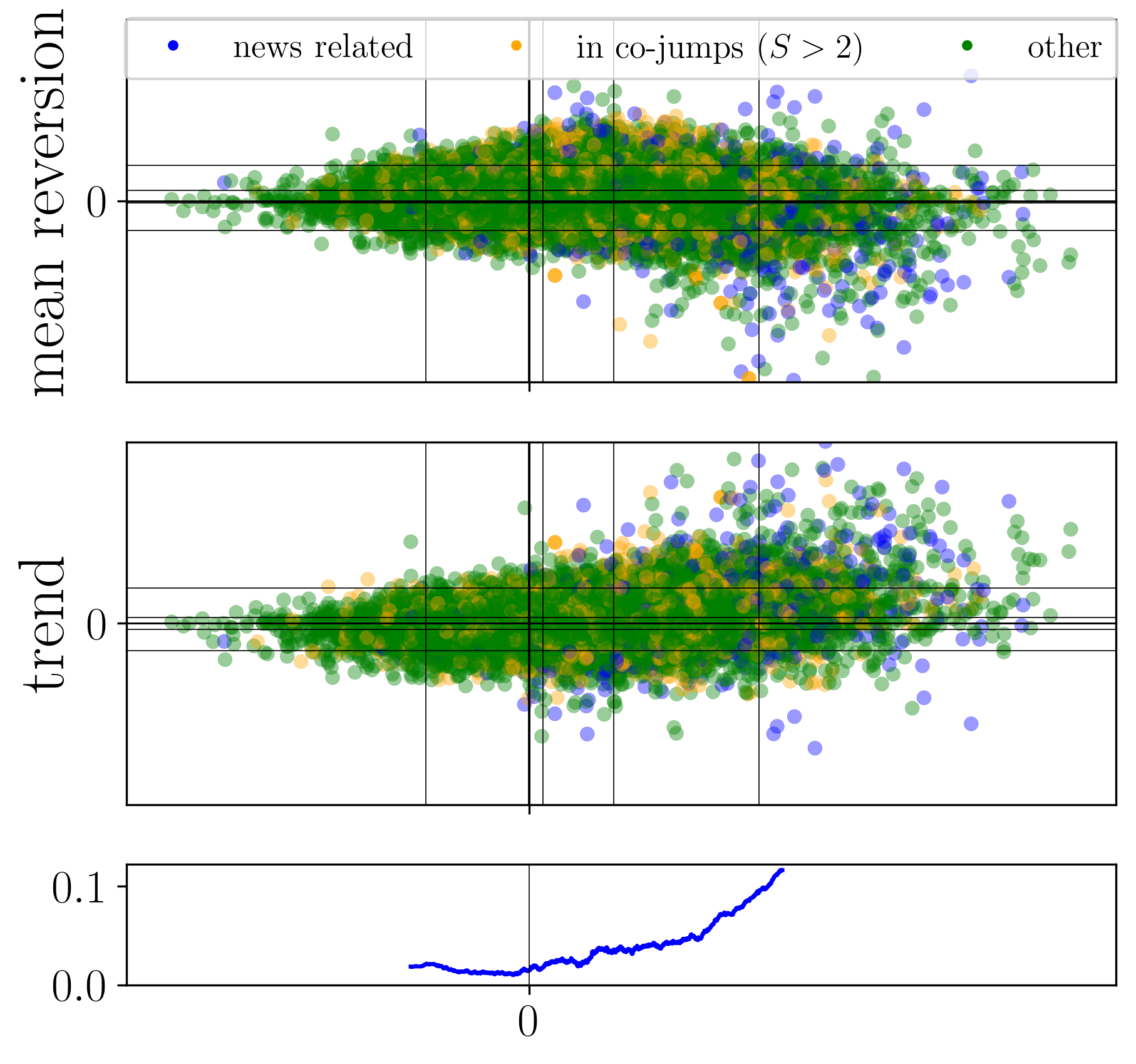

Abstract: Cascades of events and extreme occurrences have garnered significant attention across diverse domains such as financial markets, seismology, and social physics. Such events can stem either from the internal dynamics inherent to the system (endogenous), or from external shocks (exogenous). The possibility of separating these two classes of events has critical implications for professionals in those fields. We introduce an unsupervised framework leveraging a representation of jump time-series based on wavelet coefficients and apply it to stock price jumps. In line with previous work, we recover the fact that the time-asymmetry of volatility is a major feature. Mean-reversion and trend are found to be two additional key features, allowing us to identify new classes of jumps. Furthermore, thanks to our wavelet-based representation, we investigate the reflexive properties of co-jumps, which occur when multiple stocks experience price jumps within the same minute. We argue that a significant fraction of co-jumps results from an endogenous contagion mechanism.

- Sornette D. Endogenous versus exogenous origins of crises. Extreme events in nature and society. 2006:95-119.

- Epileptic seizures: quakes of the brain? Physical Review E. 2010;82(2):021919.

- Sornette D, Osorio I. Prediction. chapter in “Epilepsy: The Intersection of Neurosciences, Biology, Mathematics, Physics and Engineering”, Editors: Osorio I, Zaveri HP, Frei MG, Arthurs S, CRC Press, Taylor & Francis Group, pp 203-237. 2010.

- Filimonov V, Sornette D. Quantifying reflexivity in financial markets: Toward a prediction of flash crashes. Physical Review E. 2012;85(5):056108.

- Critical reflexivity in financial markets: a Hawkes process analysis. The European Physical Journal B. 2013;86:1-9.

- Hardiman SJ, Bouchaud JP. Branching-ratio approximation for the self-exciting Hawkes process. Physical Review E. 2014;90(6):062807.

- Aggregate fluctuations from independent sectoral shocks: self-organized criticality in a model of production and inventory dynamics. Ricerche economiche. 1993;47(1):3-30.

- Moran J, Bouchaud JP. May’s instability in large economies. Physical Review E. 2019;100(3):032307.

- Endogenous versus exogenous shocks in complex networks: An empirical test using book sale rankings. Physical Review Letters. 2004;93(22):228701.

- Deschatres F, Sornette D. Dynamics of book sales: Endogenous versus exogenous shocks in complex networks. Physical Review E. 2005;72(1):016112.

- Self-exciting point process modeling of crime. Journal of the American Statistical Association. 2011;106(493):100-8.

- Epidemiological modelling of the 2005 French riots: a spreading wave and the role of contagion. Scientific reports. 2018;8(1):1-20.

- Temporal criticality in socio-technical systems. arXiv preprint arXiv:230703546. 2023.

- Soros G. The Alchemy of Finance: Reading the Mind of the Market by George Soros (1994-05-06).

- Bäk P. How Nature Works: The Science of Self-Organized Criticality (Copernicus, New York). 1996.

- Bak P, Paczuski M. Complexity, contingency, and criticality. Proceedings of the National Academy of Sciences. 1995;92(15):6689-96.

- Sornette D, Helmstetter A. Endogenous versus exogenous shocks in systems with memory. Physica A: Statistical Mechanics and its Applications. 2003;318(3-4):577-91.

- Crane R, Sornette D. Robust dynamic classes revealed by measuring the response function of a social system. Proceedings of the National Academy of Sciences. 2008;105(41):15649-53.

- Stock price jumps: news and volume play a minor role. Wilmott Magazine. 2008;46.

- Exogenous and endogenous price jumps belong to different dynamical classes. Journal of Statistical Mechanics: Theory and Experiment. 2022;2022(2):023403.

- Classification of endogenous and exogenous bursts in collective emotions based on Weibo comments during COVID-19. Scientific Reports. 2022;12(1):3120.

- Modelling systemic price cojumps with Hawkes factor models. Quantitative Finance. 2015;15(7):1137-56.

- Collective synchronization and high frequency systemic instabilities in financial markets. Quantitative Finance. 2018;18(2):237-47.

- Multivariate quadratic Hawkes processes—part I: theoretical analysis. Quantitative Finance. 2023;23(5):741-58.

- Bruna J, Mallat S. Invariant scattering convolution networks. IEEE transactions on pattern analysis and machine intelligence. 2013;35(8):1872-86.

- Robust estimation of intraweek periodicity in volatility and jump detection. Journal of Empirical Finance. 2011;18(2):353-67.

- Probert S, Song Y. Detection and classification of high frequency transients using wavelet analysis. In: IEEE Power Engineering Society Summer Meeting,. vol. 2. IEEE; 2002. p. 801-6.

- Wavelet-based event detection method using PMU data. IEEE Transactions on Smart grid. 2015;8(3):1154-62.

- Transient event classification based on wavelet neuronal network and matched filters. In: IECON 2018-44th Annual Conference of the IEEE Industrial Electronics Society. IEEE; 2018. p. 832-7.

- Wavelet-based classification of transient signals for gravitational wave detectors. In: 2018 26th European Signal Processing Conference (EUSIPCO). IEEE; 2018. p. 2648-52.

- Kernel principal component analysis. In: International conference on artificial neural networks. Springer; 1997. p. 583-8.

- Flora M, Renò R. V-shapes. Available at SSRN 4260832. 2022.

- Scale Dependencies and Self-Similarity Through Wavelet Scattering Covariance. arXiv preprint arXiv:220410177. 2022.

- Path Shadowing Monte-Carlo. arXiv preprint arXiv:230801486. 2023.

- Gerig A. High-frequency trading synchronizes prices in financial markets. arXiv preprint arXiv:12111919. 2012.

- Harris TE, et al. The theory of branching processes. vol. 6. Springer Berlin; 1963.

- Bouchaud JP. The endogenous dynamics of markets: Price impact, feedback loops and instabilities. Lessons from the credit crisis. 2011:345-74.

- Endogenous liquidity crises. Journal of Statistical Mechanics: Theory and Experiment. 2020;2020(6):063401.

Paper Prompts

Sign up for free to create and run prompts on this paper using GPT-5.

Top Community Prompts

Collections

Sign up for free to add this paper to one or more collections.