- The paper quantifies over 500,000 unexploited arbitrage opportunities across L2 rollups and introduces a modified LVR metric to account for persistent opportunities.

- The analysis reveals that ZKsync Era exhibits significantly higher arbitrage potential (≈0.25% of trading volume) due to liquidity constraints and rapid block times.

- The study underscores the impact of the Ethereum Dencun upgrade in reducing gas fees and increasing swap frequencies, highlighting the need for rollup-specific MEV solutions.

Cross-Rollup MEV: Non-Atomic Arbitrage Across L2 Blockchains

Introduction

The paper "Cross-Rollup MEV: Non-Atomic Arbitrage Across L2 Blockchains" explores the arbitrage opportunities and MEV potential across Layer-2 (L2) blockchains, specifically rollups. It quantifies the arbitrage landscape, examining price discrepancies between decentralized (DEX) and centralized exchanges (CEX), as well as among different rollup-based DEXs. With Ethereum's recent Dencun upgrade impacting gas fees and rollup performance, the study investigates how these dynamics create new arbitrage scenarios for market participants.

Figure 1: Median transaction fees, measured in Gwei, for selected Ethereum rollups, pre- and post-Dencun Upgrade.

Methodology and Findings

Data Collection

The study focuses on the WETH-USDC liquidity pools across Ethereum rollups, including Arbitrum, Base, Optimism, and ZKsync Era. The analysis spans December 31, 2023, to April 30, 2024, leveraging data from blockchain archives and Binance APIs for price comparisons. This approach allows for an empirical evaluation of swap behavior and trading volume dynamics post-Dencun upgrade.

Arbitrage Opportunities

The paper identifies over 500,000 unexploited arbitrage opportunities within rollup environments. These opportunities exhibit persistence across multiple blocks (10-20 block durations), necessitating an empirical modification to the Loss Versus Rebalancing (LVR) metric to prevent double-counting.

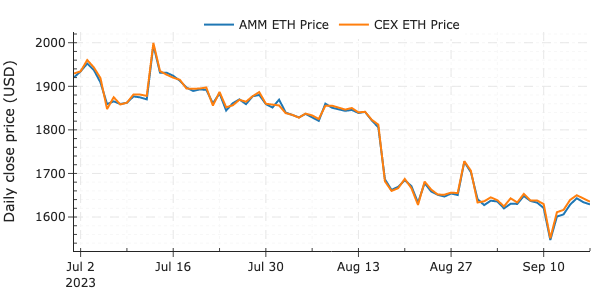

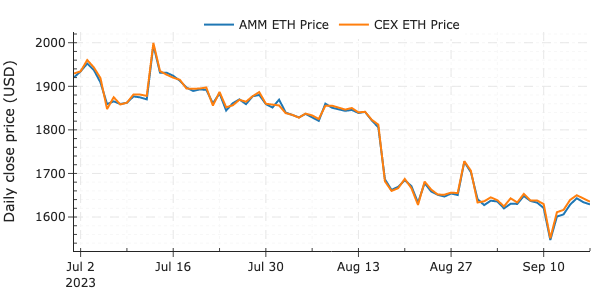

Figure 2: Time series of prices for USDC-ETH.

Maximal Arbitrage Value (MAV) calculations reveal that Arbitrum, Base, and Optimism pools offer arbitrage opportunities between 0.03% and 0.05% of trading volume, while ZKsync Era presents significantly higher figures at approximately 0.25%, attributed to liquidity constraints and faster block times.

Rollup Dynamics

The transition to rollups has led to more frequent swaps, albeit with significantly lower volumes compared to Ethereum, aligning with reduced costs post-Dencun. The analysis highlights that swaps on rollups occur 2–3 times more frequently, with reduced slippage and implicit costs due to rapid block production times, ranging from 0.25 to 2 seconds across various rollups.

Discussion

L2 MEV and Arbitrage Risk

This paper underscores the differences between atomic arbitrage on Ethereum and non-atomic opportunities across rollups. In particular, MEV mechanisms through centralized sequencers remain undeveloped, presenting both risks and opportunities for arbitrageurs dealing with state drift and non-atomic transitions.

Figure 3: Empirical daily analysis of Maximal Arbitrage Value (MAV), price discrepancies, and liquidity in the current tick within the WETH-USDC liquidity pool on Uniswap (v3) deployed on the Arbitrum network.

The reliance on centralized sequencer partnerships or saturation of networks through prospective transactions highlights strategic adjustments by arbitrageurs to mitigate these risks.

Ethical and Efficient MEV

A significant portion of the paper discusses the ethical considerations in MEV operations, advocating for mechanisms that differentiate between exploitative front-running and constructive back-running activities.

Figure 4: Mean (relative) price difference.

Deploying time-boost mechanisms within sequencers remains a promising avenue to balance transactional ethics with operational efficiency, fostering beneficial arbitrage and liquidation activities while restricting exploitative practices.

Implications and Future Work

The findings suggest a growing need for rollup-specific MEV solutions that accommodate the rapid trading dynamics enabled by recent Ethereum upgrades. As trading volumes increasingly shift to rollups, cross-rollup arbitrage strategies will become more prominent, especially if liquidity on these platforms exceeds traditional CEXs and Ethereum.

Future research should explore more refined models for arbitrage risk quantification, especially in the context of possible cross-rollup sequencer systems and instant finality mechanisms. Additionally, the strategic deployment of shared sequencers may transform the cross-rollup landscape, establishing risk-free arbitrage paradigms through unified block sequencing.

Figure 5: Architecture of a rollup.

Conclusion

The paper provides a comprehensive exploration of cross-rollup arbitrage potential, quantifying unexploited opportunities amidst Ethereum's evolving infrastructure. It serves as a foundation for further exploration into MEV innovations within rollups, advocating for ethical strategies aligned with DeFi's decentralized ethos, and offering insights into the mechanisms that could optimize arbitrage efficiency across this dynamic ecosystem.