From GARCH to Neural Network for Volatility Forecast

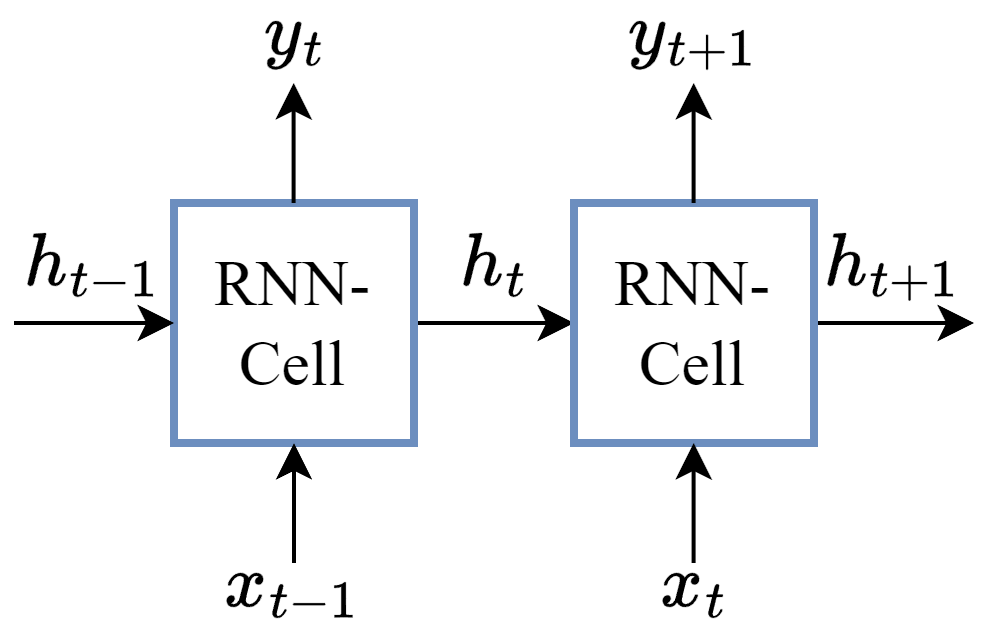

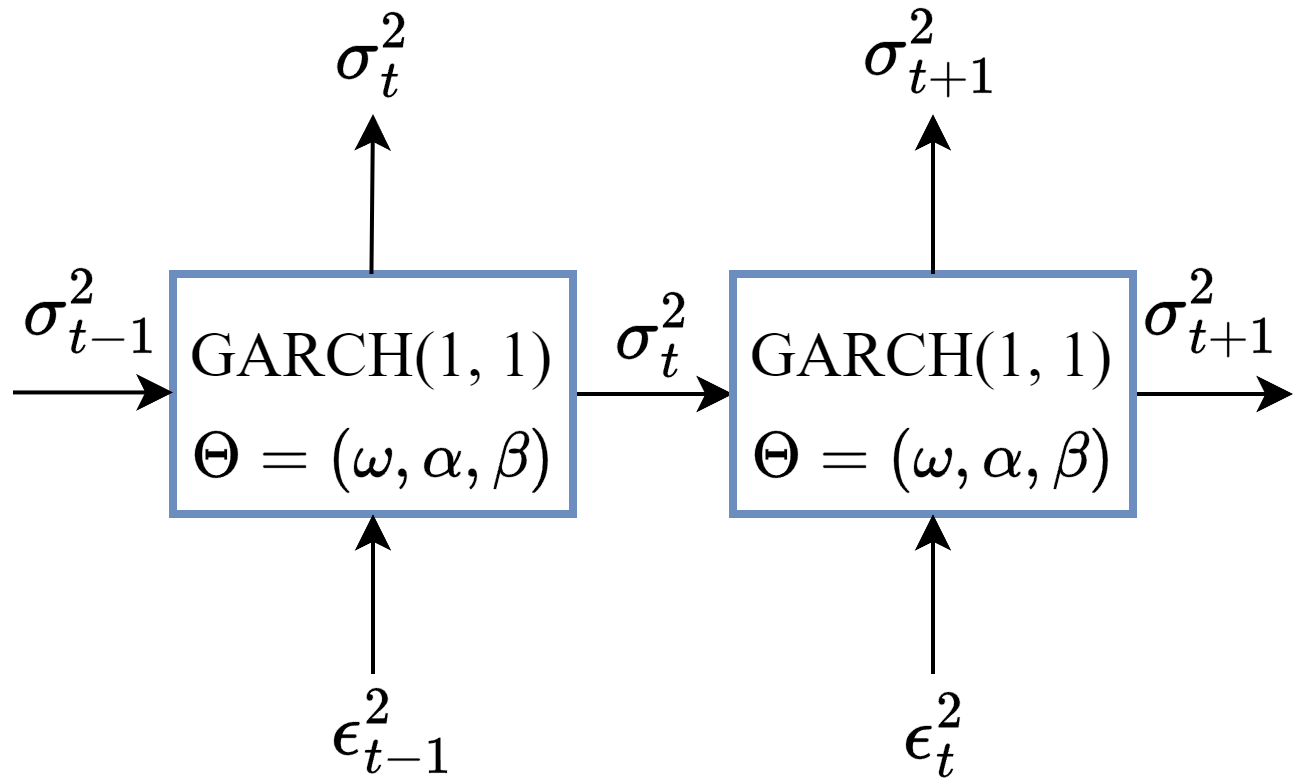

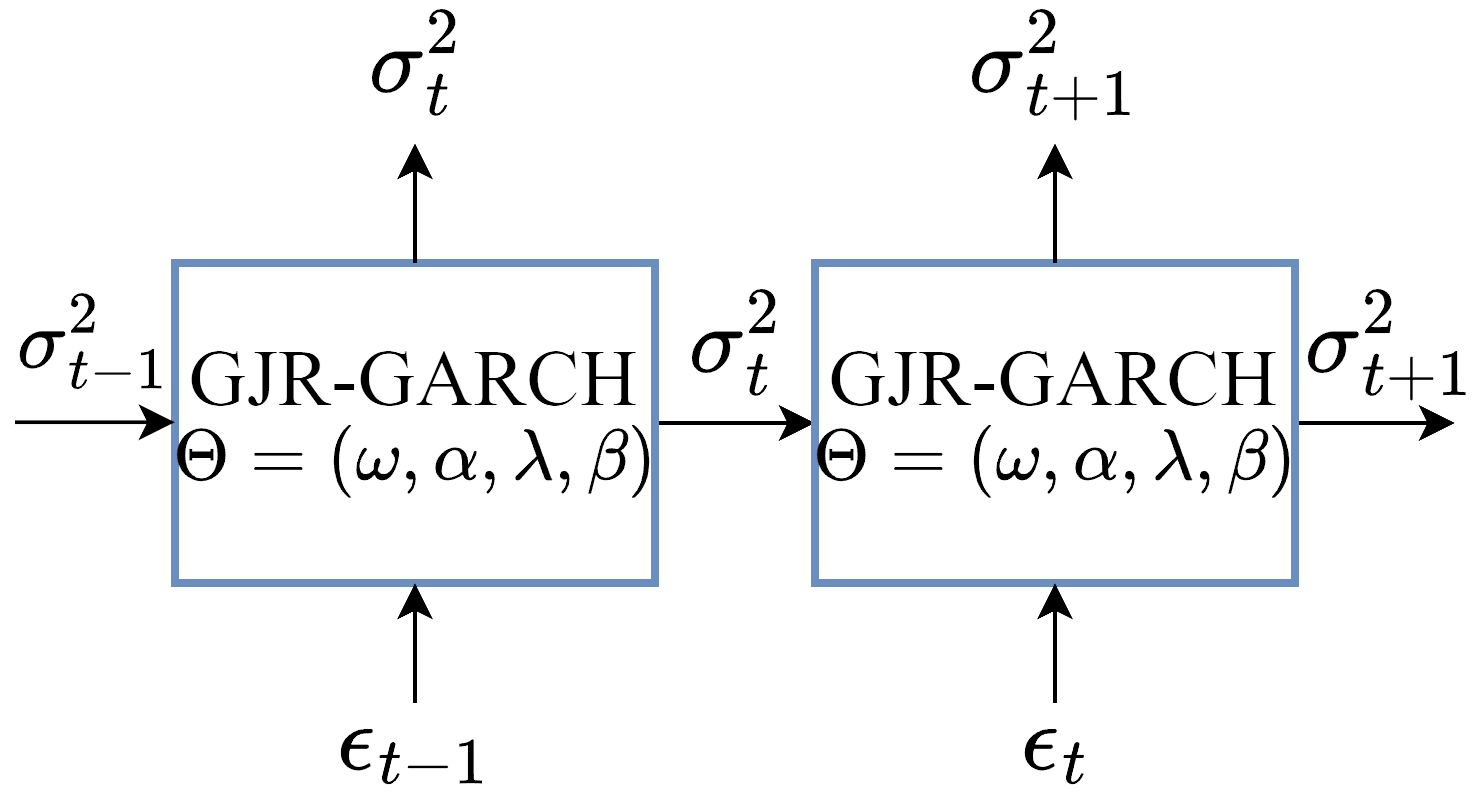

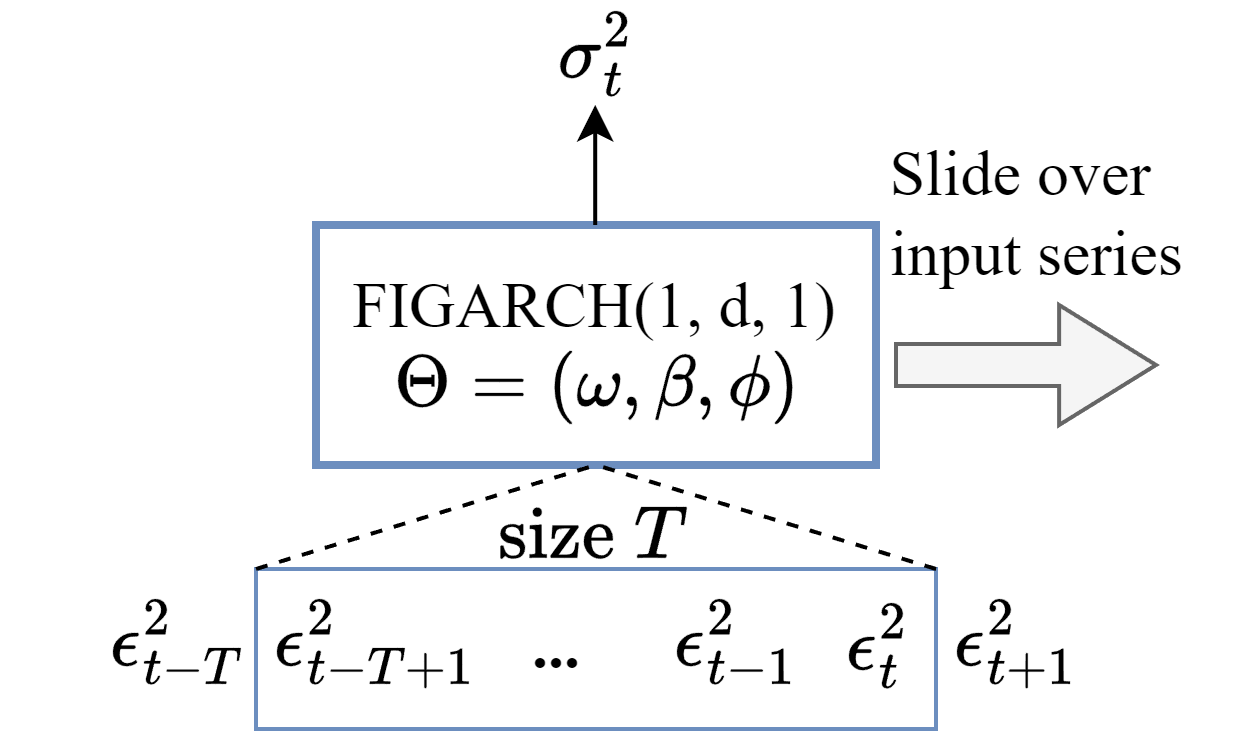

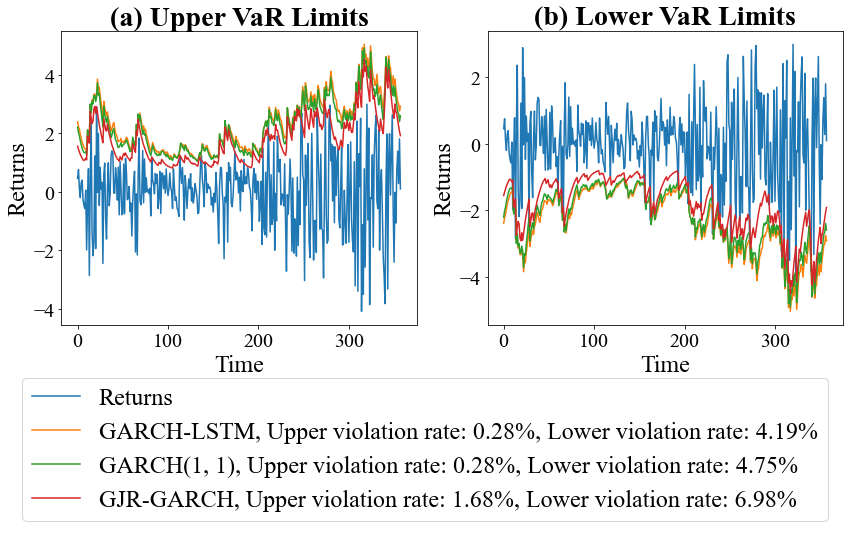

Abstract: Volatility, as a measure of uncertainty, plays a crucial role in numerous financial activities such as risk management. The Econometrics and Machine Learning communities have developed two distinct approaches for financial volatility forecasting: the stochastic approach and the neural network (NN) approach. Despite their individual strengths, these methodologies have conventionally evolved in separate research trajectories with little interaction between them. This study endeavors to bridge this gap by establishing an equivalence relationship between models of the GARCH family and their corresponding NN counterparts. With the equivalence relationship established, we introduce an innovative approach, named GARCH-NN, for constructing NN-based volatility models. It obtains the NN counterparts of GARCH models and integrates them as components into an established NN architecture, thereby seamlessly infusing volatility stylized facts (SFs) inherent in the GARCH models into the neural network. We develop the GARCH-LSTM model to showcase the power of the GARCH-NN approach. Experiment results validate that amalgamating the NN counterparts of the GARCH family models into established NN models leads to enhanced outcomes compared to employing the stochastic and NN models in isolation.

- Modeling and forecasting realized volatility. Econometrica, 71(2): 579–625.

- Fractionally integrated generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 74(1): 3–30.

- Bollerslev, T. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31(3): 307–327.

- Bollerslev, T. 1987. A Conditionally Heteroskedastic Time Series Model for Speculative Prices and Rates of Return. The Review of Economics and Statistics, 69(3): 542–47.

- Bucci, A. 2020. Realized volatility forecasting with neural networks. Journal of Financial Econometrics, 18(3): 502–531.

- Bucci, A.; et al. 2017. Forecasting realized volatility: a review. Journal of Advanced Studies in Finance (JASF), 8(16): 94–138.

- Tsmixer: An all-mlp architecture for time series forecasting. arXiv preprint arXiv:2303.06053.

- Davidson, J. 2004. Moment and Memory Properties of Linear Conditional Heteroscedasticity Models, and a New Model. Journal of Business & Economic Statistics, 22(1): 16–29.

- Do We Really Need Deep Learning Models for Time Series Forecasting? arXiv:2101.02118.

- Value at Risk (VaR) Using Volatility Forecasting Models: EWMA, GARCH and Stochastic Volatility. Brazilian Business Review, 4(1): 74–94.

- Neural Network–Based Financial Volatility Forecasting: A Systematic Review. ACM Comput. Surv., 55.

- Noisy Time Series Prediction using Recurrent Neural Networks and Grammatical Inference. Mach. Learn.

- On the Relation between the Expected Value and the Volatility of the Nominal Excess Return on Stocks. Journal of Finance, 48(5): 1779–1801.

- A forecast comparison of volatility models: does anything beat a GARCH(1,1)? Journal of applied econometrics (Chichester, England), 20(7): 873–889.

- A hybrid deep learning approach by integrating LSTM-ANN networks with GARCH model for copper price volatility prediction. Physica A: Statistical Mechanics and its Applications, 557: 124907.

- Value-at-Risk forecasting: A hybrid ensemble learning GARCH-LSTM based approach. Resources Policy, 78: 102903.

- Determining the relationship between speculative activity and crude oil price volatility, using artificial neural networks. In 2017 International Conference on Information and Communication Technologies (ICICT), 138–144.

- KIlIç, R. 2011. Long memory and nonlinearity in conditional variances: A smooth transition FIGARCH model. Journal of Empirical Finance, 18(2): 368–378.

- Forecasting the volatility of stock price index: A hybrid model integrating LSTM with multiple GARCH-type models. Expert Systems with Applications, 103: 25–37.

- Reformer: The efficient transformer. arXiv preprint arXiv:2001.04451.

- Volatility Forecast Using Hybrid Neural Network Models. Expert Syst. Appl., 41(5): 2437–2442.

- Forecasting volatility of oil price using an artificial neural network-GARCH model. Expert Systems with Applications, 65: 233–241.

- Modeling long-and short-term temporal patterns with deep neural networks. In The 41st international ACM SIGIR conference on research & development in information retrieval, 95–104.

- On Mixture Memory Garch Models. Journal of Time Series Analysis, 34.

- Financial Volatility Forecasting: A Sparse Multi-Head Attention Neural Network. Information, 12(10).

- A GARCH Model with Artificial Neural Networks. Information, 11(10).

- Statistical and Machine Learning forecasting methods: Concerns and ways forward. PLOS ONE, 13(3): 1–26.

- Masset, P. 2011. Volatility Stylized Facts. SSRN Electronic Journal.

- N-BEATS: Neural basis expansion analysis for interpretable time series forecasting. arXiv preprint arXiv:1905.10437.

- Exploiting the low-risk anomaly using machine learning to enhance the Black–Litterman framework: Evidence from South Korea. Pacific-Basin Finance Journal, 51: 1–12.

- Machine learning for realised volatility forecasting. Available at SSRN, 3707796.

- Multi-transformer: A new neural network-based architecture for forecasting S&P volatility. Mathematics, 9(15): 1794.

- DeepAR: Probabilistic forecasting with autoregressive recurrent networks. International Journal of Forecasting, 36(3): 1181–1191.

- Think globally, act locally: A deep neural network approach to high-dimensional time series forecasting. Advances in neural information processing systems, 32.

- bashtage/arch: Release 5.3.1.

- A Survey on Explainable Artificial Intelligence (XAI): Toward Medical XAI. IEEE Transactions on Neural Networks and Learning Systems, 32.

- Attention is All you Need. In Advances in Neural Information Processing Systems, volume 30.

- Autoformer: Decomposition transformers with auto-correlation for long-term series forecasting. Advances in Neural Information Processing Systems, 34: 22419–22430.

- Are Transformers Effective for Time Series Forecasting? arXiv:2205.13504.

- Stock Volatility Prediction Based on Self-attention Networks with Social Information. 2019 IEEE Conference on Computational Intelligence for Financial Engineering & Economics (CIFEr), 1–7.

- Informer: Beyond Efficient Transformer for Long Sequence Time-Series Forecasting. ArXiv, abs/2012.07436.

Paper Prompts

Sign up for free to create and run prompts on this paper using GPT-5.

Top Community Prompts

Collections

Sign up for free to add this paper to one or more collections.