- The paper presents a novel integration of Financial AI Agents using Chain-of-Thought prompting to systematically address complex financial challenges.

- It utilizes a Smart Scheduler in the LLMOps layer to dynamically allocate tailored large language models for enhanced market forecasting and document analysis.

- The modular open-source design of FinRobot enables scalable, adaptive financial analytics and fosters collaborative innovation in the financial AI community.

Introduction

The field of financial analysis encompasses the intricate tasks of market trend interpretation, economic outcome prediction, and investment strategy formulation, primarily grounded in data analysis. The escalation of data availability and complexity necessitates the integration of LLMs to automate processes traditionally executed by financial professionals. This paper introduces FinRobot, an innovative open-source AI agent platform specifically designed for financial applications, addressing existing challenges such as transparency, market adaptation, model diversity, and real-time data processing.

FinRobot Architecture and Components

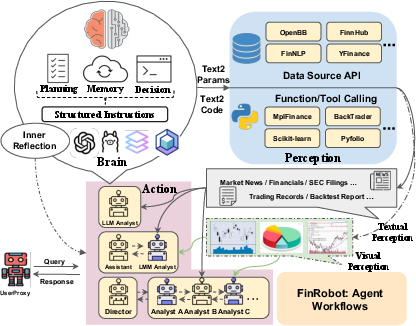

FinRobot is structured into four comprehensive layers, each serving distinct functionalities:

- Financial AI Agents Layer: This layer formulates Financial Chain-of-Thought (CoT) processes for intricate financial problem-solving, leveraging specialized agents to dissect complex challenges into logical sequences.

- Financial LLM Algorithms Layer: It dynamically applies tailored model strategies for specific financial tasks, utilizing advanced LLMs such as FinGPT to enhance analytical precision.

- LLMOps and DataOps Layer: This layer facilitates model training and fine-tuning processes, ensuring the deployment of accurate models by integrating task-specific datasets.

- Multi-source LLM Foundation Models Layer: It supports the integration of diverse LLMs, providing the foundational infrastructure for accessing these models effectively.

Figure 1: Overall Framework of FinRobot.

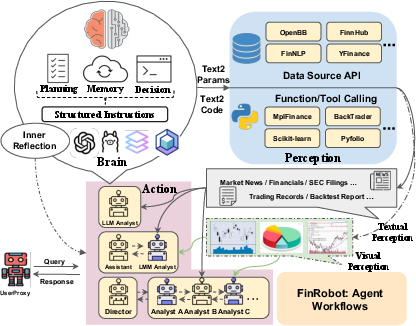

Financial AI Agents and Chain-of-Thought Prompting

In FinRobot's architecture, the Financial AI Agents Layer is pivotal. It integrates Financial Chain-of-Thought (CoT) prompting, elevating AI-driven analysis by mimicking the logical reasoning typically employed by human analysts. CoT prompting is key to dissecting complex financial scenarios into manageable components, enabling comprehensive tasks such as market forecasting, document analysis, and portfolio management to be executed systematically.

Figure 2: Financial AI Agents Workflow Diagram.

Smart Scheduler and Model Adaptation

The LLMOps Layer is empowered by a Smart Scheduler, which ensures efficient allocation and optimization of multi-source LLMs for specific tasks. This mechanism allows FinRobot to dynamically adjust and utilize the most effective LLM, leveraging adaptive strategies that align with market demands and computational advancements.

Figure 3: Smart Scheduler Structural Layout in LLMOps Layer.

Two primary applications demonstrate FinRobot's capabilities: Market Forecaster and Document Analysis & Generation.

- Market Forecaster: This application uses AI agents to integrate market news with financial data, providing predictions and insights on stock price movements. It exemplifies FinRobot’s ability to synthesize data from multiple sources for robust forecasting.

- Document Analysis & Generation: It leverages AI for the extraction and analysis of financial documents, consequently generating comprehensive reports. It highlights FinRobot's utility in automating the digestion of extensive unstructured data for strategic reporting.

Figure 4 and Figure 5 illustrate detailed equity research reports generated by FinRobot, underscoring its practical application and efficacy in financial analysis.

Figure 4: Equity research report for Nvidia showcasing in-depth financial analysis.

Figure 5: Continuation of Nvidia's equity research report focusing on investment strategy insights.

Implications and Future Directions

FinRobot sets a new standard for AI application in finance by offering a scalable, open-source platform that integrates state-of-the-art LLMs. Its modular design and open-source nature promote broader adoption and collaborative innovation within the financial AI community. As FinRobot advances, future developments may include enhancements in portfolio management and a broader array of market applications, further cementing its role in democratizing access to financial analytics tools.

Conclusion

FinRobot demonstrates significant potential in transforming financial analysis by harnessing the robust capabilities of LLMs. It not only addresses critical shortcomings in current financial AI applications but also paves the way for scalable, adaptive, and globally applicable financial solutions. As financial markets continue to evolve, FinRobot's open-source platform stands as a pioneering tool, ensuring that the finance sector remains at the forefront of AI-driven innovation.