Institutionalizing risk curation in decentralized credit (2512.11976v1)

Abstract: This paper maps the emerging market for decentralized credit in which ERC 4626 vaults and third-party curators, rather than monolithic lending protocols alone, increasingly determine underwriting and leverage decisions. We show that modular vaults differ in capital utilization, cross-chain and cross asset concentration, and liquidity risk structure. Further, we show that a small set of curators intermediates a disproportionate share of system TVL, exhibits clustered tail co movement, and captures markedly different fee margins despite broadly similar collateral composition. These findings indicate that the main locus of risk in DeFi lending has migrated upward from base protocols, where underwriting is effectively centralized in a single DAO governed parameter set, to a permissionless curator layer in which competing vault managers decide which assets and loans are originated. We argue that this shift requires a corresponding upgrade in transparency standards and outline a simple set of onchain disclosures that would allow users and DAOs to evaluate curator strategies on a comparable, money market style basis.

Sponsor

Paper Prompts

Sign up for free to create and run prompts on this paper using GPT-5.

Top Community Prompts

Explain it Like I'm 14

Overview

This paper looks at how lending in decentralized finance (DeFi) has changed. Instead of one big lending app setting all the rules, there’s now a “two-layer” system:

- Base lending protocols handle the shared plumbing (like record‑keeping and basic markets).

- On top, “vaults” managed by third‑party “curators” decide what to lend, how much risk to take, and how to earn fees.

The authors show that risk in DeFi lending has moved from the base protocols up to these curator‑managed vaults, and they argue we need better, simple transparency so everyday users can compare vaults safely, the way people compare money‑market funds.

What questions did the paper ask?

To make this complex world understandable, the paper asks:

- Who is really making lending and risk decisions in DeFi now — big protocols or vault curators?

- How efficiently do different systems turn deposits into earnings (fees/yield)?

- How spread out or concentrated is lending across different blockchains (“chains”) and assets?

- How connected are the curators to each other, and could trouble in one spread to others?

- What basic information should be disclosed on-chain so users can judge vaults more clearly?

How did they study it?

The authors analyzed real blockchain data from October 1, 2024 to November 19, 2025. They looked at six major lending systems (like Aave, Morpho, Euler, Maple, Gearbox, Silo) and eight big curators (like Gauntlet, Steakhouse, Yearn).

To keep technical ideas simple:

- “ERC‑4626 vaults” are like shared savings baskets: you deposit, get shares, and the manager decides how to earn yield with the pooled money.

- “Curators” are the vault managers who pick assets, set limits, and manage risk.

- “TVL” (Total Value Locked) is the size of the money pool in a protocol or vault.

- “Utilization” is the share of money that’s actually lent out (not just sitting).

- “Yield” here means the fees earned from lending.

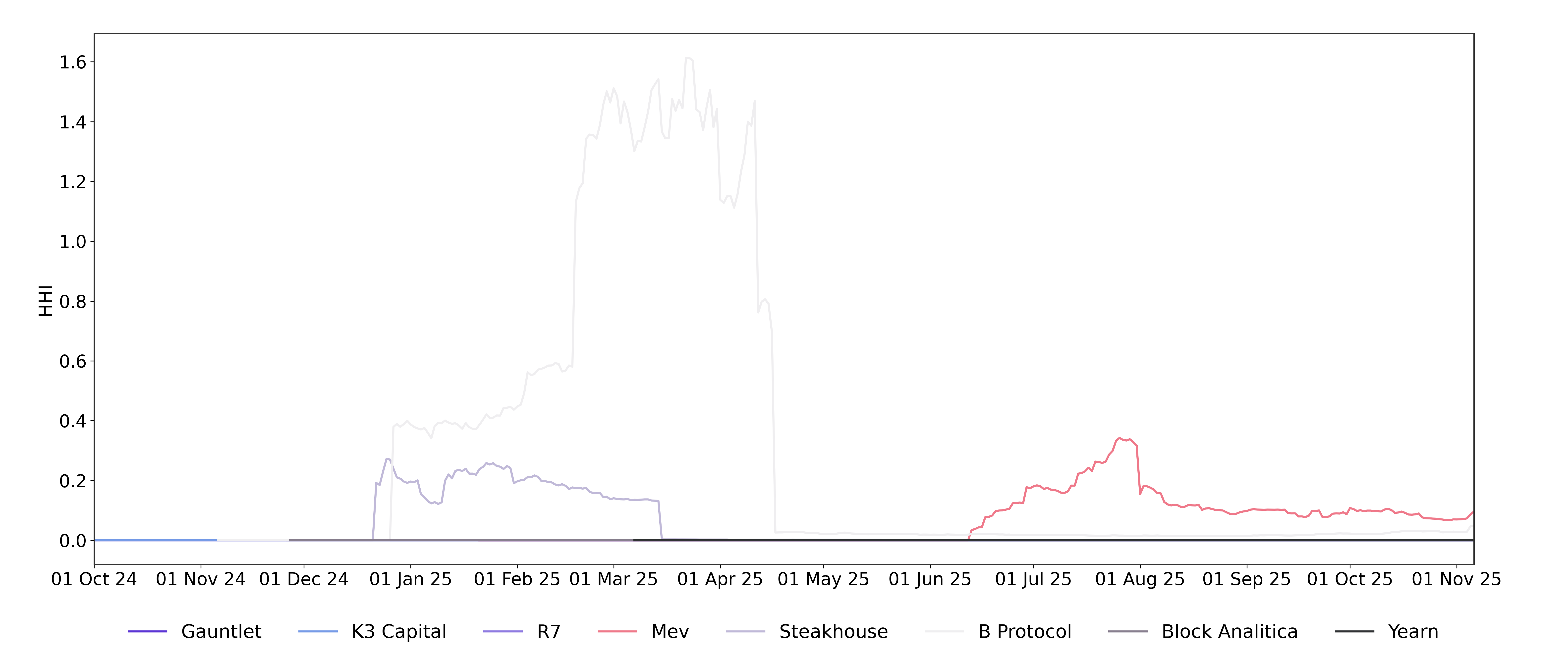

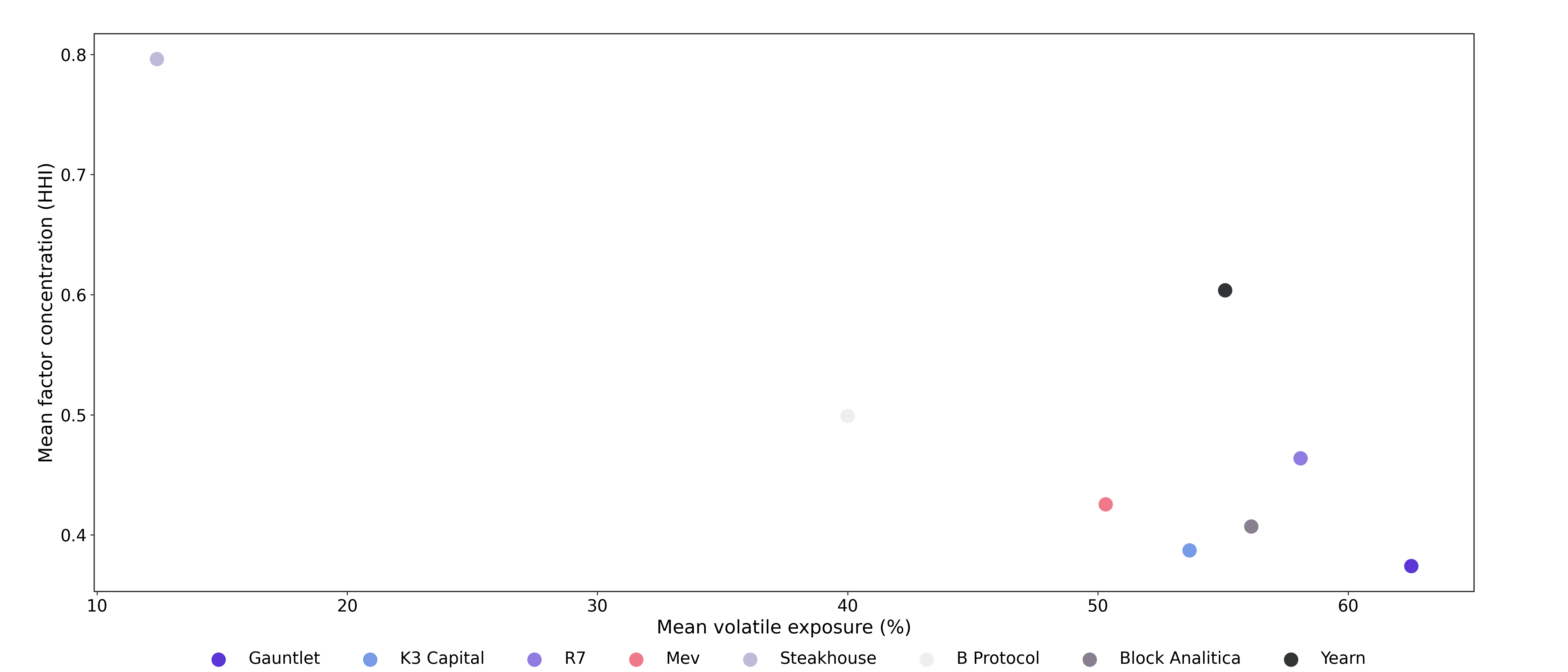

- “HHI” (Herfindahl–Hirschman Index) is a concentration score; high means assets are clumped in one place (like one chain), low means they’re spread out.

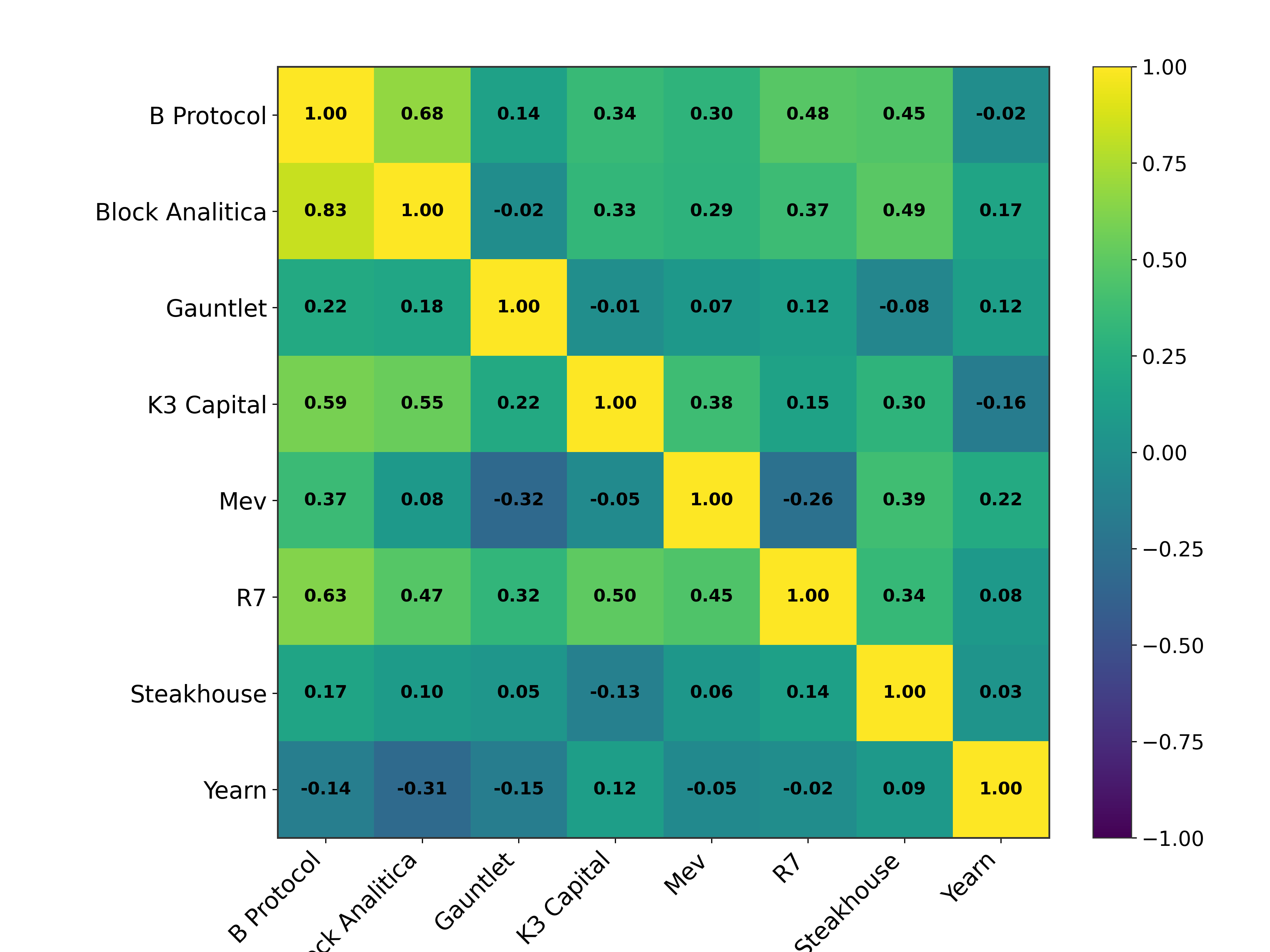

- “Correlation” measures how often two things move together (up or down).

- “Drawdown” is how far something falls from its recent peak.

- “Tail dependence” looks at whether things fall together during bad days.

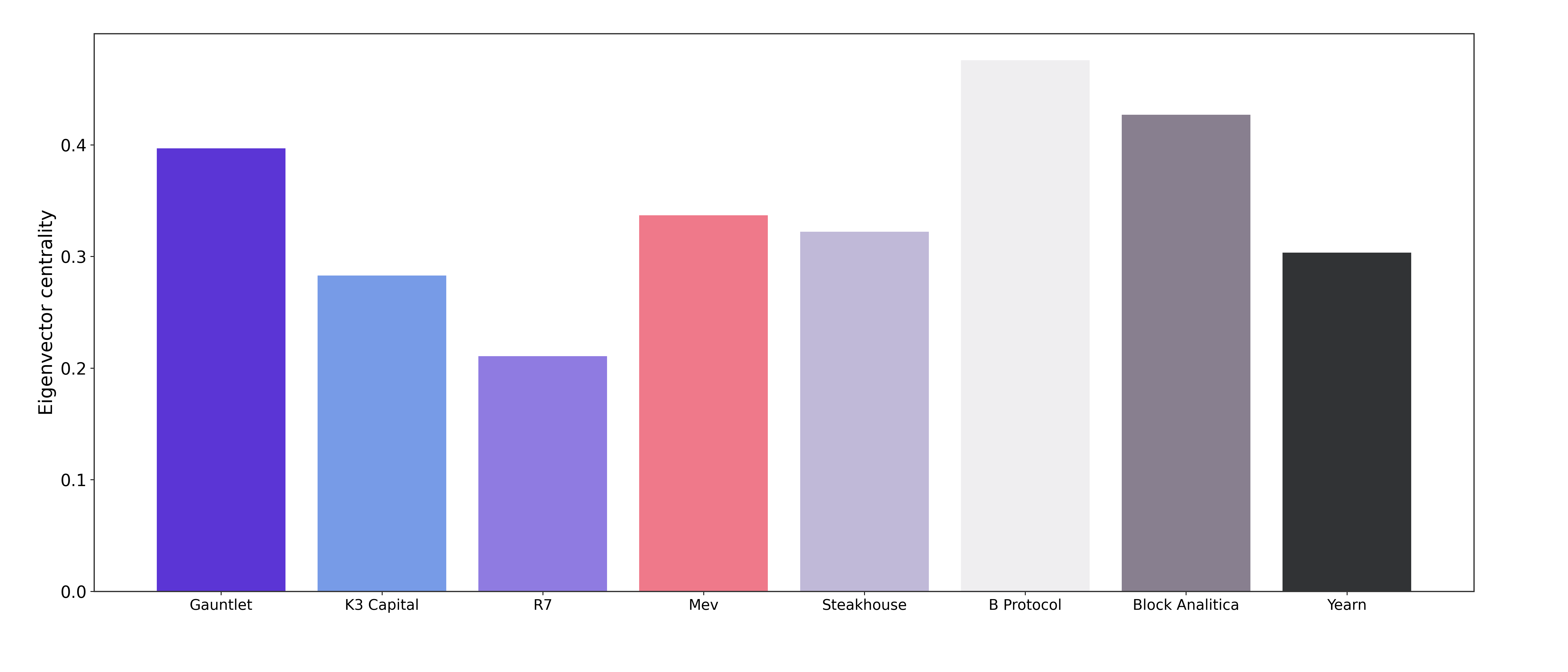

- “Centrality” scores show which curators sit at the heart of shared positions and might spread shocks.

They:

- Measured how much money different protocols used and what fee yields they earned.

- Checked how concentrated each protocol’s money was across chains (using HHI).

- Compared daily changes in TVL to see which protocols moved together over time.

- Built a “curator overlap” network to see which managers held similar positions, and calculated centrality scores to find hubs.

- Tracked how much each curator held in volatile tokens (like ETH) vs. stablecoins (like USDC).

- Estimated how much of the fees each curator kept (their effective profit margin).

What did they find, and why does it matter?

Here are the key takeaways, explained in everyday terms:

- The “risk brain” moved upstairs:

- In older DeFi lending, one big protocol (and its DAO) set risk rules for everyone.

- Now, curators running ERC‑4626 vaults choose assets, leverage, and settings. That’s where most risk decisions live today.

- Different designs earn differently:

- Protocols that lend out a higher share of money (“high utilization”) earn higher fees — but they sit closer to danger if markets get shaky.

- Systems with isolated markets (like Silo and Euler) can safely run hotter (very high utilization), earning more, because each market’s problems don’t spill over as easily.

- Aave and Morpho are more cautious overall, earning slightly less but prioritizing safety.

- Chain diversification changed the game:

- Many protocols spread their money across more blockchains over 2025.

- Some remained anchored mainly on Ethereum and a few Layer 2s, while others diversified more widely.

- Spreading out reduces the risk of a single chain’s trouble affecting everything.

- Protocols started moving together:

- Early on, TVLs (pool sizes) moved differently from each other.

- Later, they moved more in sync, likely because:

- Multichain expansions settled down.

- Most lending focused on similar assets (ETH and stablecoins).

- Big waves of liquidity hit the same ecosystems at once.

- A few curators matter a lot:

- A small number of managers oversee a big chunk of vault money.

- Some curators focus on volatile assets (higher risk, higher potential return); others stick mainly to stablecoins (lower risk, more like cash‑plus funds).

- There’s a “barbell” structure: one end has stabilizers (like Steakhouse, mostly stablecoins), the other has higher‑beta managers (more volatile tokens), with a mixed group in the middle.

- Stress can spread through shared positions:

- Curators that hold similar assets tend to experience drawdowns together, especially on bad days.

- Network analysis shows mid‑sized curators can still be central hubs if they overlap a lot with others. Shocks could spread through these hubs even if they aren’t the biggest by TVL.

- Fees vary widely:

- Some curators keep a larger share of fees (like active hedge‑fund‑style managers).

- Others operate more like public utilities, keeping fees low but focusing on safety and scale.

Why this matters: If most risk choices sit with curators, users need clear, comparable information to pick vaults that match their comfort level. Protocols and DAOs also need standard reporting to spot hidden concentrations and possible contagion paths.

What’s the bigger impact?

The paper suggests a simple path forward: raise transparency at the curator/vault layer. In practice, that means on-chain disclosures that let anyone compare vaults like money‑market funds, such as:

- What assets are held (stable vs volatile, main risk factors),

- How spread out positions are across chains,

- How much is lent out (utilization) and typical yield,

- How vaults behaved in past stress (drawdowns),

- The fee take the curator keeps.

With these basics, users and DAOs can:

- Choose vaults that match their risk tolerance,

- Spot managers that are too central or concentrated,

- Encourage safer designs (like isolated markets and better diversification),

- Reduce the chance that one vault’s trouble turns into a system‑wide problem.

In short, DeFi lending is becoming more like a marketplace of specialized funds. That’s powerful — it lets people pick the risk and return they want — but it only works well if everyone can see, in simple terms, what they’re buying.

Knowledge Gaps

Knowledge gaps, limitations, and open questions

The paper advances a descriptive map of modular credit, but several empirical, methodological, and design aspects remain unresolved. The following concrete gaps can guide future research:

- Vault-level granularity is missing: construct an overlap and contagion network at the individual ERC‑4626 vault level (positions, collateral rules, rebalancing mandates) rather than only at the aggregated curator balance-sheet level.

- Price vs flow decomposition of TVL: separate daily TVL changes into asset price effects and net deposits/redemptions (e.g., via

sharesminted/burned per vault) to identify whether co-movement is driven by market beta or investor flows. - Statistical robustness: report confidence intervals, hypothesis tests, and effect sizes for key findings (utilization–yield frontier, correlation matrices, centrality rankings), and provide sensitivity to sample windows and bootstrap resampling.

- Utilization–risk linkage: empirically link protocol/vault utilization to realized risk outcomes (liquidation frequency, bad debt incidence, loss given liquidation), testing the “locked-in” frontier predictions using hazard or survival models.

- Interest-rate model non-linearities: quantify regime shifts around the “kink” (optimal utilization) by estimating the local elasticity of borrow rates to utilization and the stability of high‑utilization regimes across architectures.

- Factor taxonomy: refine the “factor HHI” by distinguishing ETH vs LST vs restaking derivatives, stablecoin issuer/custody risks (USDC, USDT, DAI variants), and RWAs; assess whether current aggregation masks materially different risk drivers.

- Oracle risk is unmeasured: catalog curator-specific oracle choices (providers, aggregation logic, update frequency), map vault exposures to oracle failure/manipulation windows, and simulate price feed shocks and their liquidation impacts.

- Cross-chain operational risk beyond HHI: model sequencer downtime, bridge failures, reorgs, and message‑passing delays; run stress tests to quantify impacts on liquidation latency, slippage, and cross-chain contagion.

- Liquidity isolation claims: test to what extent “vault isolation” prevents spillovers by measuring how idiosyncratic redemptions in one vault affect funding rates, utilization, and liquidity depth in shared execution-layer pools.

- Fee margin attribution: decompose curator fee capture into components (beta exposure, turnover, gas subsidies, rebates/kickbacks, routing advantages) using multivariate regressions to distinguish rent extraction from genuine value-add.

- Depositor welfare: evaluate net risk‑adjusted returns (Sharpe/Sortino, drawdown-adjusted APY) across curators; test whether higher fee take rates deliver commensurate improvements in risk-adjusted performance.

- Governance conflicts-of-interest: identify curators who also serve as protocol risk managers and test whether their governance proposals or parameter changes preferentially benefit their vaults; propose disclosure of dual roles and voting records.

- Sample coverage limitation: include omitted protocols and curators (e.g., Compound V3, Spark, Fraxlend, Radiant, Venus, Chaos Labs, LlamaRisk, RiskDAO, Ajna, Dolomite, SparkLend) to reduce selection bias and improve external validity.

- Borrower-level heterogeneity: measure borrower motives, leverage distributions, and health factors within curator-managed vaults; compare with monolithic protocols to validate claims about segmentation and specialization.

- RWA/offchain credit characterization: for Maple and similar platforms, collect loan-level data (collateralization, covenants, borrower quality, default/loss track record) to align onchain TVL with offchain credit risk and realized outcomes.

- Data provenance and reproducibility: publish the contract lists, indexing methods, chain coverage, position classification rules, and code to ensure replicability; quantify biases from missing chains, tokens, or incomplete vault discovery.

- Network construction choices: assess sensitivity of centrality results to edge definitions (e.g., Jaccard of positions, liquidity-weighted overlap, net vs gross exposures), thresholds (

w_ijcutoffs), and directed edges (asymmetric nesting). - Causality in co-movement: use lead–lag analysis, Granger causality, or local projections to identify shock transmitters vs followers among curators, rather than relying solely on contemporaneous correlations.

- Fee comparability: clarify “gross fees” across protocols (reserve factors, liquidation penalties, referral rebates) and standardize revenue capture metrics to avoid cross‑architecture mismeasurement.

- Scenario stress testing: simulate ETH drawdowns, stablecoin depegs, interest‑rate spikes, oracle failures, and chain outages; trace propagation through curator networks and base protocols, quantifying drawdowns, fee shocks, and liquidation losses.

- Rehypothecation policy impacts: compare vaults that allow collateral reuse vs those that do not; estimate effects on utilization, funding costs, and tail insolvency risk.

- Liquidation engine performance: benchmark liquidation outcomes across chains under congestion (keeper availability, slippage, auction efficacy, latency), and estimate loss‑given‑liquidation conditional on chain state.

- Transparency framework specifics: the proposed onchain disclosures are not enumerated; define a concrete schema (position-level holdings, LTV and health-factor distributions, oracle providers, chain exposure, fee schedule, redemption mechanics, hurdle/benchmark rates) and pilot implementation using ERC‑4626 hooks.

- Incentive gaming and MEV: analyze whether curators can systematically manipulate utilization or interest curves, front‑run redemptions, or exploit MEV opportunities; design and test mitigations (commit–reveal, batch auctions).

- Regime sensitivity: validate findings across market regimes (risk-on vs risk-off) and around major deployment events (L2 expansions), using event studies and time‑varying parameter models.

- Stablecoin/issuer concentration risk: map curator exposure to specific stablecoin issuers, custody/settlement rails, and potential correlated tail events (USDC freezes, Tether shocks), and test systemic impacts.

- User behavior and run dynamics: study depositor cohorts, flow stickiness, APY sensitivity, and the conditions under which modular vaults experience runs; evaluate tooling for redemption gates or swing pricing in DeFi contexts.

- Regulatory/prudential analogs: formalize the mapping from UCITS risk units, money‑market fund rules, and CLO disclosure standards to onchain vaults; specify feasible capital buffers, stress‑test requirements, and redemption controls.

- Integration of credit scoring: evaluate how “black-box” on/offchain scoring mechanisms would be incorporated at the curator layer; define transparency and fairness standards to prevent biased credit allocation.

- Pricing liquidity externalities: quantify whether curators free‑ride on shared liquidity and propose mechanisms (fees, insurance pools, circuit breakers) that internalize systemic liquidity costs.

Glossary

- Aave: A large decentralized lending protocol that serves as a liquidity anchor in DeFi. "Aave remains the largest universal lending protocol, jointly holding approximately \$34~billion in TVL, or 45\% of total sector liquidity."

- Bad debt: Debt that cannot be repaid, leaving a protocol with losses. "a single failed attack was sufficient to generate more than USD~1.5~million in bad debt"

- Base protocol: The foundational smart-contract system providing market and accounting infrastructure beneath modular vaults. "while the base protocol continues to provide the generic market and accounting infrastructure."

- Betweenness centrality: A network metric indicating how often a node lies on shortest paths between others, capturing its role as a bridge for shock transmission. "Betweenness centrality measures how often curator lies on the shortest weighted paths between other pairs of curators, identifying nodes that act as bridges or conduits for shock transmission across otherwise weakly connected parts of the network."

- CLO (Collateralized Loan Obligation): A structured finance product pooling loans into tranches; used as a traditional analog for DeFi curator structures. "highlighting the convergence between DeFi curators and traditional collateral managers, UCITS risk units, and CLO structures."

- Collateral composition: The mix of assets used as collateral within a system or vault. "captures markedly different fee margins despite broadly similar collateral composition."

- Contagion: The spread of financial distress across pools or protocols through interconnected exposures. "and that contagion is driven by default cascades running from crypto-collateral pools to stablecoin pools."

- Curator: A third-party manager that defines and manages the risk profile and allocations of ERC–4626 vaults. "Delegation of risk to third-party managers introduces a second systemic layer in the form of curator interdependence."

- DAO-governed: Controlled by a decentralized autonomous organization via on-chain governance parameters. "where underwriting is effectively centralized in a single DAO-governed parameter set"

- Degree centrality: A network metric counting how many significant overlaps a curator has with others. "Degree centrality counts the number of counterparties with which curator has significant overlap, normalized by the maximum possible number of links."

- Drawdown: The decline from a previous peak, often used to measure stress. "For each curator, we compute the normalized drawdown, i.e., the fractional distance from the running peak."

- Eigenvector centrality: A network metric that measures influence by weighting connections to other highly connected nodes. "Eigenvector centrality assigns high scores to curators that are connected to other highly connected curators."

- ERC–4626: An Ethereum standard for yield-bearing vaults that tokenizes deposits and redemptions as fungible shares. "The ERC--4626 standard (2023) created a uniform accounting layer for yield-bearing vaults, allowing deposits and redemptions to function as fungible shares."

- Execution layer: The blockchain environment (chain/L2) where transactions are executed and liquidity resides. "Systemic resilience depends not only on utilization, but also on how lending liquidity is distributed across execution layers."

- Factor HHI: A Herfindahl–Hirschman Index computed across aggregated risk factors (e.g., ETH, USD stables) to measure concentration. "The factor HHI is computed after aggregating tokens into underlying risk families, e.g., ETH and its liquid-staking derivatives, BTC and wrapped BTC, USD stablecoins"

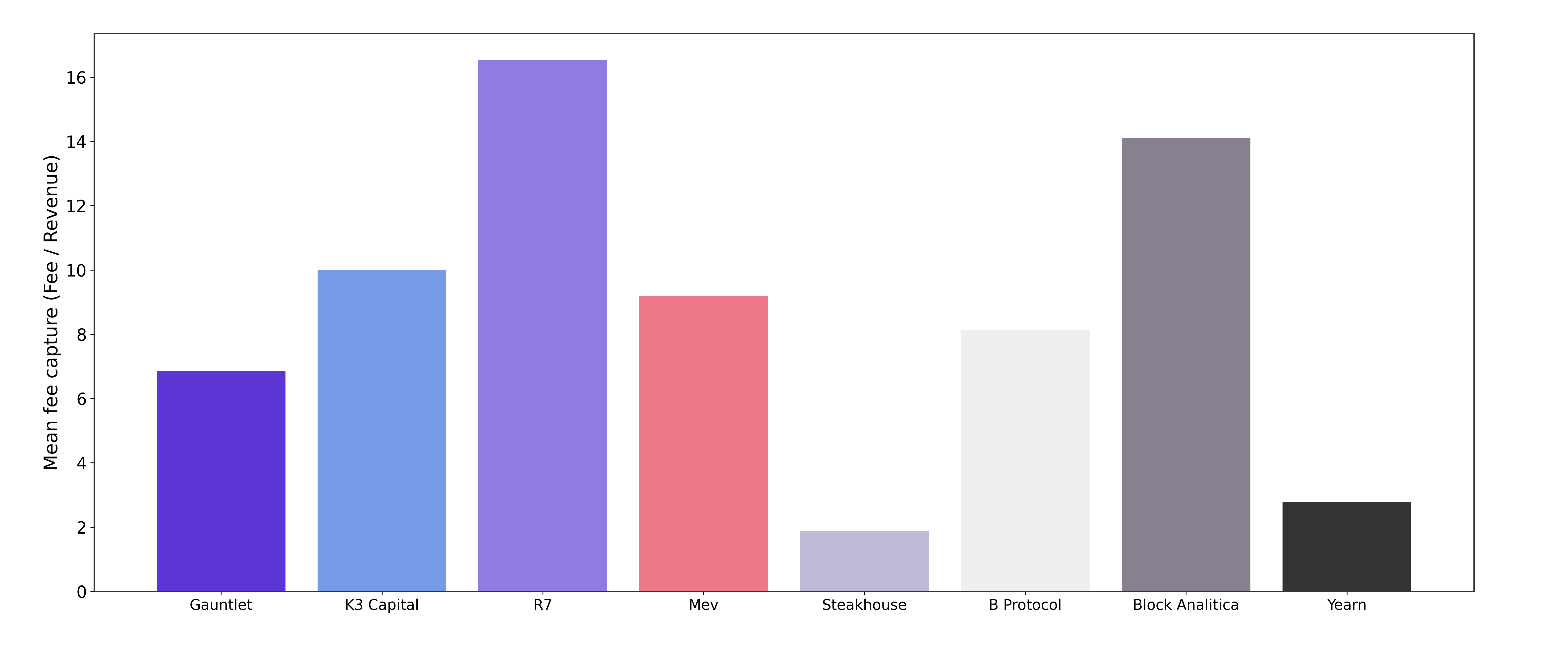

- Fee capture: The share of gross fees retained as net revenue by the curator. "R7 and Block Analitica exhibit the highest fee capture, retaining roughly 16\% and 14\% of fees, respectively"

- Haircuts: Reductions applied to collateral valuations to control risk. "Delegating risk management to an entity that can adjust haircuts flexibly in response to market conditions restores a unique, high-lending equilibrium"

- Health factor: A metric indicating the safety margin of a borrower’s position relative to liquidation thresholds. "show that more than 98\% of Aave users maintain a health factor above one"

- Herfindahl–Hirschman Index (HHI): A concentration measure used to assess distribution of TVL across chains or factors. "treating protocol TVL and chain HerfindahlâHirschman Indices (HHIs) as aggregate state variables."

- Isolated markets: Lending markets architected so that risks are confined within each market’s specific collateral set. "Eulerâs vault kit, Siloâs isolated markets, and Gearboxâs permissionless lending achieved the same outcome where risk became local, composable, and curator-defined."

- Kinked curve: An interest-rate model with a sharp change in slope after an optimal utilization point. "two-sloped âkinkedâ curve with an optimal-utilization point (typically around 90\%)"

- L2 (Layer 2): Scaling networks built on top of base chains to increase throughput and reduce costs. "the 2025 L2 expansion (Base, Lisk, Sonic, Arbitrum, and others)"

- Leverage bounds: Limits on the amount of borrowing relative to collateral defined by curators or protocols. "curators determine underwriting parameters, leverage bounds, and oracle feeds."

- Liquid-staking derivatives (LSTs): Tokens representing staked assets (like ETH) that remain liquid and tradable. "These links are consistent with overlapping exposure to core DeFi collateral (ETH, LSTs, major stables)"

- Liquidation mechanics: The rules and processes by which collateral is sold to cover debt when positions become unsafe. "leveraged positions that are 'locked in' by protocol collateral rules and liquidation mechanics."

- Liquidation thresholds: Parameter levels at which a borrower’s position becomes subject to liquidation. "risk is encoded in a small set of global parameters (loan-to-value caps, liquidation thresholds and interest-rate curves)"

- Liquidity mining: Incentive programs that reward users for supplying assets to protocols. "They show that most users either borrow stablecoins against crypto collateral or engage in liquidity mining"

- Loan-to-value (LTV): The ratio of loan amount to collateral value used to calibrate borrowing risk. "Their logistic regressions suggest that higher loan-to-value ratios and collateral volatility increase liquidation risk"

- Money-market funds: Short-term investment vehicles offering liquidity and low risk; used as a historical analog for DeFi’s evolution. "a structural transformation comparable in scope to the development of money-market funds in the 1970s."

- Multichain footprints: Presence across multiple chains/L2s distributing liquidity and operations. "Despite operating on the broadest multichain footprints, i.e., Ethereum, Avalanche, Polygon, Base, Fantom, OP Mainnet, Scroll, Metis, Gnosis, BSC, ZKsync Era, and Arbitrum"

- Normalized drawdown: Drawdown scaled by the running peak to compare stress across entities. "For each curator, we compute the normalized drawdown, i.e., the fractional distance from the running peak."

- Oracle feeds: Data sources (often price feeds) used by protocols to value collateral and enforce risk rules. "curators determine underwriting parameters, leverage bounds, and oracle feeds."

- Overcollateralised: Loan structures requiring collateral exceeding the borrowed amount to mitigate default risk. "Empirically, existing DeFi lending does not resemble bank-style credit screening but rather a standardized, overcollateralised leverage machine."

- Permissionless: Systems that anyone can use or build on without centralized approval. "Gearboxâs permissionless lending achieved the same outcome"

- Perpetual futures funding rates: Periodic payments between long and short positions in perpetual swaps indicating market bias. "Borrowing volumes rise significantly with ETH perpetual futures funding rates and past ETH returns"

- Prudential concepts: Regulatory risk-management standards used to assess safety and transparency. "We translate familiar prudential concepts into onchain disclosure items"

- Procyclicality: The tendency for risk or activity to amplify economic or market cycles. "document that Aaveâs lending activity is highly volatile and highlight concerns about procyclicality with respect to crypto prices."

- Rehypothecate: To re-use collateral or borrowed assets in new positions elsewhere. "Gearbox operates overcollateralised credit accounts that rehypothecate borrowed assets into external DeFi venues."

- Risk curation: The active selection and management of risk exposures by vault managers. "Keywords: decentralized credit, ERC--4626 vaults, risk curation, systemic risk, onchain transparency."

- Riskâreturnâruin frontier: A conceptual trade-off curve linking leverage, returns, and probability of ruin for DeFi borrowers. "derive a borrower-level riskâreturnâruin frontier for overcollateralised DeFi loans"

- Short squeeze: A market event where forced buying of a shorted asset drives rapid price increases. "analyze the November 2022 CRV short-squeeze attempt on Aave V2."

- Solvency: The ability of a protocol or vault to meet its obligations without becoming insolvent. "prioritizing solvency over marginal capital utilization"

- Stablecoin: A token pegged to a stable asset (typically USD) used widely in DeFi lending. "with WETH collateral backing stablecoin liabilities in most cases."

- Systemic risk: Risk of collapse or severe stress across the entire financial system due to interconnectedness. "how curator specialization reshapes systemic risk propagation."

- Tail co-movement: Synchronized extreme downside movements across entities. "exhibits clustered tail co-movement"

- Tail dependence: The degree of correlation in the extreme tails of distributions, indicating joint stress. "documenting portfolio structure, tail dependence, and network centrality."

- Total Value Locked (TVL): The aggregate value of assets deposited in a protocol or set of vaults. "Across all analyzed risk curators, the total TVL amounts to approximately \$7.27 billion"

- Underwriting: The process of evaluating and setting terms for credit exposure and risk-taking. "curators determine underwriting parameters, leverage bounds, and oracle feeds."

- UCITS: European regulatory framework governing collective investment schemes and their risk units. "highlighting the convergence between DeFi curators and traditional collateral managers, UCITS risk units, and CLO structures."

- Vaults: Smart-contract wrappers that pool deposits into fungible shares with defined strategies and risk profiles. "vaults take on distinct risk profiles and third-party curators determine underwriting parameters, leverage bounds, and oracle feeds."

Practical Applications

Immediate Applications

Below are practical use cases that can be deployed now, grounded in the paper’s findings on ERC‑4626 modular vaults, curator behavior, chain concentration (HHI), TVL co‑movement, tail dependence, and fee capture dispersion.

- Curator Transparency Dashboards for users and DAOs (Finance, Software)

- Build public dashboards that surface standardized vault metrics: capital utilization, fee yields, volatile/stable exposure shares, factor HHI, chain HHI, drawdown and tail‑dependence correlations, and curator centrality based on portfolio overlap.

- Tools/products/workflows: subgraphs via The Graph; multi‑chain indexers (Dune, Flipside); onchain registries of ERC‑4626 metadata; risk‑oracle APIs.

- Assumptions/dependencies: consistent ERC‑4626 interfaces (e.g.,

totalAssets,totalSupply), robust cross‑chain data, reliable oracle feeds, curator participation in disclosures.

- Wallet/Aggregator Risk Labels (“money‑market style”) (Consumer finance, Software)

- Display vault “nutrition labels” in wallets and yield aggregators, mapping each vault to a risk tier (cash‑plus, income, high‑beta) using factor HHI, volatile share, utilization, and fee‑capture signals.

- Tools/products/workflows: plug‑in risk labeling services; simple onchain registries storing label metadata; frontend SDKs for wallets/aggregators.

- Assumptions/dependencies: DAO/governance buy‑in; low false‑positive rates in labeling; timely index updates across chains.

- DAO Listing Standards for Vaults (Policy, Finance)

- Enforce minimal onchain disclosures (money‑market‑style) as a condition for vault listings on protocol UIs, including interest‑rate curve parameters, haircut ranges, asset families, and historical utilization/yield.

- Tools/products/workflows: EIP/Ethereum‑standard for “4626‑Disclosure”; governance templates for Aave/Morpho/Silo/Euler/Gearbox; auditor checklists.

- Assumptions/dependencies: community consensus; compatibility across chains; curator incentives aligned with transparency.

- Systemic Risk Monitors for Protocol and Chain Teams (Infrastructure, Risk)

- Track execution‑layer concentration (chain HHI), synchronized TVL cycles (correlation matrices), and overlap‑based centrality to identify shock conduits and to plan circuit‑breakers/liquidity routing.

- Tools/products/workflows: chain‑ops dashboards; alerting systems for HHI spikes and rising tail‑dependence; routing policy playbooks.

- Assumptions/dependencies: reliable chain‑level TVL measurements; multi‑chain deployment telemetry; alert thresholds tuned to volatility regimes.

- Fee‑Capture Benchmarking for Depositors and Governance (Finance)

- Compare curator fee‑capture rates (net revenue vs. gross fees) to vault risk and yield; flag outliers where spreads are high relative to risk‑adjusted performance.

- Tools/products/workflows: fee analytics services; governance scorecards; APR disclosure normalization.

- Assumptions/dependencies: accurate fee accounting; consistent net APY definitions; transparent revenue splits.

- Insurance Pricing and Underwriting Using Tail‑Dependence Maps (DeFi insurance)

- Price vault insurance premia using conditional tail correlations among curators to reflect joint stress probability when left‑tail events occur.

- Tools/products/workflows: actuarial risk engines that ingest drawdown/tail metrics; parametric cover designs.

- Assumptions/dependencies: sufficient historical stress data; stable contract semantics; avoidance of moral hazard (e.g., minimum risk practices).

- Curator Internal Risk Engines (Asset management)

- Operationalize “kink‑proximity” and utilization monitors to adjust parameter sets (haircuts, interest‑rate slopes) and rebalance vaults away from the locked‑in frontier during volatility spikes.

- Tools/products/workflows: automated rebalancers; health‑factor simulators; scenario testing against the utilization‑yield frontier.

- Assumptions/dependencies: fast governance hooks (or curator permissions); safe parameter bounds; predictable liquidation mechanics.

- Portfolio‑of‑Vaults Allocations for Retail Cash‑Plus (Daily life, Wealthtech)

- Offer simple retail allocations into low‑beta “cash‑plus” vaults (e.g., stablecoin/RWA‑heavy curators) with optional drift into income funds via proportionally weighted baskets.

- Tools/products/workflows: robo‑advisor‑style rebalancers; KYC‑light flows where needed; disclosures in plain language.

- Assumptions/dependencies: jurisdictional compliance; clear consumer risk explanations; stable USDC/fiat‑backed RWA links.

- Academic Replication Kits and Open‑Source Metrics Library (Academia)

- Package HHI, TVL co‑movement, drawdown/tail dependence, and overlap‑centrality into a reproducible Python/R library for research and coursework.

- Tools/products/workflows: open datasets; Jupyter notebooks; CI/CD against live subgraphs.

- Assumptions/dependencies: permissive data licenses; standardized token/risk-family mappings; curator identifiers.

- Regulator/Policy Briefings Mapping Curators to MMF/UCITS Analogs (Policy)

- Provide supervisory briefings that classify vaults into MMF‑like liquidity anchors vs. factor‑concentrated/high‑beta funds, highlighting prudential analogs (UCITS risk units, CLO‑like structures).

- Tools/products/workflows: reporting templates; crosswalks from DeFi metrics to TradFi categories.

- Assumptions/dependencies: willingness to engage; careful framing to avoid category errors; up‑to‑date exposure maps.

Long‑Term Applications

The following use cases require further research, scaling, community standards, or regulatory clarity before broad deployment.

- Onchain Rating Agency for Curators and Vaults (Finance, Policy)

- Issue letter grades or risk scores deriving from standardized disclosures: factor HHI, tail dependence, utilization regimes, fee capture, and historical stress performance.

- Tools/products/workflows: decentralized rating DAOs; attestations anchored onchain; dispute/appeal processes.

- Assumptions/dependencies: accepted metric taxonomy; resistance to gaming/manipulation; broad ecosystem adoption.

- Macroprudential Risk Oracle and DeFi Systemic Index (Policy, Derivatives)

- Publish real‑time systemic risk signals (e.g., network eigenvector centrality, aggregate tail‑dependence, chain HHI) and enable hedging via a tradable DeFi systemic index/perp.

- Tools/products/workflows: oracle networks; index methodology with transparent construction; exchange listings.

- Assumptions/dependencies: liquidity for hedges; robust governance of index changes; ethical considerations around reflexivity.

- ERC‑4626 Tranching (CLO‑style) for Modular Credit (Structured credit)

- Wrap vaults in senior/mezz/equity tranches with onchain waterfall rules to tailor risk/return and isolate credit vs. liquidity risk more explicitly.

- Tools/products/workflows: composable tranche contracts; formal verification; standardized disclosure of waterfall parameters.

- Assumptions/dependencies: regulatory treatment; sufficient diversification to avoid correlation blow‑ups; resilient liquidation processes.

- Adaptive Interest‑Rate Models Beyond the Kink (Protocol design)

- Replace or augment two‑slope curves with adaptive models responsive to utilization volatility, drawdown intensity, and collateral factor shifts to stabilize funding near high‑utilization regimes.

- Tools/products/workflows: governance‑approved controllers; simulation‑backed parameter updates; safety bounds and rate smoothers.

- Assumptions/dependencies: avoidance of feedback loops; clear monotonicity guarantees; credible commitments to parameter transparency.

- Liquidity Backstops and Mutualized Buffers at the Curator Layer (Insurance, Protocol)

- Create pooled liquidity reserves to absorb temporary vault redemptions (shared-liquidity stress) without forcing asset fire‑sales; compensate backstop providers via option‑like premiums.

- Tools/products/workflows: vault‑level backstop contracts; fair pricing models; backstop governance (eligibility, triggers).

- Assumptions/dependencies: moral hazard controls; fair sharing rules among curators; clear trigger conditions.

- RWAs and Commodities Integration for Factor Diversification (RWA, Tokenization)

- Systematically expand beyond crypto‑beta with tokenized treasuries, commercial paper, invoices, and modest commodity exposures to reduce systemic ETH‑beta and stabilize vault returns.

- Tools/products/workflows: compliant RWA issuers/custodians; reliable price/oracle feeds; settlement assurance.

- Assumptions/dependencies: legal enforceability; oracle robustness; cross‑jurisdiction asset servicing.

- Cross‑Chain Resolution Standards and Circuit Breakers (Infrastructure, Policy)

- Define common emergency procedures (halts, parameter freezes, migration playbooks) coordinated across chains to manage synchronized liquidity shocks.

- Tools/products/workflows: cross‑chain governance frameworks; message‑bus integrations; standardized “resolution states.”

- Assumptions/dependencies: multi‑chain coordination; time‑bounded emergency powers; auditable post‑mortems.

- Portfolio‑of‑Vaults “Robo‑Curators” (Wealthtech, Software)

- Automated allocators that construct and maintain diversified portfolios across curators using factor HHI and tail‑dependence constraints, rebalancing to target risk budgets.

- Tools/products/workflows: optimization engines; streaming data pipelines; rebalancing policies with slippage controls.

- Assumptions/dependencies: persistence of curator strategies; stable fee economics; user trust in automated policies.

- Consumer‑Protection and Fairness Standards for Credit Gateways (Policy, Compliance)

- If access to lending rails is gated, implement transparent, auditable scoring and appeal processes to mitigate “black box” bias in decentralized credit scoring (per the paper’s cited concerns).

- Tools/products/workflows: explainable scoring models; third‑party audits; user‑rights charters embedded in protocol governance.

- Assumptions/dependencies: community enforcement; privacy‑preserving attestations; regulator alignment.

- Auditor Methodologies and Assurance for Curator Risk (Audit, Assurance)

- Standardize onchain audit procedures for vault mandates, parameter changes, rebalancing logic, and loss buffers; publish assurance reports akin to SOC‑type certifications.

- Tools/products/workflows: provable monitoring (Merkle proofs, zk‑attestations); continuous audit feeds; curator compliance portals.

- Assumptions/dependencies: auditor neutrality; coverage across multi‑chain footprints; sustainable economics for continuous assurance.

- Data Cooperatives and Shared Indexing for Multichain Coverage (Software, Community)

- Form community data co‑ops to reduce duplicative indexing cost, harmonize token/factor taxonomy, and ensure timely synchronization of vault metrics across many L1/L2s.

- Tools/products/workflows: open data standards; funding via protocol grants; governance for schema evolution.

- Assumptions/dependencies: sustained grant support; contributor incentives; consensus on canonical mappings.

- Education and Certification for “DeFi Risk Curators” (Academia, Professional training)

- Create curricula and certifications that teach vault architecture, tail‑risk measurement, overlap networks, and governance workflows, improving professional standards in the curator layer.

- Tools/products/workflows: university/bootcamp partnerships; hands‑on labs; continuous professional education credits.

- Assumptions/dependencies: industry demand; credible exam content; alignment with protocol practices.

Collections

Sign up for free to add this paper to one or more collections.