- The paper presents a novel graph-theoretic framework for analyzing Bitcoin transactions using transaction, address, and cluster graphs.

- It employs centrality measures, graph traversal, and community detection to identify influential nodes and uncover suspicious activity.

- The study demonstrates effective data parsing and clustering methods, offering practical insights into Bitcoin's transaction dynamics and economic behaviors.

Bitcoin's Blockchain Data Analytics: A Graph Theoretic Perspective

Introduction

Bitcoin operates as a decentralized digital currency based on an immutable ledger, colloquially known as the blockchain, which facilitates pseudonymous transactions over a peer-to-peer network. This infrastructure eliminates the need for trusted third parties while retaining the advantages of cryptographic security and minimal transaction fees. The public nature and growth of Bitcoin's blockchain present a nascent field for data analytics, especially involving graph-theoretic methods to garner insights into transaction patterns, economic indicators, and emergent trends.

Graph-Theoretic Approach to Bitcoin Analysis

The paper outlines the graph-theoretic modeling of Bitcoin's transactions, leveraging transaction, address, and cluster graphs to represent their respective dynamics. The graph models facilitate structured analytical techniques such as computational graph analytics and graph pattern matching. Transaction graphs model the flow of Bitcoins between transactions over time, address graphs depict flows between public keys, and cluster graphs aggregate linked addresses. These graph models enable centrality-based analyses to determine key influencers within the Bitcoin ecosystem.

Figure 1: An example of transaction graph.

Computational Graph Analytics

Centrality Measures

Centrality measures, such as Betweenness, Closeness, Eigenvector, PageRank, and HITS, are instrumental in identifying significant nodes within the Bitcoin network. Entities with high centrality often correlate with influential nodes, such as service providers interacting with a large number of participants. By identifying these nodes, researchers can better understand and monitor economic dynamics within the network.

Traversal Techniques

Graph traversal methods, including exploring node connectivity, reachability, and shortest paths, are critical in understanding transaction flows. These techniques, when applied to Bitcoin data, help elucidate transaction pathways, aiding in anomaly detection and forensic analysis of suspicious transactions.

The identification of strongly connected components enables the recognition of address clusters that are frequently engaged in transactions, which aids in understanding the network's underlying structure and behavior patterns among participants.

Graph Pattern Matching

Graph pattern matching techniques support fraud and anomaly detection. By querying specific sub-structures within the graph that correspond to known suspicious activity templates, such as money laundering trails, analysts can proactively flag and investigate potentially illicit activities.

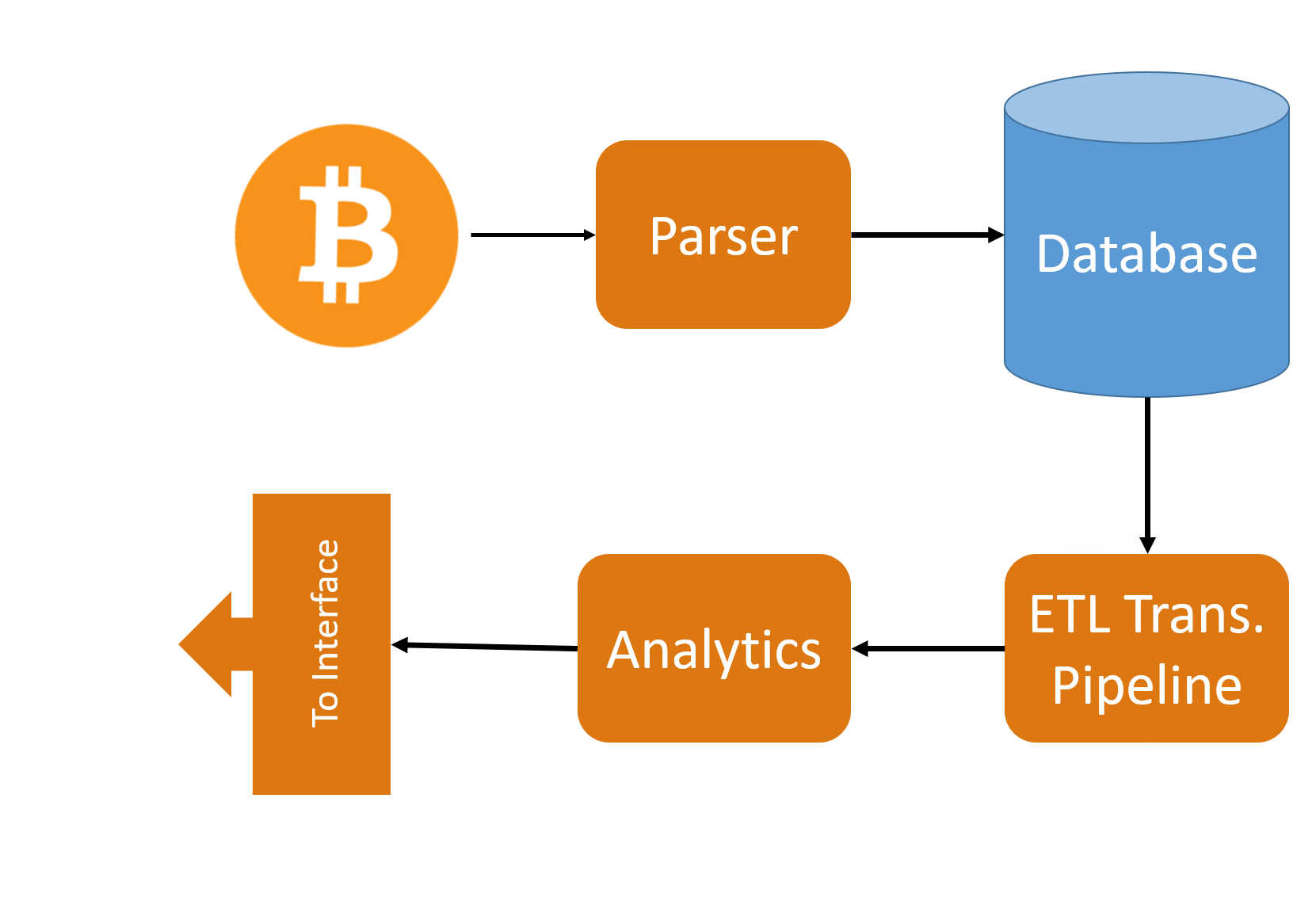

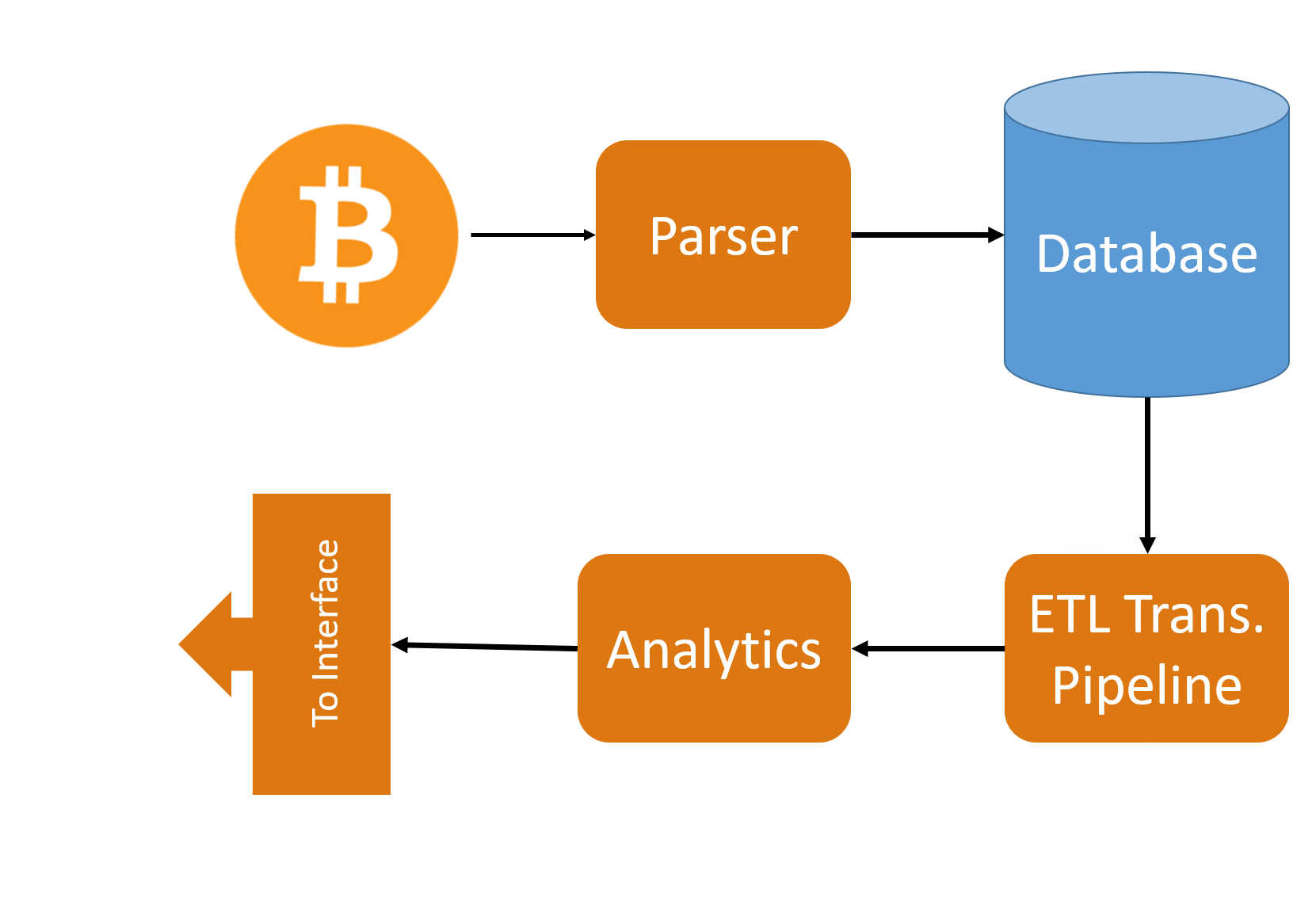

Figure 2: A framework for Bitcoin Analysis.

Proposed Analysis Framework and Experimentation

The study proposes a framework for Bitcoin blockchain analytics, incorporating data parsing, transformation, and relational database storage to facilitate graph-based analysis. Utilizing the BlockSci parser and Apache Cassandra, the framework achieves efficient data management and enables robust analyses of blockchain data.

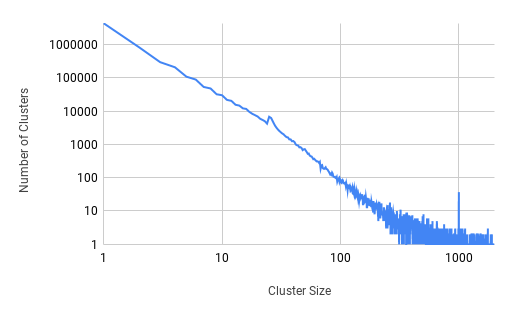

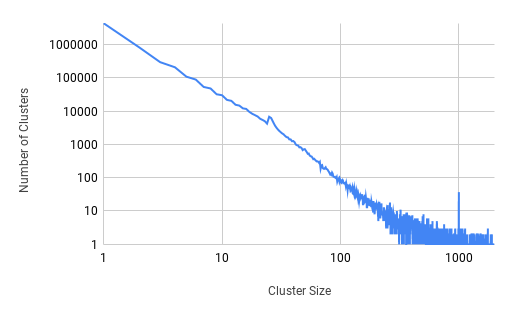

Address Linking and Clustering

By employing heuristics such as multi-input transactions and change addresses, the framework clusters addresses into entities, simplifying the complexity of the raw blockchain data. This procedure not only de-pseudonymizes identities to some extent but also facilitates deeper insights into Bitcoin's usage patterns.

Figure 3: Address linking as graph enrichment.

Case Studies and Findings

The framework's efficacy is exemplified through various analyses, including assessments of trends in transaction velocity, address usage, and high-value transactions. Such insights elucidate economic behaviors tied to Bitcoin's market dynamics and user preferences.

Figure 4: Distribution of cluster with respect to sizes after clustering based on address-linking heuristic.

Conclusion

The paper highlights the potential and intricacies of employing graph-theoretic approaches to Bitcoin blockchain analytics. This perspective provides an innovative lens through which practitioners can monitor cryptographic currency ecosystems, with implications for both privacy assessment and regulatory oversight. Future work should focus on enhancing clustering heuristics and augmenting graph-theoretic methodologies to further refine insights into transaction dynamics, thus balancing concerns of privacy and transparency within the broader adoption of cryptocurrencies.