- The paper introduces an LLM-driven framework to simulate economic behaviors and optimize tax policies through in-context reinforcement learning.

- It models worker decisions as a Stackelberg game with heterogeneous persona agents and employs a generalized beta distribution for demographic realism.

- The approach demonstrates that AI-optimized tax schedules can converge to equilibrium, mirroring social welfare improvements observed in classical policy models.

LLM Economist: Large Population Models and Mechanism Design in Multi-Agent Generative Simulacra

Introduction to LLM Economist

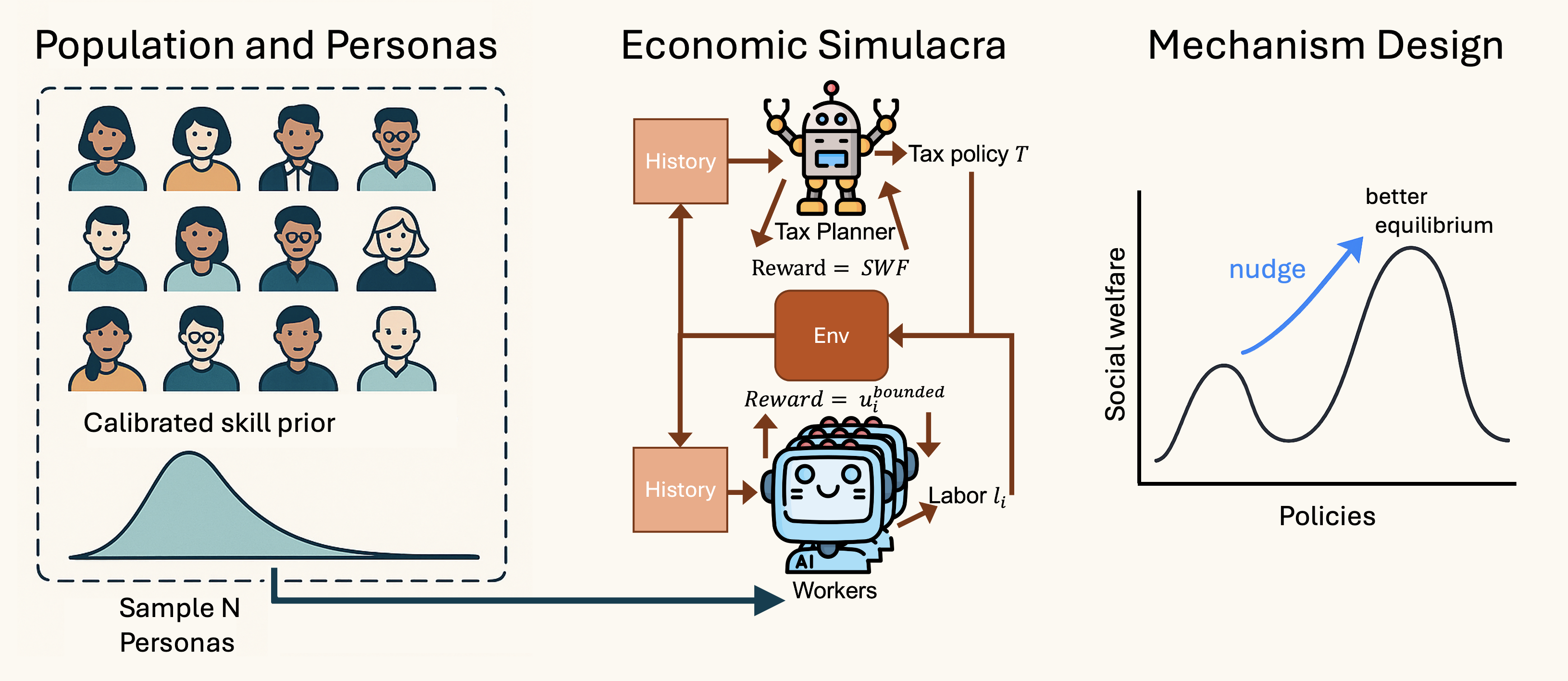

The LLM Economist framework addresses economic policy design within strategic environments by leveraging multi-agent simulacra driven by LLMs. Here, heterogeneous worker agents, modeled as personas, select labor supply to maximize utility functions derived from in-context learning. A planner agent uses reinforcement learning to optimize piecewise-linear marginal tax schedules anchored in the prevailing U.S. federal tax brackets. This construction allows for the simulation of economic behaviors at scale and facilitates mechanism design of tax systems through language-based optimization.

Figure 1: Overview of the LLM Economist. Left: Population of persona-based agents; Center: Economic simulacrum with labor choices and utility feedback; Right: Mechanism design as social welfare optimization.

Technical Insights and Mechanism Design

At its core, the framework models optimal taxation as a Stackelberg game with a hierarchical decision process. The worker tier consists of agents with diverse demographic statistics who condition labor decisions on their synthetic utility functions. The planner tier, executing in-context reinforcement learning, adapts tax policies annually to guide the system towards desirable social welfare Optima. By treating tax policy adjustments as Stackelberg game updates, the LLM Economist achieves convergence to equilibrium states while accounting for bounded rationality in agent behaviors.

Through in-context prompt engineering, agents explore and exploit different behavioral strategies, allowing the system to internalize elasticity responses and align closer to social welfare objectives. This process iteratively enhances the taxation mechanism by using both historical observations and normative cues encoded in the LLM-generated narratives of agency.

Population Dynamics and Utility Optimization

The simulated population model employs a Generalized-Beta distribution fit to empirical demographic data, reflecting the diversity seen in real-world economic agents. Persona-conditioned prompts are utilized to generate diverse utility landscapes, allowing for nuanced modeling of worker decisions under varying tax regimes. This approach ensures that agents are more representative of actual human behaviors, surpassing traditional scenario assumptions of homogeneity.

(Figures 2 to 4)

Figure 2: GB2 Income fit; Figure 3: Pre-tax income stability; Figure 4: Redistributive effects post-tax.

With personas ranging from entrepreneurs to public servants, the model tests the implications of tax adjustments across demographics. The adaptation dynamics show that agents drawn with bounded utilities can substantially adjust labor supply, impacting overall income distribution as tax policies evolve. Once the policies stabilize, a bounded worker's utility aligns more closely with isoelastic benchmarks, underscoring the potential for this framework to emulate realistic economic responses.

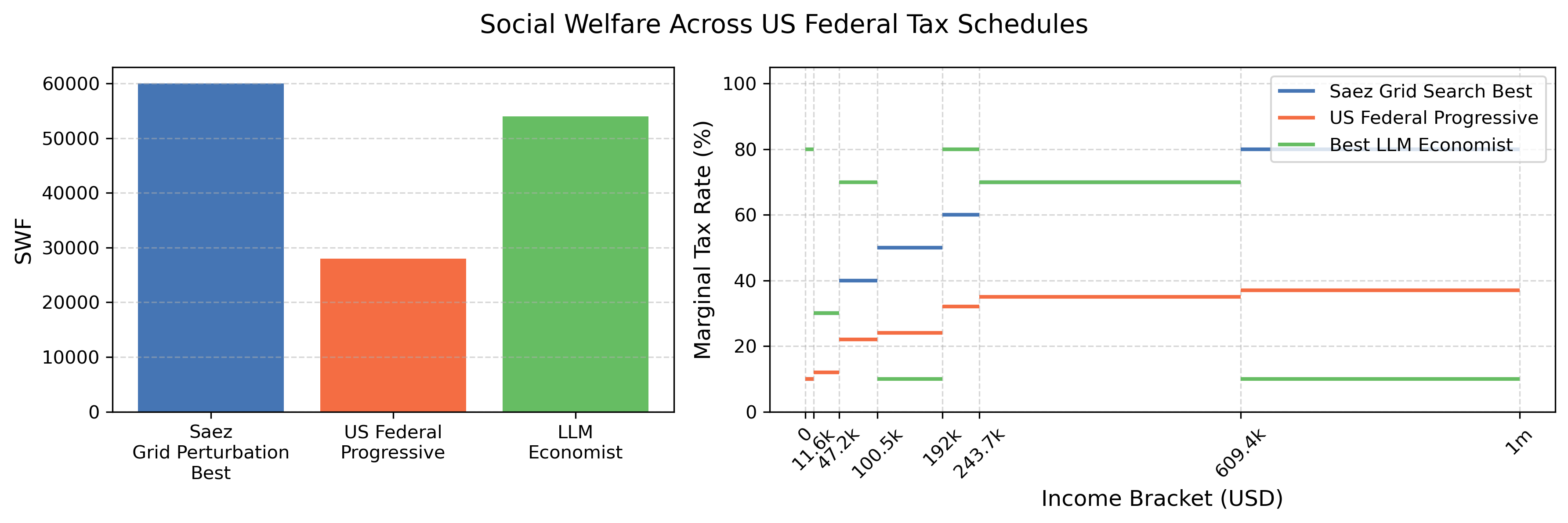

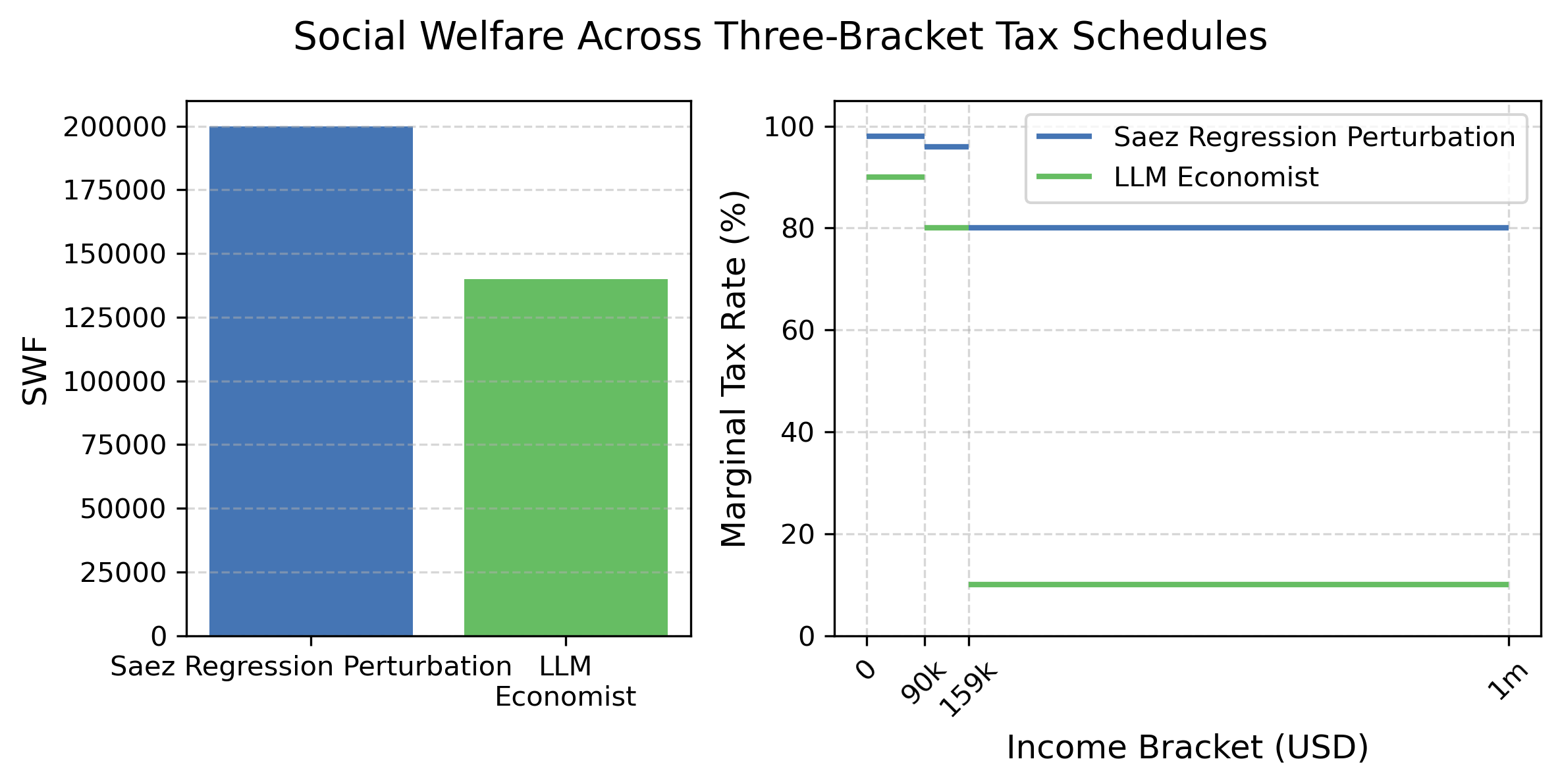

Policy Evaluation and Democratic Feedback

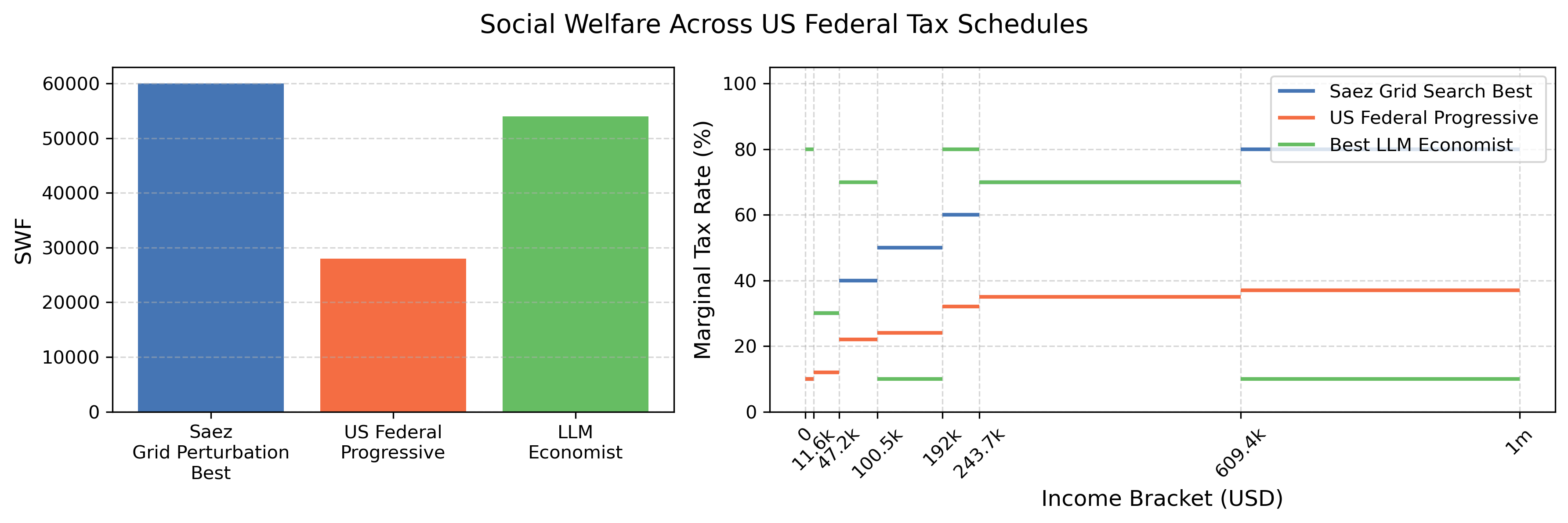

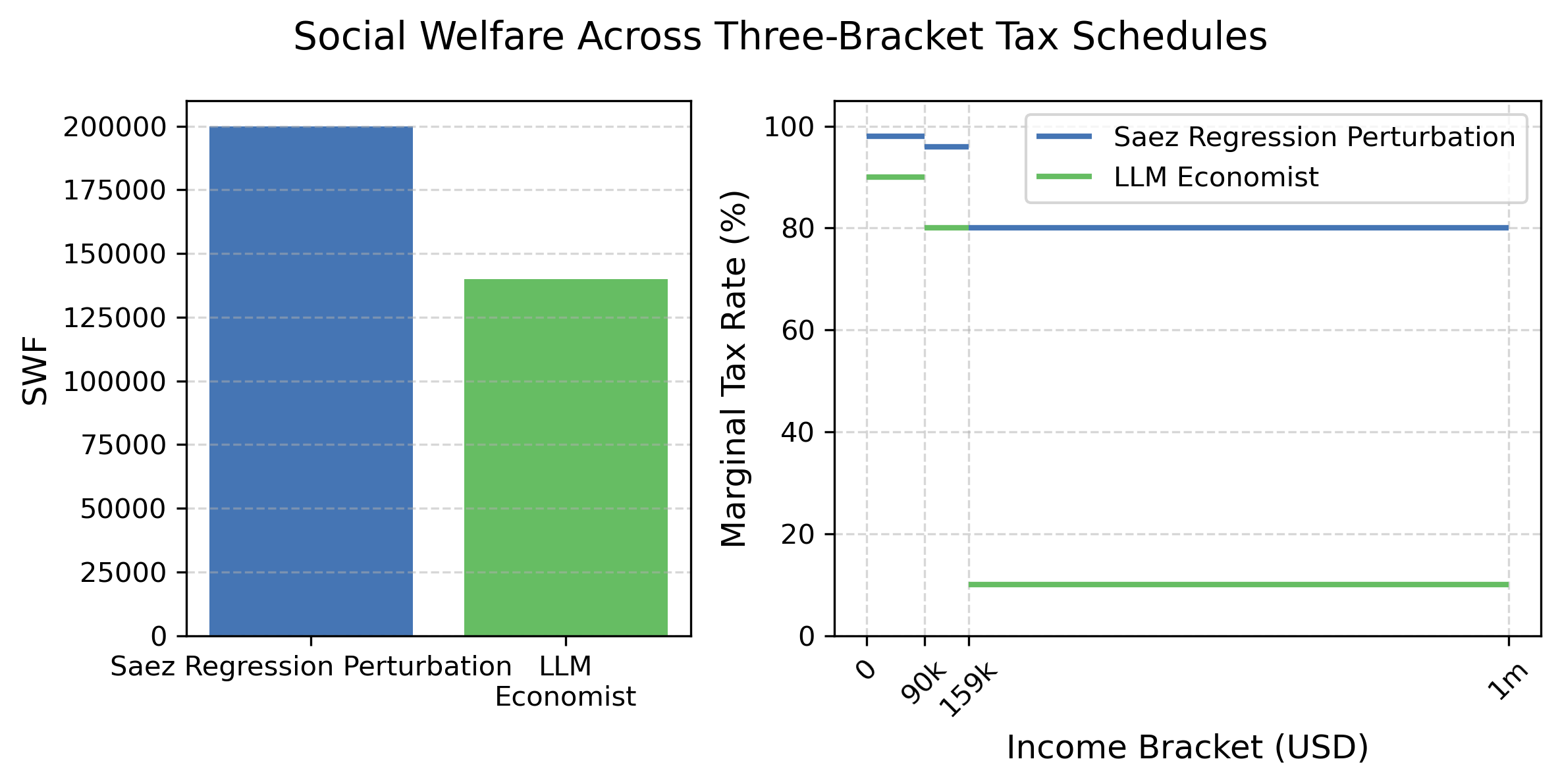

The LLM Economist tests conventional wisdom against emergent behavior by evaluating tax policies that prioritize different socio-economic objectives. In experimental validations, tax schedules optimized by the in-context RL planner approximate or exceed the social welfare of classical solutions (e.g., Saez coefficients). This indicates that AI-driven tools could innovatively explore policy spaces traditionally constrained by analytical solutions.

Figure 5: Bounded utility worker utility convergence; Democratic turnover impacts.

Furthermore, by integrating a democratic mechanism through agent-based elections, the framework mimics political phenomena like leader turnover. Agents' majority-rule voting on planners introduces adaptive multiplicity to tax schedules, creating dynamics akin to real-world political economies with benefits like aversion of stagnated policy regimes. This democratic simulacra layer demonstrates potential for AI to address political dimensions in fiscal policy simulations, albeit bounded by the LLM's interpretive capacity of 'social preferences'.

Conclusion and Future Directions

The LLM Economist offers a promising alternative for simulating and evaluating economic policies in synthetic societies, positioning AI at the intersection of automated decision making and social science experimentation. The framework grounds mechanism design upon richly defined agent interactions, capturing the complexity of fiscal environments shaped by diverse human analogs.

While effectively simulating emergent economic behaviors, future work could bolster its utility through scaling to macroeconomic contexts, enabling rich inter-agent interactions like trade, and reconciling broader socio-economic phenomena with computational efficiency. Potential applications extend beyond purely fiscal policies to any socio-economic system driven by strategic human-like agents.

This synthesis and expansion of mechanism design with LLMs emphasizes AI’s potential role in pre-deployment policy vetting, fostering reliable social experiments conducted within controlled, yet lifelike, digital environments.