Distributionally Robust Quick Response Model

- The model leverages distributionally robust optimization techniques using moment-based and Wasserstein-based ambiguity sets to handle demand mis-specification in quick response systems.

- It employs a two-stage decision framework with initial production and fast-response adjustments while incorporating waste-to-consumption constraints for sustainability.

- Empirical analyses reveal that the approach consistently outperforms traditional quick response benchmarks by enhancing profit and reducing waste.

A distributionally robust quick response model is a data-driven optimization framework that addresses production and procurement decisions under ambiguous and uncertain demand, particularly in quick response (QR) systems widely used in retail and fashion supply chains. By leveraging distributionally robust optimization (DRO) techniques, the framework aims to systematically mitigate the risks arising from limited historical demand data and unknown or shifting demand patterns, while also enabling the incorporation of explicit operational and social responsibility constraints such as waste-to-consumption (WTC) ratios.

1. Mathematical Formulation and Model Structure

The core model extends a standard two-stage planning process for a quick response system. The decision-maker first procures raw materials—specifically, the fabric quantity —and commits to an initial production batch before observing the random market demand . After demand is realized, the system allows a “quick response” by producing additional units at a premium marginal cost, constrained by available fabric (). The total profit is

where is the discounted demand, is raw material (fabric) cost, is standard manufacturing cost, and is the quick response cost premium.

The second-stage “quick-response” lot is determined by

A key structural property is that is concave and piecewise affine in . This enables tractable reformulation for distributional robustness.

The optimization problem is then:

Where is the feasible set ( for lower and upper bounds of demand), and is the ambiguity set reflecting distributional uncertainty in .

Two forms of ambiguity sets are considered:

- Moment-based:

- Wasserstein-based: , with an empirical distribution from data, and the 2-Wasserstein distance.

With moment-based ambiguity, the min-max problem can be solved using a finite “moment-reduction” approach, typically reducing to solving over a finite set (often three) of strategically chosen demand scenarios. The Wasserstein-based formulation is relaxed to a second-order conic program (SOCP) for computational tractability.

2. Addressing Demand Uncertainty and Data Limitations

This approach explicitly abandons the classical assumption of a known demand distribution, which is rarely justified in data-poor or non-stationary retail environments. Instead, all demand distributions within the ambiguity set compatible with observed moments (mean, mean absolute deviation) or within a Wasserstein ball centered at the empirical distribution are considered.

If historical data is scarce, the moment-based DRO is effective due to its parsimony. When more data is available, the Wasserstein ball provides a “data-driven” ambiguity set, with the ball’s radius scaling appropriately with the sample size for theoretical guarantees and statistical consistency.

Numerical experiments demonstrate that when the demand distribution used in traditional fixed-distribution QR models is misspecified (e.g., fitting a uniform when the true demand is lognormal or beta-distributed), performance degrades substantially—both in terms of expected profit and waste. In contrast, the DRO models maintain robust performance across diverse demand scenarios because they hedge against all plausible distributions in the ambiguity set.

3. Environmental Constraints: The Waste-to-Consumption Ratio

A distinctive feature is the integration of an explicit waste-to-consumption (WTC) ratio constraint, which controls the environmental footprint of the QR system by limiting deadstock relative to demand fulfilled. The WTC ratio is defined as:

This constraint is incorporated as:

for a specified threshold , ensuring that the total waste does not exceed a set multiple of realized consumption under any distribution in . The constraint is accommodated in both the moment-based and Wasserstein-based DRO problems, and in the Wasserstein case, the resulting SOCP contains additional conic constraints associated with waste.

Numerical results demonstrate that this constraint can resolve the so-called “waste paradox” of quick response systems: while QR often reduces unsold finished goods, it may incentivize greater raw material procurement, increasing total system waste. The DRO model with a WTC constraint limits the environmental impact, achieving higher profit at lower waste than non-flexible (fixed-quantity) benchmarks.

4. Tractable Reformulation and Solution Approaches

For moment-based ambiguity sets, the worst-case expectation over can be reduced to an optimization problem over at most three support points (the endpoints and an interior point determined by moment-matching), as established in the classical DRO literature for piecewise affine payoffs.

For Wasserstein ambiguity, the reformulated SOCP efficiently captures the worst-case expectation over the Wasserstein ball, with constraints and variables scaling with the number of empirical demand samples . Jointly considering profit maximization and waste ratio constraints, the SOCP is solved using commercial solvers (e.g., Gurobi, Mosek).

The tractability of both DRO formulations is crucial for the applicability of this framework to real-world quick response settings, especially when rapid updates to policies are needed as new data becomes available.

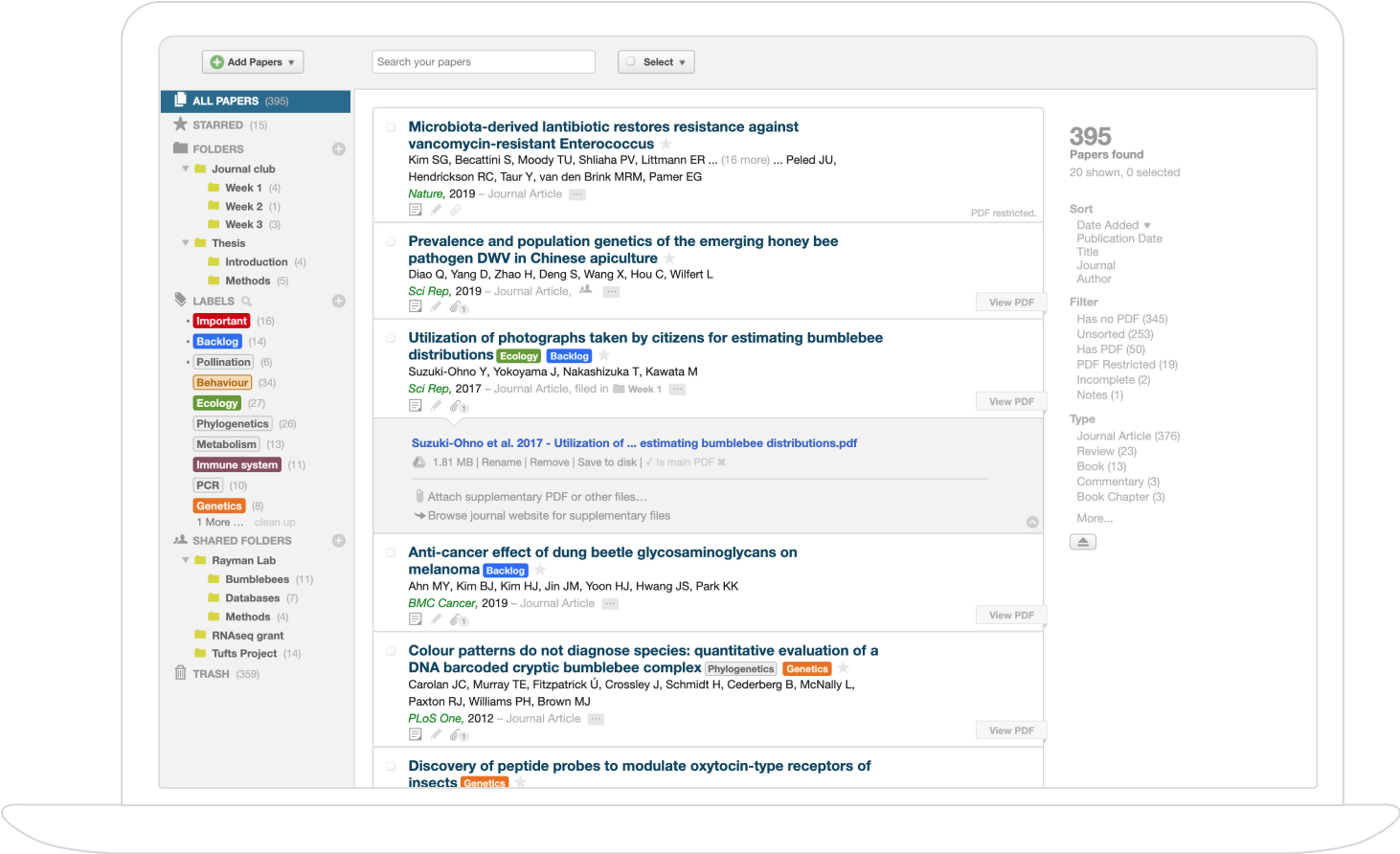

5. Empirical Performance and Numerical Insights

Comprehensive numerical studies are conducted with (i) uniform, (ii) lognormal, and (iii) beta demand distributions under both unconstrained and WTC-constrained settings. Comparative benchmarks include:

- Standard quick response models assuming known, fixed demand distributions (“QR-Benchmark”).

- SAA (sample average approximation) policies.

- Moment-based DRO and Wasserstein DRO.

Key findings:

- In the presence of demand mis-specification, QR-Benchmark suffers severe expected profit and WTC ratio loss; Wasserstein DRO in particular attains consistently higher profit and lower waste.

- The tightening of the WTC constraint strategically reduces fabric procurement and final waste while maintaining quick response flexibility; the paradox of higher overall waste under QR is averted.

- As the data sample size increases, Wasserstein DRO policies approach the performance of an oracle with full distribution information, and outperform SAA in sample-starved regimes.

A tabular summary:

| Model | Profit under misspec. | Empirical WTC | Robust to misspec.? |

|---|---|---|---|

| QR-Benchmark | Degrades sharply | High | No |

| Moment-DRO | Moderately robust | Low | Moderate |

| Wasserstein-DRO | Consistently high | Low | Yes |

6. Managerial Implications and Prescriptive Guidance

The analysis resolves the “quick response or not” debate by focusing on how to effectively manage QR systems under deep demand ambiguity. The results show that:

- Distributionally robust quick response policies (especially with environmental constraints) deliver a “win-win” solution: they maintain or increase profit while verifiably reducing waste, compared to both traditional QR and fixed-supply models.

- The framework provides actionable decision rules—notably, threshold-based procurement and production policies that are robust to data imperfections and misspecification.

- The WTC constraint offers direct managerial control over environmental outcomes, aligning operational flexibility with sustainability requirements.

Future research is suggested to extend this class of models to address features such as multi-product upcycling and explicit differentiation between raw and finished product waste.

7. Context: Relationship to Broader DRO and QR Literature

This model builds on the emerging recognition in DRO research that robust policies should adapt to empirical data uncertainty, particularly via ambiguous sets parametrized by moments or data-driven metrics such as Wasserstein distances. Unlike earlier QR work that did not address distributional ambiguity or environmental constraints, this framework unifies robust profit maximization with sustainability. It showcases that ambiguous-demand QR can be operationalized through tractable convex optimization, accounting for both profit and social responsibility (Papavassilopoulos et al., 1 Aug 2025).

In summary, the distributionally robust quick response model provides prescriptive, data-driven guidance for production and procurement under ambiguous demand, equipping firms to optimize both profit and environmental objectives with provable robustness in data-limited or volatile market conditions.