Speculative Verdict: Uncertainty in Decision-Making

- Speculative verdict is a decision-making framework that quantifies uncertainty using Bayesian and probabilistic inference methods.

- It unifies approaches in legal, financial, and computational fields by converting evidentiary signals into measurable posterior probabilities.

- SV applications range from stochastic volatility models in finance to consensus-based reasoning in AI, highlighting both practical benefits and operational challenges.

A speculative verdict (SV) is a form of inferential or provisional decision that arises in reasoning systems or procedures—legal, computational, financial, or epistemic—when available information supports a quantifiable, evidence-based conclusion under uncertainty, rather than a categorical determination via traditional doctrine or deterministic computation. As a methodological principle, the SV concept recurs across a variety of disciplines as both a mode of probabilistic inference (in law, logic, and finance) and a computational paradigm (in algorithmic, security, and multimodal AI contexts), unifying disparate approaches that prioritize explicit, structured quantification of uncertainty and provisional commitment to a conclusion pending additional evidence.

1. Mathematical and Logical Foundations of Speculative Verdicts

The SV framework is fundamentally grounded in Bayesian and probabilistic inference. In legal adjudication, SVs emerge when fact-finders convert evidentiary signals into explicit posterior probabilities regarding liability or guilt rather than relying upon categorical or purely qualitative standards. The canonical Bayesian model (Guerra-Pujol, 2015) formulates this as:

where is the prior (risk threshold of the prosecuting party), is the process sensitivity, and accounts for both true positives and false positives. This enables assignments such as , quantifying the confidence in the verdict and allowing a formally “speculative” conclusion under epistemic uncertainty.

Within epistemology, SVs connect closely with logical uncertainty and the assignment of probabilities to statements whose truth or falsity is not immediately decidable. In (Sudhir et al., 2024), the speculative verdict is formalized via game-theoretic semantics—specifically in the form of a verification-falsification (VF) game on FOL sentences—by associating bets with options on eventual resolution:

$\play{P}{N} = \begin{cases} \bigvee_{n \in N} P(n) & \text{for } P \in \Sigma \ \bigwedge_{n \in N} P(n) & \text{for } P \in \Pi \end{cases}$

The equilibrium price of such an option reflects a market's collective speculative verdict on the statement, allowing probabilistic beliefs to be expressed even for events neither currently verifiable nor falsifiable.

2. Legal and Judicial Contexts: Evidence, Narrative, and Uncertainty

In law, SVs stand in contrast to binary verdicts enforced by rigid doctrines such as "beyond a reasonable doubt." Bayesian legal models (Guerra-Pujol, 2015) and narrative-based probabilistic frameworks (Urbaniak, 2017) argue that judgments should be based on explicit probability thresholds, incorporating both prior beliefs and the evidentiary signals' reliability. The latter approach augments bare-bones thresholding with requirements that the prevailing narrative not only achieves a high probability of guilt but also:

- Explains all relevant evidence (strong plausibility),

- Lacks significant gaps (completeness),

- Remains resilient to potential new information (robustness).

Formally, the acceptance of a speculative verdict involves satisfaction of layered threshold conditions such as:

and

This approach allows the issuance of a verdict even in the presence of unresolved narrative gaps or ambiguous evidence, provided the narrative remains dominant and resilient.

A recurring implication is the increased transparency and accountability of the legal process, as speculative verdicts articulate not only the final judgment but also the degree of evidentiary and epistemic support, quantifiable as posterior belief or confidence level.

3. Applications to Prediction, Finance, and Risk

In finance and risk management, SV designates a class of stochastic volatility (SV) models, marked by their explicit modeling of latent uncertainty and their support for risk quantification and option pricing under conditions of volatility and incomplete information (Xiao, 2022, Frutos et al., 2018). Augmented (Editor’s term) SV models incorporate:

- Fat-tailed innovations (e.g., Student's t-distributed errors),

- Leverage effects (correlated innovations between returns and volatility),

- Integration with Extreme Value Theory (EVT) for accurate estimation of tail risk and value-at-risk (VaR).

The model is formulated, e.g., as

with and with nonzero correlation.

SV models equipped with EVT (SV-EVT) deliver dynamically adaptive estimates of extreme risk, supporting speculative verdicts in financial decision-making in terms of predictive VaR. Empirical analysis demonstrates SV-EVT's superiority in out-of-sample risk estimation and backtesting over traditional models, especially under market stress scenarios.

In option pricing, SV models extended to account for stochastic interest rates (Frutos et al., 2018) use additional stochastic differentials for the risk-free bond, yielding closed-form solutions for option prices that incorporate additional sources of speculation—namely, uncertainty in future interest rates.

4. Computational, Security, and Multimodal Reasoning Paradigms

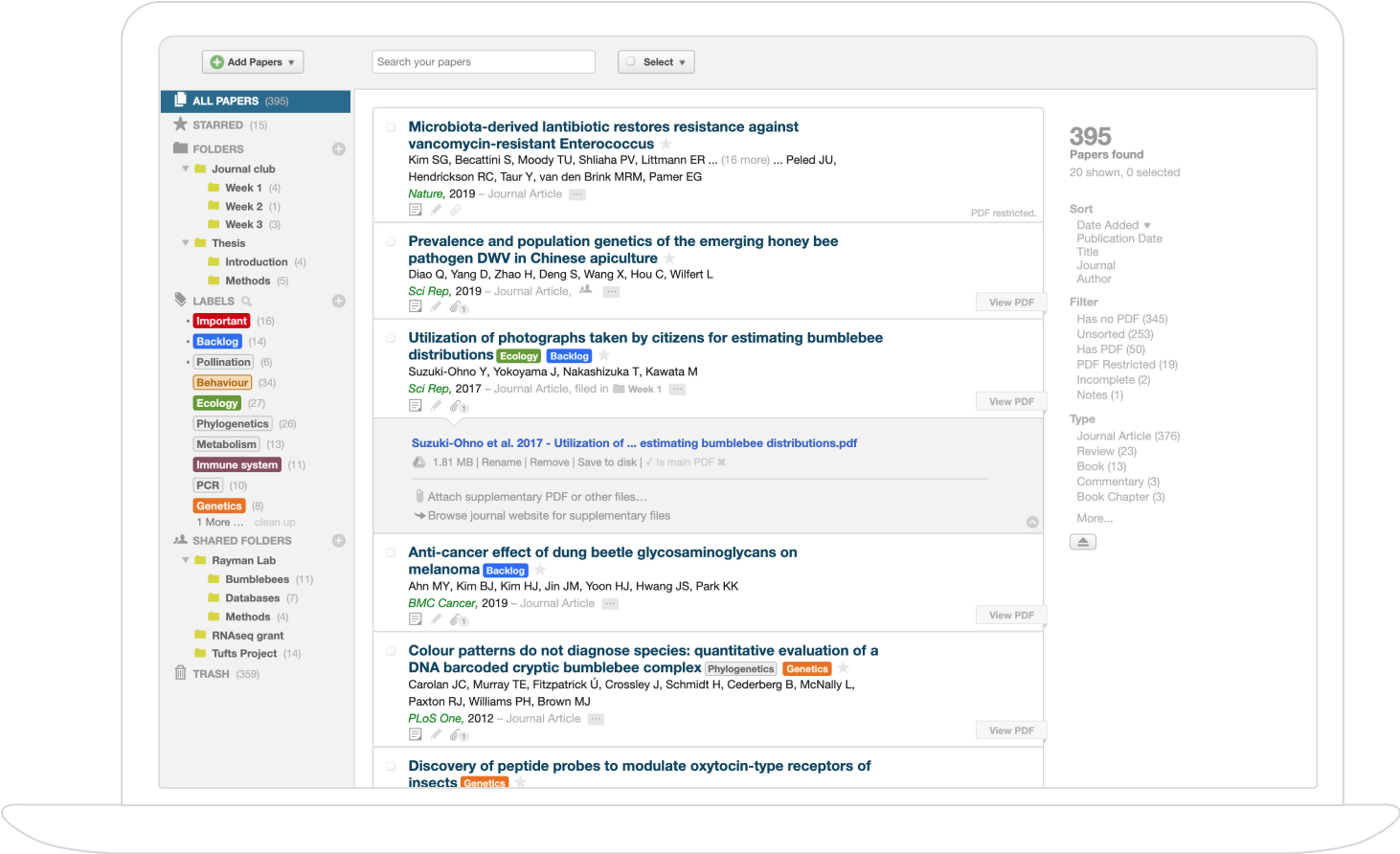

In computer systems and AI, "speculative verdict" has been appropriated to designate frameworks or algorithms that separate fast, uncertain "draft" inferences from slow, robust conclusion stages. In vision-LLMs (Liu et al., 23 Oct 2025), the SV framework involves:

- A pool of lightweight model “draft experts” that rapidly propose diverse reasoning paths for information-intensive, densely annotated images,

- A powerful verdict model that synthesizes, cross-checks, and consolidates these speculative paths into a final answer.

Key algorithmic components include the consensus expert selection mechanism:

This framework achieves both increased reasoning accuracy and efficiency, capitalizing on diverse, partially correct drafts and robust final synthesis.

Security research leverages SV to refer to the (composed) outcome of combining different (speculative) microarchitectural behaviors, such as speculation through branches, stores, or returns (Fabian et al., 2022). The "speculative verdict" in this sense formalizes security guarantees or the detection of sophisticated vulnerabilities resulting from the interaction of multiple speculative mechanisms, with soundness theorems ensuring that verdicts about information leakage from composed speculations inherit the soundness of their parts.

5. Philosophical and Constructivist Perspectives

From a foundational perspective, the speculative verdict concept is intertwined with issues of logical uncertainty, constructivism, and market epistemology (Sudhir et al., 2024). The SV occurs when a claim's truth value is not fixed by observational or deductive closure, but a system (e.g., a betting market) assigns prices to claims based on the option to resolve them through a structured, interactive process (the VF game).

Constructively, an SV reflects not just the weight of current evidence but the availability of an effective strategy to build or refute the claim under adversarial play, aligning the equilibrium price with the notion of constructive truth:

$\longrun(P) = \lim_{t \to \infty} \price_{pp}(t, P)$

This approach allows agents to rationally assign value to claims far beyond empirical or provable propositions, linking speculative reasoning to computable verification and the interactive construction of truth.

6. Challenges, Impact, and Implications

SV methodologies introduce several challenges:

- Threshold Selection: In judgment under uncertainty, the selection and justification of probability or plausibility thresholds is a central difficulty (Urbaniak, 2017).

- Narrative Completeness: In legal and epistemic contexts, operationalizing and formally expressing the fullness, resilience, and lack of gaps in candidate narratives is non-trivial and context-sensitive (Urbaniak, 2017).

- Computational Complexity: Multistage speculative frameworks entail the coordination of diverse lightweight and heavyweight models, requiring system-level optimization (Liu et al., 23 Oct 2025).

- Security Soundness and Compositionality: In microarchitectural verification, ensuring the correctness and preservation of security properties under speculative composition is intricate but critical (Fabian et al., 2022).

Despite these challenges, SV approaches offer several impactful benefits:

- Greater transparency and quantification in decision processes where uncertainty is fundamental.

- Alignment of formal models with observed or constructed realities (modifying legal, financial, logical, and computational practice).

- New paradigms for machine reasoning, security, and multimodal inference that scale with complexity and inherent uncertainty.

SV systems highlight the shift away from dichotomous, doctrine-bound determination toward structured, auditable reasoning under uncertainty—a pattern observable in advanced law, logic, AI, and risk domains.