- The paper presents the main finding that LLM-based GenAI reduces processing times for unstructured financial documents from hours to minutes through automation.

- The paper demonstrates the design of agentic networks that enable modular, end-to-end automation of workflows by integrating GenAI across diverse financial operations.

- The paper highlights robust risk control measures addressing issues such as hallucination, malicious data feeds, and unauthorized data disclosures to ensure compliance.

GenAI on Wall Street: Opportunities and Risk Controls

Introduction

This paper presents a comprehensive analysis of the integration of Generative AI (GenAI), particularly LLMs, into the financial industry. The author systematically explores both the transformative opportunities and the multifaceted risks associated with GenAI deployment in investment banking and related financial services. The discussion is grounded in practical use cases, technical workflows, and risk management frameworks, providing a rigorous perspective for practitioners and researchers.

Opportunities of LLM-Based GenAI in Finance

Accelerating Unstructured Data Processing

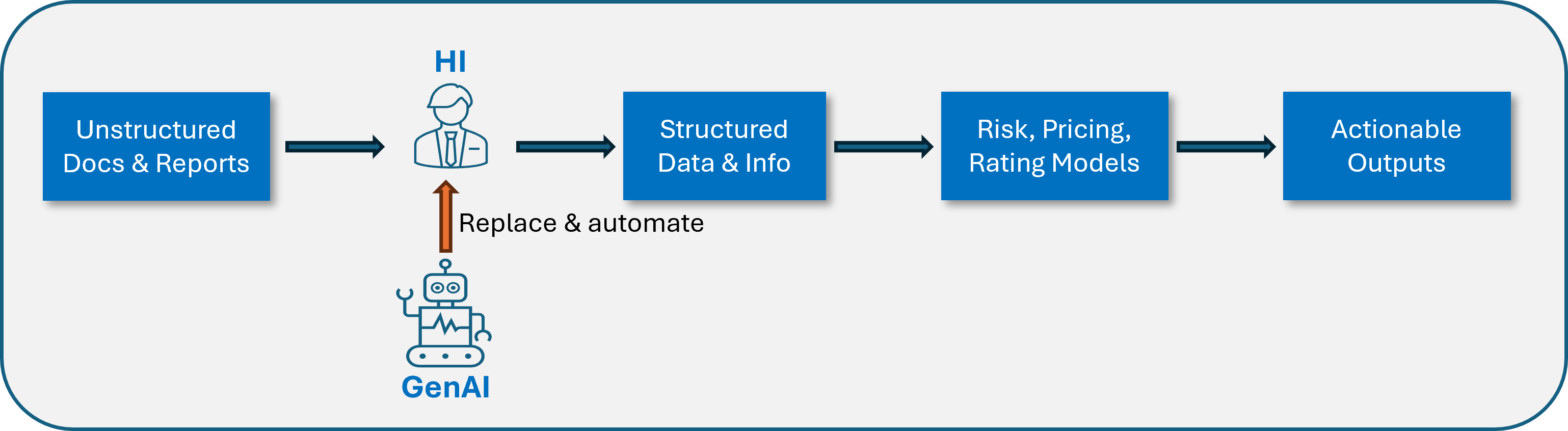

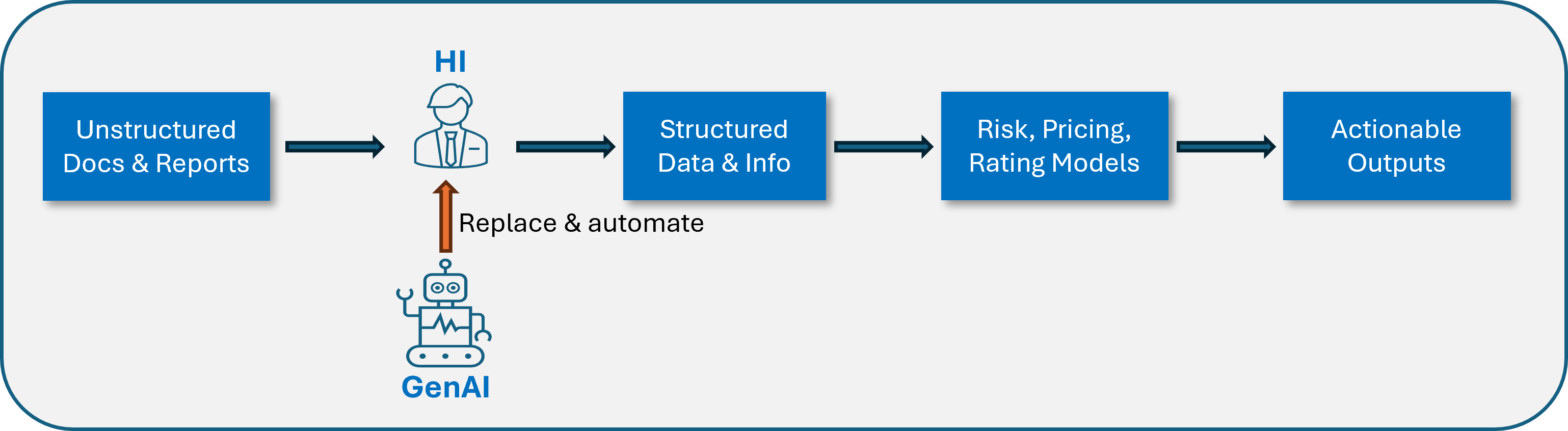

A central thesis is the ability of LLM-based GenAI to dramatically reduce the time required to parse and process unstructured financial documents. Traditional workflows for legal contracts, loan agreements, and equity research reports often require hours or days of manual effort. GenAI systems can automate extraction, summarization, and structuring, reducing turnaround to minutes or seconds, thereby increasing operational efficiency and throughput across departments.

Figure 1: LLM-based GenAI can substantially shorten the parsing and processing time for unstructured financial documents, increasing efficiency and capacity across financial departments.

Structuring and Unstructuring Data

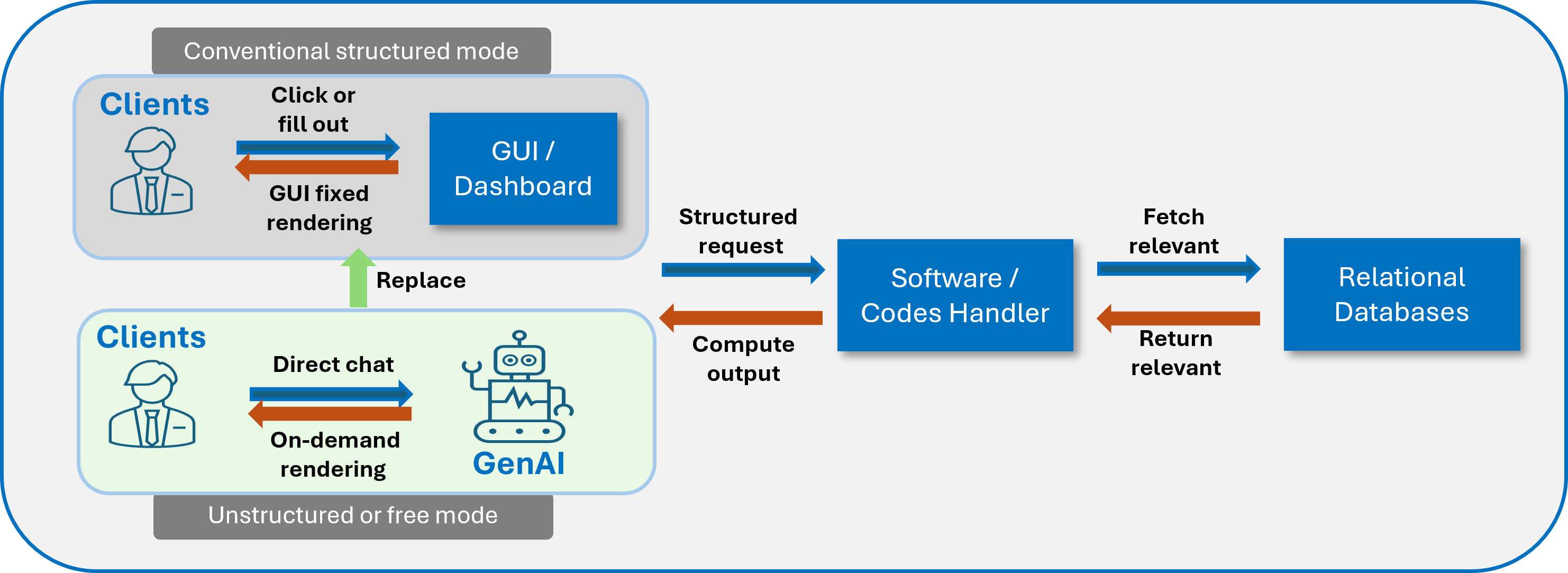

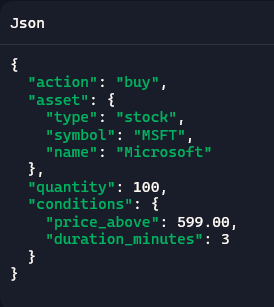

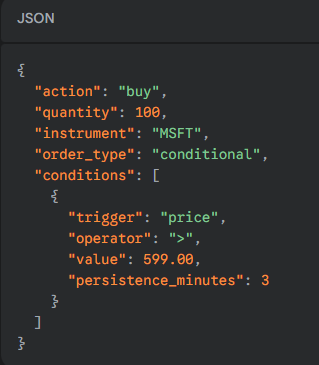

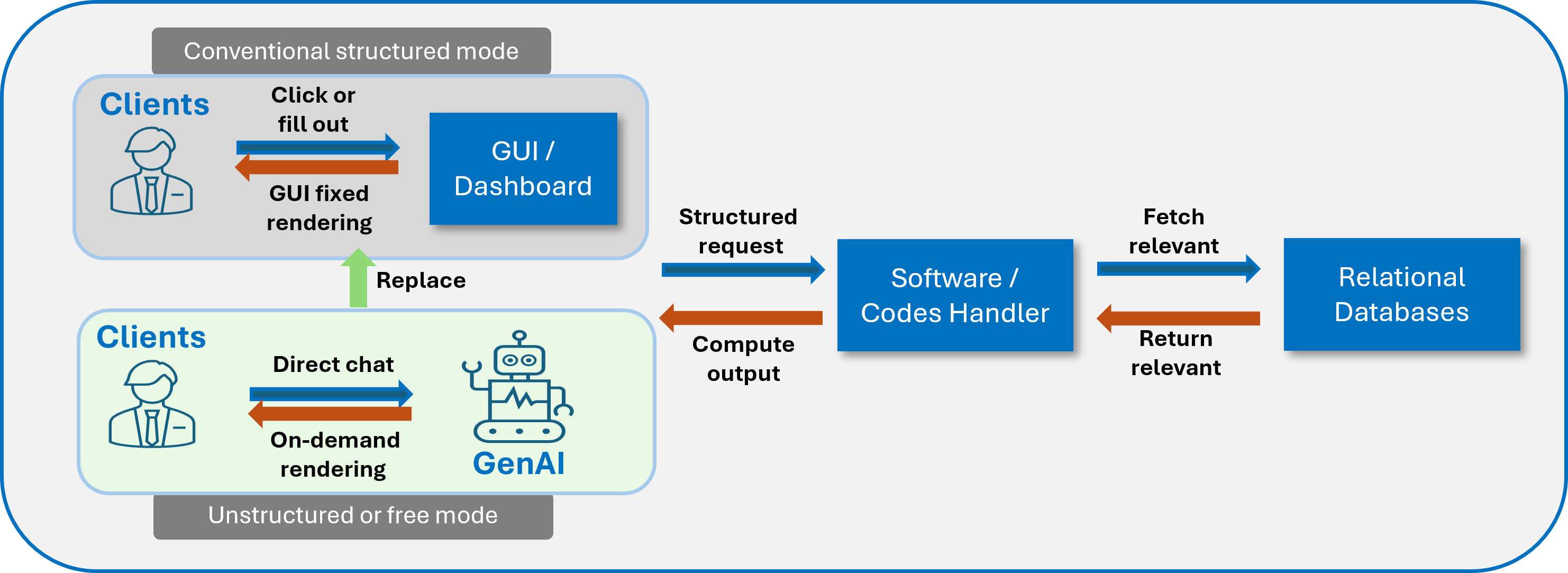

GenAI excels at converting unstructured client requests (e.g., free-form emails or chat messages) into structured formats such as JSON, which can be directly ingested by downstream systems for pricing, risk analysis, and trade execution. Conversely, GenAI can also enable users to interact with highly structured systems (GUIs, relational databases) using natural language, bypassing the limitations of pre-defined interfaces and unleashing latent capabilities for non-technical users.

Figure 2: LLM-based GenAI can replace pre-structured GUIs, enabling flexible, conversational access to backend systems.

Agentic Networks and Automated Workflows

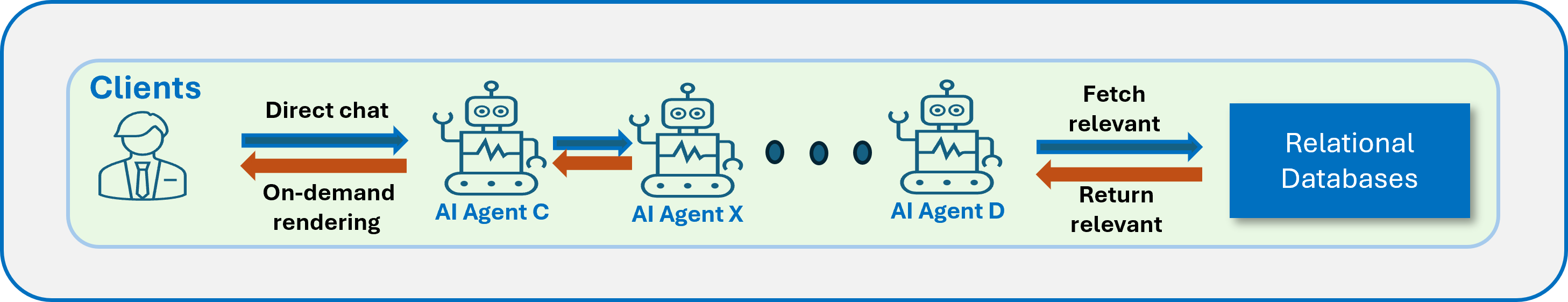

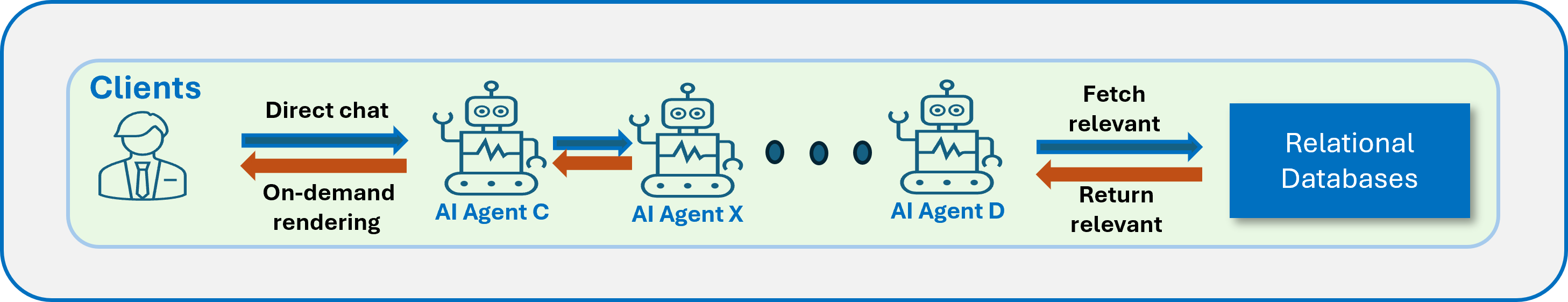

The paper introduces the concept of Agentic Networks: orchestrated ensembles of specialized GenAI agents, each responsible for a distinct workflow task (e.g., parsing, scheduling, database querying). These networks facilitate end-to-end automation of complex business processes, such as order management, HR recruiting, and client communications, with iterative error correction and modular integration with legacy systems.

Figure 3: Agentic Networks deploy multiple GenAI agents specialized for distinct workflow tasks, enabling fully automated, modular business processes.

Coding-Free Code Generation

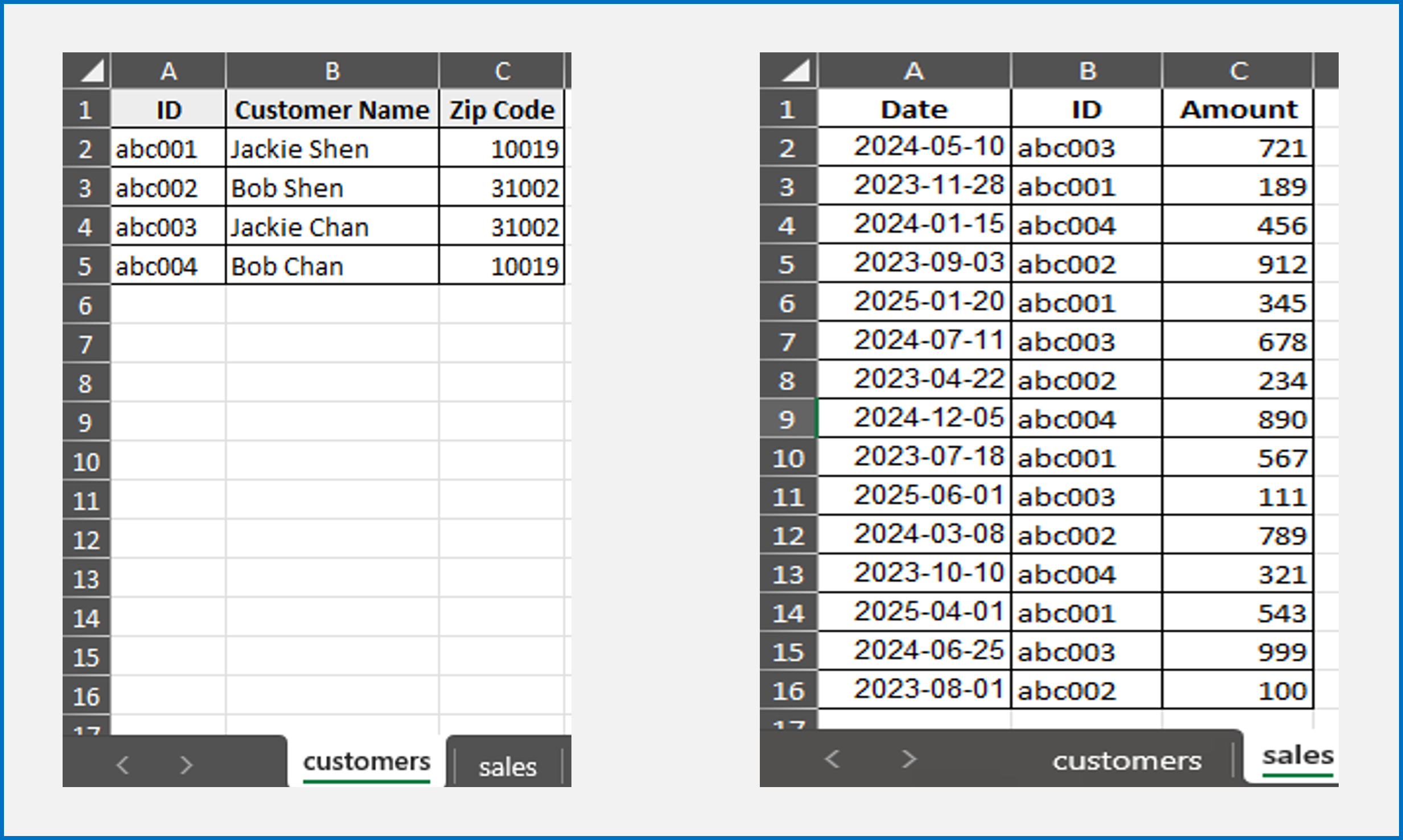

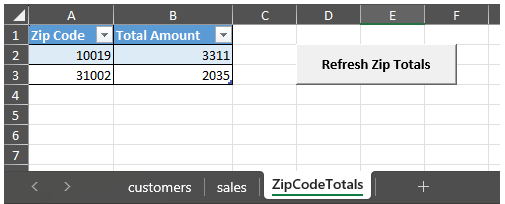

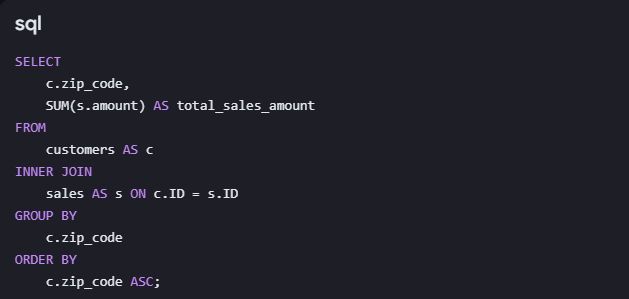

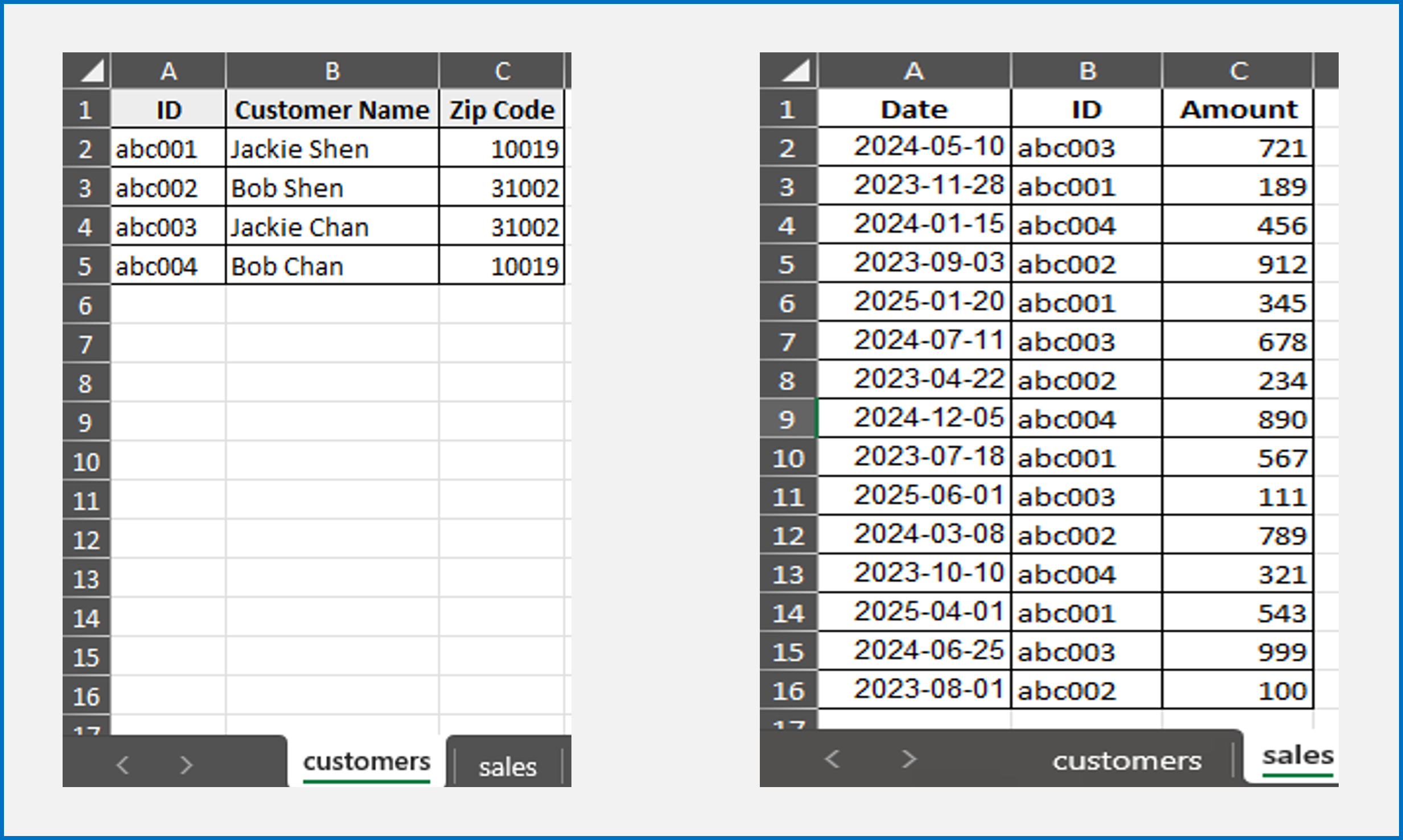

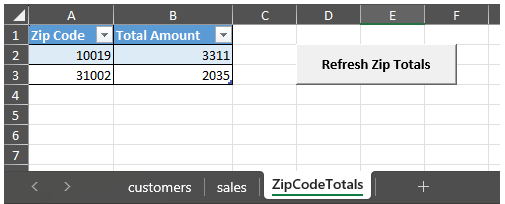

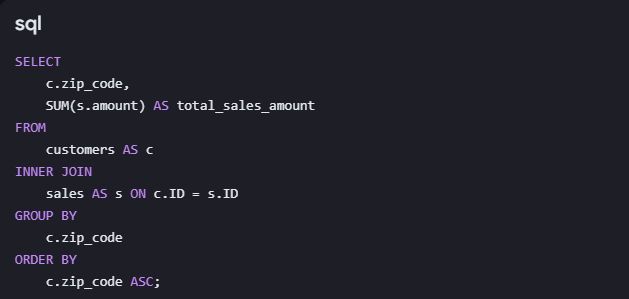

GenAI democratizes access to programming and data analysis by generating code snippets (e.g., VBA for Excel, SQL for databases) from natural language prompts. This capability empowers non-engineering staff to automate routine tasks, aggregate data, and build custom analytics without formal training, significantly lowering the barrier to digital transformation.

Figure 4: Example of customer and sales data in Excel sheets, illustrating a typical office scenario for GenAI-assisted code generation.

Figure 5: Microsoft Copilot generates VBA code and a refresh button for aggregating sales by zip code, enabling non-technical users to automate data analysis.

Figure 6: Google Gemini produces a correct SQL query from a natural language prompt, unlocking database querying for non-engineers.

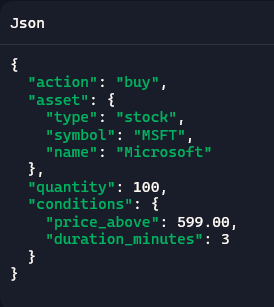

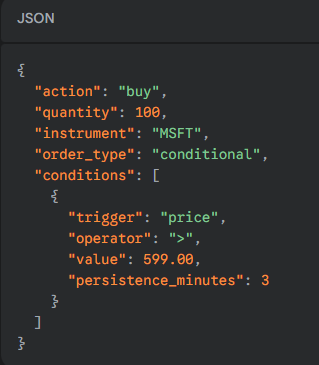

Real-Time Parsing and Trade Automation

GenAI agents can parse complex, bespoke trading instructions from clients and convert them into standardized, machine-readable formats for integration with order management systems (OMS) and execution management systems (EMS). This enables scalable, accurate, and compliant trade processing, even for highly customized requests.

Figure 7: JSON parsing of a customer trading request by Copilot and Gemini, demonstrating GenAI’s ability to translate natural language into structured trade instructions.

Risk Landscape and Control Measures

Hallucination

LLMs are prone to generating fabricated or inaccurate outputs (hallucinations), which can lead to erroneous business decisions. The paper emphasizes that hallucination is a statistical artifact of generative modeling, not a pathological failure. Mitigation strategies include human-in-the-loop validation, benchmarking across multiple GenAI systems, and regression testing with representative prompts.

Brainwash (Malicious Data Feeds)

GenAI systems are vulnerable to intentional manipulation via biased or fraudulent data feeds, especially in retrieval-augmented generation (RAG) contexts. The author advocates for strict reproducibility protocols, four-eye checks, and robust data governance to ensure integrity and auditability of GenAI outputs.

Improper configuration of GenAI backend data access can result in unauthorized disclosure of confidential or material non-public information (MNPI), violating regulatory and compliance requirements. Controls include user-level data access restrictions, division-specific GenAI deployments, and centralized incident reporting systems for error correction.

Over-Generalization

Over-reliance on GenAI for performance evaluation or decision-making can result in biased or incomplete assessments, as not all contributions are digitally recorded or language-represented. The paper recommends holistic evaluation frameworks and formal policies to prevent unfair or misleading use of GenAI-generated summaries.

Chain Reaction in Agentic Workflows

Errors in individual agents within an agentic network can propagate, causing systemic failures. The author prescribes adherence to SDLC standards, deployment of control agents for output validation, comprehensive documentation, pre- and post-deployment testing, and rigorous change management protocols.

Implementation Considerations

- Integration: GenAI agents should be modular, interoperable with existing systems (OMS, EMS, HR databases), and capable of context-aware parsing and code generation.

- Scalability: Agentic networks must be designed for horizontal scaling, with robust error correction and monitoring.

- Security and Privacy: Data access must be tightly controlled, with clear documentation of user entitlements and backend feeds.

- Performance: Empirical results indicate substantial reductions in processing time (orders of magnitude), with accuracy contingent on prompt engineering and model fine-tuning.

- Resource Requirements: Deployment of LLMs in production requires significant computational resources, especially for real-time parsing and large-scale document processing.

Implications and Future Directions

The adoption of GenAI in finance signals a paradigm shift in operational efficiency, client service, and workflow automation. The emergence of agentic networks and coding-free automation will likely redefine job roles, skill requirements, and organizational structures. However, the risks of hallucination, data manipulation, privacy breaches, and systemic errors necessitate rigorous controls, continuous monitoring, and adaptive governance frameworks.

Future research should focus on:

- Developing domain-specific LLMs with enhanced factuality and compliance alignment.

- Formalizing agentic network protocols for interoperability and error correction.

- Advancing explainability and auditability of GenAI outputs in regulated environments.

- Quantifying the impact of GenAI on workforce dynamics and organizational resilience.

Conclusion

The paper provides a detailed roadmap for leveraging GenAI in the financial industry, balancing transformative opportunities with robust risk controls. The integration of LLM-based GenAI into core financial workflows promises significant gains in efficiency, capacity, and accessibility. However, the complexity and unpredictability of generative models require disciplined implementation, vigilant monitoring, and continuous adaptation of risk management practices. The financial sector stands at the threshold of a new era, where the synergy between human and artificial intelligence will shape the future of Wall Street.